Decentralized finance has been one of the most talked about subjects in recent months in the crypto world. They quickly attracted attention and a large amount of money to their protocols, which aim to represent tools and applications in the centralized financial market, allowing more freedom through a mechanism that does not need a central body for validation and authorization of transactions.

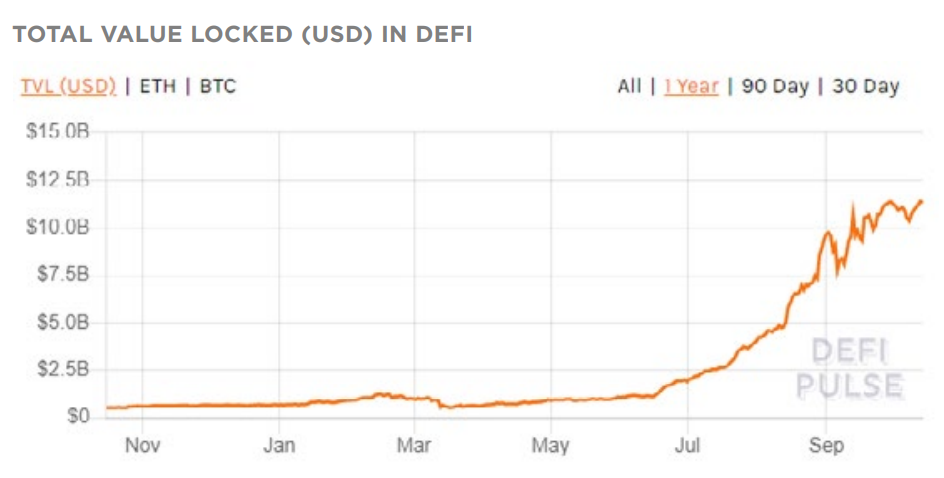

The trajectory is really impressive, with the total amount locked in the DeFi protocols starting at US $ 700 million and currently reaching US $ 11 billion.

