I am not interested in what the price of CUB is today, tomorrow, or even a month from now. I'm farming till at least Q4, plain and simple. I want to be guaranteed the most CUBs possible by Q4, no need to gamble. There's a perfectly good farm right here.

Smartly, the CUB/BUSD pool is the highest yield and safest one to farm as far as being a CUB ape is concerned. Half of the LP being a stable coin will help a lot with price variance. Now is a pretty good time to get in, at a price of ~$4, even if it crashes to $2, it will most likely pop back up eventually, avoiding impermanent loss and capturing max LP farm. Even now it's still earning 12% ROI a day, which is obviously insane.

ROI

Of course ROI is 100% dependent on the price of CUB, and it assumes we are selling. We aren't selling: we are apes. I'm an ape farming 750 CUB a day. Selling zero till Q4 (not technically). I don't care that I have "12% ROI per day". I care that I'm farming 750 CUB a day. That's the number that matters, and it is extremely volatile on the short term.

All farm goes into Den.

While the price of CUB declines, to ape to maximum capacity, place all CUB in the den until you have enough to justify selling half and reentering a farming pool. Selling outside funds to match the other side of the pool is also an option for hardcore farmers.

Ideally, the price of CUB will go up, when that happens I intend to sell half of what I've stored at the CUB DEN into CUB/BUSD and reenter the pool to lower volatility and increase compounded farm.

If the price of CUB bleeds I have a harder decision to make: do I HODL it like an ape and hope it goes up? Or do I capitulate back into the BUSD pool? Depends on the price. I'll probably sell CUB if it dips to $3 or higher. I wouldn't sell CUB in the $2-$3 range. I don't think it can dip lower than $2 with all this hype. Playing it fast and loose.

All the biggest buyers will go through the BUSD pool due to liquidity being higher than CUB/BNB. It will be interesting to see the actual Pancake yields after this initial phase of mega-farming has cooled down.

LP yield on PancakeSwap

PancakeSwap charges 0.17% fees to the users that goes to LP holders. The two main farming pools are going to have massive volume just from yield farm alone. A lot of the inflation will get dumped on the market, but there is also a lot of demand to buy and a lot of liquidity in the pools.

This creates the exact scenario we saw with KOINOS mining. It's profitable to mine (farm) so miners scaled up there operations and consistently dumped the Uniswap pool for instant profits. These dumps in price inspired buyers without server farms to buy in directly with ETH. The result was volatile price action with an absolutely gigantic farm. In the beginning KOINOS daily volume was higher than the market cap, and the buying and selling pressure often created mass volume with tolerable impermanent loss.

CUB is a token that has taken this mechanic and jacked it to 100. 22 Pools can farm CUB by design. That's insane. Money generated from those pools is used to buy more CUB. Yields are still high. Yields will still be good after the initial 2 weeks is over. (lowered inflation has that effect: higher token price).

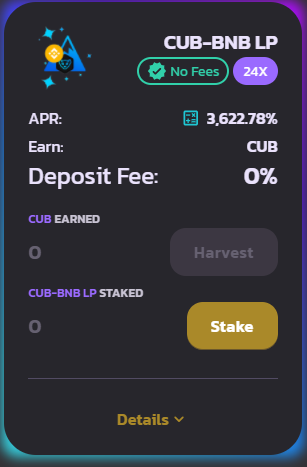

CUB/BNB LP

This farm is amazing for when Q2 starts (perhaps May). Great pool to be in during a mega-bull run when you don't want half of your asset's value to be stored as a stable coin. I'll think about using the BNB pool when I'm more confident in lower volatility and the inflation of CUB is centered at the baseline (28800 CUB per day). Personally I think the lower yields are going to push the price up, not down. Especially in the mid term (Q4).

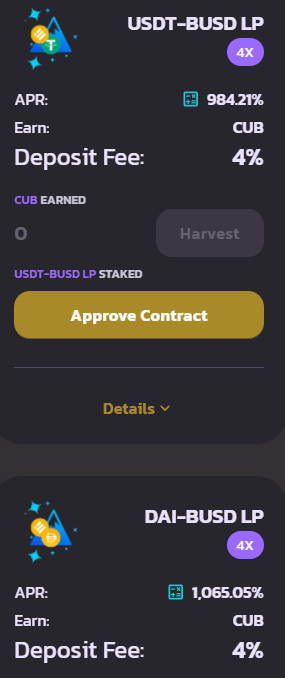

I can't even express how amazing these two pools are.

2022 bear market getting you down? Why not buy some stable coins and use THAT to farm CUB. LOL, that's incredible. What a good feature.

Again, we have to think long term.

Not 2 weeks from now.

Another interesting pool,

This is the only one with a 2% deposit fee instead of 4%. If I had a position in BNB I'd think about powering down some LEO and putting it here. I'm very salty about BNB because I dumped it all out of spite during the hostile takeover even though I knew BNB was going places. I'm sure many of us are in that boat, and even don't like the idea of using BSC in general. Oh well.

Conclusion

We are being underestimated right now by the BSC network. Some of them got in for the initial farm and are looking to exploit. Go ahead and dump, there are many with there bags open. I've never seen LEO general chat so amped. Ta da moon.

Most importantly just don't sell.

Ride the wave to Q4 and thank me later.

