Few weeks ago I wrote about Ethereum 2.0, where we went trough the basics of what Ethereum 2.0 represents, when it will be launched etc.

Now we will look into the status of the network, what’s new and look in some tools as https://beaconscan.com/

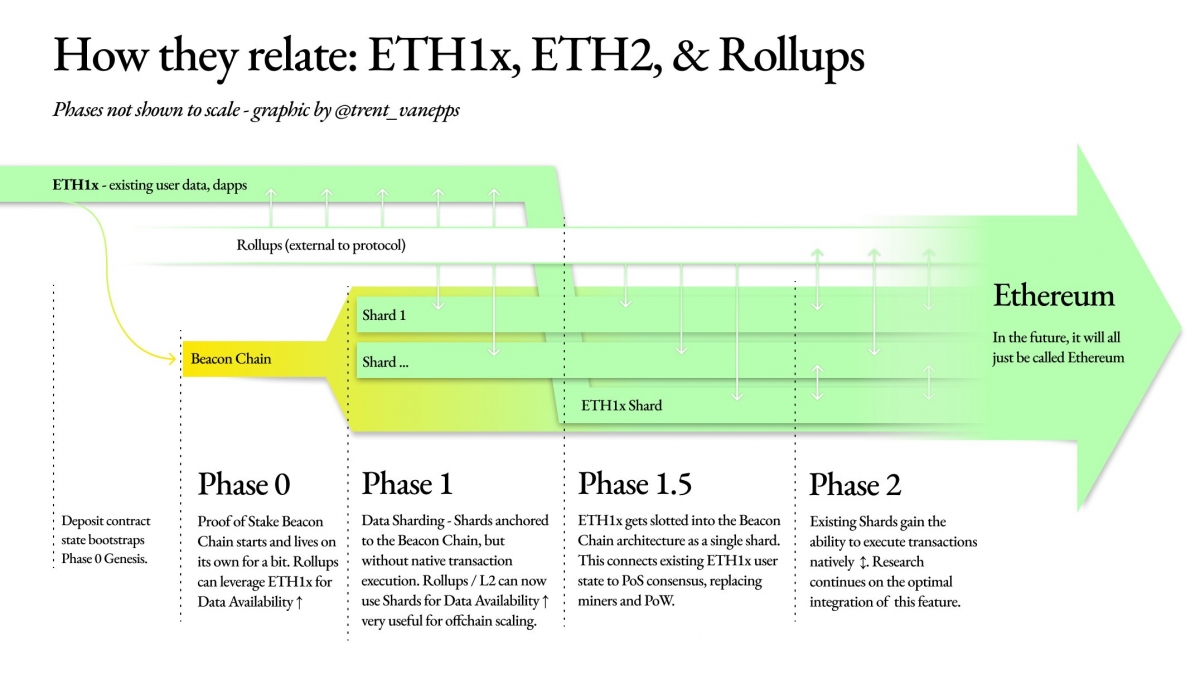

As noted in the previous post Ethereum 2.0 will be deployed phases in around two years time .

The three phases are:

- Phase 0, Beacon chain

- Phase 1, Shards

- Phase 2, Smart contracts in shards

At the moment we are in phase zero, Beacon chain which main role is to create a registry of validators and deploy a proof of stake consensus mechanism.

This chart illustrates the Ethereum transition quite well.

