Exchange Traded Funds (ETFs), are investment products that offer investors exposure to a range of stocks, bonds or other assets in different geographic regions and market sectors, including: debt securities from various countries around the world, stocks of companies, currency of emerging countries, commodities and several alternative strategies.

The investment objective of most ETFs is generally to track the return on a benchmark index using a fund management style known as passive management.

Since its inception, ETFs have become common and widely accepted as an investment vehicle and, in less than 25 years, have become one of the most popular investment vehicles for institutional and individual investors.

Convenience makes ETFs attractive and some factors have driven their use.

They are cheaper and better than mutual funds, offer diversification at low cost, in addition to a mechanism that allows for speed in the negotiation process. In the US alone, ETFs are valued at approximately $3 trillion.

In addition, they grant broader access, providing retail investors with an opportunity to access products and investment alternatives that were previously unavailable to them.

Since the establishment of the first US ETF in January 1993, the SPDR S&P 500 ETF (SPY), which tracks the S & P500 index, has gained wide traction and the ETF market currently has $5.75 trillion in assets under management (AUM) and more than 7,000 ETFs traded globally, present in almost every sector imaginable.

The SPDR S&P 500 ETF (SPY) has more than $250 billion in assets under management and its current trading price is around $344.94.

The second largest ETF, the iShares Core S&P 500 ETF (NYSE: IVV), started trading in May 2000, and in May 2020 it had nearly $176 billion in assets under management, with an average volume trading book of $8.6 million.

SPDR's GLD GoldShares is a Gold-related ETF, one of the most larger, with $35 billion under management.

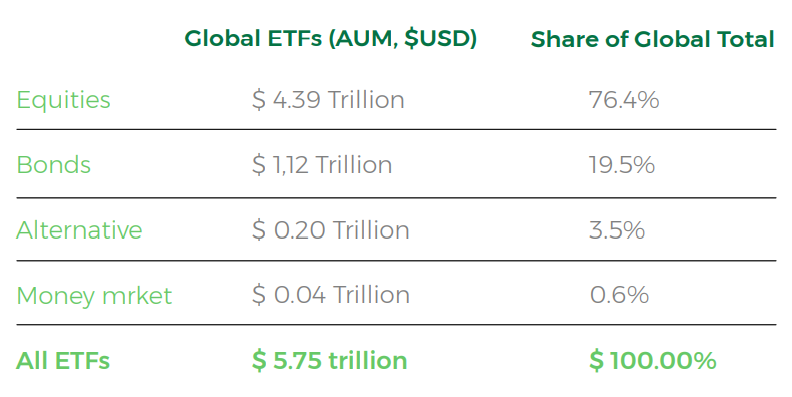

Stock ETFs account for 76.4% of the market, with $4.39 trillion under management. Next up are bond (bond) ETFs, which track indices related to debt issued by governments and companies, with $1.12 trillion under management.

The first bond ETFs were introduced in 2002 and the category has since grown in a market that exceeds $1 trillion in AUM. Bond ETFs are expected to exceed the $2 trillion mark by 2024.

In total, ETFs add up to $5.75 trillion in AUM.

IMPORTANT EVENTS IN THE HISTORY FOR ETFS IN THE USA:

- 1993 - The first ETF is launched in the USA, following the S&P 500

- 1998 - Sectoral ETFs, tracking individual sectors of the S&P 500

- 2004 - The first commodity ETF listed in the USA is formed offering exposure to gold bars

- 2008 - ETFs receive “green light” from SEC

- 2019 - US ETFs reach $4 trillion in AUM

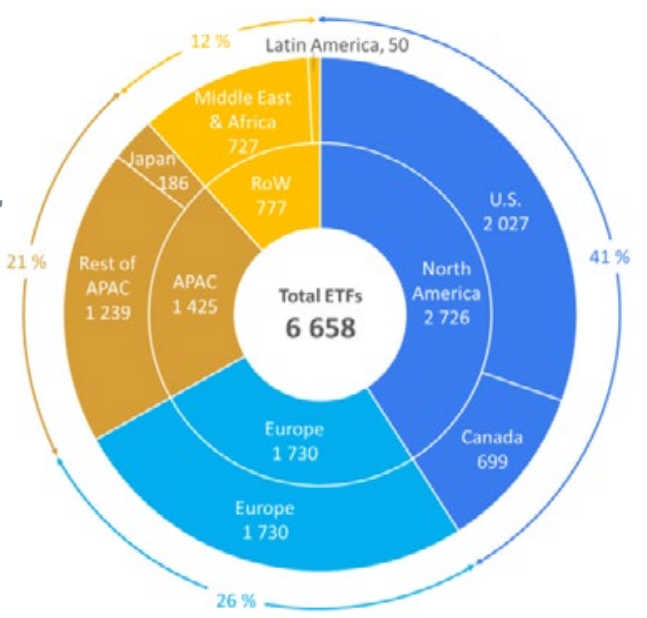

Regarding geographic distribution, Europe and North America they represent more than two-thirds of all ETFs, with the US alone accounting for 30% of the total.

