From a price perspective stablecoins are not very interesting. After all their sole purpose it to not fluctuate in price. But from a market cap perspective they are moving a lot and can be very interesting. There market cap has grown a lot in the previous years.

Let’s take a look at this.

There are a lot of stablecoins these days. Although they become more popular in the last bull run. Since then more have come to existence. As mentioned, the basic function of these tokens is to keep a peg to a fiat currency, in most cases USD. To do this usually an equal amount of money deposited in a bank is need for each token minted.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Dai [DAI]

- Binance USD [BUSD]

- Huobi USD [HUSD]

- TrueUSD [TUSD]

There is a few more out there but we will focus on these one for now.

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly its founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank.

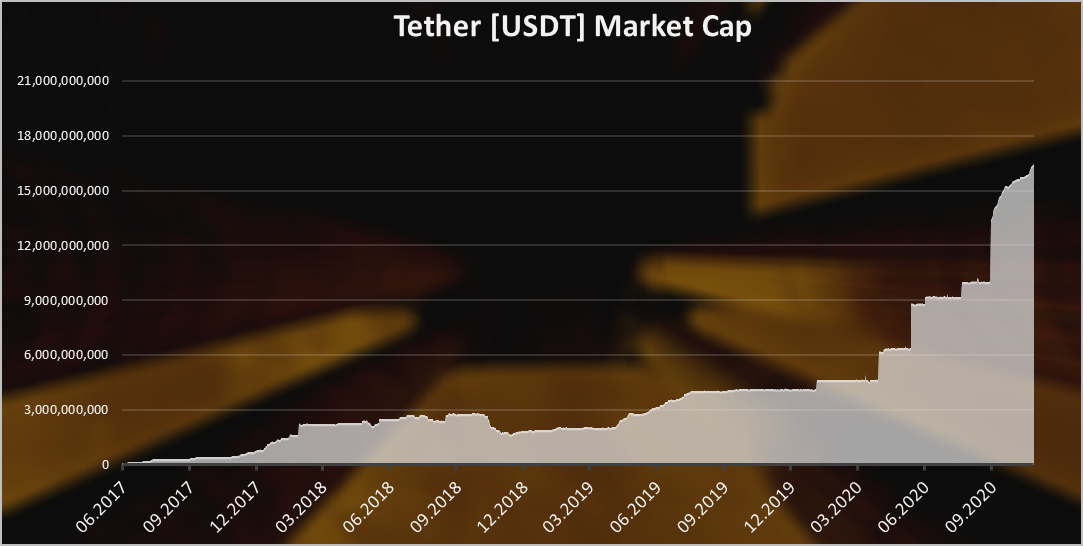

Here is the historical market cap for Tether

Well this chart is a bit more dynamic than the price chart😊

As mentioned, Tether has been around from 2015. But until 2017 the market cap for tether has been very. In 2017 it started to peak up. Started with around 10M at the begging of 2017 and ended the year with 1.3 billion in market cap.

In 2017 Tether has increased its marketcap by x130!

After the bull run ended in 2018, Tether has seen a drop in the marketcap going from almost 3B at the end of the bull run to under 2B.

In 2019 Tether started increasing its marketcap, printing more USDT and by the end of the year reached more than 4B.

In 2020 the Tether printer has went full speed and at the moment of writing this the Tether market cap is more than 16B.

12 billion in Tether printed just in 2020. USDT has reached the no.3 spot on the rankings flipping XRP.

Even with all the controversy around USDT in the previous years, it still remains the most used stablecoin in the crypto industry.

USD Coin [USDC]

USDC is a common project between Coinbase and Circle. Its supply should be more legit.

