When I first started SEED, it was originally conceived as a secondary job to my overall activity in the markets. However, the idea attracted a lot of interest, and I quickly became overwhelmed by what was supposed to be an experiment in the first place.

I spent a lot of time in my bubble thinking about the future of SEED and what I want it to become over the coming year(s), or simply what to expect from a profit perspective. For this reason, I've been thinking about redacting an updated roadmap and having it as a reference point for the future (which is exactly the motivation of this post, since the old one is already outdated).

Also to help people to understand better my current priorities, and how I'll be managing the portfolio in the future for stability & growth purposes.

It is worth mentioning that on a personal level my positions migrated to a very low-risk profile being most of them composed of ETH, BTC, HIVE & stables... and obviously SEED. Following the previous reasoning, SEED will be my 'high risk' portfolio for the coming years, where most of the alt bets, yield farming & degen plays will happen.

In other words, I see SEED as an opportunity for external participants to get direct exposure to my own portfolio and my way of riding the markets, so you're not investing into a 'managed fund', you're directly giving me your money and I am quantifying your ownership % with the SEED token. Simple as that.

I'll also take the time to address with this post a few 'slightly' outdated themes like Burns, HBD & Liquidity Pools, Refunds & Management fees.

A look to the Present. Where are we standing?

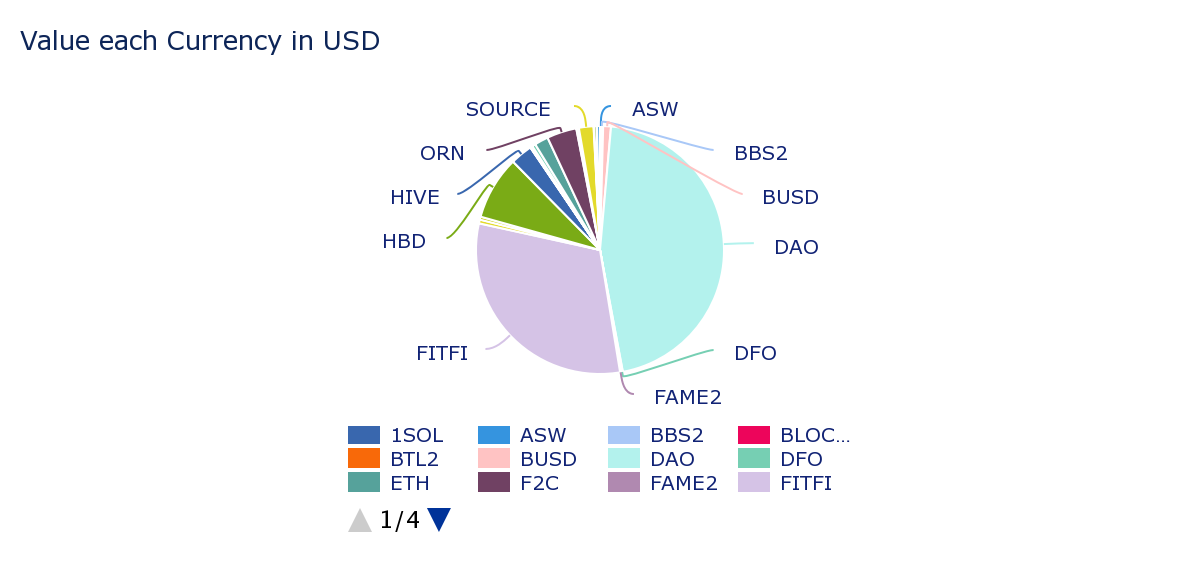

SEED as a project is standing in an overall pretty good position. After less than a year of existence (late July 2021) a few very important milestones have been achieved:

- Around ~200K$ in assets under control (~500K$ ATH).

- Decent value proposition (DAO Maker presales) for a 'tokenized business' linked to 1 person.

- TOTAL supply released. Without initial hype, an unfair founder premine, or burned investors.

This does not come without a very important weakness:

~80% of the assets in the portfolio are locked in long-term vesting locks which gives a lot of importance to cash flow management. However, this problem will gradually be solved as more assets are unlocked. And well, it's also my job so...

