Tether is probably one of the top projects in the crypto industry when it comes to FUD around it. A ton of controversy in the past, uncertainty around its reserves in USD, and yet it keeps on marching on and growing.

These days the Tether market cap is at 83B, at the levels it was just a year ago in May 2022, prior to the collapse of Terra UST.

It’s been a fun ride for stablecoins in the last year. Let’s take a look!

The TerraUST fiasco has left a mark on the stablecoins industry. It happened back in May 2022 and it seems to be the first in a series of implosions since then. FTX has been the culmination of the 2022 collapse, but just recently we have seen a FUD on Circle USD, when one of the banks holding its reserves collapsed.

With this said let’s see how the market cap of the top stablecoins looks in the last period.

Apart from the fiat backed stablecoins (USDT, USDC, BUSD….) that are keeping USD in banks (or equivalent) there are tokens like DAI, UST, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Binance USD [BUSD]

- Dai [DAI]

- TrueUSD [TUSD]

- FRAX

There are a few more out there like PaxosUSD, USDP, etc, but we will focus on the above as the biggest ones in market cap.

The period that we will be looking at is from 2022-2023.

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly it is founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank.

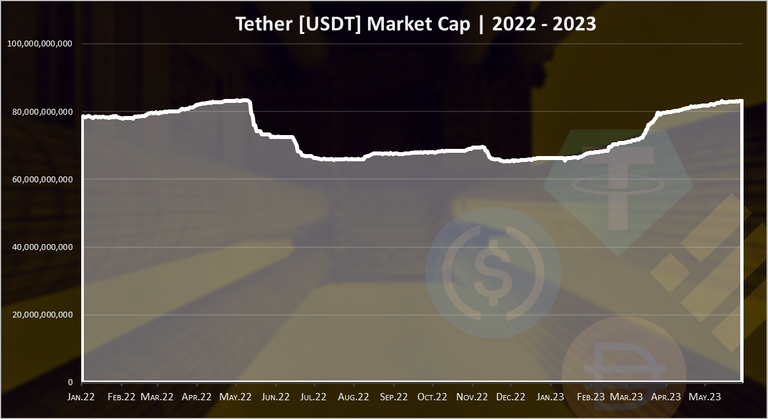

Here is the market cap for Tether in the last period.

We can see that after the dip Tether had in 2022, from 83B to around 65B, in 2023 it has been growing. At the moment there is 83B USDT in circulation reaching its previous levels.

We can notice a higher increase in March 2023. At this time the Circle USDC had problems with its peg and funds switched from USDC to USDT. Since then there has been a steady increase in Tether market cap.

In 2023 alone Tether started the year with 66B, and now it is at 83B. An increase in the market cap for 17B, or 25%.

USD Coin [USDC]

USDC is a common project between Circle and Coinbase.

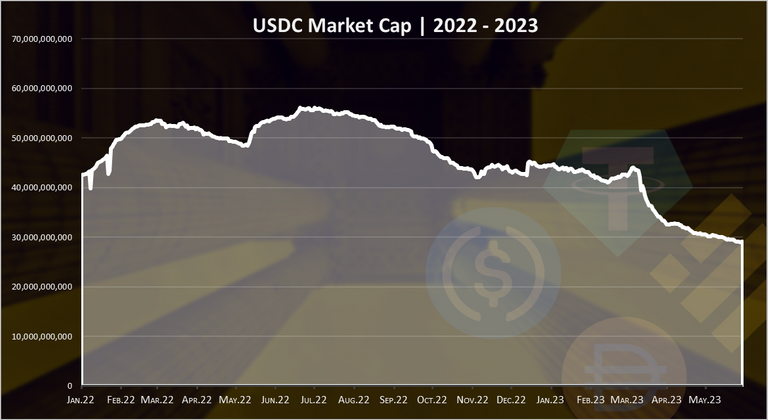

Here is the chart.