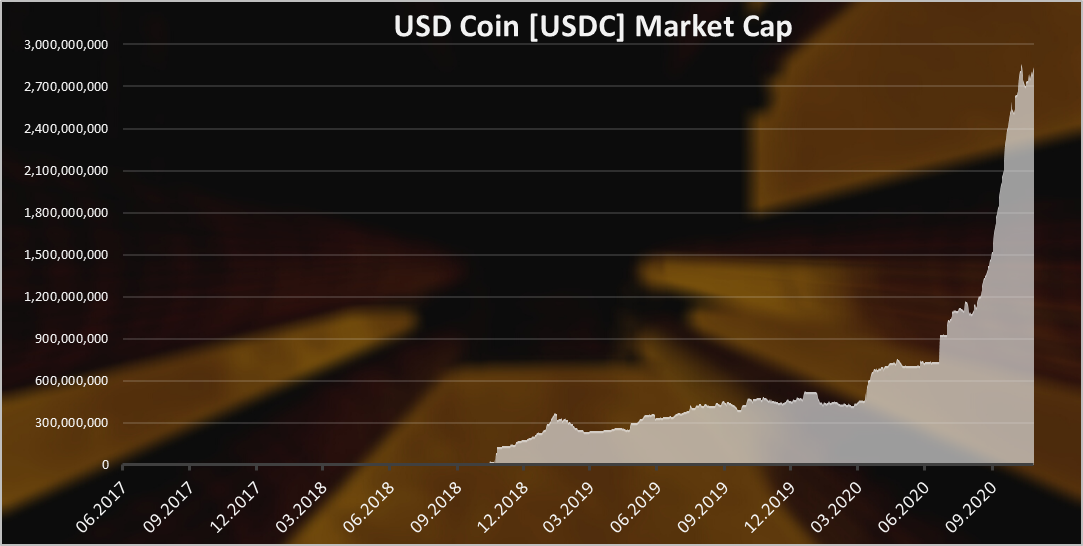

Here is the chart.

I have intentionally left the horizontal axis on a same scale with Tether, to show that this stablecoin, and the others have come after Tether.

USDC started its journey at the end of 2018. Same as USDT, a lot of USDC has been printed in 2020. The marketcap for USDC in 2020 started with 0.5B and at the moment is almost 3B. A 2.5B USDC printed in 2020.

Dai [DAI]

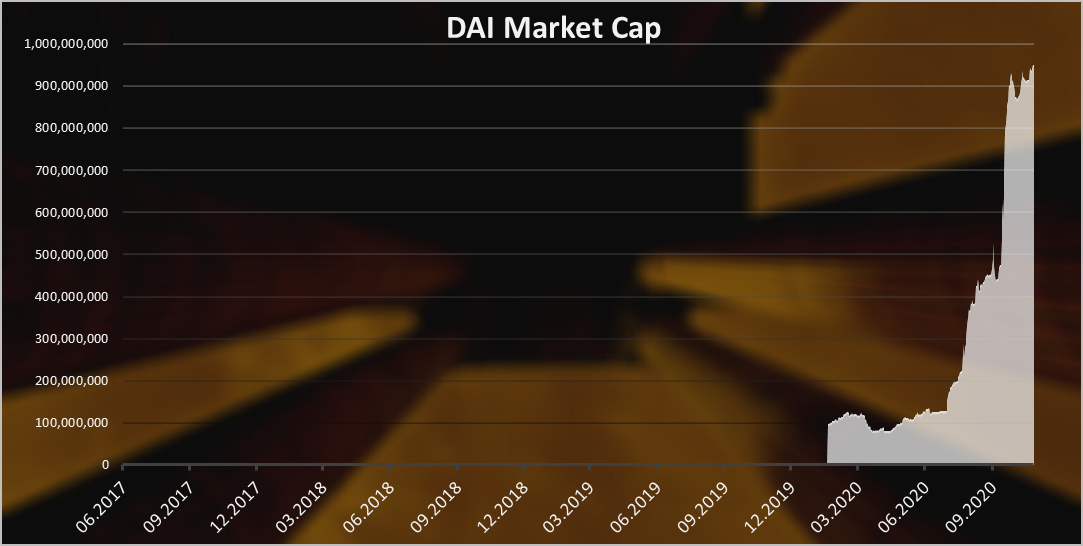

DAI is the decentralized version for stablecoin. Its run as a smart contract on Ethereum. Everyone can use the Maker protocol, deposit collateral and generate DAI as a loan.

DAI started even later than USDT or USDC. The current version of DAI (multilateral) stared in January 2020. From what I know there was a previous version of DAI, a single collateral one, that started at the end of 2017. Although the market cap for DAI is available only from January 2020.