In terms of AUM (Assets Under Management), the USA has the most developed ETF market, with 71% of the total.

Both institutional and retail investors look for a lot by ETFs in the USA.

REGIONAL DISTRIBUTION OF ETFS, APRIL 2019 (NUMBER OF ETFS)

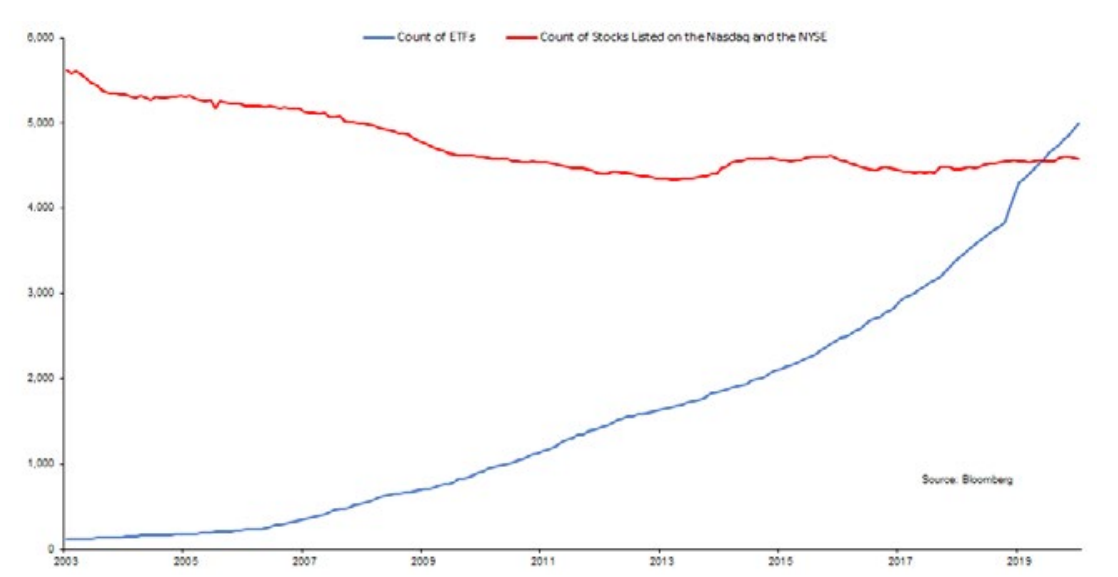

IN 2019 IN THE USA THERE ARE MORE ETFS THAN SHARES IN NASDAQ AND NYSE (NEW YORK STOCK EXCHANGE).

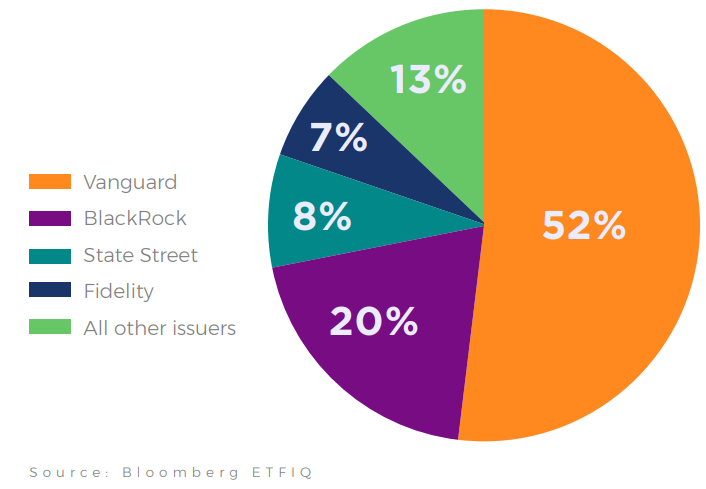

Vanguard is the player that holds more than half of the passive funds market share, which are composed of mutual funds and ETFs.

Next up is BlackRock, State Street and Fidelity.

MARKET SHARE FOR PASSIVE FUNDS INDEX MUTUAL FUNDS AND ETFS (2019)