source

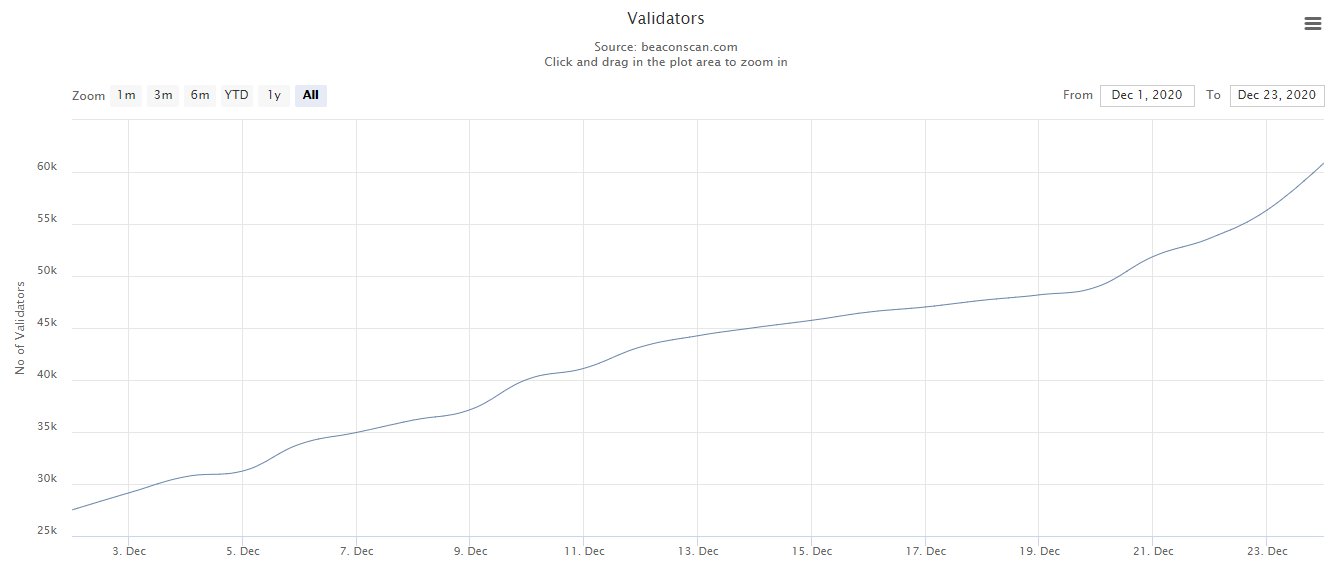

Number of validators

Since the main role of the Beacon chain is to establish the validators lets take a look at the current status of the Beacon chain in terms of number of validators.

The condition that is put in the contract for validators (new name for miners) is a minimum of 16,384 registered validators each with 32 ETH staked. A total of 524k ETH (0.5% of the ETH in circulation). Setting up such a big number of validators (16k) is needed for the security of the chain. Proof of stake does sacrifice decentralization and maybe some security (up to debate). To prevent this there was this condition for a large number of validators (new name for ETH miners) registered.

We will be using the Beacon chain explorer https://beaconscan.com/ to get some data. You can look at this explorer as an equivalent to the https://etherscan.io/.

source

A total of 60k validators as of December 24th. That’s is much higher than the minimum of 16k. What’s even more interesting is that in the last week the number has been going up more than usual. More than 15k validators were registered in the last few days alone.

Just a reminder the ETH staked is locked up until the ETH2 network is launched. Meaning at least two years commitment.

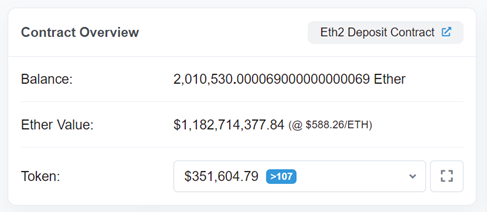

At the moment here is how the deposits looks like in the contract address.

source

More than 2M Ether locked. At the current value of around 600 USD that is almost 1.2 billions in USD value. Quite an achievement. This shows the support and the trust people have in the Ethereum network.

