Opponents of Bitcoin (central banks, some politicians, among others) interested in the depreciation of the asset's popularity, generally make all sorts of negative statements to convince the general public of the “harmful” side of Bitcoin, linking the asset to illegal practices.

It is in fact notorious for everyone that, in its early years and still very little known, Bitcoin had a very small market capitalization and was associated with Silk Road, a darknet market within the deepweb that was used for illegal online trading and that gave rise to so many others.

But, coming from a steady and organic growth, Bitcoin started to be adopted in more conventional markets and, currently, there is empirical evidence of the decrease in its use by criminals.

Contrary to what can be said, it is much more difficult to use Bitcoin for illicit activities than fiat currency.

A currency whose transactions are transparent, immutable and publicly recorded in a public ledger, makes it a less-advantageous option for criminals. These inherent characteristics of the Bitcoin network make the work of the authorities of each country, in tracking transactions for illicit purposes, easier.

In the traditional banking system, there are many more ways to do this type of misconduct, it is also a fact that some people try by all means to hide fraudulent transactions. While Bitcoin is decentralized, the financial system is supported by large institutions that often cover up fraudulent schemes, as can be seen from the most recent example, involving large global financial institutions in the case known as FinCEN Files, which surfaced in the month of September.

Money laundering, the act of trying to hide the illicit origin of an appeal is a worldwide concern. This practice is what makes many other crimes possible, such as drug trafficking, financing of terrorism, among others, so it is a legitimate issue.

For a criminal, who is planning how to profit from his act, one of the most important things is to find a way to “wash” the money, which is the process of taking dirty money - a product of crimes, such as drug trafficking or corruption - and putting it in circulation in the economy without being discovered, through shell companies or in an account at a renowned bank, where it will not be linked to crime.

The United Nations Office on Drugs and Crime estimates that more than $ 2 trillion is used annually in illicit activities and, according to US Treasury officials, the currency most used by criminals for illicit activities of this nature is the old US dollar, through traditional financial services.

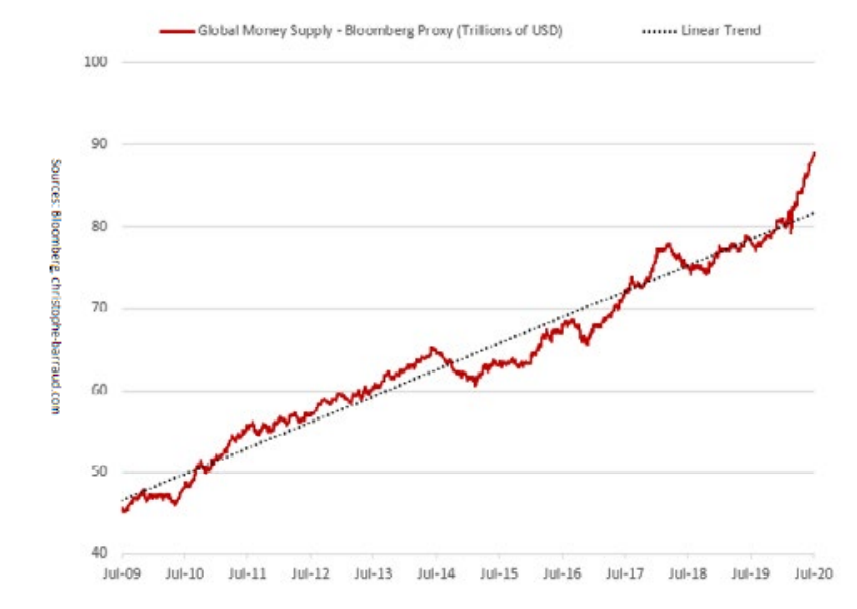

Currently, the global money supply in circulation is almost $90 trillion. That is, on average almost 2% of this total is used for illicit activities all year.

However, this is only an estimate, as the number can be much higher if we take into account other activities that are practiced illegally, such as the sale of drugs and weapons.