We can see that the DAI marketcap has grow and its almost a 1B now in less than a year existence of the current version. Unlike the USDT and USDC, all DAI is generated in a decentralized manner with collateral locked in a smart contract. The average ratio of the collateral is somewhere 3:1. So for 1B DAI there is an approximate 3B collateral. No fractional reserve policy here 😊.

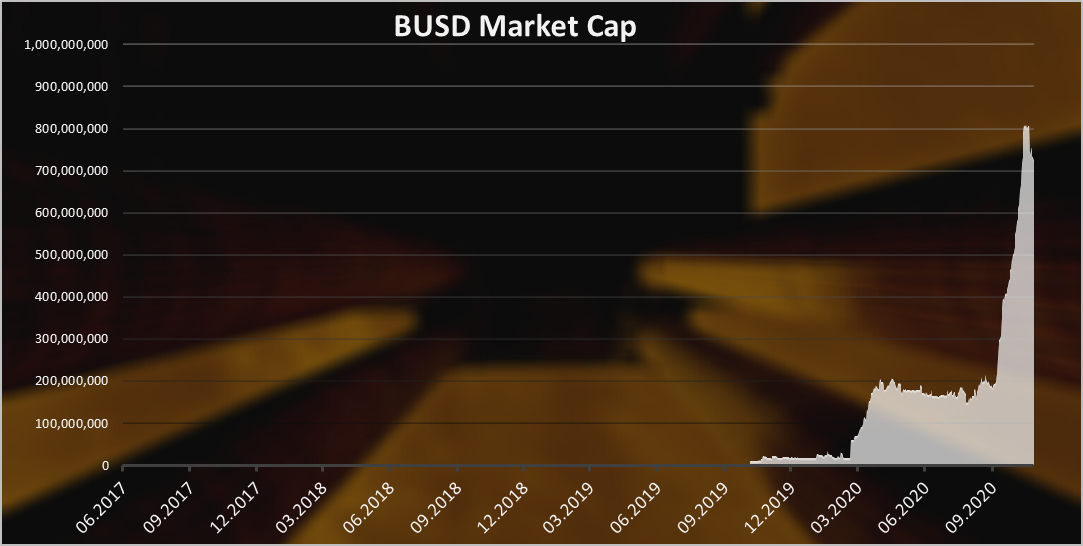

Binance USD [BUSD]

The Binance exchange stablecoin. Its mostly used on Binance as well as a trading pair against other cryptos.

Again, here we are seeing a sharp increase in supply for BUSD in 2020. A 0.8B supply now, from almost non excitant supply at the begging of 2020.

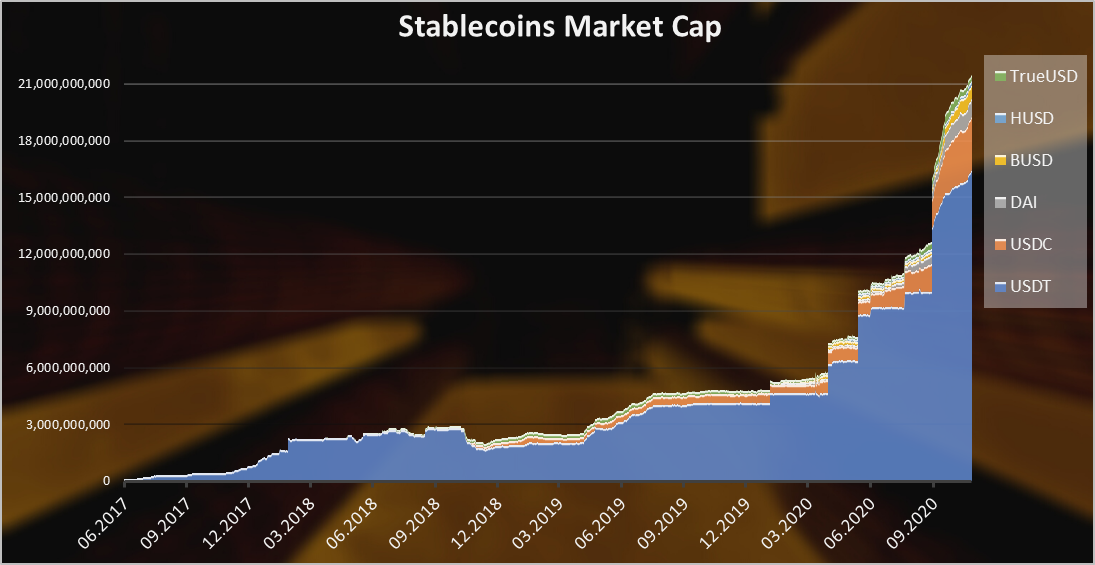

Cumulative stablecoins market cap

When we add all the coins above we get this.

