In this guide I'm gonna show how to create ETH wallet and send your HIVE to the ETH network. Next we're gonna try to do some DeFi trading but since ETH fees are super high lately, it's not gonna be easy! Let's go!

If you would like to know what's all the fuss about, be sure to check out the part 1.

Step 1: Getting into ETH

First we need to have ETH wallet to store our ETH and other tokens that operate on this network. One of the best solutions here is Metamask. It operates as a browser extension (like our Keychain) and as a mobile app.

I will install fresh Metamask on Brave browser from here: https://metamask.io/download.html (for Brave you can install Chrome version). Here's how it looks after installation (notice the Metamask icon in the top-right corner, next to Keychain icons):

Let's get started and create new wallet. The whole process is very easy, just be sure to write down your passphrase.

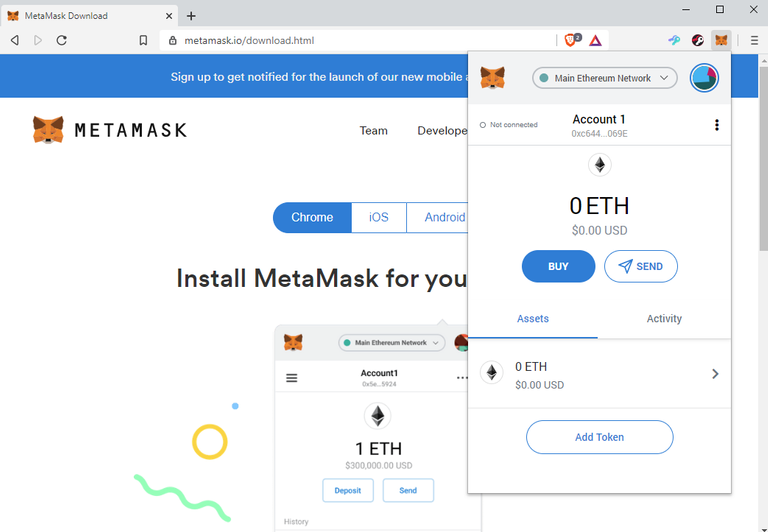

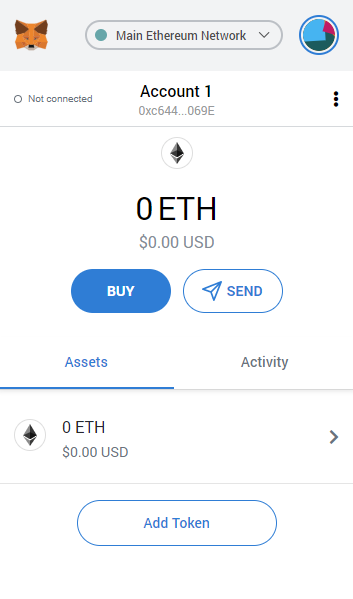

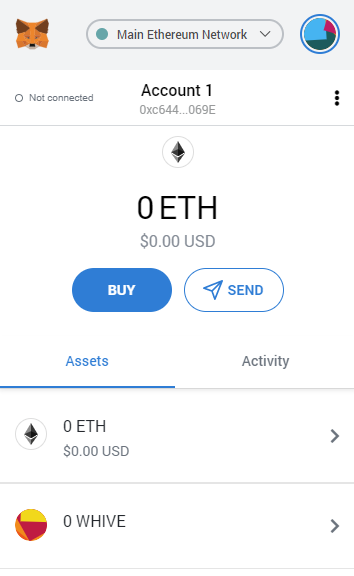

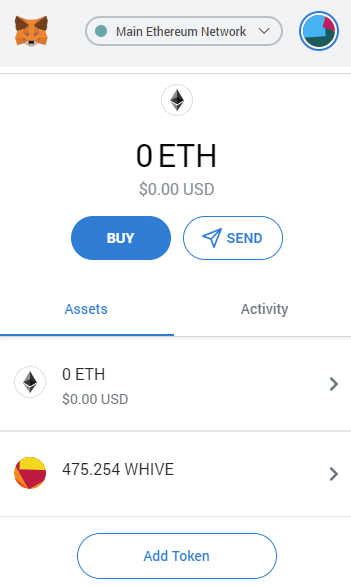

After you crated your wallet, click on the foxy icon on the top-right corner to access it at any time:

Step 2: Wrapping HIVE

We're gonna start by adding support to WHIVE to our wallet. Click Add Token at the bottom of wallet window:

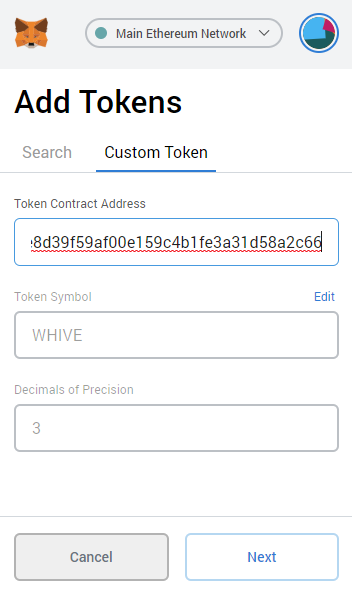

Select Custom Token and paste this: 0x11d147e8d39f59af00e159c4b1fe3a31d58a2c66 in Token Contract Address:

Now simply click Next and confirm with Add Token. Here it is!

You can see that the tokens doesn't have custom icon yet but this should be fixed soon(TM).

Now let's send some HIVE to our ETH wallet! We call this wrapping and of course HIVE is not the only token you can wrap on ETH network - for example we also have WBTC (bitcoin on ethereum blockchain).

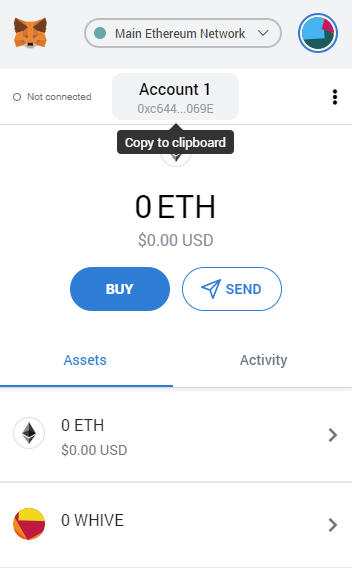

The whole process is super easy. First we need to get our ETH wallet address - to do it, simply click wallet name (Account 1 in my case) at the top wallet window. This will automatically copy it to clipboard:

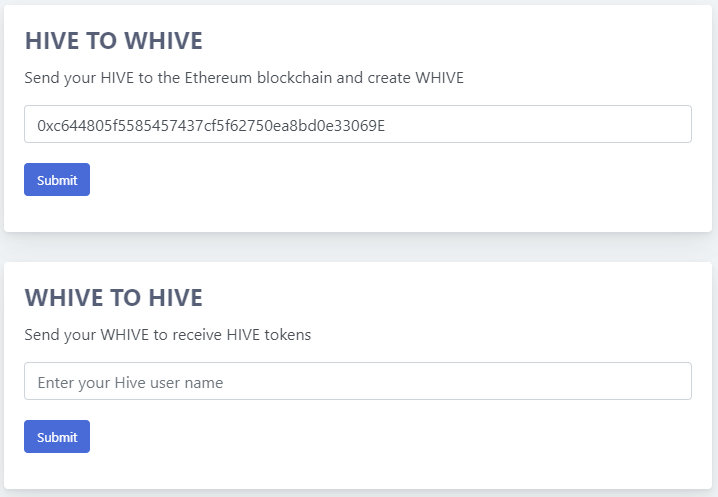

Now go to https://www.whive.network and paste your ETH wallet address in HIVE to WHIVE box:

Click Submit and select how much HIVE you want to wrap - this is entirely up to you but keep in mind that ETH transaction fees are pretty high right now so you want to wrap a lot of HIVE - so that the fees don't eat up any potential profit when we're gonna be using it to trade or other activities (providing liquidity etc.)

The ETH fees are not dependant of the transaction volume - the fee will be the same whether you transact value of $1 or $1 000 000. Currently interacting with Uniswap (where we will be going) costs around $4 per transaction.