It is extremely important to highlight this, as it is very easy for someone who hears about Bitcoin, to link the topic to illegal activities or something like that, mainly due to its characteristics that give anonymity and speed to a transaction.

However, the reality is different and data show that a minority of the volume traded in crypto is used in illicit practices.

Credit cards, online banking, wire transfers and cash transactions were and continue to be used for crime and carried out even within large financial institutions.

But don't expect that truth to appear in the mainstream media, as it is much more convenient to alarm people about the “dangers” of Bitcoin and the existence of the Dark Net.

FinCEN (US Financial Crimes Enforcement Network) is the United States Financial Crimes Enforcement and acts as the responsible for combating money laundering.

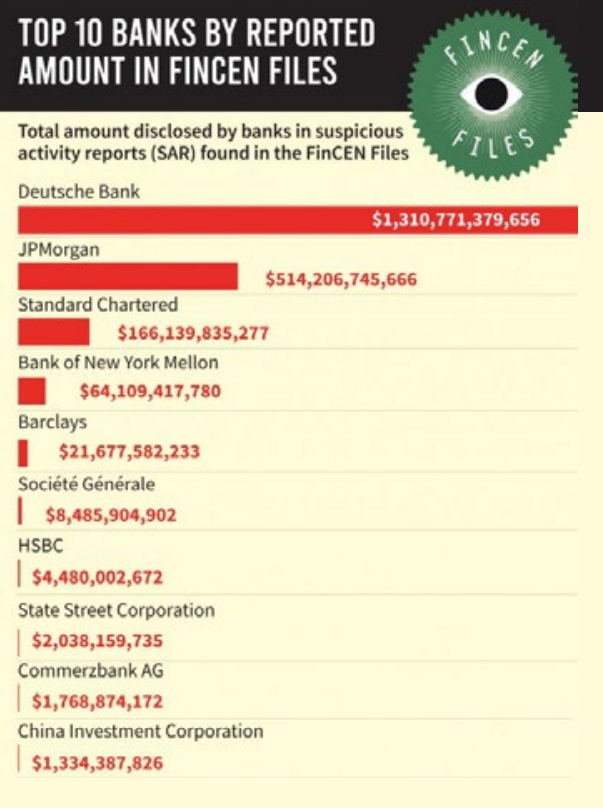

FinCEN documents include more than 2,100 reports of suspicious activity and involve about $ 2 trillion in transactions between 1999 and 2017, revealing the participation of major global financial institutions and oligarchs in some countries in the movement of dirty money, which the US government was unable to prevent it.

JPMorgan, HSBC, Standard Chartered Bank, Deutsche Bank and Bank of New York Mellon reportedly made a profit from operations involving terrorism, even after fines for previous failures to avoid sanctions that should have prevented them from putting their money in the West.

Hundreds of journalists have examined the dense technical documentation, revealing some of the activities that banks would prefer the public not to know.

To give you an idea, HSBC bank allowed fraudsters to move millions of dollars in stolen money around the world.

JP Morgan allowed a company to move more than $1 billion through an account in London, without knowing who owned it.

The bank later discovered that the company could belong to a mobster on the FBI's top 10 most wanted list.

Deutsche Bank transferred dirty money from money launderers to organized crime, terrorists and drug dealers.

FinCEN records show that five global banks - JPMorgan, HSBC, Standard Chartered Bank, Deutsche Bank and Bank of New York Mellon - continued to profit from money from illegal practices, even after they were

alerted. More than $ 2 trillion in transactions between 1999 and 2017 were identified, which were flagged by internal financial institutions compliance officers as possible money laundering or other criminal activity.

The top two banks are Deutsche Bank AG, which revealed $ 1.3 trillion in suspicious cash in the archives, and JPMorgan Chase & Co., which revealed $ 514 billion, according to the analysis.

