Stock investors should have a new sense of confidence in the markets this week seeing that Citi released a report stating banks worldwide will purchase $6 trillion dollars worth of assets over the next 12 months.

Strategists at the company believe the bullish injection of stimulus will cancel out any bearish moves, and predicted that equity valuations next year will be approximately where they are today.

Already Inflated Markets

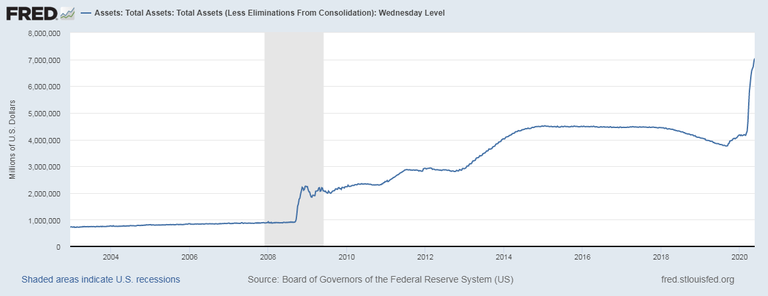

By the end of May, the Federal Reserve's balance sheet had already surpassed seven trillion dollars. $3 trillion of that was added in less than two and a half months due to COVID-19 related stimulus programs.

While many had expected the expansion of the money supply over the years to lead to consumer price inflation, the majority of the new cash has gone into stocks, bonds and real estate, creating what's known as the "everything bubble".

Despite tens of millions of job losses due to the COVID-19 pandemic, stock markets continue to rally. Just today the NASDAQ reached a new all-time-high, and Amazon shares made a new record, closing above $3000.

None of this would be possible without the assistance of the Federal Reserve, which continues taking unprecedented measures to prop up the markets. In addition to mortgage-backed securities and treasuries, the Federal Reserve has started to buy corporate bonds, including some that are junk-rated.

The Wealth Gap

The stimulus has done very little to jolt the real economy, but has continued to fuel an ever-increasing wealth gap between the rich and poor.

Most of the new money goes directly into the stock and bond markets, further enriching the investors who already own those assets.

Those who are just starting their careers must pay artificially higher prices for their homes and retirement contributions, leaving them with less disposable income.

From Capitalism To Corporatism

The federal reserve's decade-long bailout of banks and corporations has created a moral hazard, in which too-big-to-fail banks and mega-corporations no longer consider it necessary to act financially prudent. They can take excessive risks while relying on the central bank for assistance if they fall on tough times.

But in order for a nation's economy to strengthen and expand, weak businesses who fail to prepare adequately must be allowed to go bankrupt, so that the prudent ones, who use resources more efficiently, can take their place.

As more citizens and businesses begin to rely on the government for assistance, the nation becomes weaker. The final result is that complacent empires are replaced by more diligent ones.

Cryptocurrencies

The cryptocurrency industry may be the last free market we have left. None of the thousands of other innovative, hard-working crypto projects have received any bailout funds from the central banks throughout this difficult period.

The crypto market is merit-based, and only those projects which deliver on their promises and provide real value to their users will end up attracting wealth and succeeding.

As well, different from national monetary policies, the supply curve of cryptocurrencies is transparently fixed and cannot be changed at-will by a central party. Any changes to the inflation rate would need to be democratically approved by a majority of stakeholders on the network.

To learn more about how central bank monetary policy is affecting the markets, be sure to follow the Peak Prosperity and Real Vision Finance channels on YouTube.

Sources:

https://www.cnbc.com/2020/07/06/citi-sees-markets-in-a-stalemate-over-the-next-12-months.html

https://www.barrons.com/articles/global-stocks-are-set-for-12-month-stalemate-citi-says-buy-the-next-dip-51594043929

https://www.nytimes.com/2020/05/12/business/economy/fed-corporate-debt-coronavirus.html

https://www.fxstreet.com/news/feds-balance-sheet-rises-above-7-trillion-202005220305

https://www.ai-cio.com/news/gundlach-charges-fed-propping-rickety-companies/