Even if CUB crashes to $1 in the short term...

let's be real I'm probably just buying more.

What kind of functionality is CUB going to have in Q4?

There's at least one dev working on it the whole time until then.

Speculators gonna speculate.

Apes gonna ape.

Compound all gains: farm to Q4.

Posted Using LeoFinance Beta

You are really represent Leo Logo

Heart of Lion

Appreciate your perseverance

Posted Using LeoFinance Beta

I remember you posting about Liquidity pools and how they help reduce volatility. You even talked about "impermanent gains" on the downside. I've done more research today on the math behind liquidity pools (because of damn CUB) and apparently you were wrong.

Price difference (up or down) causes losses compared to a HOLD position with both tokens.

So if you provide liquidity to cub-busd and cub goes down, you lose both the value that cub lost + the added impermanent loss.

https://peakd.com/hive-167922/@edicted/impermanent-loss-and-gamblers-syndrome

I explained the entire concept in detail.

The content is dense and perhaps misinterpreted.

Impermanent loss rounds to zero when looking at the CUB inflation bounties.

Less risk is incurred on LPs.

It's a safer gamble.

Less volatility in both directions; betting against the market.

You are ignoring the money gained by farming the LP.

Definitely agree with that. I am also in that pool.

Here is the part I (or you?) misunderstand. Less volatility on the upside I agree, because impermanent loss reduces the gains. But there is more volatility on the downside. Because as I said, impermanent loss is added on top of the capital loss.

If cub goes down 50%, you lose 50% of your cubs' value and you get an impermanent loss of around 5.5% compared to your busd cub holdings if you were not providing liquidity.

If you weren't providing liquidity half of your money wouldn't be in BUSD to begin with.

That's what the math fails to understand.

99% of people are going to shove 100% into CUB they aren't going to leave 50% stable.

Ohh I see. Was not assuming you would keep 100% in CUB. Makes sense now

On a month what do you think ARP will go ?

Posted Using LeoFinance Beta

For me it does not matter what the APR thinks it is.

The APR depends on when the person sells.

Directly correlated to CUB price.

I'm not selling till Q4.

It's impossible to even guess where an asset this volatile will end up in a month.

Inflation is going to be cut massively into thirds,

but token price can easily go up due to the reduced inflation.

i don't even know what am i doing, but i fomo-ed in to the BNB and BUSD with some "free" btc. after that i just bought CUB because i wanted CUB and not to split it.

The idea of selling some CUB to get into LP sounds interesting, only if i would have more to harvest :D doing it with 5-10 cub is maybe just to small.

Total noob here "LP yield on PancakeSwap" how this thing work? do we get BNB for being in the pools? or?

It's all percentages it doesn't matter how big your stack is.

Same as wLEO and Uniswap.

The fees that traders pay goes into the pockets of the LP providers.

Fees make the LP pools bigger, and when you exit the pool you'll get those tokens.

this ape is in his first LP rodeo. never got into it, as my play money was few ETH transaction fees big :D

Thanks for clarification

You really make a good argument. I have already reduced myself to the CUB-BUSD farm and the CUB den (lol, yesterday I wrote totally different strategies but the ape in me was stronger). But instead of just moving my CUB into the DEN and lock them there, I also might take half of it every now and then, when the stake is large enough and add into the farm.

What is your threshold?

I want CUB price to go up before I pump a wave back into the BUSD pool.

I'm going to consider doing it on a daily basis at this point while the inflation is high.

If CUB spikes to $5 or $6 it's an automatic sell back into the high yield pool.

If not I have to speculate on how low it will go (currently thinking $3).

I think there's a very good chance with this much volume and inflation we stay in the $3-$5 band until inflation gets reduced.

Already considered selling my body for more BUSD but after reading this, I'll just sell my Cubs for BUSD and then farm more baby lions that I'll use to match the previously sold Cubs for BUSD.

I'll be doing it on a two-two days basis. That is; mine Cubs for two days, swap for BUSD, and then mind Cubs for another two days to pool against the BUSD.

I'm making like 20 Cubs a day, way more money than I'd make if I was a government worker. So that's basically pooling 40 Cubs against $280 BUSD every two days.

Posted Using LeoFinance Beta

How do I get to fatm cub as well?

Even though I targeted Q2 for an update of my investment ratio on CUB pools, it may not be wise to make any change while they are already quite profitable. Thus, harvest and add more liqudity on BUSD sounds still logical. With the realization of Q2 outcomes, we may never see one digit price🤤

Posted Using LeoFinance Beta

Wow, 750 per day! That is nuts! Congrats on that! Looks like I maybe need to move into some BUSD to try and take advantage of this!

Posted Using LeoFinance Beta

If you've mined Cubs, sell half of it on the cubfinance exchange for BUSD and then pool them against each other. Easy peasy

Posted Using LeoFinance Beta

I jumped in on CUB-BNB. Looks like once a month my WLEO:ETH geyser reward and my farmed CUB are going to be roughly equal. I'll turn LEO into BLEO, then swap it for BNB and push in harder on CUB-BNB. Love watching the little ticker go up.

Thanks for sharing your view, and I agree on all points. Happy farming!

Posted Using LeoFinance Beta

Dalz have a chart. Do you know how to build one? its not that easy to track all movements over a day/week without :D

Posted Using LeoFinance Beta