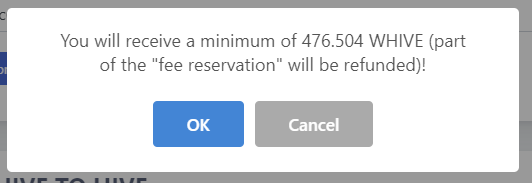

I've decided to wrap 500 HIVE and the "fee" popup informs me what is the minimal amount of WHIVE that I will get at this moment:

The maximum fee that will be taken currently is 23.5 HIVE - it will be used to pay the ETH transaction fee. But that's the worst case scenario and the actual fee can be determined only after the transaction is complete. Please note that the fee would be the same whether I want to wrap 50 or 500 000 HIVE (that's why you want to wrap higher amounts).

Click OK, confirm the transfer (with Keychain or Hivesigner) and sit tight! About one minute later you should see your WHIVE in your ETH wallet :) Magic!

I also got a refund of 13.329 HIVE which means that wrapping costed us 10 HIVEs.

Step 3: We need some ETH

Before we start - why should you even care about trading on DeFi platforms?

First - no KYC. There's no one to verify your ID because the whole platform is handled by decentralized smart contracts, not people (well, the devs write the code for those contracts but you get it!)

Second - you don't need to make any deposits, that could be taken, frozen or stolen by the exchange. The tokens leave your wallet only when you accept the trade and the whole trade is handled by the smart contracts. In other words - it's the safest way of trading. The downside is of course the cost of the fees (we really need ETH 2.0 at this point). But, despite the fees, there's still room for profit to be made :)

First, we're gonna need some ETH to pay the trading fees. If you don't have any, you can buy it on any exchange or use https://blocktrades.us or https://swap-app.app to quickly get it. We're gonna use the second option.

I'm the creator of @swap.app so sorry for this shameless plug, I had to.

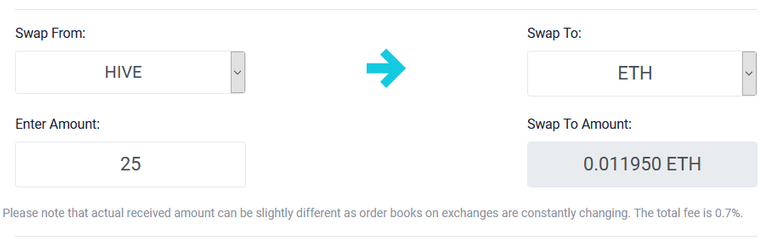

We're gonna sell few HIVEs to get around $5 in ETH. Go to https://swap-app.app and check the rates:

This should be enough. Now, as stated on the https://swap-app.app website, all you need to do is sent HIVE to @swap.app with memo eth eth_wallet_address

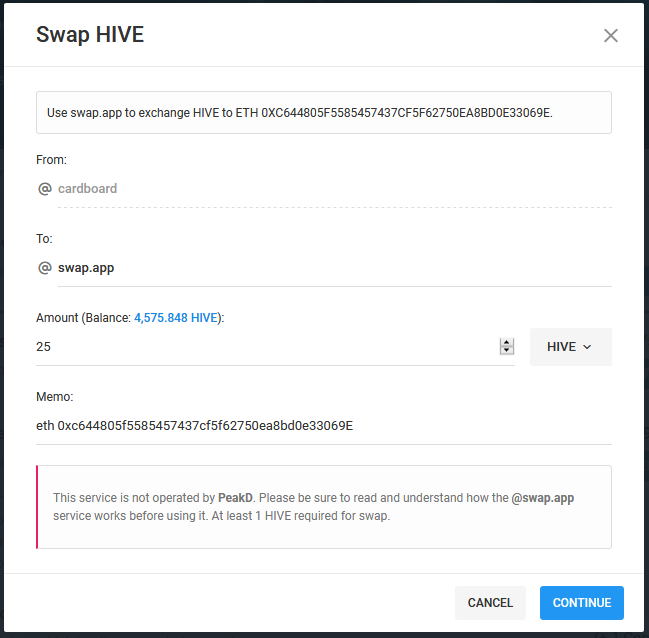

Our wallet address is 0xc644805f5585457437cf5f62750ea8bd0e33069E so the memo should look like this eth 0xc644805f5585457437cf5f62750ea8bd0e33069E:

Using awesome https://peakd.com wallet here to send the transfer.