For now, this keeps forcing me to keep a decent buffer of cash in order to:

- to keep participating in presales.

- in case someone wants a refund for his SEED.

In general terms, we (just) need time to palliate our liquidity needs since the $$ is standing there. Diversifying into other things is secondary while these two aren't accommodated enough.

What about the Future? 2-year vision for SEED

While I fully understand that 2 years is a very long-term timeframe, I think it's still important to define objectives that I believe are 'realistic' for our growth, two years from now I would like to see the following (in order of priority):

- Portfolio of at least ~1,000.000$ in different assets (SEED at a backed value of 10$).

- Over ~70% of assets are available at any given time.

- Non-inflationary, growth dependant, HBD Staking rewards for SEED holders.

- SEED Rebrand (TBA).

- SEED OG's NFTs (TBA).

Checking at numbers, It's funny (and scary!) to check that I should be making ~1095$ on a DAILY basis in order to accomplish the 1M$ goal, within 730 days from now. It's very optimistic, maybe, but I'd rather be half-heartedly trying to achieve an ambitious goal than go over the top on a mediocre goal.

IMHO, it's much more difficult to grow up to 200K$ from 0$ rather than 1M$ from 200K$, so I guess the difficult part has already been accomplished.

One or two more bull phases and we'll be much closer than expected.

Regarding the Rebrand and the upcoming NFTs, I can't still share any details since both have been in my mind for quite some time but I'm still researching the best way to implement them (specially NFTs). Regarding the Rebrand, I'm thinking first about a name change, and then we would see. All suggestions are welcome.

SEED Endgame: HBD Staking rewards

Although the first two points might seem somewhat obvious, the third one might need a bit more explanation. This idea still needs a lot of refinement & hard thought, but since the beginning, my idea always has been to link SEED with HBD.

I'm not only holding a part of SEED holder's collateral in the form of HBD, the main idea is to redistribute % of revenue (of the whole fund) to long-term SEED holders.

Making SEED highly desirable, not only as a backed asset on the low-end but more as a producing income asset.

What our portfolio would look like at that time? Some fun with magic internet money.

Imagine that our TVL is 1M$. How would you distribute that? I would do the following:

- 40% of stables like USDC, HBD, DAI... pooled/staked generating a ~5-10% return. But I wouldn't have a problem holding HBD if the APR in savings is still 10-20%.

- 30% in wBTC and sETH, lent in Defi protocols like Aave & while borrowing more stables for an additional ~3-5% return

- 30% in alts, Mainly DAO, HIVE & locked tokens.

Being optimistic and playing with simple numbers, let's assume the following yield/s:

- 400K HBD in savings generating a 20% APR = 80K HBD

- 300K in wBTC & sETH generating a 4% APR through lending and stablecoin borrowing = 12K$

- Not counting anything from the 3rd category (also the most volatile).

And assuming very simple rules for SEED staking like:

- 100 SEED staked as a minimum requirement and a 10K SEED cap.

- 4-week lockup with weekly unstacking unlocks (power-down of 4 weeks).

Assuming no changes in the current distribution of holders, the maximum eligible amount of SEED to receive staking rewards is around 60K.

92K HBD / 60K SEED = 1,53 HBD per SEED /year

Which would account for a 15,3% APR paid in HBD... with a SEED price of 10$ (since TVL would be +1M $).

Holders of 1000 SEED would have a 10K$ collateral while producing 127,5 HBD on a monthly basis. Not a bad paycheck!

And this APR would still be scalable. If our TVL keeps growing, assume more assets locked into HBD/stables and wBTC/sETH, further increasing the yield. Take that Terra!

All of these changes are great on paper, but these new future mechanics of the token makes me rethink a bit some of the already implemented ones (although on hold atm), especially the buyback & burn and the liquidity pool features.

Let's address them.

Burns, Refunds & Liquidity Pools

Although the idea of burning SEED tokens has been explored in the past (through continuous buybacks p.e.), the utility of burns for such a small-cap like SEED is questionable and I see much better utility locking tokens into a liquidity pool (like the one we already have on Hive-Engine).

If I plan to redistribute HBD through a staking mechanism in the future, doesn't make much sense to keep trying to reduce the supply artificially, better to save the funds instead and redistribute them later.