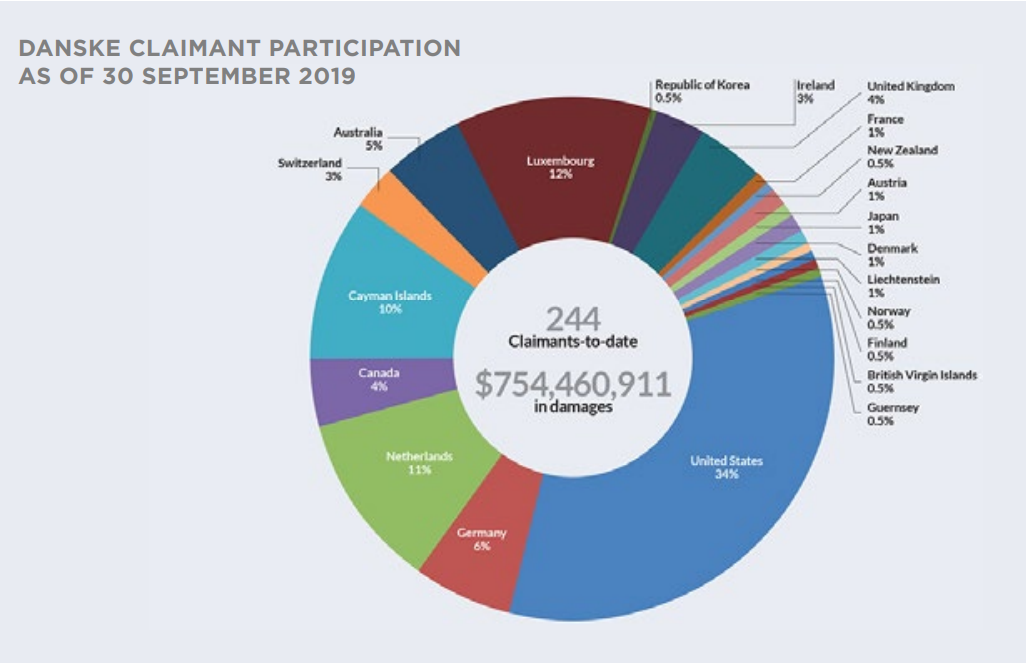

Another case of a large financial institution involved in such scandals is that of Danske Bank, the largest bank in Denmark, whose Estonian subsidiary has laundered more than 200 billion euros. Another case of complicity by the authorities with money laundering and illegal activities involving the US dollar.

