I' ve never seen one of these and I feel that the cryptos have been around long enough to house some obscure concepts and finally have their own Iceberg of words, in case you don't know how they work, the concepts at the top of the Iceberg are the concepts that are commonly known in the general culture, words that have been in the news or that are spoken almost daily in social networks, from there each level below pretend to be concepts much further away from the public eye and much more "niche" that are only known among those who have been immersed in the subject for a few years.

I' ve got almost a decade knowing cryptocurrencies so I think I have a little bit of travel to recognize some of the strange concepts that this world has had over the years, I have been researching for weeks to make known in a simple and straightforward way from the best known concepts to the most obscure at the bottom of the Iceberg.

Still in process :d

I'm going to divide in 2 parts this Iceberg explaining in this first post some of the concepts, the truth is that even for me it has been a lot of research and I still don't have well defined some of the concepts, the second part I will publish on Thursday 28th so I invite you to follow me on Hive if you don't want to miss the post! Thanks again and let's define this Iceberg!

Level 1

Blockchain: I have seen many definitions about blockchain on the net and although it may sound like a complicated term reserved only for experts the truth is that blockchain is just a database similar to the one owned by banks and financial institutions that work to store and verify the transactions of their customers (think about what VISA or Mastercard does) with the peculiarity that all this information is not in a central server but distributed by several computers around the world belonging to ordinary people and who are also responsible for keeping this system running.

Bitcoin: At this point if you do not know it you probably live under a rock, it is the first cryptocurrency to use Blockchain technology in its design having as a premise the concept of decentralization, that is, that there is not a single central point (eg banks) responsible for its maintenance and operation but that this task is entrusted to a network of miners dispersed among several computers and with fairly strict rules on its operation, One of the most famous features is that Bitcoin can only have a total of 21 million coins, no more and no less, marking a clear difference with respect to the currencies that we all know in which the rules can vary quite a lot.

Pizza Day: It is a date on which the community celebrates every year for being at least the first recorded case of exchange between cryptocurrencies and goods and services, it all started on May 22, 2010 when the American programmer Laszlo Hanyecz wrote in bitcointalk, one of the first Bitcoin forums, that he would give the amount of 10. 000 bitcoins (BTC) to whoever could bring him two pizzas from Papa John's to his residence, today those two pizzas cost more than 200 MILLION DOLLARS.

Exchanges: They are platforms or digital markets that allow to store and exchange between cryptocurrencies and also to FIAT money (which are the currencies we all know, Dollar, Euro, etc), if you've heard of Binance is because it is one of the largest Exchanges in the crypto world but also others like Poloniex, Bittrex or Mt. Gox have marked in one way or another this world over the years, something that does cause me a little fun is that despite the philosophy of decentralization that always flies over the cryptocurrencies exchanges have almost always been characterized by being centralized and that many claim has given basis to several known hacks and loss of funds by these platforms, more of this in a moment.

Whales: The concept of whales is a bit strange in recent times, in the beginning it was understood that they were all Wallets that had between 1,000 and 5. 000 Bitcoins but I think this definition has changed especially with the creation of other cryptocurrencies, today we could define it as a Wallet or a specific user who has a large amount of coins in his possession, if you still do not visualize it just think of a millionaire every time you say the word whale, due to the characteristic of cryptos to be "always public", in view of everyone who wants to see, we can track the movements of these millionaires and there are even Twitter accounts that are dedicated to follow these transactions.

Trading: Another concept that is initially from the traditional financial world but that cryptocurrencies has given a boost of popularity among new investors, trading is according to Wikipedia is the speculation on financial instruments with the aim of obtaining a profit usually through Exchange. It is also here where we can find two studies of market actions, our beloved technical and fundamental analysis, the first is based on patterns seen in graphs to anticipate market movement while the fundamental is based on more tangible data such as periodic financial studies in this case of cryptocurrencies or valuation techniques that allow, again, to anticipate market movements and make a profit from it.

Satoshi Nakamoto: Is the pseudonym of the alleged creator of Bitcoin, in truth it is not known if Satoshi created the bitcoin from scratch or if this is just one of the developers of a larger group that created both blockchain and Bitcoin, there are many theories about the identity of this individual although many people believe that potentially a group of developers who have created the entire project of Blockchain and Bitcoin.

Level 2

FOMO: From the acronym Fear Of Mising Out (translated to fear of missing something), is a behavior that can be observed in the enthusiasts of this market and is characterized by the need to be always connected in digital media to not miss a new investment or a coin rising or falling in the market, usually referenced much in the crypto market due to the volatility that has had since its inception and where literal minutes can decide whether you have made a good investment buying that coin or you have lost your house.

Coinmarketcap: It is a website where you can track the vast majority of cryptocurrencies created, normally if you want to know if a crypto at least exists this page would be the option that most users would go first, you can see graphs of the top 100 coins as well as a vast amount of many other less relevant, with detailed descriptions of each of their projects and reference links. As a curious fact I would say that it is one of the few media that have been cited on numerous occasions by companies like Bloomberg and even the U.S. government uses data from the site for reports and research.