Regarding refunds;

Refunded tokens (if any) won't be burned for now.

But since our liquidity is thin at the moment, an OTC buyer will be sought preferably.

I don't want people changing their minds at the last minute, so If you ask for a refund (I prefer to write this down) I reserve the right to ask for a 2% upfront deposit of your SEED.

I won't start moving assets from one place to another (spending gas fees p.e. or taking out HBD from savings) BEFORE this upfront payment has been done. If you later change your mind I'll keep those for the time & fees lost.

Contact me always through discord first to coordinate ( empoderat #6408)

Regarding Liquidity Pools;

I've tried a couple of times to raise a meaningful liquidity pool, but given the risk of IL and the long-term vision of most of the holders, the result has been mediocre in both cases (although the second one went much better).

When the HBD in the HE contract dries up a few months from now, won't be refilled with more HBD (since it's a 'debt' liability & the same argument with burns apply). Not to mention the pain in the ass which is to manage swap.HBD in HE.

What about Management fees?

This has been a topic I have actively avoided since I believe it's pointless to talk about management fees when you're starting out. IMHO it's much better to create value long-term and the rewards will come eventually. That said, this situation should not drag on forever and must be addressed at some point.

My SEED tokens are equal to the rest, I have the same rights compared to any other holder obviating perhaps the important fact that I am the one controlling the funds and all the trust falls on me. I own exactly half of the supply 50K SEED and I (probably) won't be selling any of these in years (or at least this is my intention).

How do I get paid for the job then? Apart from an occasional payment in the past (from the buyback&burn program) and discounted SEED tokens, I have put into SEED a lot more money than I have taken out.

I think I have found a solution to this matter.