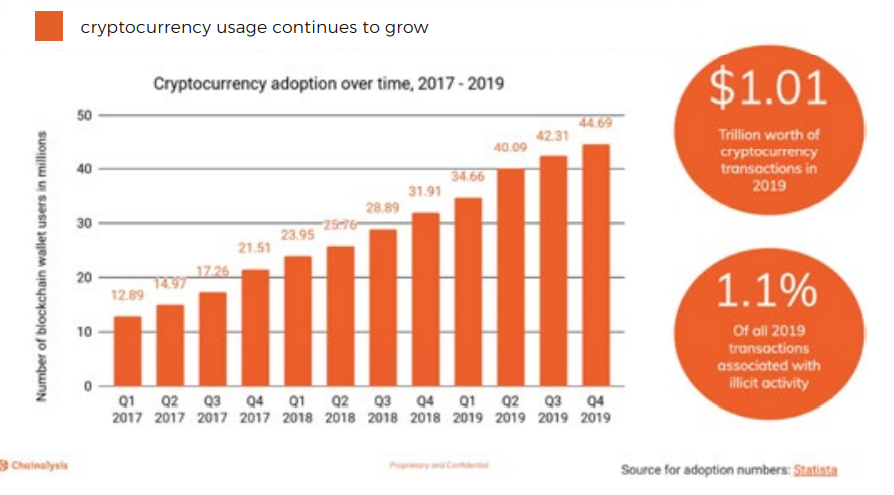

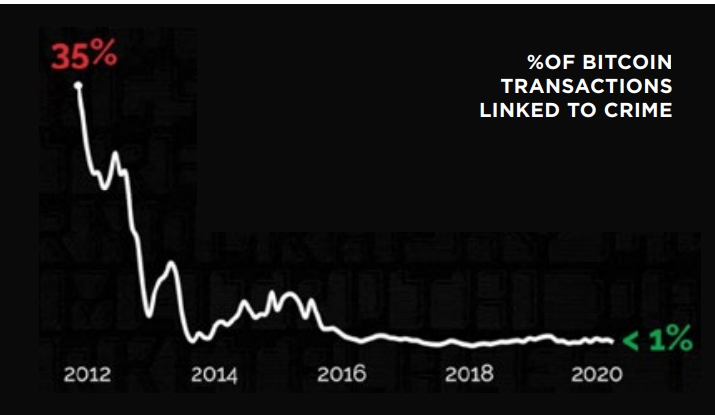

Chainalysis' annual report, called Crypto Crime Report, provides us with a comprehensive analysis of the use of Bitcoins and cryptocurrencies for illicit activities and finds that only 1% of all Bitcoin transactions are related to this type of activity.

According to the report, there were more than $1 trillion in cryptocurrency transactions in 2019 and only 1% of them were involved in any illicit practice.

According to Chainalysis, in 2019, the total of active wallets was 44 million, and the number of transactions was $1 trillion, with only 1% of that total being associated with illegal activities.

CURRENTLY, THE NUMBER OF WALLETS IN USE ALREADY OVER 50 MILLION.

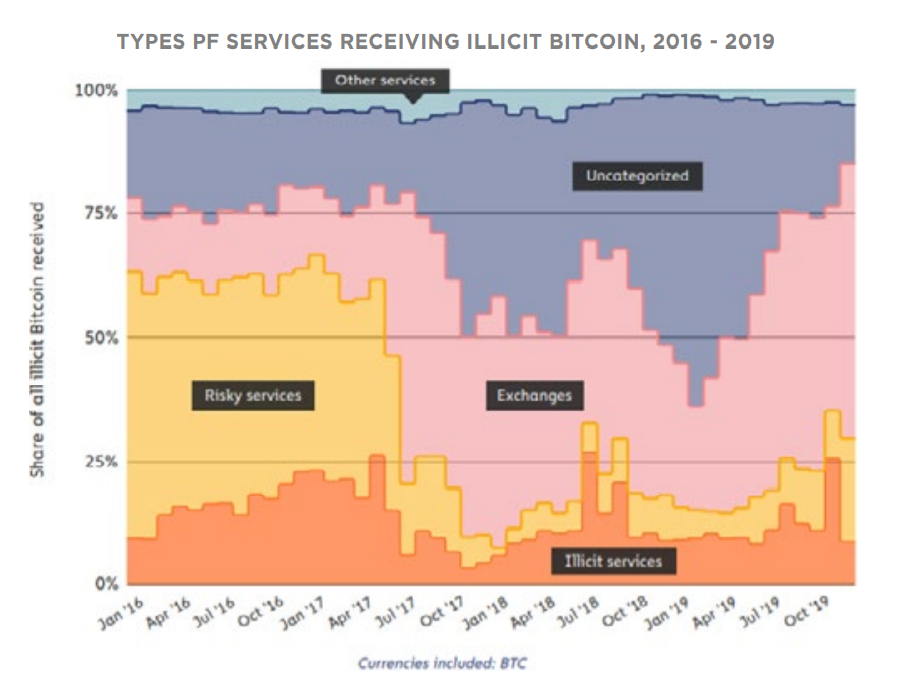

Exchanges are the most common destinations to which criminals have sent Bitcoin related to illegal activities.