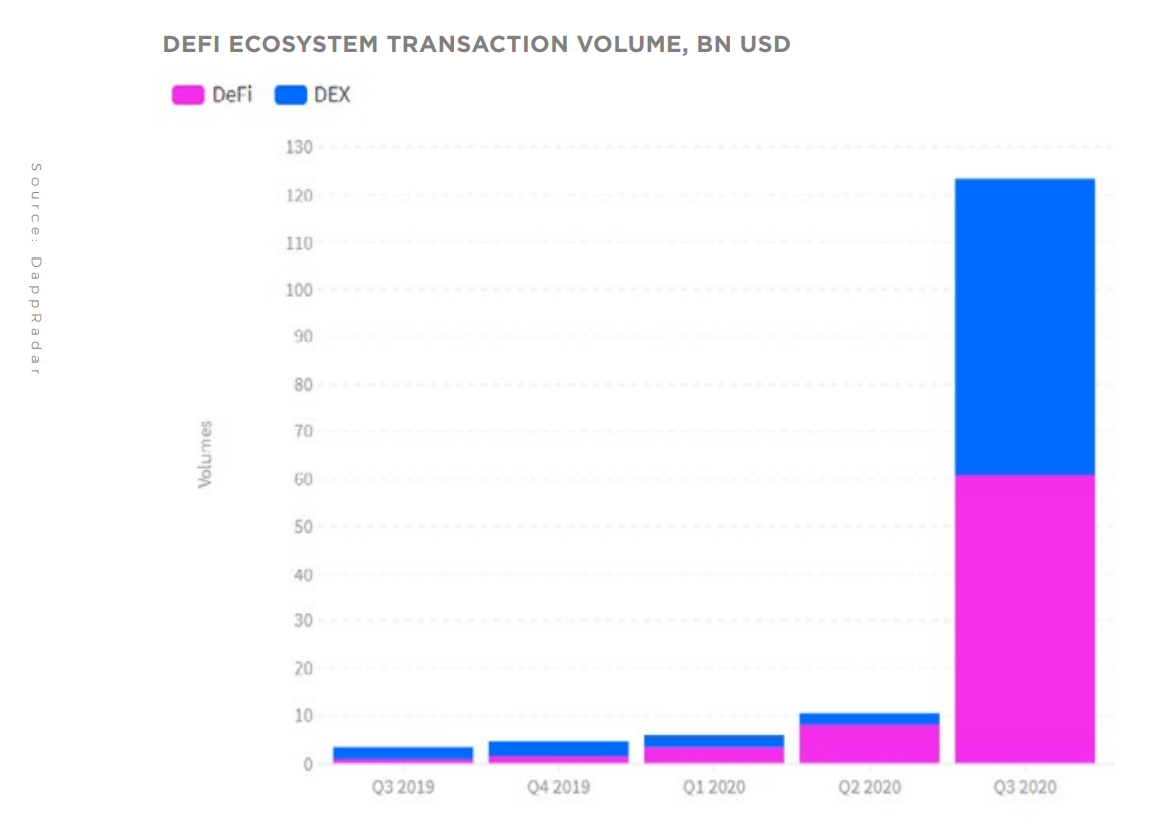

In the third quarter of 2020, record numbers were achieved in all metrics within the DeFi ecosystem, generated mainly by dapps built on the Ethereum network.

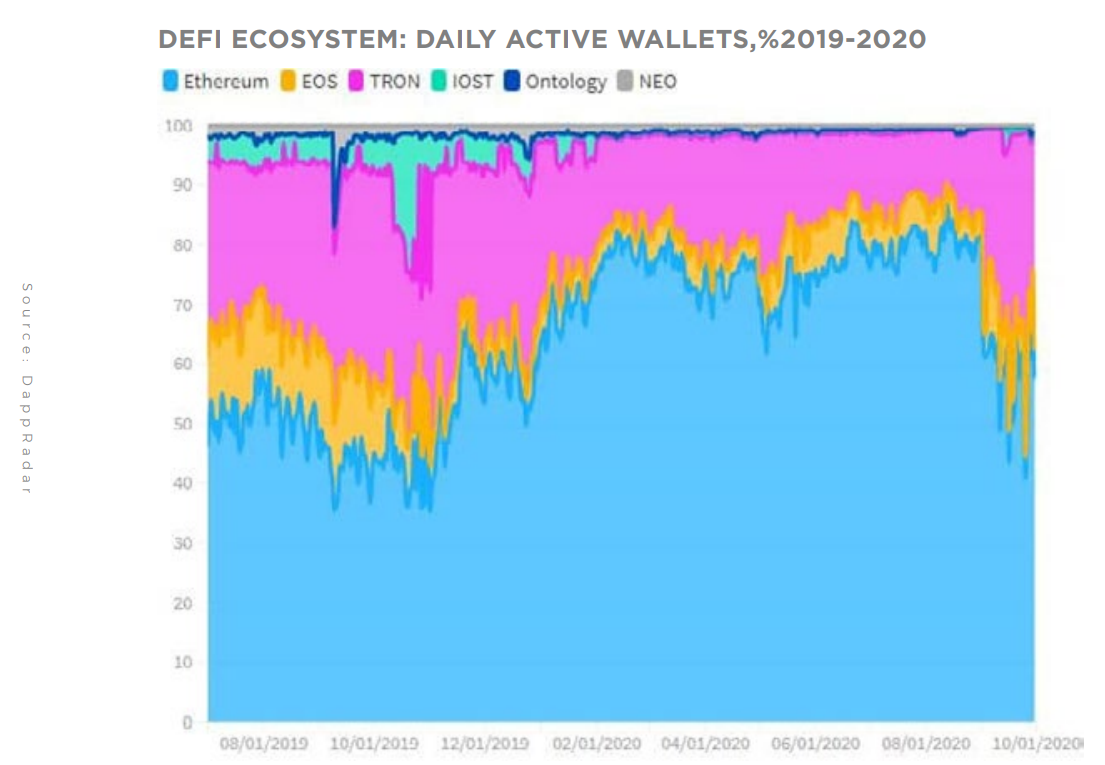

Data collected from Dapp Radar shows that the third quarter of 2020 was the best for decentralized finance. The Ethereum network dominated the DeFi space, but TRON and EOS increased in market share, showing themselves as potential competitors.