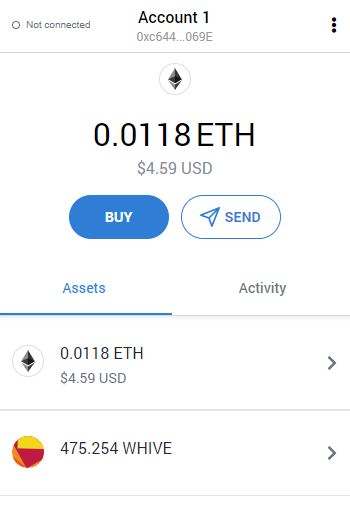

About 15 seconds later - here it is.

Step 4: DeFi trading

Now, we can finally do some trading. We're gonna try to sell our WHIVE on the Uniswap DeFi platform and see if we can make any profit.

First, go to https://app.uniswap.org/#/swap and click Connect to a wallet in the top right corner:

Select Metamask and pick your account - it's all very fast and easy.

If you run into any problems here, go to Brave settings -> extensions and change Web3 provider to Metamask:

Because WHIVE is not yet officially added to the tokens list, we're gonna use a shortcut. Go to WHIVE stats page:

https://uniswap.info/token/0x11d147e8d39f59af00e159c4b1fe3a31d58a2c66

and click Trade in the top right corner:

You can also manually add WHIVE token to the list: just paste the WHIVE address:

0x11d147e8d39f59af00e159c4b1fe3a31d58a2c66in the Token field.

Make sure you have ETH selected as To token:

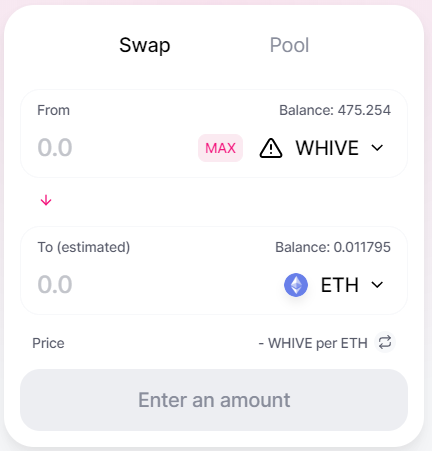

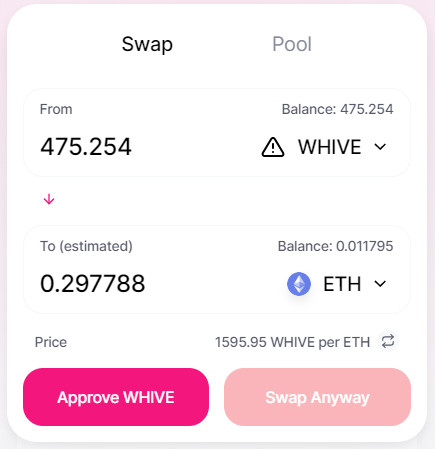

Click MAX to sell all WHIVE:

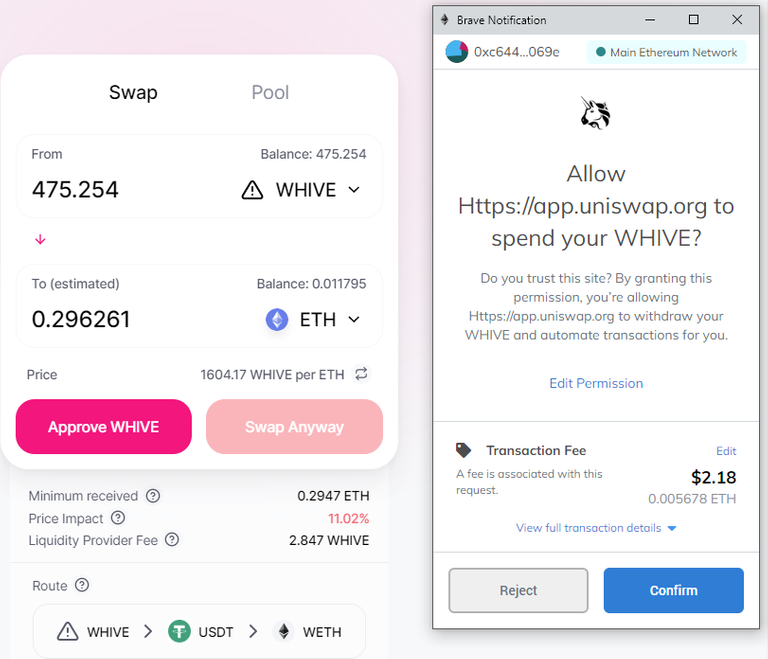

You can see a new option appeared - Approve WHIVE. We need to give Uniswap permission to trade WHIVE using our wallet. This means interacting with smart contract which costs a fee - thankfully this operation needs to be performed only once. Click on the Approve WHIVE button and Confirm the operation in Metamask wallet:

$2 - ouch. Let's hope it was a money well spend.

We're gonna compare the amount of ETH we'll get from Uniswap and @swap.app - and because @swap.app uses Binance prices - also with the traditional exchanges.

The thing is - Uniswap automatically "routes" your trade to get the best deal. This means that there's a potential to make some profit. Let's see how much ETH we will get:

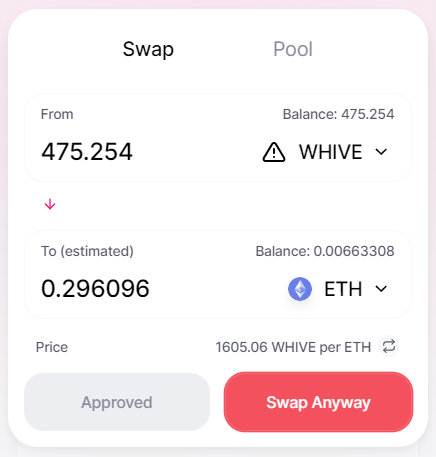

0.296096 ETH. It is a good offer? Let's compare it to @swap.app (or any other exchange):

That's less ETH! For this trade, Uniswap will give us 0.022954 ETH, or $8.72, more compared to @swap.app, Noice!

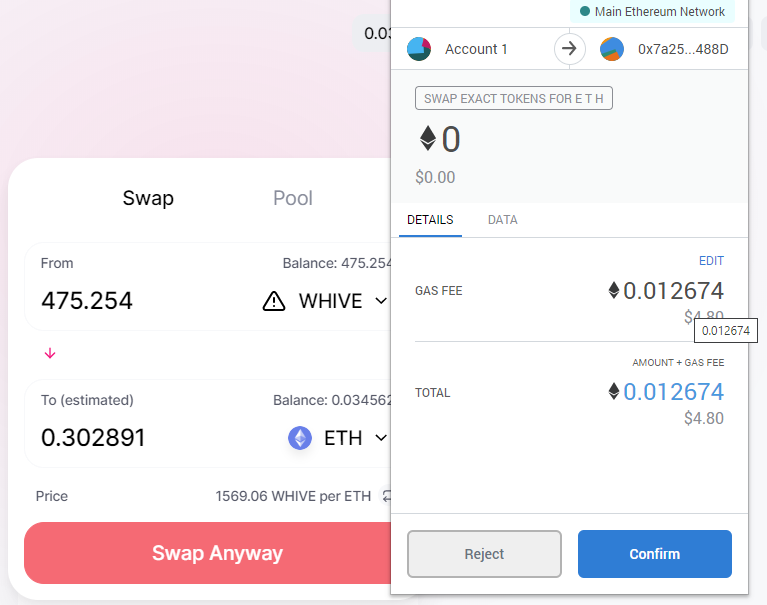

Let's make the trade - click Swap Anyway

The reason why the button tells Swap Anyway and is orange is because our trade will move the price by over 10%. That's because of low liquidity of WHIVE on Uniswap but it's getting better every day.

