When we create our Portfolio, there are lot of things which we have thought of and created the best portfolio as per our needs. But there are lot of things which are not in our control like the Market's Up and Down as well as the risk taking ability can change anytime as per your financial status.

PC: Pixabay.com

Portfolio Rebalancing in simple terms is the risk managing strategy. As the time passes your asset allocation has to be changed as per the current market conditions as well as current financial status. That means suppose you have a Goal of retirement where you have started with 100% equity but after 5 years you wanted to take less risk as the retirement goal is fast approaching so what you will do is you move those equity asset to low risk debt asset securing your profit and thus now your portfolio stands at 80% Equity and 20% Debt.

Again lets say you started with same percentage of equity and debt ratio, and thus the asset class gives different returns so after a while your equity might give you 15% returns where as debt will give you 6% and thus the portfolio will be more of equity and less of debt. Thus if we want to keep that asset allocation same we have to to Portfolio Rebalancing.

Why we will do it, because when we have started the portfolio we have determined a number of keeping equity and debt portions in portfolio and thus down the line if that ratio deviated we have to bring it back to the original ratio by doing portfolio rebalancing and thus maintaining the risk.

Just think of a scenario where your one of the Coin gives 10X in one year, will it give the same return next year you never know. Now as you are lucky to get 10X its always better to safe guard that also. I am not saying sell everything, but by portfolio rebalancing strategy you might want to sell half of the profit and keep it for a safer place. Because you never know when the riskier asset class will start to fall or how much it will fall.

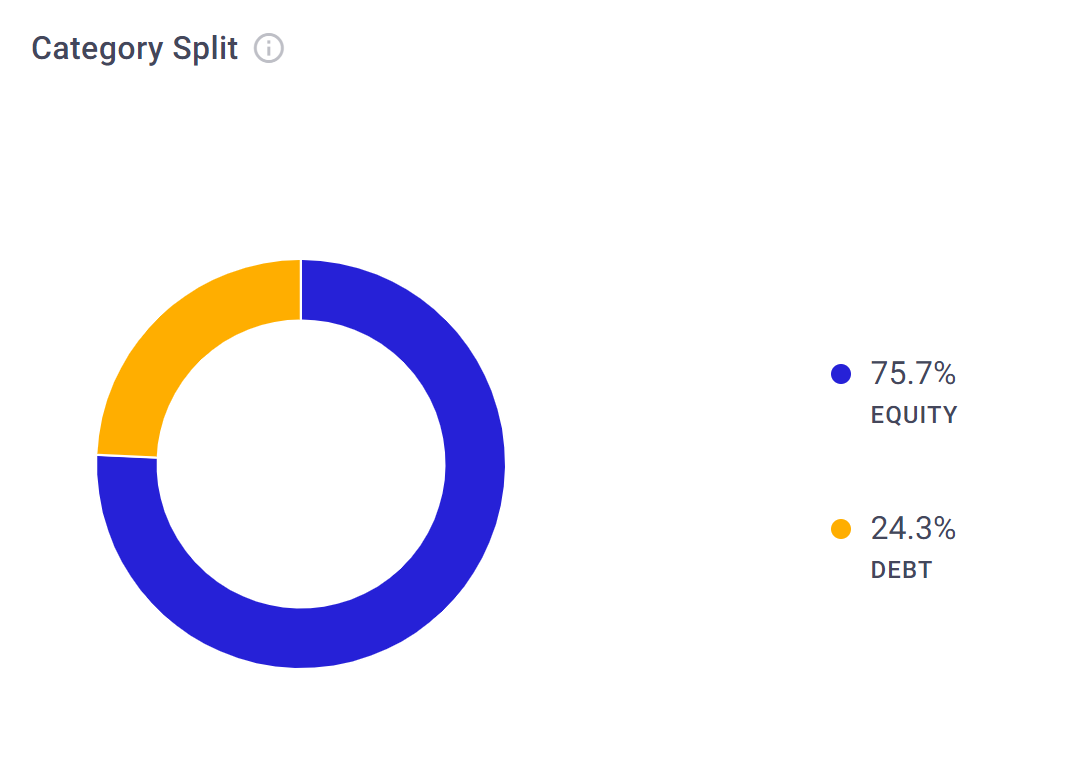

If I have to take my example, When I started investing into mutual fund I had a category split of 70% Equity and 30 % Debt, but now over the period of 4 years my category split stays at 75.7% Equity and 24.3% Debt. As you can see my initial ratio does not match to the current ratio. So I am in need of portfolio rebalancing. But again, as I can take some small risk in this portfolio I am ok to get to 80% Equity level and once that it reached and if the market is doing well, I will be doing portfolio rebalancing to bring it back to 70% Equity and 30% Debt.

PC: Groww

I feel one should review their portfolio every 6 months and do the portfolio rebalancing. If the market is too volatile then you should not do any changes and wait till the market becomes stable.

Posted Using LeoFinance Beta