**Pump & Dump: They are another concept that is not originated in cryptos but let's be honest, who does not have a friend who has invited him to these groups where thousands of people are dedicated to "artificially manipulate" the volatile price of cryptocurrencies? well that is precisely what a Pump & Dump is, raising or lowering the value of a coin through synchronized actions of, often, a large group of users, and although it is an illegal practice in most markets in the world in cryptocurrencies is an instrument that many Telegram groups still use to get some quick dollar out of many of their investments in shitcoins (more of that concept in a minute).

Whitepaper: It is a document that specifies the characteristics and the roadmap of a cryptocurrency, it can contain both the roadmap of a project as well as more technical characteristics of the currency, how its blockchain works among other things, perhaps the best known of all in the world of cryptos is that of Bitcoin which in only 9 sheets explained all the processes of the cryptocurrency as well as the operation of the Blockchain.

Proof-Of-Work: or proof-of-work system is a mechanism used by certain currencies such as Bitcoin to control, limit and validate the creation of their coins, here we can get technical but in essence this system makes all participants of the Blockchain (miners) have to solve a series of problems involving computing power to be the validators of a transaction (aka put a block on the Blockchain) and as a reward receive some coins that releases the system.

Shitcoins: The term is used for coins that usually copy the systems of other cryptocurrencies without innovating anything to its predecessor, it has been seen in cases such as Dogecoin or other coins that are born as a joke or product of people with a lot of free time and usually do not have a certain goal or just try to capitalize in some way the market that has emerged in recent years.

Silk Road: was a website for the purchase and sale of all kinds of objects and illegal substances having Bitcoin as the main method of payment, as a curious fact this small website that operated between 2011 and 2013 was responsible for one of the steepest falls of Bitcoin even when it was worth little more than a few hundred dollars, 25% was the fall of the cryptocurrency the week in which the FBI announced the closure of the website and locked up its creator, and although it seemed all closed recently have reopened the investigation of the case by the alleged existence of a computer that still has the amount of . . get comfortable ... 400,000 Bitcoin! product of the commissions earned by several administrators of the web. It' s been a little over 10 years since the shutdown so the FBI can be confident that all those Bitcoin are safely tucked away in someone's pocket on some private island.

Level 3

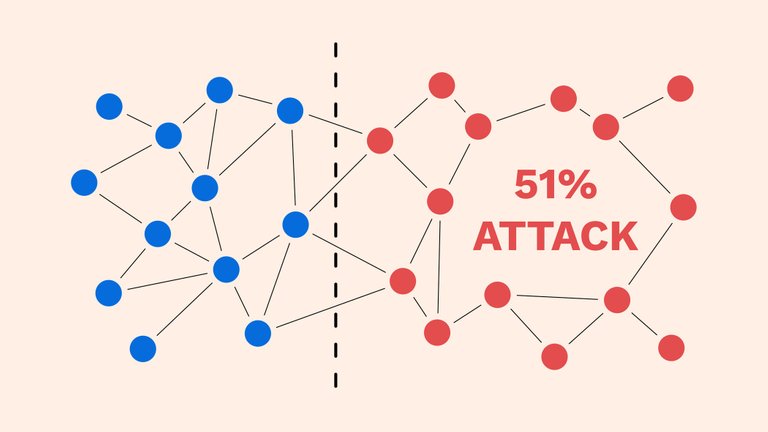

51% attack: It is said that this is one of the potential flaws that cryptocurrencies may have and is based on the fact that if any person or group gets 51% of the computational power of the network could, in theory, control the blockchain and even modify the normal operation of this, there has been much debate about whether this case is possible since it is known that countries like China have had huge warehouses full of miners but the truth is that to this day there has been no attack and even there are doubts whether there are sufficient profits to justify one.

Double spending: This is another of the potential flaws that cryptocurrencies such as Bitcoin that are based on digital files may have, in essence the double spending is based on the fact that these coins can be duplicated to be spent more than once due to a bug in the code or an attack on the network in which they operate. In reality this would be like an extension of the 51% attack since one is necessary for double spending to be possible in the first place.

David Chaum: is the inventor of many of the cryptographic protocols used by today's cryptocurrencies and is even considered by many as the inventor of digital money since in 1990 he founded Digicash, the first digital currency, an alternative for those who wanted to make online purchases, although with the rise of online purchases and transactions sponsored by banks and financial institutions, the company that created Digicash went bankrupt shortly after.

$PORN: This one is curious, because it is not exactly a coin, at least not one that I could find, it is a token project of Pornhub in 2020 to create their own cryptocurrencies so that their customers can pay subscriptions with them, you have to take into account that only Pornhub moved more than 115 million visits DAILY so it did not sound so bad a crypto that would take advantage of this community, with an innovative system of "Proof Of Cum " and 69 million tokens planned, this token really was a project carried out by the page to take advantage of all the movement of cryptos at that time but that today may be buried for good, the coin remained as a project but there are others of this same theme as $PORNSTAR, $PORNVERSE and PornRocket that I could find in Coinmarketcap.