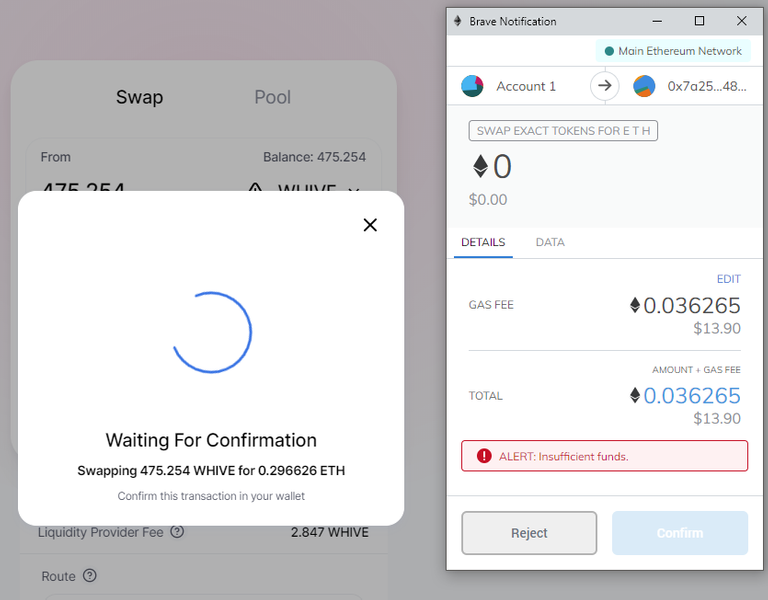

And FAIL :D

The trade would cost us $13 in fees. This is the highest I've ever seen (normally it's around $4). We could edit the fee and set it far lower but then we risk that the transaction will be delayed and cancelled in the end.

It seems I've picked a bad moment to make the trade as currently ETH is highly congested. It might get better in an hour or so but for now I'm just gonna grab a coffee :)

Now that looks better! The ETH difference now is 0.031169 ($11.68) and the transaction fee is $4.80 (I sold few HIVEs in the meantime to get ETH needed for fee). Let's click Confirm to accept the transaction.

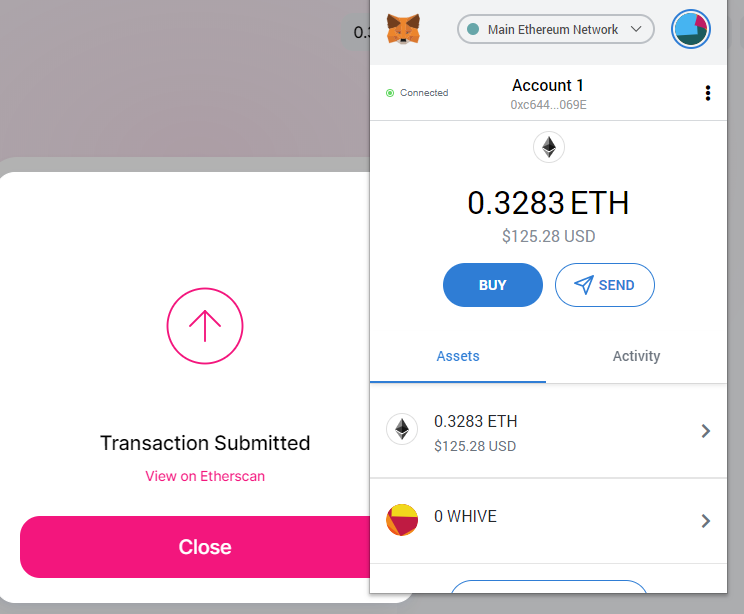

Few seconds later - and here it is:

Let's see if we're in profit despite the fees:

- $2.2 for wrapping (10 HIVEs)

- $2.18 for allowing Uniswap to trade our WHIVE (this has to be paid only once)

- $4.8 for the transaction

Total fees: $9.18 which means that we've made a whopping +$2.5 which is around +2.3% of our initial investment (487 HIVE). Please note that with next trades we won't have to pay $2 wallet connection fee.

Now, our profit comes from HIVE price difference between centralized exchanges (like Binance) and Uniswap DeFi platform. This means, that we can now send ETH our earned ETH and use it to buy more HIVE that what we've started with. In fact, this is what I did yesterday, turning 980 HIVE into 1054 HIVE :)

In conclusion

The goal of this guide was to show how to wrap HIVE and trade WHIVE on the ETH network. The fact that we've made profit is pretty cool but it's obvious that with the current, expensive ETH fees you should be trading at least $100 - and the more, the better.