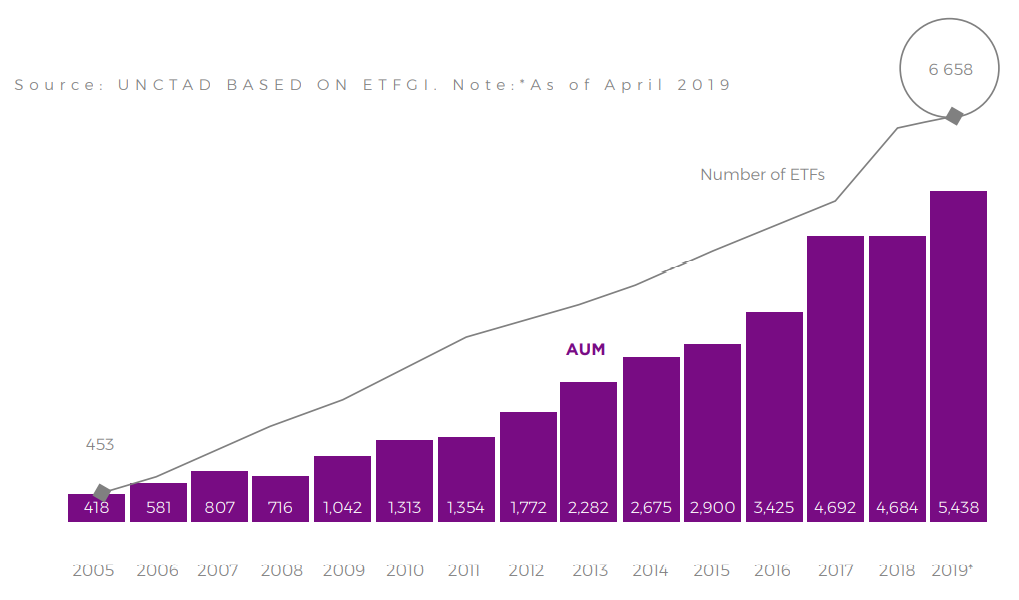

The ETF universe has seen impressive growth in recent years.

Worldwide, it increased from 453 in 2005 to 6,658 in 2019, growing annually at a rate of 19.6%.

The total value of ETF assets under management (AUM) has also steadily increased, more than tenfold, growing from $ 418 billion in 2005 to $ 5,436 billion in 2019.

This amount represents 6% of the capitalization of the world stock market.

NUMBER OF ETFS WORLDWIDE AND ASSETS UNDER MANAGEMENT (AUM), 2005-2019 * (BILLIONS OF DOLLARS)

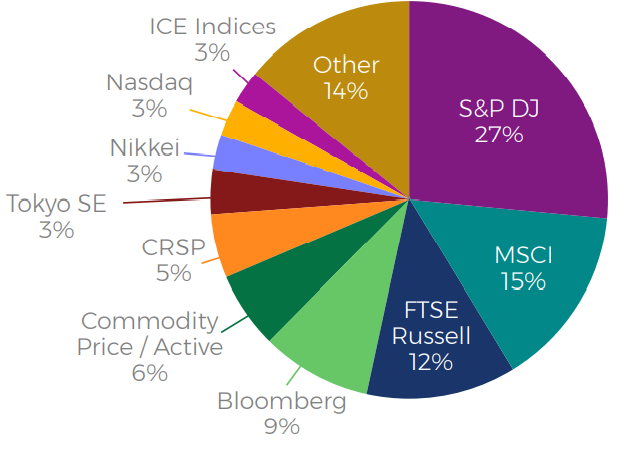

Market share S&P DJ, MSCI and FTSE Russell hold more half of the market share in the ETF index providers scenario.

INDEX PROVIDER ETF MARKET SHARE - GLOBAL, DEC'18

With such a wide range of ETFs, it was to be expected to be a matter of time before the launch of the first Bitcoin ETF. And this is what will happen, also carried out by a Brazilian company, Hashdex.

On September 18, the manager obtained authorization from the regulator of Bermuda, to launch with Nasdaq the first crypto ETF in the world.

The Hashdex Nasdaq Crypto Index ETF will replicate the Nasdaq Crypto Index, which provides data from the crypto market and is expected to debut between November and December on the BSX (Bermuda Stock Exchange), a stock exchange that has a more open regulation for innovation and more flexible for digital assets.

The launch of the ETF may contribute with a positive impact to the market in the coming years, accelerating the entry of large institutional investors, such as sovereign and pension funds in the digital assets market, and placing a Brazilian company as a relevant global player in the universe crypto.

Founded in 2018, Hashdex is a fund manager specializing in crypto assets that offers funds for different investor profiles. She was the creator of the HDAI (Hashdex Digital Assets Index), an index distributed by Nasdaq, which is based on the main cryptocurrencies and with strict eligibility criteria, being adjusted as the market matures.

The HDAI (Hashdex Digital Assets Index) was developed by Hashdex to represent the crypto market. Hashdex's funds, in their portion allocated in crypto, replicate the composition of HDAI.

The index is distributed by Nasdaq and also published in Broadcast.

To be eligible for HDAI, cryptography must meet the following criteria:

- Floating price.

- Traded at a crypto broker qualified.

- Supported by a professional custodian.

- Average daily volume of US $ 4 million.

- Minimum market representation of 0.25%.

On the other hand, some experts do not welcome the idea of a Bitcoin ETF. This is the case of Andreas Antonopoulos, who believes that although it can open the door to institutional money, a Bitcoin ETF could lead the ecosystem to more centralization and manipulation due to greater market concentration.

Another criticism is that, with outsourced custody, the investor does not have private keys, so the assets would not be his and would only have an exposure to the price.

Criticized or not, the fact is that an ETF would make Bitcoin exposure accessible to a greater number of people, especially retail investors, by offering portfolio diversification in a passive and transparent manner.

Although it has been rejected by the SEC several times, with the growth of the market, the launch of more Bitcoin ETFs is inevitable, but for approval of an ETF in the U.S. it needs to meet a series of demands stipulated by regulators.

The market is moving rapidly towards widespread adoption, with more and more signs showing this.

Posted Using LeoFinance Beta