Obviously, Tether [USDT] is a dominant player in the sector with 16B market cap at the moment.

But we can see that other stablecoins have appeared in the last year or two and they are now also growing at a fast rate.

USDC with almost 3B in marketcap is on the second place followed by the decentralized stablecoin DAI.

What is clear from the above is that all the stablecoins have grown a lot in 2020.

The stablecoins printers have went brrrr even more than the USD one in 2020.

The cumulative marketcap for them have went from 4.8B at the begging of 2020 to a 21.4 currently. This is more than x5 increase in marketcap. Actually the stablecoin market cap has experience one of the biggest growth in the industry. Neither Bitcoin or Ethereum has increased their market cap by x5 in 2020. At least not yet 😊.

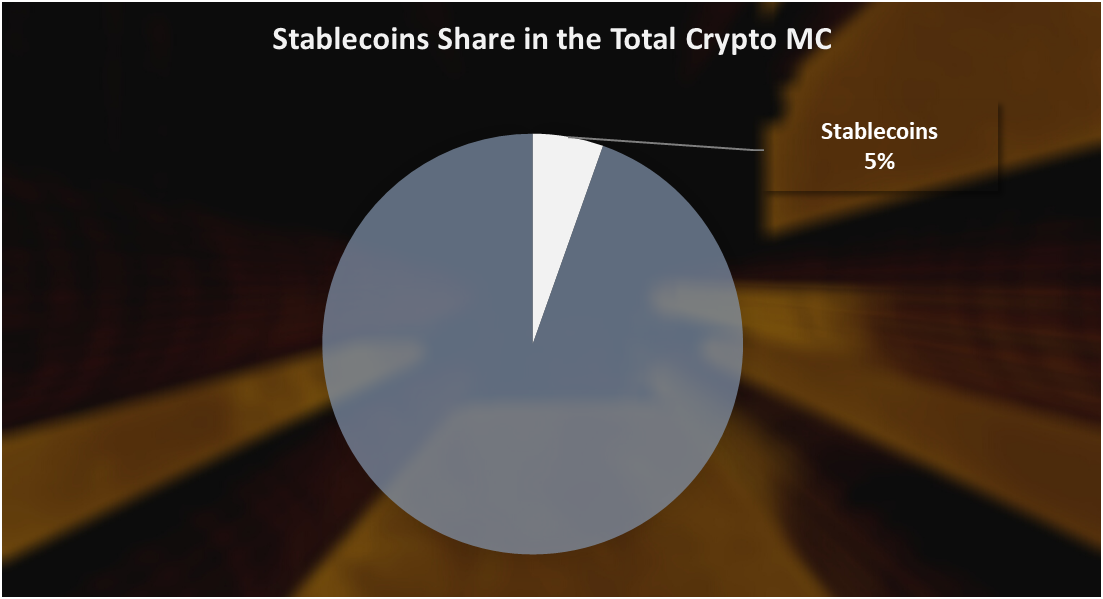

With 21.4B in market cap stablecoins now represent 5% of the total market cap of the industry.

With so much capital laying on a side thing should get interesting going forward.

All the best

@dalz

Posted Using LeoFinance Beta

Stablecoins rise is a certainty and the super dollar is something the crypto market is referenced to. These are mandatory instruments to support the current DeFi projects and everything around them.

Posted Using LeoFinance Beta

Yep, stablecoins are needed

Stable coins are really something! You can use them when prices are falling to maintain your balance.

Posted Using LeoFinance Beta

22 billion is 5% of crypto but are these really cryptos apart form DAI, I would say we should look at how much percent of fiat is locked in blockchain so of the $37 trillion in circulation 22 billion has been put on-chain. I think looking at that seems more meaningful.

