Stablecoins were originally created to solve the problem of getting liquidity into the bitcoin space, and the issue of having exchanges custody funds. Instead of each exchange having to create its own fiat treasury, accept fiat, and deal with the banking wires, having a stablecoin reduced that complexity.

A central body would manage all the creations and redemptions, while the funds in the system would be pegged to that treasurey. Exchanges would offshore their risk to these third parties in exchange for speed and simplicity of their operations.

Stablecoin markets

Eventually, stablecoin markets became a trading pair, instead of shitcoin to bitcoin transfers you could now go from stablecoin to shitcoin, or stablecoin to bitcoin transfers.

Instead of shitcoins having to be tethered totally to bitcoin, they now had a hedge through their stablecoin liquidity, and it allowed shitcoins to smooth out their crashes.

Shitcoins are still very much leveraged bets on bitcoin, but stablecoins do reduce the impact of that leverage and why so many shitcoins are desperate to set up pairs against stablecoins of all types.

The more dollar exposure and liquidity you can get, the more capital can flow into your ecosystem.

Stablecoins was created for a niche use case

Stablecoins were created to allow for instant settlement in various digital markets and allow for more efficient arbitrage between exchanges. But as fate would have it shitcoiners don't understand this and they think stablecoins are meant to create shoddy financial products on top of it.

Now this chase for yield is using stablecoins as an affinity scam, people understand fiat, but they don't understand risk, so they discount the one and associate safety with the other.

This helps sucker people to compromising positions many won't get out of before it's too late.

Stablecoins are digital fiat

Apart from the obvious issue, is that its a fiat currency that continues to devalue. The stablecoin has to be a centralised service to run successfully, it's an extension of the underlying asset.

Stablecoins can only be managed from a central treasury where redemptions can be managed, if you're going to try to back it with a floating asset you're going to have a bad time.

You've already seen that with the implosion of LUNA.

The failure of stablecoins

If you think UST is the only one, you would be wrong, Bean Finance blew up a few weeks earlier

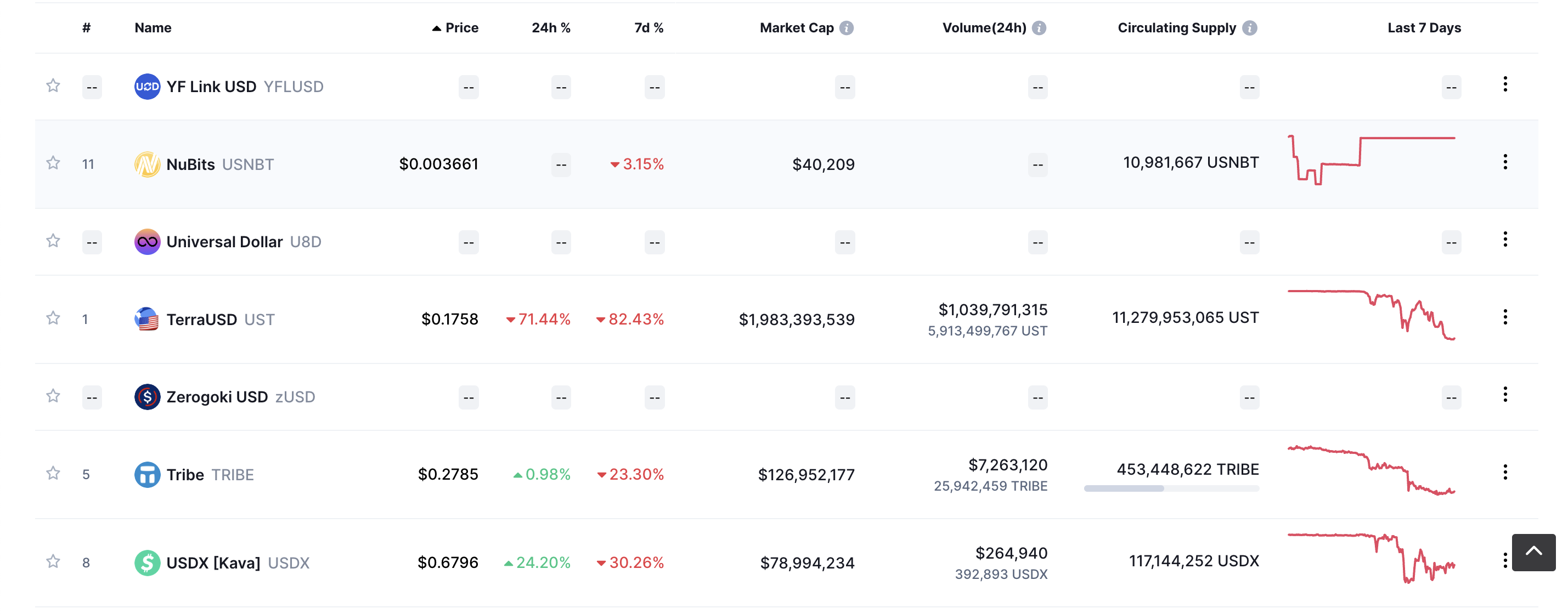

It looks like 10 stablecoins have already broken and there are 12 more that are in the same boat. If we have a look at some of the failed attempts, you can see some of them below:

The truth is algo stablecoins are a disaster waiting to happen, the collateral they are using is firstly subpar, the demand for the collateral is hardly enough, in fact, more people want the stable coin than the underlying making it a cock up in the first place.

You can maintain an algo stablecoin in certain environments where there isn't much demand for the coin so you can manage inflows and outflows to maintain the peg, but then you're doomed to be an obscure environment.

The moment you achieve any kind of scale, the obvious peg balancing will be exposed.

If anyone that tells you their algo stablecoin is different is a moron. It's only a matter of time before it fails.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

Posted Using LeoFinance Beta

Well, I cannot disagree more.

But then again, the tone of your writing is not very conducive to reasoned argument.

First of all, the main use case for stablecoins is as payment instruments, a use case for which a crypto can only function if it underpins an economy, lest its volatility is too high.

Second, algo stablecoins are only doomed to fail if their monetary mass disconnects from the economy of the backing crypto. In economic terms, if M > (P*T / V). If the algorithm keeps (by adjusting interest rates, printing and redemption costs) M under control, a stablecoin becomes part of a "currency board" which is a well proven monetary tool in traditional finance and has functioned well in many cases (e.g Bulgaria in 1997 - 2000)

So no, your provocative take is shortsighted. But to your credit, so are most of the current promoters of poorly designed, ponzi-like stablecoins. Whether an algo stablecoin is a Ponzi in disguise or a currency board depends on whether there is real usage of the underlying crypto (outside self-referential DeFi) or not. Hive arguably has that with the "creator economy" around blogging and curating, and the gaming on Splinterlands and other. A small economy for now, but probably enough to give substance to a few million HBD.

Can you show me proof the amount of volume stablecoins are doing in any sort of commerce? If you can't then you are only speculating, because I can point to every exchange and show you the volume of stablecoins traded between shitcoins and bitcoin which is probably 99% of its use, other than arbitrage between exchanges. Stablecoins were created for the sole purpose of clearing, trying to make a marginal use case the primary use case the reason for existence and growth is a stretch

Here's an easy way you can disprove me, pull up stablecoin wallets, look at how much of those transactions are going to wallets that are not exchanges and not attached to smart contracts, and ill give you the benefit of the doubt on all margin of error and you tell me the percentage of those transactions and we assume its commerce. How much do you think that would be? more than 1% I doubt it.

Algorithms aren't hard stops, they are automated jobs, if the liquidity is out of band no amount of automated correction is going to help, you're always going to be living and dying by the rate of redemptions, which NO Algorithm can force, either way, you can spoof it but there is no hard rule to stop it.

Calling me shortsighted doesn't provide any more validity to your argument in fact, it just shows that you have no merit to stand on

By "The main use case is" I didn't mean that's what they are used for now. I meant "that's what they could be most useful for" ... provided they could get regulated and mass adopted. I agree that now, they are used as you say for "greasing the wheels" of the crypto financial machinery.

About algorithms, you are wrong: youcan program them to check liquidity and stop redemptions if liquidity is out of band. I don't understand your reasoning when you write:

This is code, for Pete's sake, you can force whatever you can think of ! Why couldn't you program a rule to simply prevent redemptions, as long as redemptions are done by the algorithm ? You send your troubled algo stable to the smart contract to get back whatever the backing is. The algo checks a formula. Formula out of band ? Well, you get back the answer "sorry, the bank teller is closed, withdrawals are temporarily unavailable, check back later, don't call us, we'll call you !"

How am I wrong? UST proved that algorithmic stablising both with native and 3rd party assets is very much valuable.

LOL that's not how code works mate, because you're dealing with an oracle problem, if your coin is traded on a market and it has to reflect the market price or it will be clipped until your treasury is depleted.

Do you know these things work? because I do, a algo stablecoins market price is NOT set by the smart contract, it's set by the market, the market price feeds come from external service providers like exchanges. The more lisitngs you have the more exposure and the less control you have over managing the peg.

