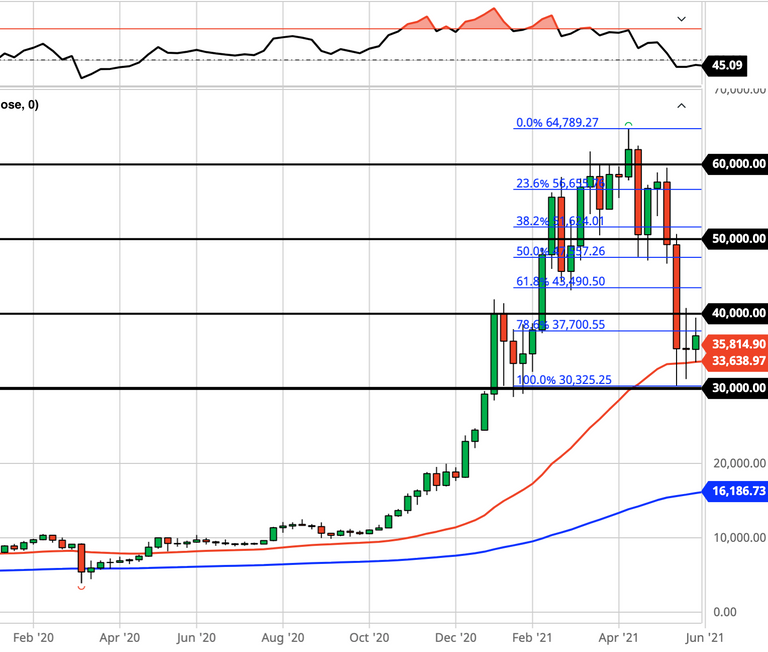

Bitcoin rallied a bit last week, rallying to nearly $40K before slipping in concert with another Elon Mark tweet and finishing the weekly candle net-positive around $36K. This is a bullish doji candle as Bitcoin continues to find support at the 50 Week EMA and appears to be consolidating following a massive ~50% selloff.

(June 6, 2021 8:30PM EST)

Short-Term

Bitcoin continues to trade sideways following the massive late-May selloff, finding some footing around the 50 Week EMA around $35K. There has been a lot of FUD lately but fundamentals remain strong and there continues to be a lot of buying volume. We're approaching an inflection point in which BTC will either rally to a short-term higher high or get rejected and continue lower to retest the lows. When you zoom out, you can see Bitcoin is still in a long-term uptrend and bull market, so we continue to approach this situation with a BTFD strategy. Compared to the current ATH at $65K, Bitcoin is roughly 50% off. If you believe in the commonly-cited Stock-to-Flow Models or Pantera Capital's price projection, Bitcoin could go another 3-10x from here within the next 6-12 months.

.

.

This selloff resembles that off 2013 when Bitcoin had an early-cycle rally to new highs, sold off dramatically, consolidated for a while, and then rallied to exponentially higher highs months later. This is not an uncommon occurrence in markets, especially in crypto, which benefits from volatility as well.

.

.

BTC Dominance

Long-Term

BTFD. Fundamentals have not changed. Daily and even weekly charts will show relatively large corrections; this is standard bull market behavior. Now that another altseason has been spectacularly squashed, this sets us up for another Bitcoin leg up to new highs, likely $75K+ and higher. By nearly every measure, we are nowhere near a top; in fact, we are maybe halfway through this bull market. What do you do during bull markets? Buy. The. Dip.

Support: 50 Week EMA at roughly $33.5K, then 100% fib at $30K.

Resistance: $40K, $45K, then $50K.

Posted Using LeoFinance Beta