Unlike Tether, USDC has been going down in market cap. As mentioned in March 2023, one of the banks where USDC had a share of its reserves in USD, collapsed, causing the market to panic and pushing down the peg of USDC as low as 88 cents. This was short lived and the USDC peg recovered in a day or two, and later it even managed to get access to its funds in the collapsed bank.

But the damage was done and a lot of funds exited from USDC.

Another reason for the decline in the USDC market cap might be the overall situation with crypto regulation in the US. The overall climate has not been very friendly towards the industry and a lot of banks have cut off their ties with crypto companies.

On a yearly basis the USDC market cap started with 44B, and now it is at 29B. A total reduction in 15B or a 34% in market cap.

USDT VS USDC

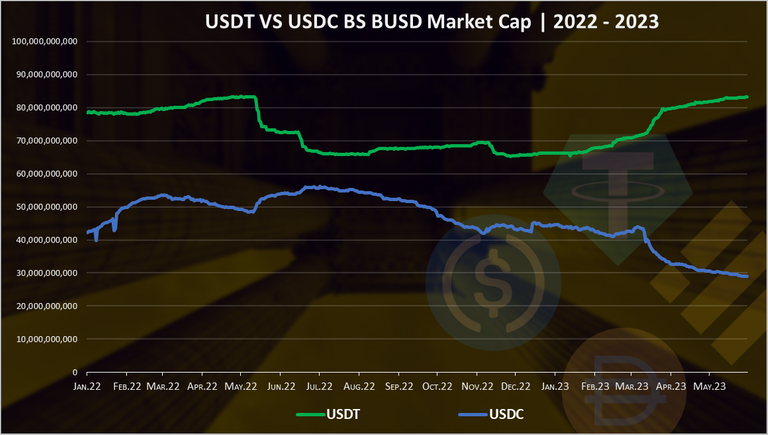

When we plot the market cap of the two biggest stablecoins we get this.

An almost ideal inverse pattern!

Obviously in the last two year the market cap of this two has been inversely corelated. Whenever Tether lost market cap, USDC gained. In the last period USDC has been loosing its market cap at a cost of Tether.

Binance USD [BUSD]

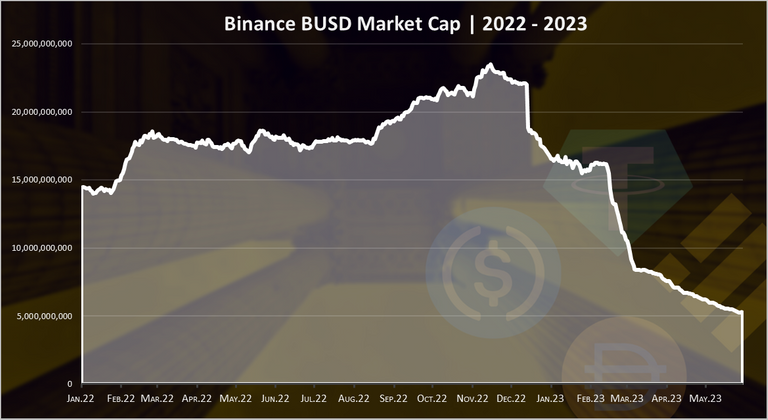

The Binance exchange stablecoin. It’s mostly used on Binance and BSC as well as a trading pair against other cryptos. It is issued by Paxos with the Binance branding.

This coin has been doing great in 2022 up until the regulators stepped in and sued Paxos in December 2022, for issuing the coin. Since then there is no more minting of the token and it is slowly being decommissioned as fuds exit the project.

At the top BUSD had a market cap of 22B and now it is at 5B. As time progresses this project will be closed down.