This greatly limits the usability of DeFi swaps for users with smaller crypto portfolio but at least know you know how to use it. And when the ETH 2.0 comes (or fees at ETH 1.0 go lower), you will be ready to roll :D

In the next part we will be doing something much cooler than just trading, trading is for peasants! We're gonna be providing liquidity for traders and getting a nice cut from the trading fees. In other words - passive income with HIVE without need to sell it or power-up.

WTF! That's a lot of work.

So if it only makes sense for large amounts.. that rules out all the poor (figuratively and literally) fools that take years to get even 500 Hive.

If you still have to buy ETH to get into the DeFi game then isn't this just adding an intentional (and unnecessary) hurdle for yourself? Why not just buy ALL THE ETH with Hive to play the ETH game?

Am I not seeing why this wrapping is smart?

Is this just for the 'intensely committed to Hive' types?

ETH does not have 10%+ APR like Hive does :) Plus if you want to provide liquidity or generate profit from price differences, you need both ETH and Hive.

Ok all makes sense now cheers!

Nah... Hive is so cool it doesn't need to be wrapped.

Mixed feelings so you got a Complaint+Upvote bundle ;-)

Great guide! Thank you @cardboard!

What do you think of DeFi apps such as http://bit.ly/DeFiArbitrage, which lets you have a higher returns as a liquidity provider on contracts based on Balancer.

I was looking into them today following your initial WHive post, and found them to be quite interesting. As long as the contracts are not hacked, or the operators do not mint infinite tokens secretly and crash the market, or just flat out exit and run, one can make a great ROI by providing liquidity.

I am assuming that the operators are actually doing some arbitrage trades on the different DeFi platforms and are making almost double or more than what is being paid out to liquidity providers.

This is something that I still need to learn about :) do you earn only the yfv token?

Yeah, you earn the YFV token, which covers the impermanent loss, if any, on the Balancer contracts. You also earn vETH and vUSD in addition to the YFV.

What is nice about the Balancer contracts is that the weights can be other than 50%/50%, which is especially great for riskier token contracts.

So one can actually provide liquidity in a 49% RenBTC/ 49% wBTC/ 2% YFV contract, or something with ETH or Stablecoins.

Damn, I should take lessons from you when it comes to DeFi platforms :) I didn't go much into the yield farming thing, might need to catch up :)

As for Balancer - it would be awesome to build liquidity there but first we need much more WHIVE on Uniswap so the big boys can make their trades there - at least that's the plan!

I just started looking into it 2 days ago, after reading your post about the wETH/wHive pair on Uniswap. Wish I had learned about this DeFi thing sooner.

How are you making out with providing liquidity on Uniswap. Is it worth it?

Also, what is the ERC20 contract address if others want to be liquidity providers on Uniswap?

Thank you.

Hope to make a tutorial about it today :)

Sh!#t, I've messed something up when setting @reward.app for this one. Sorry!

LOL 😂

my head is exploding 😳😁 definitely bookmarked this to look into later. Great post!

Thanks for the very clear how to guide, dear @cardboard. 🙏

I love passive income, so I can't wait to read your third part. 😜

Another one! Let's spread the word #posh

https://mobile.twitter.com/HivePolish/status/1299077146749607936

Great step by step guide.

Another option would be to get the ETH directly from your Hive using a service not requiring KYC as SimpleSwap , of course, they add their commission on top of the one from Binance so all is done in one simple step but probably at a much higher cost, plus you have to send your tokens to simpleswap service and that adds additional risk.

Now this is a sweet one!

Posh

Thanks for this guide - I probably should have waited till you put this out before playing around with this, but didn't. This will make getting involved an easier process for many that have not used Uniswap previously.

good

Neat guide. I haven't messed with WHIVE yet, but I just might have to tonight after reading this 😁

Posted using Dapplr

Wow this is probably one of the best guides I've read about using defi! Perfect walkthrough, thank you so much for taking the time to post this!

Another quality wHIVE guide.

Bookmarked for when I take the plunge.

Posted Using LeoFinance

Superb information bro..😍

Muy interesante y instructivo tu post, la verdad me agrado, me pone al tanto, saludos.

Would there be any advantage/possibility to being able to wrap a hive-engine token?

As far as I can tell, DEC is already functioning on ETH network. Anyway yes, as long as there's someone who wants to trade it (in large volume).

Gracias por su explicación, para mí muy útil ya que estoy incursionado en este mundo