However, in the past few weeks, this segment of the market has seen a decrease in volumes and in the price of some tokens, which sparked rumors that DeFi was over.

We will then analyze how decentralized finance performed in the third quarter of 2020 to assess the performance of the protocols and the ecosystem as a whole.

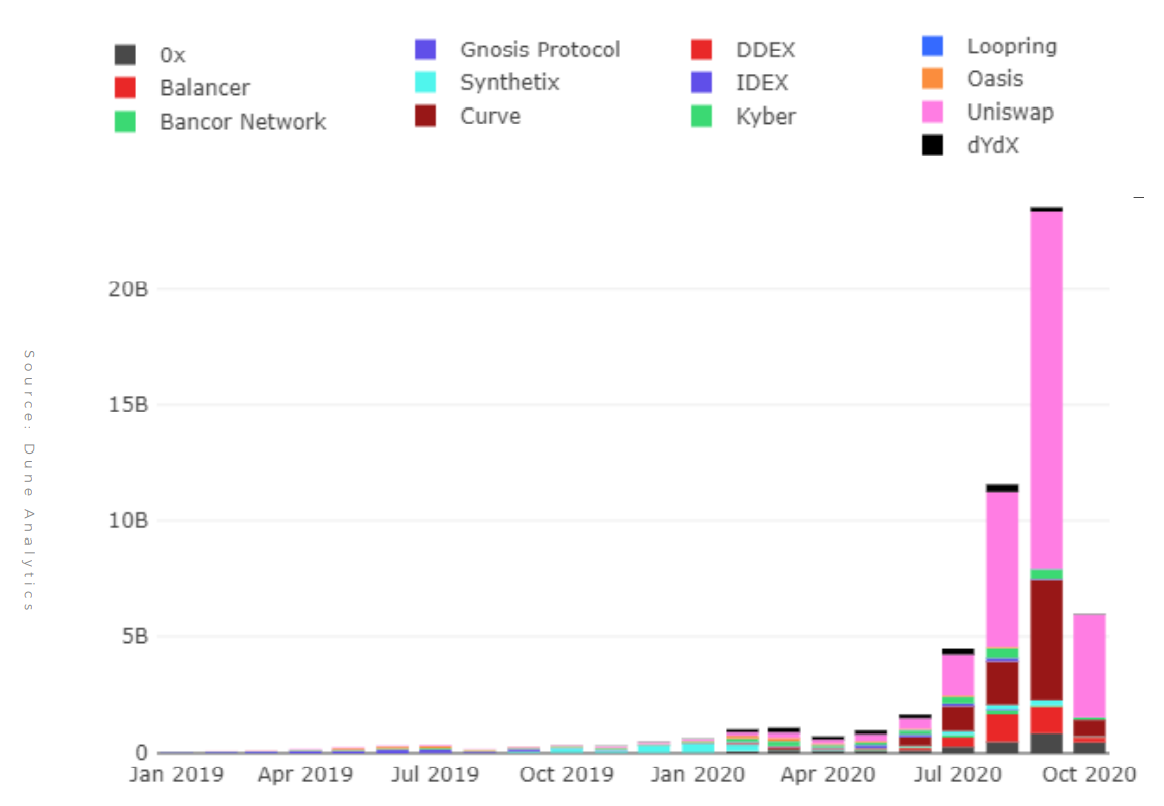

The volume of transactions has been steadily increasing from mid-2019 to mid-2020 and has exploded from around $ 10 billion to $ 123 billion in this third quarter, with 96% of the total volume belonging to Ethereum.