Its NOT a self contained system, so when someone shorts your stablecoin or collateral backing it, on one of the data providers, arb traders come in and clip the premium on exchanges yet to catch up and then the on-chain has to correct flooding those markets and being the floor, diluting its collateral and breaking the peg.

Can you walk me through this step by step? So say my algo A is traded on markets N1, N2, ... against other cryptos, including other stablecoins, say collaterlized like USDT or USDC.

Next an attacker borrows my algo A in a large quantity. However, the quantity he's able to borrow depends on M (the monetary mass), id est how much there is available. If you want to sell A (trying to break the peg), there needs to be someone out there to lend it to you. If the total monetary mass of A is reasonably controlled, how much can the attacker borrow ?

So now say the attacker has borrowed as much as he could find and sells enough A on the market N1 that the whole order book there is cleaned and the N1 market lists A as $0.01 because there are no more buyers on that market. Some people may call "break the peg" but that doesn't qualify, in my opinion. The smart contract might or might not be programmed to defend the peg on each and every market. Why would it ? That would be stupid and open A to manipulation. At any rate, that is a CHOICE of the programmers. I can have oracles, I can look at markets. So what ? What forces me to engage in defending the peg on individual markets ? The peg is guaranteed on the blockchain, nowhere else

"A" fails and the peg is broken only when there permanently is no way to redeem it at par from the issuing smart contract on the blockchain. That is the central authority which has ultimate responsibility over the peg, not an individual market, whichever that my be, not ANY number of individual markets.

The fact the UST failed proved that it was not programmed right, NOT that no algo can be programmed right and all are doomed to fail.

So what happens next, can you please indulge me with an exploration of the mechanics ?

I literally explained it already, check above, if you still don't understand here is an in-depth deep dive into the fundamental issues of algo stablecoins, please read it

Your explanation is based on an underlying assumption I do not share. Your assumption is that

An algo stablecoin "price" is indeed set by the markets. Just like the dollar price expressed in euros is set in the Forex markets. But if the goal of your stablecoin is to facilitate payments between individuals and businesses (rather than merely enabling meaningless financial shenanigans), then the price (expressed in, say, dollars) set by a market at any given moment is mostly irrelevant to what should be the main mission of a stablecoin, facilitating peer-to-peer transactions in the "flesh" economy. And that, at least as long as there is a credible theoretical path of returning to parity.

You need to see the evolution in time of the relationship between the stablcoin and its peg as a continuum. At one extreme, you have nearly microsecond-level parity, and then you need to manage the peg as you say, which can be very tenuous. At the other extreme, you have a "permanently unstable stablecoin" such as the SBD which lacks appropriate stabilization mechanisms and therefore sits most of the time far away from its peg, to the point where it completely lost credibility as a stablecoin.

In between, you have stablecoins such as HBD which are not that stable but still reasonably so.

In terms of stability, I measure the quality of a stablecoin by its ability to stake a serious claim at being "close to the peg most of the time". But one can be more or less strict in that definition and the stricter one is, the more difficult managing the peg becomes.

The article you quoted is intellectually shallow and mostly useless.

Well said. "Stable coins" have a very limited use case.

Efforts to make a "stable coin" the primary focus of a platform undermines the platform.

I have to put "stable coin" in quotes because their is no such thing. All financial assets fluctuate in price.

The thing I liked about crypto is that the exchanges were developing a market that realized this natural flux.

Anyway, I am heartbroken that HIVE has chosen to follow the path of UST and the other blockchains that jeopardized the platform of the sake of a stablecoin.

Posted using Proof of Brain

Jokes about stablecoins will appear soon)... at least the combination of the words coin and stability will cause hysterical laughter)

Posted Using LeoFinance Beta

That's the shitcoin narrative game, since there is no fundamental use case, you constantly have to invent one to keep people coming back, has bitcoin's usecase changed in 13 years no? Because it does what it says, shitcoins have failed miserably against bitcoin and now want to pivot into becoming mini central banks issuing unbacked fiat currency

You are literally using a "shitcoin" platform to exchange ideas (not "coins") with other people and engage in collective knowledge production. That is something Bitcoin was not meant to do, and it's something useful and powerful at the same time. Hive is backed by this process of collective knowledge production, by the transactions in nftshowroom.com and other marketplaces for digital art, by the games it powers. That's today, but the power of this platform is that it can sustain a host of other collective endeavors, where people come together and collaborate and achieve something. It's been done in the past, in the time of steem, there's no reason it cannot happen again.

