The Commodity Futures Trading Commission (CFTC), which regulates the futures and options markets in the United States, filed a civil enforcement action in the Southern District District of New York, accusing BitMEX founders, Arthur Hayes, Ben Delo and Samuel Reed from various illegal activities, including operating an unregistered trading platform and violating money laundering regulations.

The CFTC stated that BitMEX has illegally offered leverage trading services to retail investors worth $1 trillion since its inception in 2014 and has not followed security procedures such as registrations and KYC (Know Your Costumer).

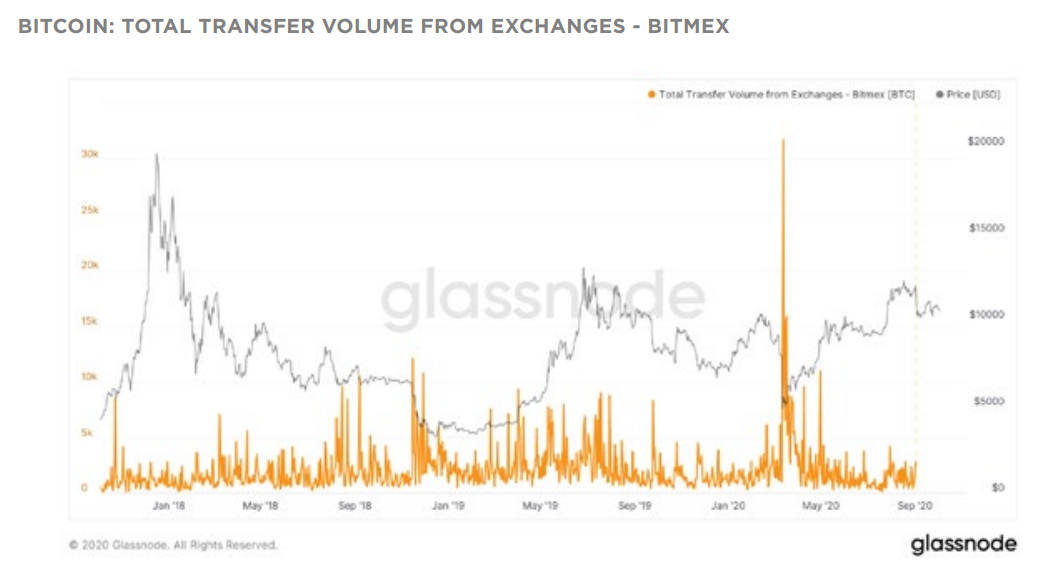

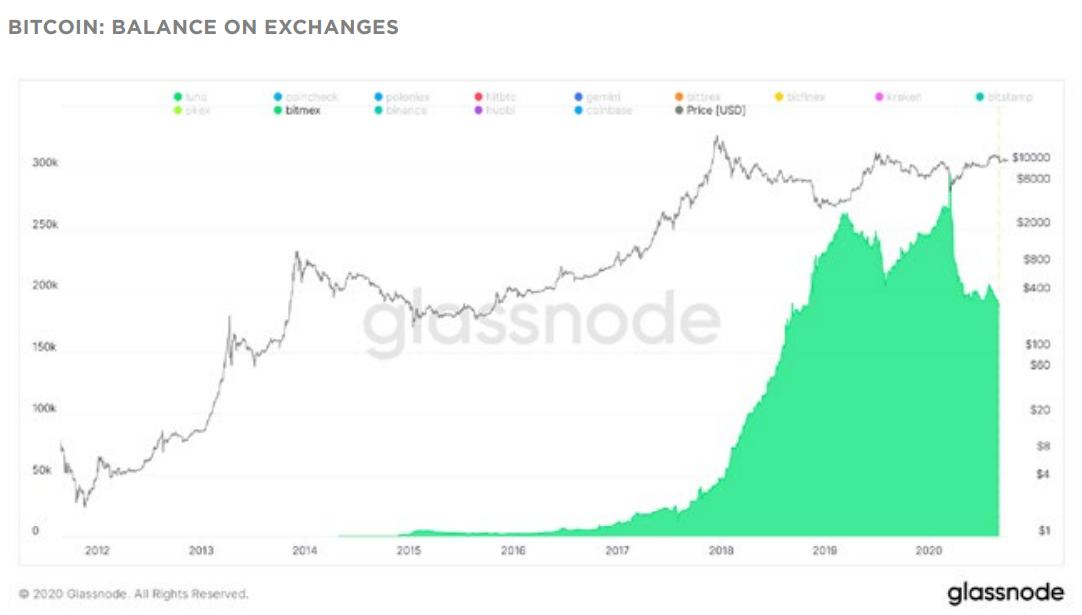

After the event, BitMEX had withdrawals of more than 23,200 BTC in less than 24 hours and in total more than 40,000 BTC were withdrawn, according to Glassnode data. This amount represents more than 20% of Bitcoins deposited at the exchange, which holds almost 1% of the outstanding BTC stock.