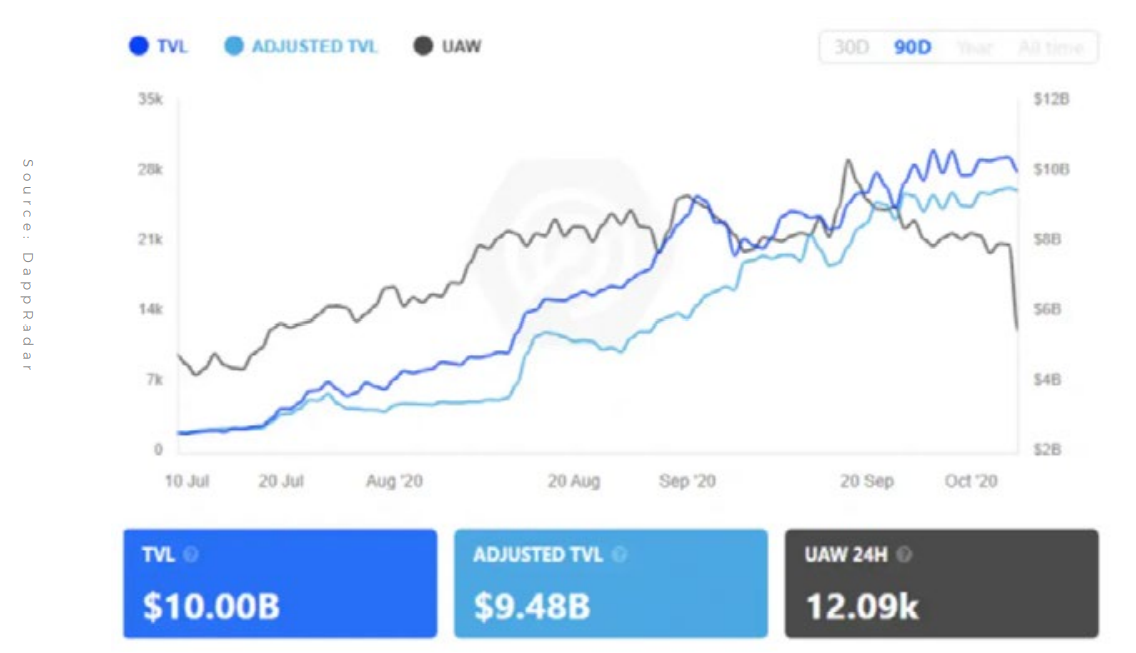

The total blocked value (TVL) also showed strength, increasing 380% since the end of the second quarter of 2020, reaching US $ 10 billion.

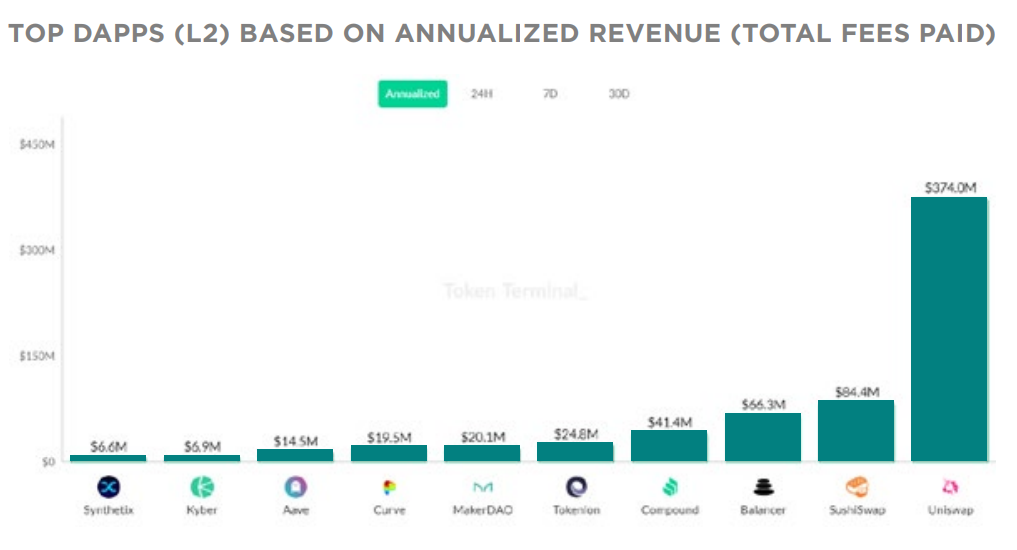

The dapps responsible for most of the TVL volume are Uniswap, MakerDAO and Curve. Uniswap's growth was mainly driven by the introduction of the UNI governance token.