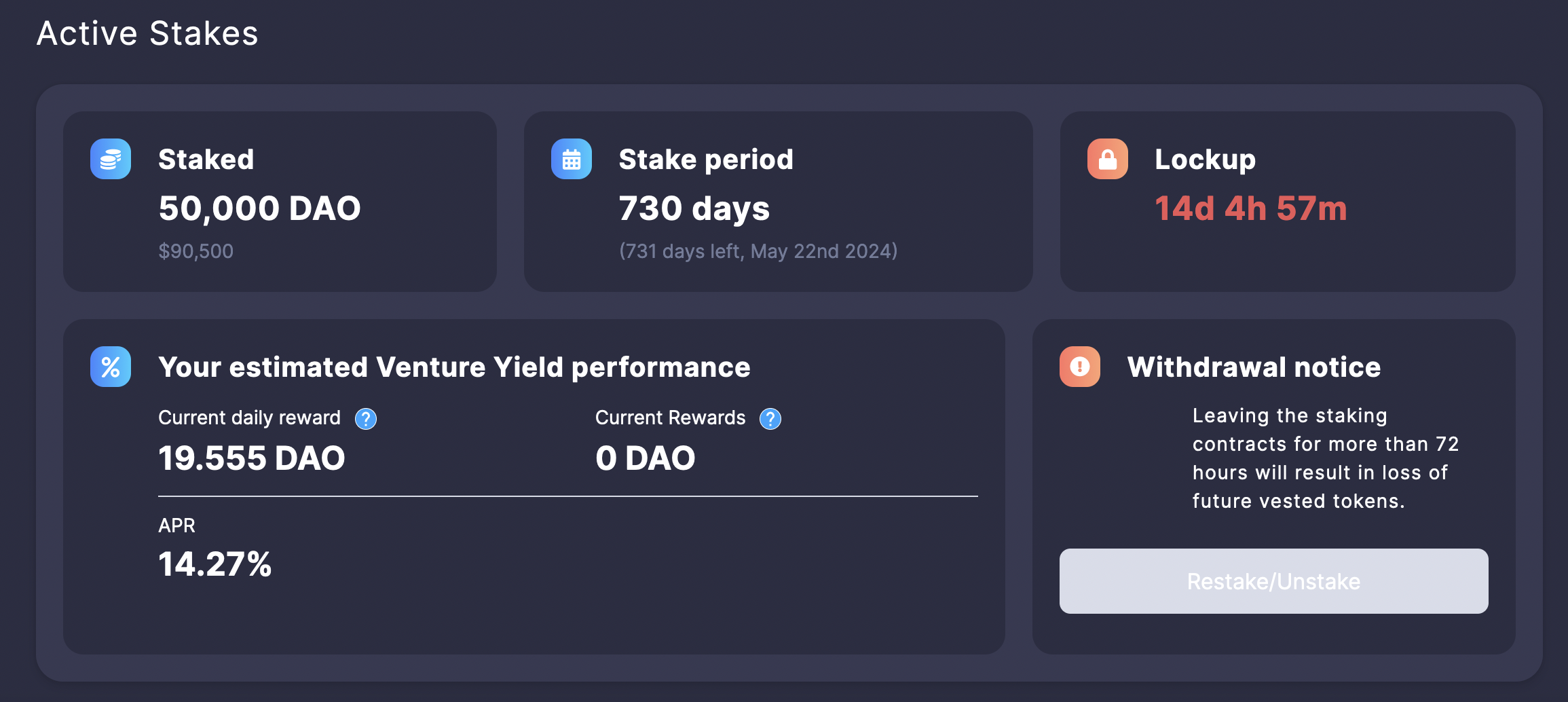

Exactly today A couple of days ago, our DAO Maker stake ended. Tokens which I re-staked shortly after in order to keep receiving future vesting unlocks of our presale participations. I re-staked for 2 years (730 days) for a ~14% APR.

I'll take that yield as my compensation at the end of the period.

Something which aligns with my long-term vision for the whole project, since the funds(+reward) are locked until the end of that period.

- If DAO goes to 0 in that timeframe, I (we) receive nothing.

- If DAO goes to 10$ in the next wave, then the 2-year long-term vision (probably) will be fulfilled and all of you will be able to enjoy an x10 on your 1$/SEED entry (or a decent monthly paycheck). Then I get paid a fat sum at no cost for the whole project.

The most interesting part is that this yield is directly correlated with our whole portfolio, which aligns with everyone's incentives.

This is all, I think. back to my cave.

Remember you can follow the portfolio in real-time here:

https://cointracking.info/portfolio/seedtreasury

You can join us on Telegram and follow me on Twitter.

Posted Using LeoFinance Beta

To sum up:

A project led by a quality person can equate to a quality project.

This is exceptional in my opinion. A well thought out plan that is evolving and adapting as the situation changes. Laying out the next two years is a smart move.

Of course, this is crypto and we know how the industry can change. That said, this is a good plan to work from, then adapt as the entire spectrum tied to crypto changes.

For now, it is solid along with being workable. The goal of $10 in two years is feasible simply because we know the bear will exit at some point.

In the meantime, the building phase puts us in a stronger position.

Posted Using LeoFinance Beta

your comments always make me blush

As I said it could be reached very fast If the market conditions change, until then it's a survival game (a game which we are very used to on Hive as a whole).

Even half of that goal puts us in a very sweet spot, but the key as I see it is to remain humble and listen to what the markets are telling us.

Keep rocking taskmaster!

Perfect as I invested in you and this is more of what I had expected. I will be topping up slowly over the next few years if there is #SEED on the market.

Posted Using LeoFinance Beta

DCA is and always has been the best strategy, without exception ;)

I want to buy a car with my seed. I can wait 2 years buddy, no problem 😊

Now serious, I think the way the management fees will be paid is good for the project.

Posted Using LeoFinance Beta

Very nice goal! Crossing fingers for that to happen (If I don't rug pull you before, obviously).

hehe thx bud :)

Posted Using LeoFinance Beta

I am a willing OTC buyer as long as SEED is under $3. If it is over that price at the time it will depend on checking my portfolio.

I will prepare a discord server to manage these types of things, I think it would be helpful to coordinate.

Qué hay de lo tuyo?

Posted Using LeoFinance Beta

Bien, he relajado mucho, tengo unos posts pendientes, pero estoy contento y en gran parte por sus consejos puedo mover para adelante con confianza sin afanarme.

Estamos pendiente su post de los buenos consejos!

Ahí te quiero yo ver! Me alegro muchísimo.