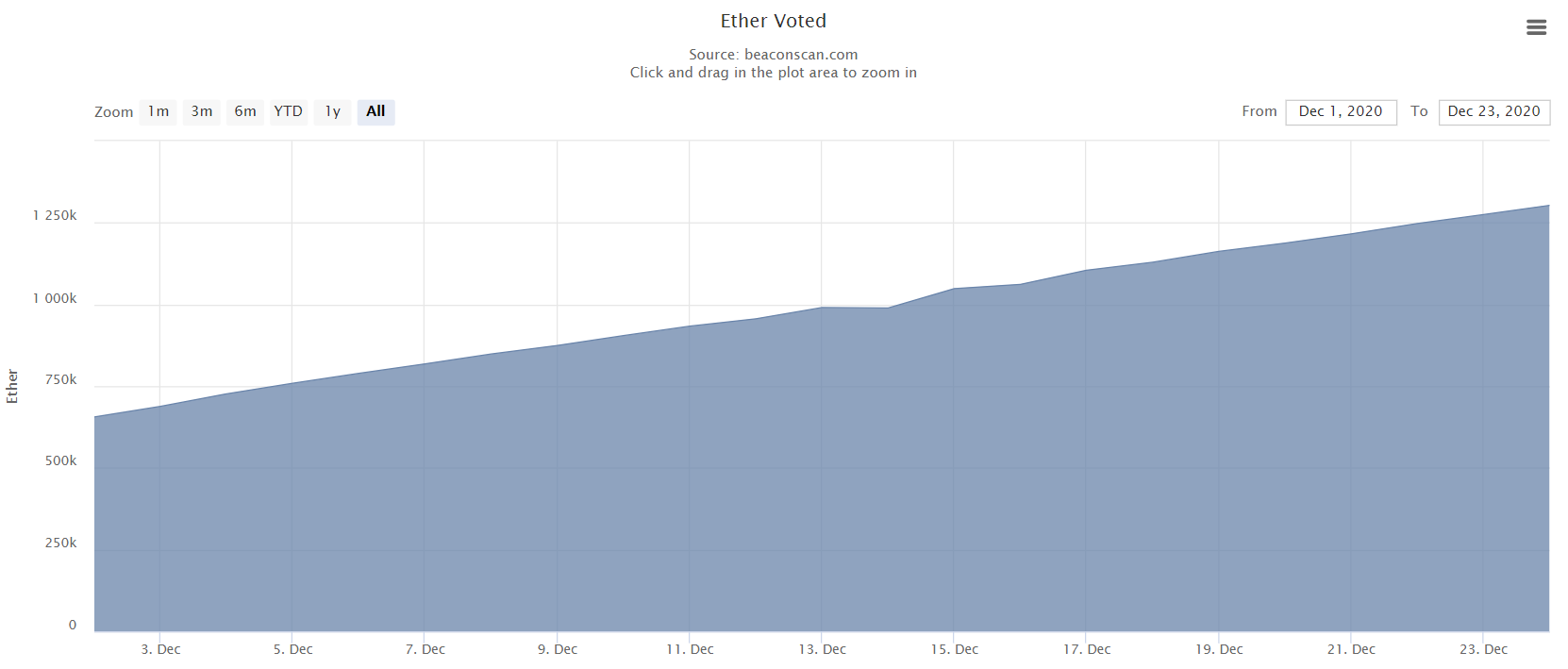

If we take a look at the Ether voted chart on the Beacon chain we have this.

source

At first, I thought this chart represents the amount of ETH deposited to the ETH2 staking contract but it seems that it’s not exactly that. Since there is only 1.3M here, and as we can see the total deposited ETH is 2M.

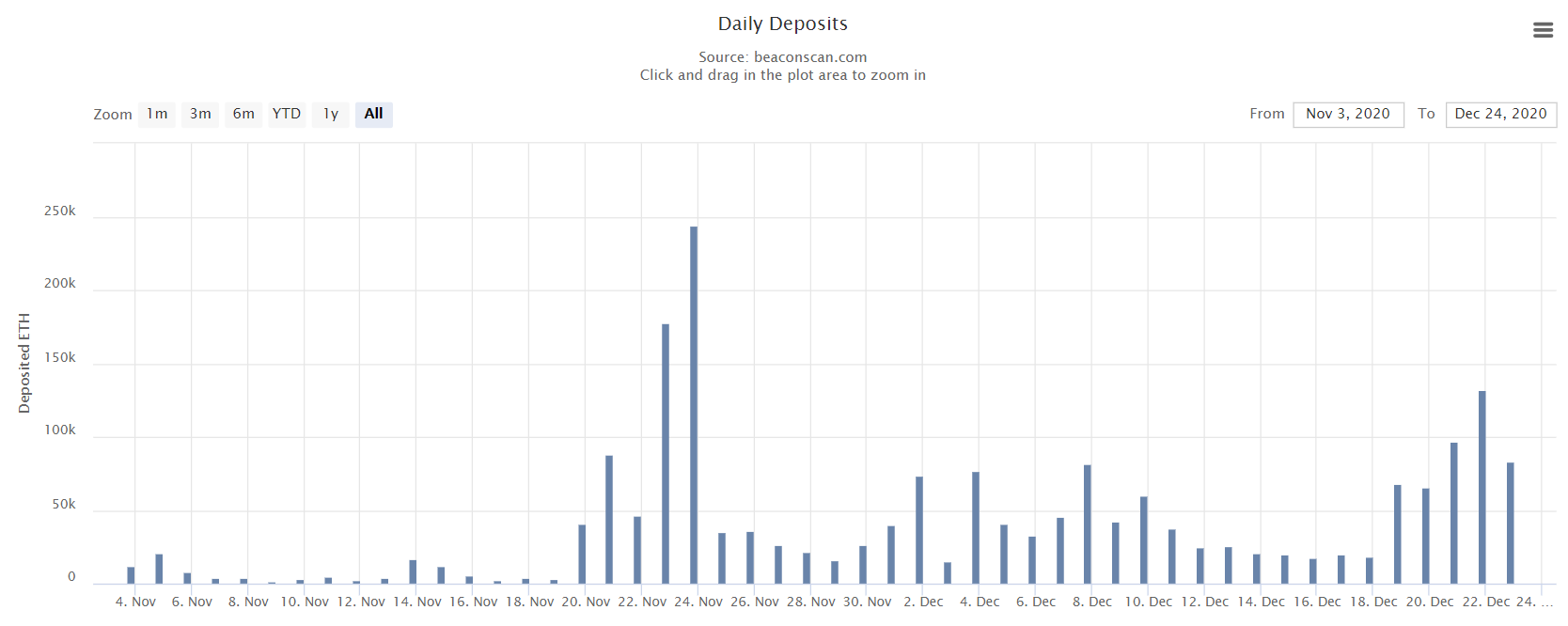

The daily deposits charts looks like this.

source

We can see the spike in the last few days.