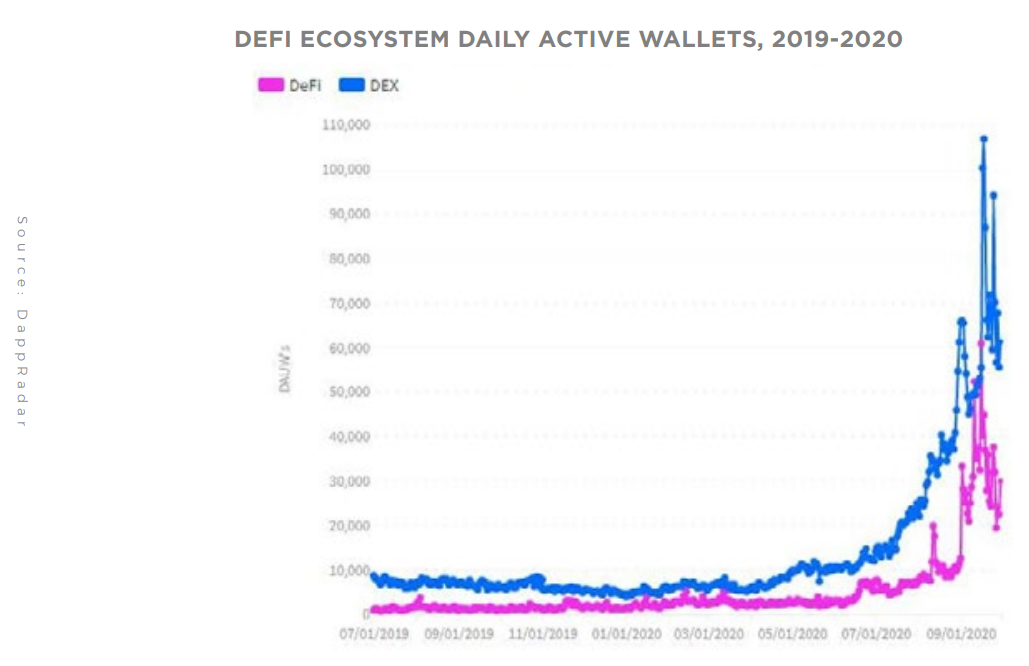

In terms of daily active portfolios, Ethereum represents more than 57% of the total. The biggest contributors to the Ethereum protocol were Uniswap, SushiSwap, Balancer and Compound. Together, they generated 56% of daily active portfolios.

With the significant increase in the use of the Ethereum network, there was congestion and, consequently, the speed of transactions decreased while rates increased.

At peak times, transaction costs reached more than 400 Gwei. As a result, networks like EOS and TRON received part of the market flow, holding 5% and 35%, respectively, of active portfolios.

In total, Ethereum, EOS and TRON hold up to 97% of daily active portfolios.

Other networks with less substantial presence were IOST, Ontology and NEO, which represented only 3% of all daily active portfolios and increased by 357%, 1,589% and 840%, respectively.

In the EOS protocol, the highlights were Defibox, Dmd.Finance and the DeFis Network, which generated more than 4,300 daily active portfolios.

In the TRON protocol the applications JUST, Zethyr Finance and Oikos.cash, Sun, Protocol Unifi and SharkTron gained popularity and generated more than 32,000 active wallets daily.

