You are most likely on cloud nine right now with all the gains from BTC hovering around its previous all time high. While you are all preoccupied with the potential start of the bull run, let me distract you.

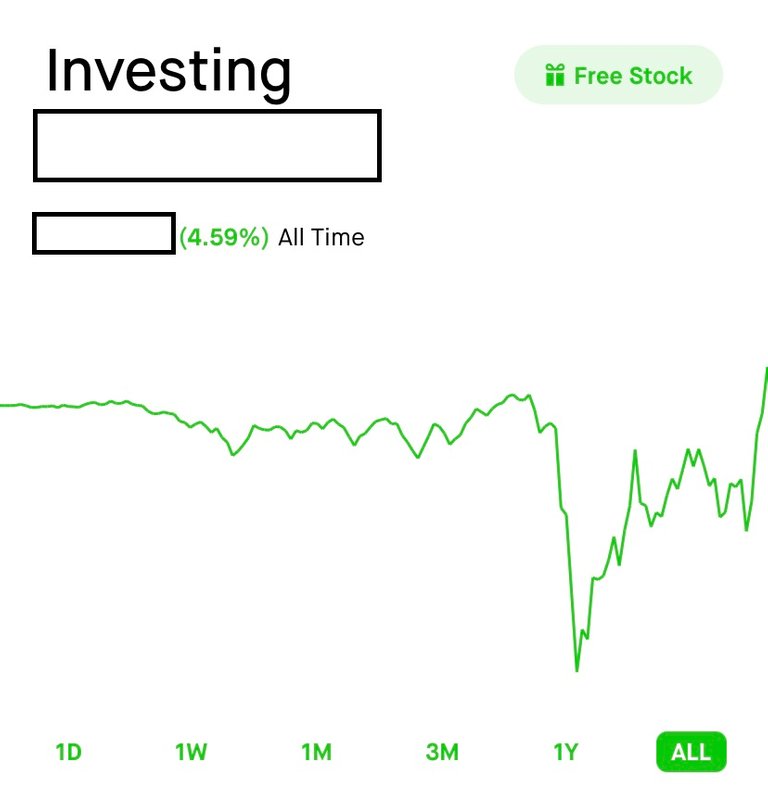

Outside of crypto, I also invested into stocks and precious metals. One of the most surprising thing that happened to me was seeing my entire portfolio in the greens. To be more specific, the all time value of my portfolio was green since I started it a few years ago.

Of course, the gains are nothing like the ones you've seen in crypto, but it's an encouraging sight. The pandemic, despite all the problems associated with it, did allow me to cost average better. Even as I am typing this now, I still have a handful of oil stocks below my initial entry point.

| Ticker | Percent Return |

|---|---|

| COP | (-17.95%) |

| ENB | (-3.39%) |

| PSX | (-26.02%) |

| RDS.A | (-23.39%) |

| VLO | (-28.58%) |

None of these companies have discontinued or lowered their dividends. In fact, it only serves to lower the time for me to break even. I will most likely pick some up again in the near future.

I'm not a trader, so all I do is accumulate and adjust my positions as needed. It's better than spending money in a reckless manner or depreciating in the bank. And, it's no time to celebrate yet because who know what will happen after inauguration in January. Until then, I'll keep accumulating and let the dividends do their thing.

None of this is financial advice, by the way.

Posted Using LeoFinance Beta

Congrats on your impressive returns!

If I can offer my 2 cents, I predict bitcoin and metals will outperform all other asset classes in the coming year. I expect to see a large spike is both metals and crypto this spring as a massive, new coronavirus "stimulus" is almost certain when Biden takes office. This spike could be even bigger if any sort of student loan forgiveness is reached. In this case, SLABS (student loan asset backs securities) would be slammed which could very easily precipitate a massive crash from the subsequent deleveraging. Similarly, commercial real estate is seeing the highest vacancies in decades, which will lead to massive earnings misses in the coming quarters. Any or all of these outcomes will lead to massive printing by the FED which can only fuel metals and crypto higher. Oil could remain depressed in the near-mid future as oil producing countries from Russia to the Mid-East continue to churn out the production. The glut of oil will be even larger if the Biden administration rejoins the Iran deal and Iranian oil floods the markets.

Good luck on continued success in your investing!

Posted Using LeoFinance Beta

Bold predictions!

We shall see how things go.

I have been wondering....is it possible that the 'over priced' stock market is incorporating future high or hyper inflation, and are really underpriced since the earnings and thus the record P/E ratios would make more sense.

Owning profitable and well managed companies is probably always a good idea, the question is just about pricing 🤣

Hard to say. It could be the vaccine hype.

At the end of the day, I'm looking for longevity since most of my position is built from a dividend approach.

Theee year backn I was active in share market (nof too much) but after I involved myself in Hive I lost the inrest in share market... byt still I am holding shares that I but atvthat time...

Cheers for the Green color of your Portfolio...

I just keep my portfolio diversified.

Good plan...

Not good to place all apples in one basket..

Diversification is must... thats the eeason I still holding the shares I inveated in past... some of them are green some are red... but overall is green ....😀😃

Oh sorry I was commenting form my kids account by mistake (just realize) lol... it hapens when you have two accounts configured in one dapp...

I'm glad to hear youbare all up. Reward yourself with some piece of mind and perhaps exploring a new asset class like whiskey or news collectables.

I've been nervous with the markets recently. Been moving a lot of my gains into lower risk funds.

Oil is an interesting bet. What hapoened earlier this year was unexpected. But then so was covid and the rapid price recovery of most indxes.

Precious metals have been wonky this week. These days I'm just buying paper stuff. The real stuff is a pain to manage and expensive for shorter term investments and especially speculating.

I don't mix crypto and the markets, I just stick to around 10% of my investment moneys and DCA in. But I'm happy (to say the least) with how my cryoto is doing recently. I'm getting skeptical again which is good.

A healthy dose of skepticism is always good.