Yes I know and dumping the shitcoin has been a complete ball ache because there is no liquidity lol 🤡

I completely agree: algorithmic Stablecoins are a trap.

Especially because of the wrong meaning given to them by Shitcoiners!

For the time being.

I am sure the developers will be able to create a hybrid stablecoin that in cases of depegging, have an underlying to handle it.

From some rumors, this Earth/Moon drop was intentional because of 2 big investors teaming up: if so, in addition to dealing with Shitcoiners, we would also be dealing with "Shitinvestors"

Shitcoiners will say anything to get you to participate and give up your money based on their mythical stories with no backing, the space is a good way to develop critical thinking and question their bullshit, something very few have learned

I will say that for me, this cleaning is very useful, and I did not have time to send my funds in the wrong direction)

Posted Using LeoFinance Beta

Lol only time will tell, while I try to help, I will enjoy watching normies and shitcoiners get wrecked

Even the pain of enemies, as they say, does not need to rejoice)

Posted Using LeoFinance Beta

Well when you warn people and they don't listen that's all I can do

Noah encountered something similar)

Posted Using LeoFinance Beta

well written. you didn't mention DEI stable coin that crashed after UST?

Don't worry though, HBD will take over supported by blogging and Splinterlands.

I didn't think I needed to Rehash DEI because I did an entire write up here

Lol I don't worry because I have bitcoin HBD is a joke lol 😂 it's not even worth my time ripping into I've already done that

keep up the good work. you're killing me with the talk of unicorns and napkin backed stable coins.

Algorithmic coin look like money printed from thin air , I feel Money printed by fed machine has more value then it.

But anyways, I am thinking to keep some holding in HBD and USDC.

Posted Using LeoFinance Beta

The way a few stablecoins trembled is a sign of concern for stablecoin investors.

And the way UST crashed, have caused a fair amount of fear in the rest of stablecoin market.

Posted using LeoFinance Mobile

The shitcoiners will return, they are all yield hogs, and as pigs come into bull markets, they eventually get slaughtered in bear markets, I've seen it time and time again.

Today I see stablecoins almost as a danger

They've always been one people jys discount it

I'm too tired to "go off" on this at length.

Short answer: No, Stablecoins won't save you. Not sure what they are supposed to save us from, however.

The entire cryptosphere has — sadly — become an enormous shitshow; greed, yields, "wen Moon" and Lambo dreams have all but totally usurped the original promise of crypto as alternative payment services. All we really have now is a frothy mess of exotic derivative investment vehicles that put "pink sheet" stocks to shame.

I still like Hive because there's at least a shred of a use case here, with a content creation platform, gaming and such. Fingers crossed that Lightning might add some actual utility to the rest of the Cryptosphere, aside from "wen Lambo?"

=^..^=

Posted Using LeoFinance Beta

It's all about greed, there's nothing underlying here that is even remotely salvageable. I think there are already lightning apps like stacker news, sphinx, zion, libretube, bitcoin tv and vida showing what can be done with bitcion, lightning, and your own node, providing the case that hive will remain a niche interest.

Do I think all those bitcoin apps will make it? No, but some will, do I think bigger companies like Twitter might just absorb the functionality and overlay it on their network, a strong possibility.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

some algorithmic Stablecoins might have destroy our trust for stables but not all of them are bad because I still believe in stable coin especially Hbd

Posted Using LeoFinance Beta

You believing in it has nothing to do with the quality of the underlying collateral and the liquidity of the market, which is the only thing keeping the house of cards going, but good luck getting rekt

What makes you so sure the asset you are holding can’t go down to zero? This is crypto anything can happen

Posted Using LeoFinance Beta

Because if bitcoin goes to zero, there would be no crypto market left and fiat is 100% designed to debase to zero with 5000 years of repeat failures to look at, so thats what make sme so sure

I think DJED will change your tune when you see it launch in June. I agree with you as the majority of stable coins are a pure sham. Djed has 8x the collateral required and will only be minted or burned depending on the smart contract. Shen is the reserve coin and is not like a normal crypto coin as you can only buy and sell under set conditions. This is maybe over kill but better safe than sorry as they have to maintain the peg.

Posted Using LeoFinance Beta

We've already seen this with DAI and the issue with an overcollaterlised stablecoin is that you now require more staked to acquire it so what's the point? Why would I want to stake an asset to get a stablecoin that is being devalued by the inflation rate of the underlaying currency it represents?

If it's to trade and a yield so it's self-defeating, because you need to beat the sunk cost hurdle rate before you even start making profit. So why not just get an issued stablecoin or just use fiat? Algo stablecoins are a solution looking for a problem