ICO: Remember how, to enter the stock market companies make a first exit of shares seeking funding from investors? ( the so-called IPO), well the same thing but add that is being funded is the project of a cryptocurrency that is about to come out through a smart contract and investors to put their money they receive tokens that can then be exchanged for the cryptocurrency when it is released, was very popular in the rise of Bitcoin and Ethereum but with it also came to light the typical scams that took advantage of the popularity of this concept to make easy money.

Bitcoin for Dummies: It could be a chapter of the series The Good Wife where the implications of a currency called bitcoin and the trial of its alleged creator where the protagonist represents the defendant against the U.S. Treasury Department, this chapter would have been one of the first exhibitions of cryptocurrencies to popular culture but also *Bitcoin for Dummies * could be the book of the same name where they explain some basic concepts about Bitcoin and cryptocurrencies as well as how to operate them through Trading.

Basic Attention Token: It is the token of the Web Browser Brave project, which if you already have some time in the world of cryptos you will be familiar for being one of the web search engines where users are rewarded for doing online searches or refer to the Brave application itself, its users are rewarded with this token but in reality the main function of the token according to its creators is to be a main unit for different advertisers to promote themselves in the Brave search engine.

Level 4

DeFi: or Decentralized Finance, is a concept that consists of developing financial tools (such as Exchanges, Wallets etc.) in a completely decentralized way, without central servers of any kind, remember when I said that the problem of most exchanges was that being a centralized platform was vulnerable to failures or hacks? Well, DeFi pretends to solve this by making a Smart Contract that "creates and maintains" financial services without the need of third parties, there are quite interesting examples like Uniswap that allows to exchange ERC20 tokens in a much easier way than usual or the exchange platform Bisq in which a software is in charge of executing rules that allow the exchange to operate.

Mt. Gox: It was one of the first Bitcoin exchanges to gain notoriety in the market, to the point of hosting by 2011 more than 70% of the Bitcoin transactions in circulation through its website at a time when the currency was experiencing some of its first major rises. However I believe this particular exchange is known for one of the most talked about cryptocurrency thefts in 2014 after a series of hacks to their wallets resulted in the loss of over 750,000 Bitcoins from their customers as well as 100,000 belonging to the exchange, at the time the amount stolen was $450,000 MILLION and the news broke so much that in the following months Bitcoin would lose 36% of its value as well as many media would start to put their focus on cryptocurrencies.

Bitcoin 2: There have been several references to what is considered a second Bitcoin for years and although most cryptocurrencies have the Blockchain as the main inspiration for their protocols (and therefore can be considered as replicas of Bitcoin) there are several examples of coins dubbed as Bitcoin that being a variant of the original have caused interesting moves in the market, the case of Bitcoin Cash that modified the original protocol improving at the time different features of the main coin and having some success or Bitcoin SV that proposed to return to the "true" bases of the project proposed by Satoshi Nakamoto but certainly the one that has caught my attention is simply titled itself Bitcoin 2 in coinmarketcap and although the coin is garbage I just want to appreciate that a couple of users really called their coin Bitcoin 2.

Onecoin: It's one of those bad ideas that nobody knows how they found power in the market, to summarize a bit Onecoin is a ponzi scheme (yes, those involving pyramids) that used a coin to sell educational packages about the crypto world, in fact, much of its "success " during its existence was based on more and more people inviting to "invest" in these packages that allowed to mine the coin, and I'm not talking about small casual talks between people, no, the company behind Onecoin sponsored events around the world selling its coin as the successor of Bitcoin, as in every ponzi scheme the person who attracted a new investment kept a commission in the form of these coins that could be exchanged in an exchange of the company and in this way the scam was growing and growing until after a couple of complaints and judicial investigations the service and all its websites closed without notice in 2017, researching a little I could see some news in which Onecoin is accused in different countries of fraud and many of its "leaders" are currently facing prison sentences.

ALL BEST ICO SATOSHI: sounds like they have mixed a couple of concepts from this Iceberg and made it a currency, this is one of those projects we see everyday that are destined to "change the world of finance" with "a novel blockchain based financial system" only to disappear in a couple of months, and don't look at me, that's literally its description, it talks about something generic at least in this area, this particular coin seemed funny to me because it is the last one in the Coinmarketcap coins list, which as I said, is maybe the biggest website where all kind of cryptocurrencies are listed.

That will be all for now, I still need to define several concepts besides adding some that I have in the list, I had never done such a huge post for the community and I think it is ideal if I split this megapost in two editions, you know, the next one I will be publishing it on Thursday 28th to have the images and concepts ready, if you have any suggestions to put in the Iceberg leave them in the comments, Thank you very much for visiting and see you later!

Posted Using LeoFinance Beta

What's up man?

Very good post brother

Keep it up

Very interesting article!

Posted Using LeoFinance Beta

Thanks for the feedback my dude!

Posted Using LeoFinance Beta

It's amazing, I really have been doing this for a relatively short time but I consider myself an enthusiast and I didn't even know 10% of these terms dude. Thanks for bringing them here! Huge post

definitely