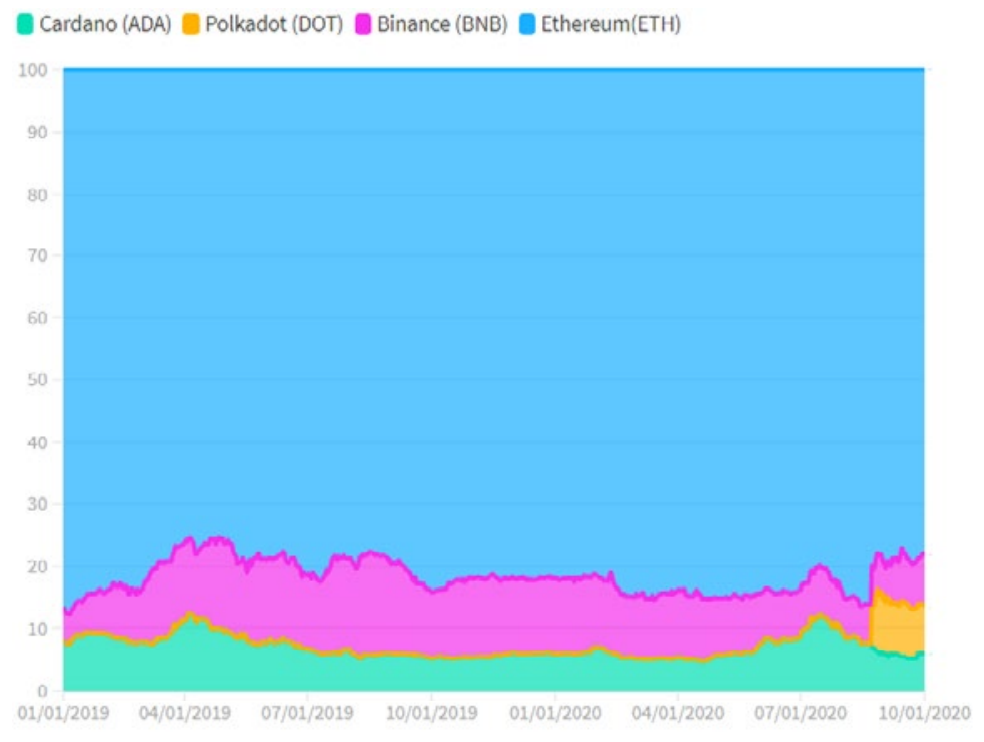

With the congestion presented by the Ethereum network and the Ethereum 2.0 still under development, Cardano, which is the first blockchain platform with a scientific philosophy and adopting a research-based approach, shows itself as a viable PoS alternative for DeFi projects.

Second, the Polkadot (DOT) blockchain recently joined the market capitalization leadership ranking. The Polkadot blockchain network is optimized around interoperability, allowing you to move any type of data across any type of blockchain.

Last, but not least, is Binance. The company joined the DeFi race in August, launching a new future product based on its DeFi Composite Index.