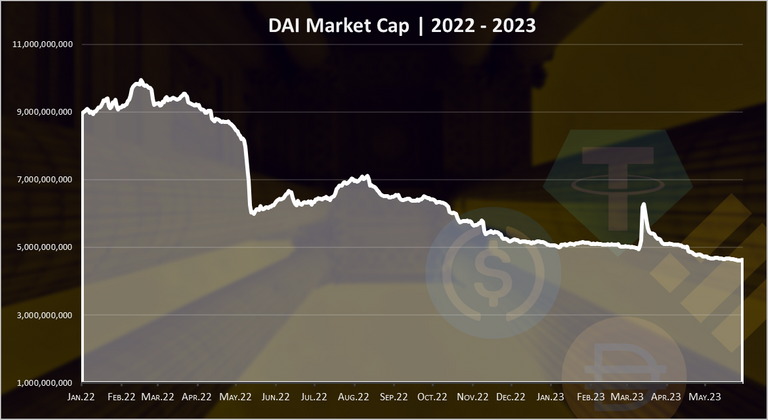

Dai [DAI]

DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

DAI works as overcollateralized stablecoin, where users put in a minimum of 150% or more of other crypto assets to mint 1DAI. Since it’s backed by crypto asset, and the price of those has dropped it is logical for the overall market cap of DAI to drop as well.

We can see that during the UST fiasco in May 2022, the DAI market cap reduced as well, from , from 8B to 6B. Since then a slow decline in the market cap, with one spike in March 2023. This was when the USDC crisis happened, some funds were moved from USDC to DAI, but then they exited fast.

One thing about DAI what is a bit concerning is that most of it is now minted by USDC. This puts a centralized attack vector on the token. DAI also lost it peg for a short period of time when USDC dropped.

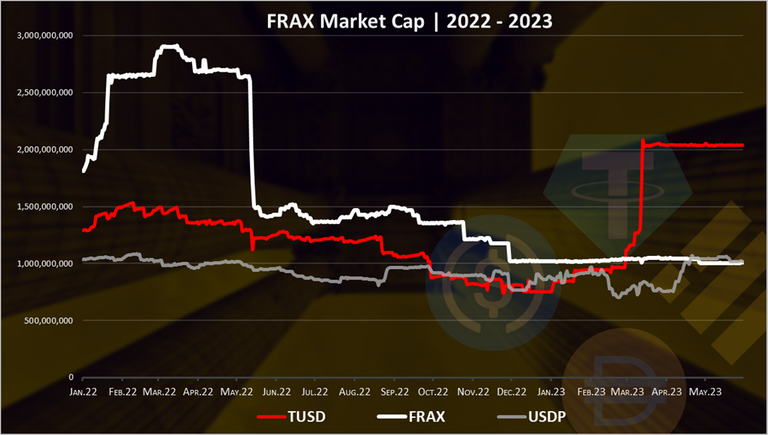

TUSD, FRAX and USDP

These are three of the next biggest stablecoins. When we plot the market cap of them, we get this.

These three are in the range of 1B to 2B.

We can see that FRAX has the bigger drop in market cap, after the collapse of UST.

TUSD on the other hand has increased in March 2023 from 1B to 2B. This is most likely because of the support of Binance that listed a few tokens pairs in TUSD.

A steady market cap for Pax Dollar around the 1B.

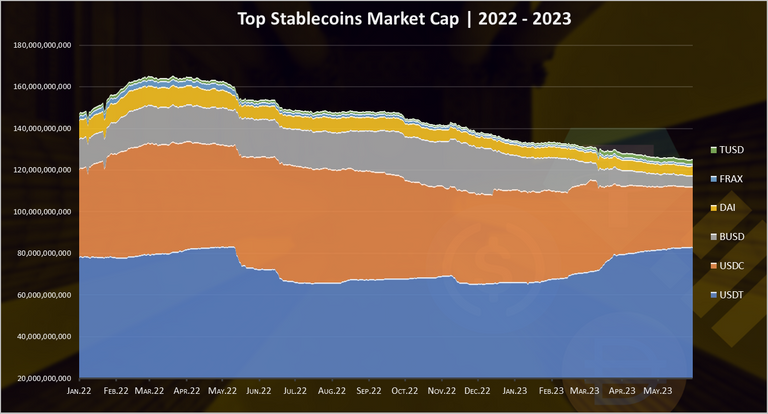

Cumulative Stablecoins Market Cap

Here is the chart for the total stablecoins market cap.