Y si, a ver si me inspiro a hacer ese post :)

please exit pump sir!

I still say that can be resolved with the ill of the community. There are many who would buy SEED, so just a shoutout and you can honor the request.

I couldn't agree more. Money makes money and with 💩you can only make 💩.

Told ya at the beginning 😂 but I'm glad to hear it's going to happen 💪

The plan to redistribute HBD is a very good idea, I don't mind at all.

Last but not least, I'm ok with the solution you have found for the management fee and the rest of the plan also is ok.

Thanks for the detailed post and have a nice week :)

(a happy seed holder :P)

I know, but I have to be prepared anyway. People collectively asking for a 5K SEED refund would be a bit tricky although I would be a buyer.

I know I know lol haha , I still remember that $EMPO ticker.

Thanks for the support erikah, Have a nice week.

Posted Using LeoFinance Beta

I invested in SEED because I saw Daomaker as expensive and it was smarter to get indirect exposure through the SEED project. Just wondering, but is Daomaker planning to start up the pre-sales soon or is it still waiting?

Posted Using LeoFinance Beta

They're coming. Next one in 6 days after 2 months of halt.

We're still waiting for tokens to be listed on markets!

Very interesting. I think you have been doing a great job with the management of the project. I think I say this every time, but SEED continues to be the biggest investment in my Hive-Engine wallet. I just wish I had more of them!

Posted Using LeoFinance Beta

Main difference with most of the other HE tokens it's that SEED is fully backed... so when HIVE dumps don't matter that much for SEED

Posted Using LeoFinance Beta

Good point!

Posted Using LeoFinance Beta

lambo lambo

bera bera

Posted Using LeoFinance Beta

no lambo? :(

bulla bulla!

First suzuki. PoS = Proof of Suzuki but Vitalik never told us

Imo, when the bear market ends, SEED can reach 1M like in no time.

Posted Using LeoFinance Beta

I prefer to remain skeptic, but yes, a decent bull run would put us very closer to that point.

Posted Using LeoFinance Beta

One of the few Hive Engine token investments I haven't regretted.

Coming from you means a lot. Thanks Marky :)

Posted Using LeoFinance Beta

I am all in for 2 year and $10 plan.

Best of luck empo.

Posted Using LeoFinance Beta

Thanks bud! I'll be doing my best to achieve that

very long post ser

When it comes to the naming the thingy I hope you'll pick something at least as meme-able as SEED is/was :P

It was and always has been.

Posted Using LeoFinance Beta

I currently have like 13 seed in liquidity pot ( small fry I know but you where one of my first H.E purchases) should I pull it out for staking or just let it sit for now?

No problem letting in (as long you don't mind IL). This pool will remain active for at least +200 days more (until all rewards gets consumed).

Posted Using LeoFinance Beta

Tha ls for the advice !PIZZA

I see no problem with the roadmap or your solution for management fees. I invested in SEED (or whatever it will be called) to have someone with your experience hopefully make me some money. Seems to be working so far. :)

Posted Using LeoFinance Beta

I'm also very happy to see how everything unfolded (especially the first months)! Feels incredible to be already at that spot.

Thx for the support!

Posted Using LeoFinance Beta

You've been doing a lot of good and hard work on SEED. Keep it up and I know it will only increase in value. You have a strong work ethic just need to keep at it and make the system work by providing more value.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

:P It's all about the reward! nice allocation of funds. I have a good mix of different investments..

it would be great to get a monthly return in HBD from our SEEDs. The $ 1 million goal depends heavily on the market over the next few years but in the next bullish wave this goal can be easily surpassed.

You are doing a great job and you obviously deserve reward for your work. On the other hand, you are growing our SEED quickly, so we are all happy with your work.

I try to go a little further: TVL $ 10 million by 2030? ☺️

@tipu curate

Upvoted 👌 (Mana: 16/36) Liquid rewards.

Whoa!

10M$ are big words! Let's achieve the first 500K and after that 1M$ and we'll see after.

Thanks for your support :)

PIZZA Holders sent $PIZZA tips in this post's comments:

@failingforwards(2/5) tipped @empoderat (x1)

Please vote for pizza.witness!