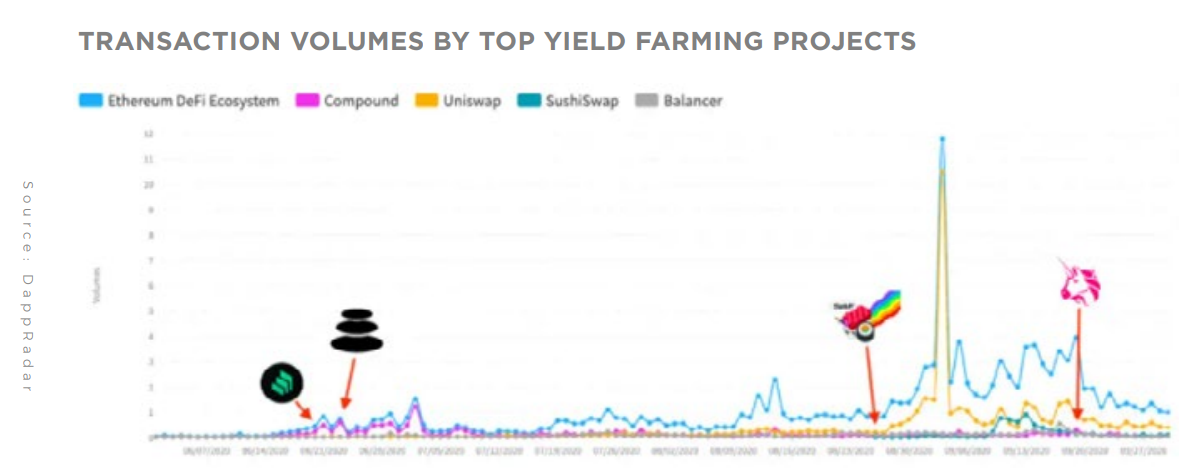

Yield Farming or Liquidity Mining, one of the popular DeFi solutions, which allows investors to receive interest for the loan of their tokens, was one of the catalysts for DeFis' outstanding results in the last quarter, helping to keep Ethereum in the leading position in this ecosystem.

The remuneration follows the concept of staking, in which the funds are kept in an encrypted wallet to facilitate transactions on a blockchain network.

Digital funds held in the portfolio can generate returns by providing liquidity, being kept in pools.

The transaction volumes generated by Uniswap were US $ 33 billion, representing almost 60% of the total transaction volume. On September 17, Uniswap distributed the UNI governance token.

From the beginning of the year until now, Uniswap has already achieved revenues of US $ 374 million. SushiSwap and Balancer received second and third place.

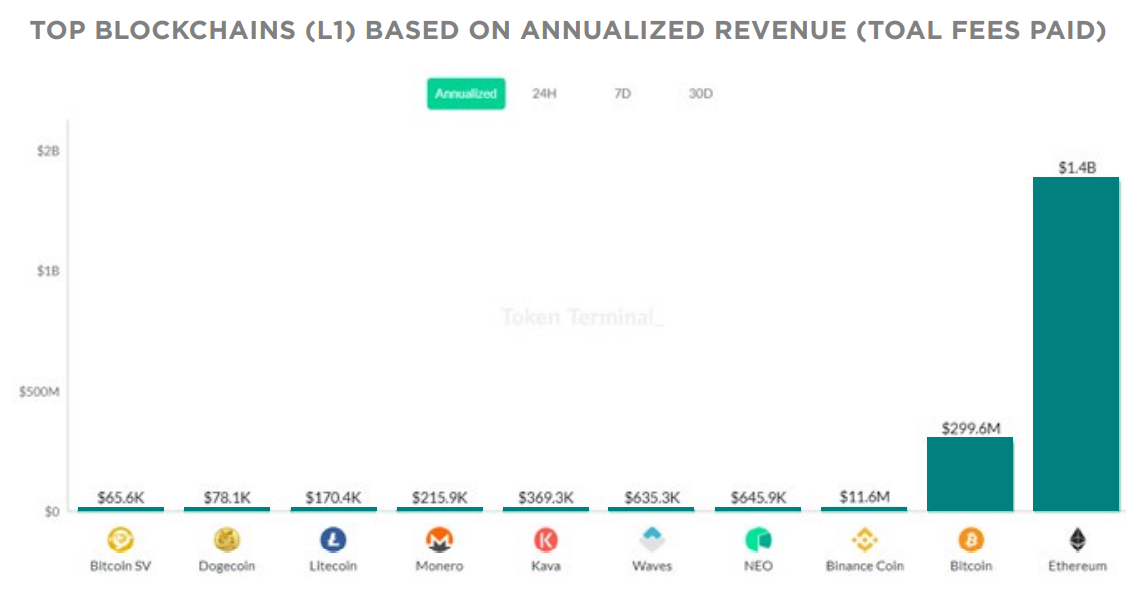

In the total analyzed so far, the Ethereum network has already generated US $ 1.4 billion in fee income.

In recent weeks, some moves have sparked the rumor that DeFi protocols are losing popularity.