Posted Using LeoFinance Beta

Well are they crypto or not is up to debate :)

Tether is the controversial here with its huge market cap.

How much out of the total fiat is in crypto is interesting view at things. But I would say a lot of fiat is in the other coins like bitcoin.

Posted Using LeoFinance Beta

I searched a lot and published a post about Stablecoins as their importance has not been acknowledged by thousands of people yet. The mindset behind is astonishing, digilitalizing and stabilizing your real world value. I guess that's what we call future of money as a means of exchange 😌

Btw, personally, I use DAI and USDC to minimize the risks that I take. As DAI is decentralized and colleteralized, I'm in love with it. However, USDC is minted by Circle (which is backed by Goldman Sachs) and I do not foresee and further risks by holding it, as well.

Posted Using LeoFinance Beta

Well that's news to me, that certainly is insane growth, now I just need to go find out what it actually means!

Isn't HBD supposed to be a stable coin, I guess that just doesn't even feature in terms of market cap compared to the big guys?!?

Posted Using LeoFinance Beta

Ya, it is supposed to be, yet failed for...4 years. As long as there are people willing to buy a digital asset that is worth $1 for $1.1/$1.5/$2...$17 back in 2018 it will never be pegged to $1.

Even today...people hold their HBD instead of burn it for HIVE, with the hope that it will spike to $10 on day and they'll earn big.

Posted Using LeoFinance Beta

Yep stablecoins are growing. Tether especially :)

this is a place to get security but in my case i do not get this i prefer the volatility of the market.

Posted Using LeoFinance Beta

Stablecoins are essential for traders.

Posted Using LeoFinance Beta

Yeah.. Right, they are the stable coin and very hard to trade. I have no idea for the purpose of it except to use like a token equivalent to a fiat.

Posted Using LeoFinance Beta

The purpose of it is to trade crypto agains dollar on the crypto exchanges.

Posted Using LeoFinance Beta

Thanks!

Posted Using LeoFinance Beta

Imagine the growth of BTC just by comparing USDT's market cap of 2017 to 2020... Those people haven't printed all that much stablecoins for nothing...

Posted Using LeoFinance Beta

It's going to be really interesting to revisit this again in a couple years and see what happened, assuming another Bitcoin bubble in 2021. Will money flow out of stable coins and FOMO into the "real" market? Or will the amount of stake in stable coins go up with the rest of the space? I'm legitimately curious.

Logic would dictate that during a period of extreme FOMO many users would dump their stable coins, forcing the suppliers of said coins to tap into their USD reserves in order to buy back their own product so the value doesn't crash. But you really never know it this market... a bigger market cap more Bitcoin might dictate the need for even more stable coins to act as a hedge.

Yes. Basicly not just the apsolute value, but a % in corelation with the total crypto market cap.

Posted Using LeoFinance Beta

My personal favorite stablecoin right now is PAXG which is PAX Gold... but if you want a dollar pegged I do use USDC mostly.

Posted Using LeoFinance Beta

I know pax, but wasnt awere of pax gold.

Is it legit? How can we be sure in its peg?

Posted Using LeoFinance Beta

Yeah it’s legit. Fully regulated peg. You can even redeem it for actual gold. Available on to earn interest on it as well on Blockfi and Nexo. I am earning 6% daily compounding interest on Nexo along with the rest of loaned out crypto.

https://www.paxos.com/paxgold/

Posted via D.Buzz

Stable coins are the answer of crypto volatility. The use of stable coins are good to secure crypto assets. To make profit from holding stable coins are not recomended. To make profit investing low market cap coins can be a choice but the risk is high too.

Posted Using LeoFinance Beta

I am sure you will agree on the reason: Volatility.

Most cryptos are so volatile, that it is impractical to take currency risk on them while running a business. Since there is not much in the way of interest rate swaps or other kinds of currency swaps. People running any kind of crypto businesses need a stable coin of sort. I think they are here to stay, and their slice of the pie will only increase.

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Great information in this post. I don't know much about stablecoins except that they are pegged to fiat. Thanks for posting.

Posted Using LeoFinance Beta