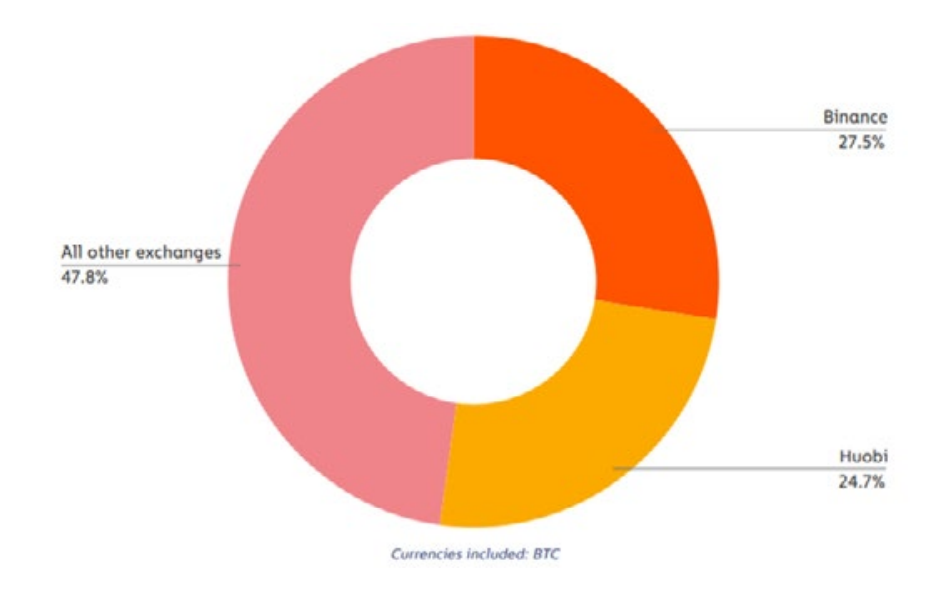

BINANCE AND HUOBI LEADED BETWEEN EXCHANGES WITH RECEIPT OF ILLEGAL TRANSACTIONS.

EXCHANGES RECEIVING ILLICIT BITCOIN, 2019

Elliptic, a UK company that provides blockchain analytics tools has also found that, in recent years, less than 1% of transactions involving cryptocurrencies were from illicit sources. That number was 35% in 2012.