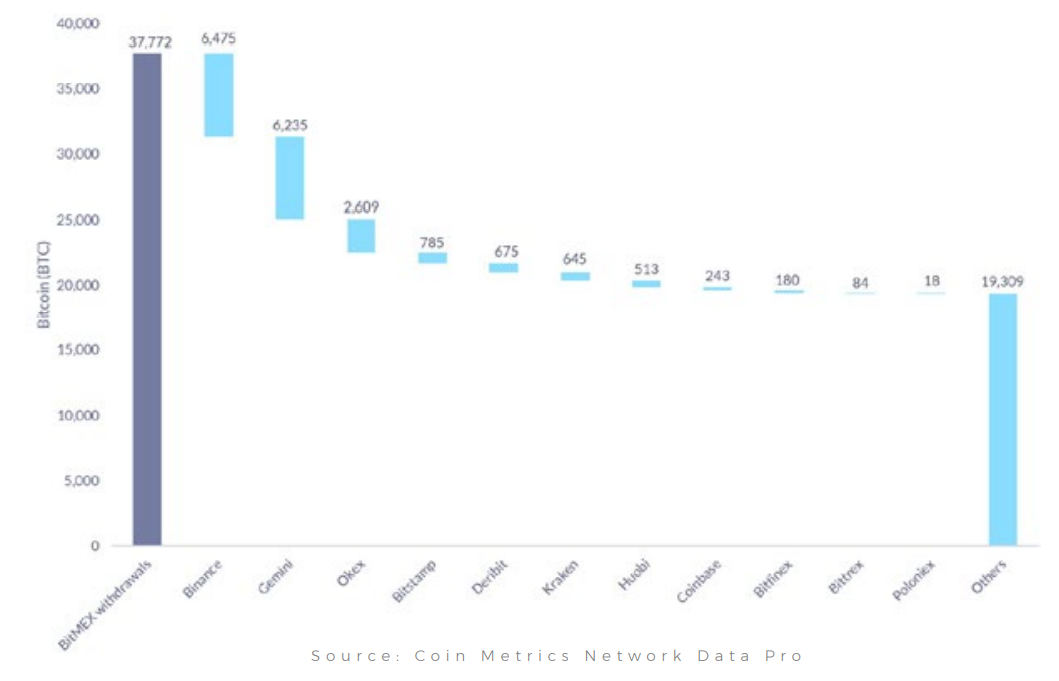

The total withdrawal amount was almost 40,000 BTC.

In just one hour, 23,200 BTC (approximately US $240 million) were withdrawn off the platform, recording the highest BTC outflow per hour in BitMEX history.

This amount represented about 13% of all Bitcoins held on the exchange.

Withdrawals accelerated in the following hours, reaching approximately 40,000 BTC, 0.23% of all BTC stored at Bitmex.

There are about 170,000 BTC ($ 1.8 billion USD) held in BitMEX portfolios. That's almost 1% of the Bitcoin stock in circulation.

Open positions in BitMEX (Open Interest) futures have fallen by more than 22%, from $592 million to $460 million since the CFTC announcement.

OF THE 40,000 BTC WITHDRAWN FROM BITMEX, ONE-THIRD WAS CAPTURED BY BINANCE AND GEMINI COMPETITORS.

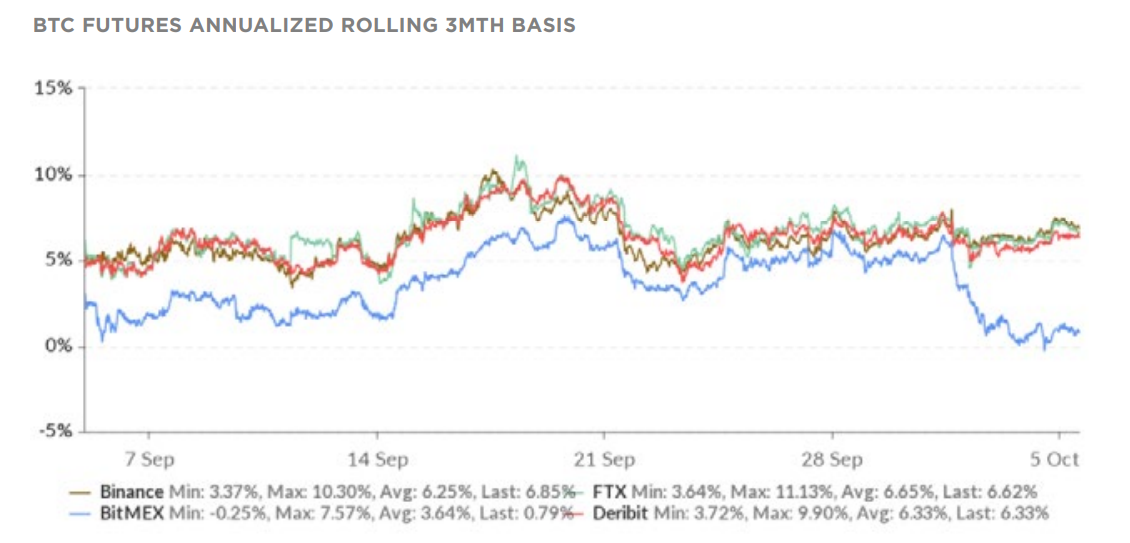

The premium of BitMEX's BTC futures contracts is approximately 5% different from the premium of competitors, Binance, Deribit and FTX.

This shows a lack of interest in the contracts provided by BitMEX and puts their liquidity and solvency at risk.

The CFTC denunciation eventually led to the resignation of Arthur Hayes and Samuel Reed to the position of CEO and CTO, an attempt by the exchange to demonstrate changes in governance perhaps more focused on adapting to legal and regulatory compliance.

With so many unfavorable situations, there is a clear warning signal to users regarding the future of BitMEX.

The increase in withdrawals affects liquidity and puts the exchange's solvency at risk, which is why much attention is needed when using derivative exchanges and monitoring the development of situations involving regulators, which will make other exchanges more and more conform to standards and laws.

Posted Using LeoFinance Beta