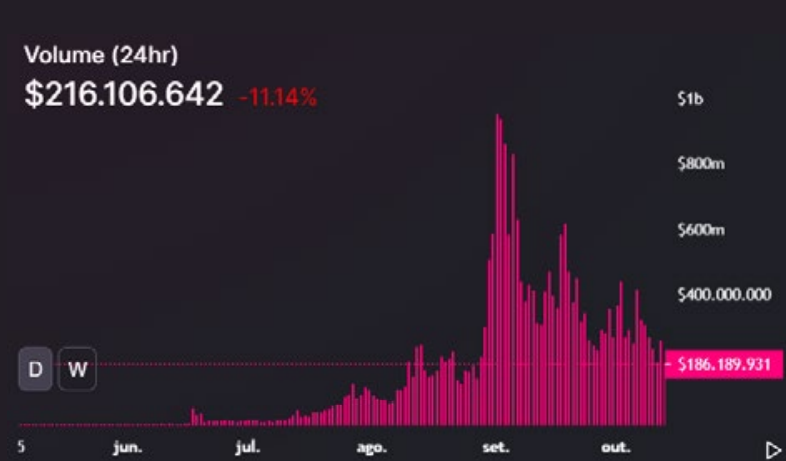

At Uniswap, the largest DEX, the largest decentralized exchange, daily trading volumes fell to an average of $ 200 million, after reaching a record $ 954 million on September 1.

FROM SEPTEMBER 1 TO 28, THE FALL WAS ALMOST 66% OF ITS VOLUME

Overall, last month saw a drastic reduction in turnover for almost all DEXs.

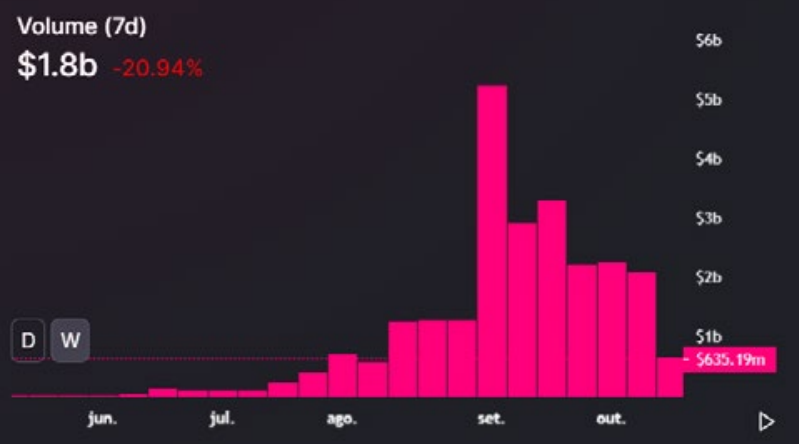

The drop in turnover can be felt in the weekly chart, which shows a reduction from US $ 8 billion to US $ 4 billion. The combined volume of DEX has halved in less than a month.

It is too early to say how the DeFi ecosystem will evolve going forward.

For some, it is a replica of the trajectory of ICOs, for others it is really paving the way for the financial market of the future, decentralized and much more accessible.

The protocols are still very recent and bring considerable risks that are not always obvious, such as the real ability to be able to deal with the features they propose. One example was the SushiSwap token, which fell more than 50% after the main developer sold all of its SUSHI tokens.

It is a normal cycle, and the drop in volume seems to be a healthy process, which keeps those projects that really demonstrate usefulness in play. In this process, speculators will win and lose, but whoever is most connected can be part of something that could become very big and that at this moment is consolidating its fundamentals.

Perhaps the hype around the subject may subside, but there are no signs of abandonment, on the contrary. This departure from focus is good for allowing developers to create products and platforms that are robust and resilient and tokens improve their functionality.

**DeFi may indeed be here to stay, and a simple reason can prove it, solving indisputably real problems.

**

We are having the privilege of seeing all this taking shape and this is unique.

Posted Using LeoFinance Beta