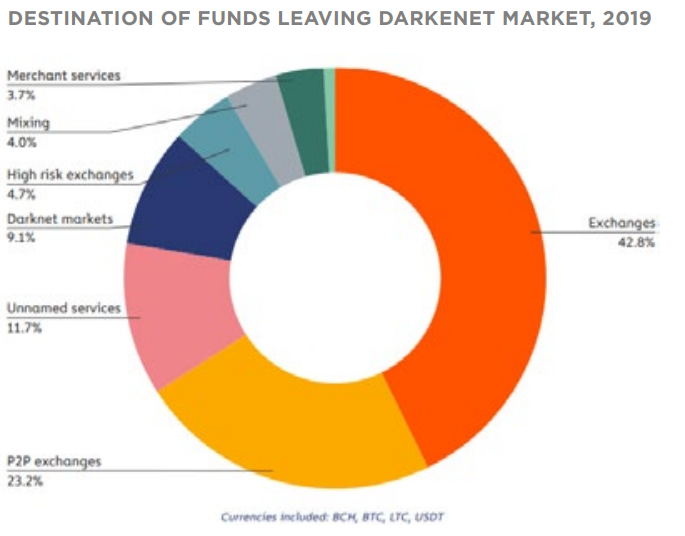

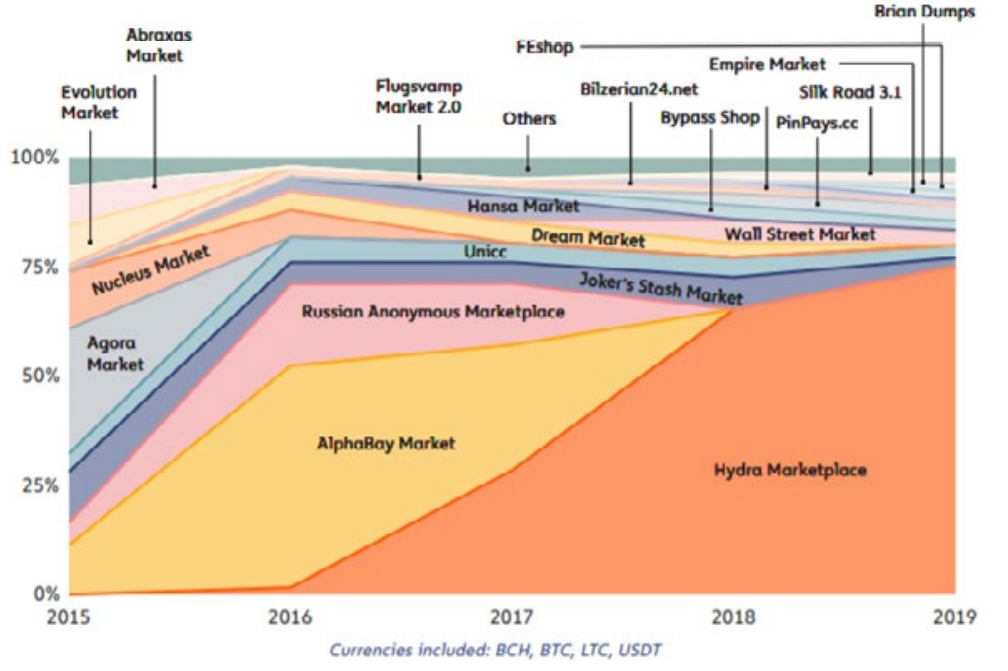

Most of the resources coming from Darknet Markets also went to the Exchanges in 2019. Listed here are all dark markets and the size of each one. The drug market is the most popular in the darknet. Hydra Marketplace is the largest.