The total stablecoins market cap has dropped in 2023!

From around 134B at the beginning of the year to under 130B now. The biggest drop is recorded to USDC and BUSD, while USDT has been growing, but not enough to cover from all the loses from the other two top stablecoins.

What interesting is that no other alternative to the existing stablecoins has emerged.

At the peak back in 2022, the cumulative stablecoins market cap was at 180B, compared to todays 130B.

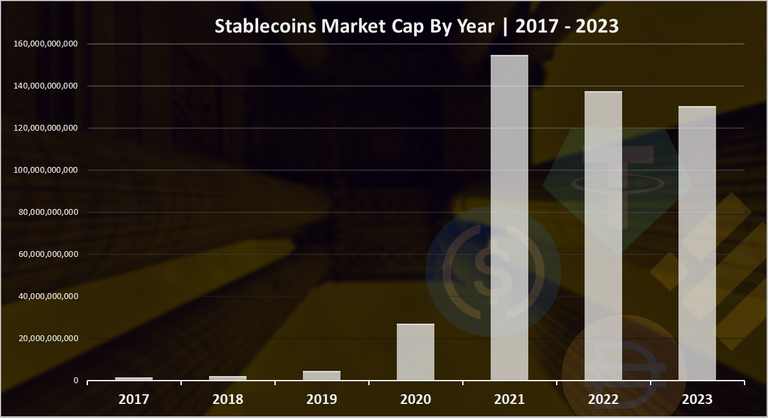

For context on a longer timeframe, on a yearly basis the market cap for stablecoins looks like this.

After an explosive growth in 2021, the stablecoins market cap has been dropping in 2022 and 2023, although at much lower rate then the drop in prices for the overall crypto industry.

For example, the stablecoins market cap has reduced for around 10%, while the top cryptos, BTC and ETH have both seen a drop more than 50%.

Top Stablecoins Rank

Here is the chart for the latest market cap of the top stablecoins.

Tether is still on the top. USDC and BUSD are following. DAI is on the fourth spot, and will most likely surpass BUSD soon, having in mind that token will only loose its market cap.

All the best

@dalz

Man,

Justin Sun has bought a lot of his own stable coin this year!

What do you mean?

That one was USDD?

Oh my bad! I thought that was his, glad to see that's nowhere in that case!

I've learnt something from you today

Thank you so much for sharing

Good information for market movement

I'm looking forward to the day when HBD is listed among the top few Stablecoins 😁

On the same day a pig will fly over the moon whilst reciting "The Ten Crack Commandments" by Biggie Smalls 🤣

Cg

Tether is good stable coin. I have usdt in metamask !

It's really awesome knowing about the progress of tether and thanks for sharing.

Impressive! 💪🏻

Tether will probably be at the top for awhile. The stablecoin is doing great in this bear market. Thanks for the perspective on stablecoins :)

The way we see it every time within the bear market we see news like it's going to end, it's going to come down, but it's stable very well. The most faith of people at the moment is on this coin and the most money of people at the moment is also lying in it. I myself use the same whenever I have to sale my coins so I keep money on usdt.

Thank you for not joining the "delusional crew" by mentioning HBD. I find it embarrasing when people say HBD is a stable and try and compare it to real stable coins with a market cap of billions.

When the stables first came out I didn't really get it, but with the success of USDT and USDC I totally get it now and use them all the time.

Cg

Stablecoins are here to stay in the market. We need them to preserve our crypto wealth in the unpredictable market!

hopefully they will stay stable , imagine what could happen if a 83B markets gets down