Also, around November 24th and 25th, there was a huge amount of Ethereum deposited just before the launch on December 1st.

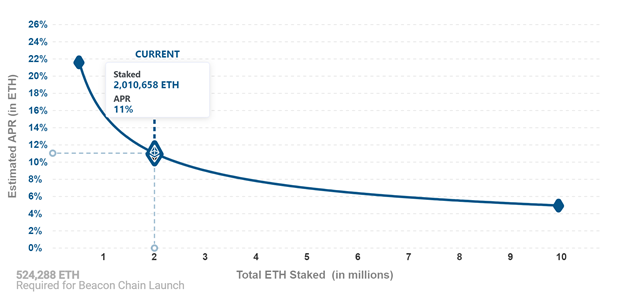

At the end a chart about the staking rewards.

source

This one comes from the lauchpad.ethereum.org web. What this chart is showing is basically as the amount of ETH staked increases the rewards for the validators goes down. At current levels these rewards are at 11% APR, that is still quite high IMO, for a blockchain as Ethereum. Probably in time thew will drop bellow 10%.

Overall, the Ethereum 2.0 launch is going quite well. The number of validators keeps increasing weeks after its launch and the staked Ethereum as well reaching more than a billion dollars value. I expect this trend to continue and we will probably see more than 100k validators on the ETH2 network and more than 2M ETH staked. Although if we take into consideration the total supply of Ethereum that is more than a 100M, these numbers are just above the 1% from the total supply. Anyway the trend is clear, we have a large userbase that is willing to lock their Ethereum for years and support the ETH2 network.

All the best

@dalz

Posted Using LeoFinance Beta

It's nice to see Ethereum finally getting onboard scalability train. Many users with small portfolios like me weren't able to invest in much of the Dapps. Those GAS fees were prohibitively expensive. If ETH Dapps weren't giving me the opportunity to get the best out of the ecosystem because of fees, then there's no way an impoverished community barely making anything at all is going to get helped by Ethereum.

I've seen many folks from Venezuela post on Hive. Because of the nature of this blockchain it's easy for them. It barely cost them anything. These ETH 2.0 stuff is long overdue. I was hearing about PoS ETH in 2017. It's only now things are changing. It's better late than never. I just want to say that blockchains should focus on being accessible to the little investors as much as possible. That's how you really change the world.

Posted Using LeoFinance Beta

Great analysis,

I myself owned 0.1 Eth and used it to stake with Binance in 2.0.

Awesome man! Thank you for the update on this as I have not been able to keep up to date on it.

Posted Using LeoFinance Beta

Thanks!

That's what leo is for :)

Very nice review, I am still holding my ETH despite the temptation to roll it into BNB, or DOT ....time will tell if I made the right decision. I would love to hold all three, but feels late for BNB, so dollar cost average buying Dot. I am also looking at Rune and Link and expecting big news from Rune soon. Did you write about those tokens before?

Posted Using LeoFinance Beta

That's a very nice update, @dalz.

Posted Using LeoFinance Beta

Thanks!

Wooah that's a deep analyze on etherum! Thanks @dalz

Posted Using LeoFinance Beta

You have been a very reliable source of information to know about many blockchains. The biggest strength for Ethereum is brand recognition and the DAPP ecosystem. If blockchains like EOS push their marketing and sponsor some great DAPPs they have a great chance to overtake Ethereum.

Currently Ethereum is a real pain to use. As someone who doesn't have a lage portfolio, GAS fees are a nightmare I'm not willing to deal with. Even HIVE and HIVE-Engine with smart contracts (@aggroed is already trying to make this a reality) we still have a chance to convince DAPP developers to move to HIVE before Ethereum scales themselves properly.

Posted Using LeoFinance Beta

Thanks!

I personally don't see EOS catching up to ETH any time soon. At this point the Binance Smart Chain has show to be the closest to ETH.

Binance is at a better position than any other to dethrone Ethereum. EOS really had the chance to make themselves attractive to DAPP developers with their billions raised with ICO. They could have done lot better marketing too. I have a lot of interest in https://hedera.com I don't own any at the moment. But it is the most interestingcrypto currency project for me at the moment.

Posted Using LeoFinance Beta

Why did they call it ETH 2.0? Is it still an ETH? Or different? I am confused.

Posted Using LeoFinance Beta

Just a softwere vesrion v.1, v.2 .... its the same thing

Ahhh... Thanks buddy.