ALL DARKNET MARKETS BY SHARE OF TOTAL MARKET SIZE OVER TIME, 2005 – 2019

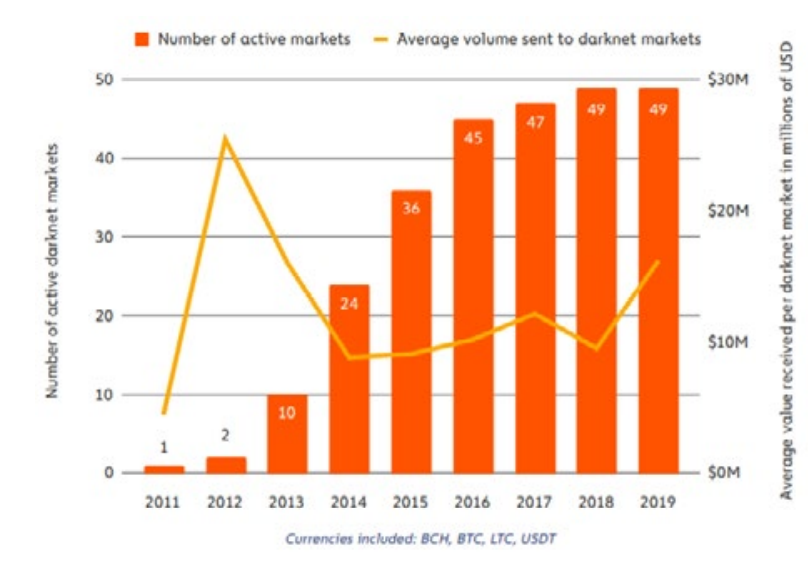

THIS IS THE AMOUNT OF ACTIVE DARKNET MARKETS BETWEEN 2011 AND 2018

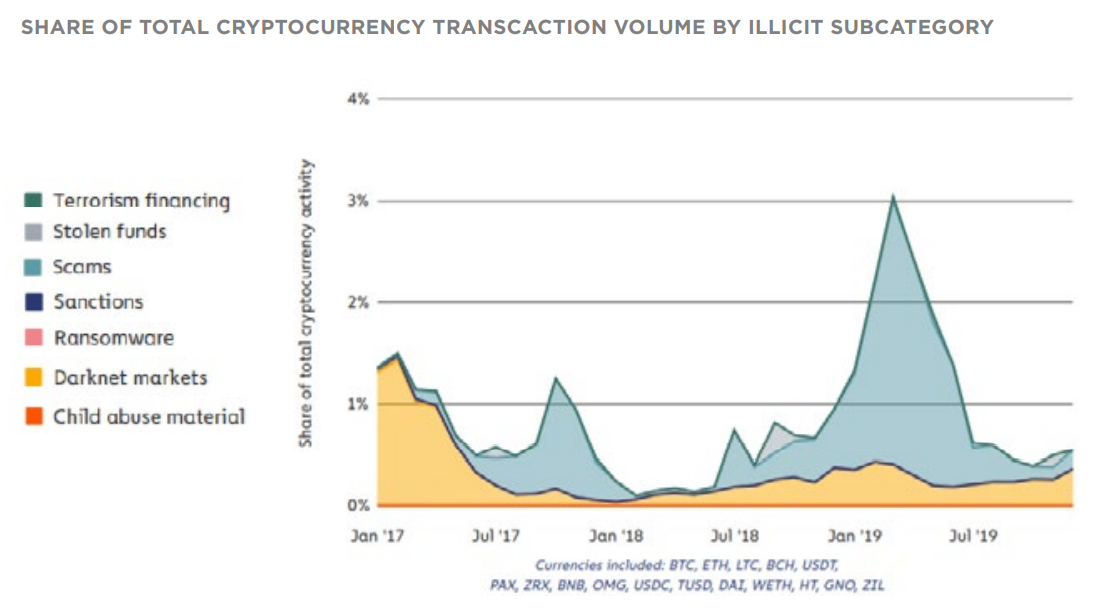

The graph shows which crimes have occupied the majority of cryptocurrency-related transactions since 2017. In 2019, scams were the vast majority.

Cryptocurrency scams pose a significant danger to the consumer protection.

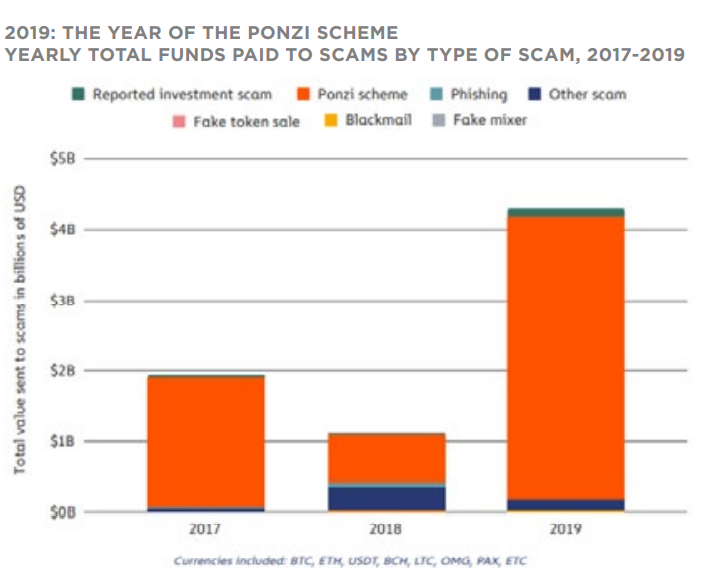

Ponzi schemes represent a major source of losses for users.

Therefore, educational activities are important to improve the technical quality of users.

Different means of payment bring new risks of new ways of carrying out illicit transactions when they are presented to the public, but they tend to be contained when mechanisms are developed to mitigate the use by criminals, but never completely eliminate the practice.

Darknet will continue to exist and with increasingly sophisticated methods in its infrastructure, to try to maintain its activities in a way that becomes increasingly difficult to be tracked and to escape from the laws.

Bitcoin is a currency and as such, it is also used for lawful and illicit purposes, such as buying drugs and other crimes, but clearly the rumors made by people with an interest in bringing Bitcoin's popularity down are just rumors and, as we've seen, don't they pass the test of the analysis of the facts and we know that against facts there are no arguments.

The evolutionary process of cryptography is improving every day, making it safer for all users and participants in this beautiful “ecosystem”.

Posted Using LeoFinance Beta