Direct from the desk of Dane Williams.

How has it been a month since I've talked about the most liquid forex currency pair on the planet?

Well, after EUR/USD bullish momentum was first slowed by resistance, price has just traded sideways along our zone - That's why. Chopping through up and down. Hugging the zone enough to keep it relevant, but not clean enough to day trade.

With the EUR/USD bears looking like they've now taken some level of control in the market, it's time to start paying attention from a day trading point of view once again.

EUR/USD Higher Time Frame View

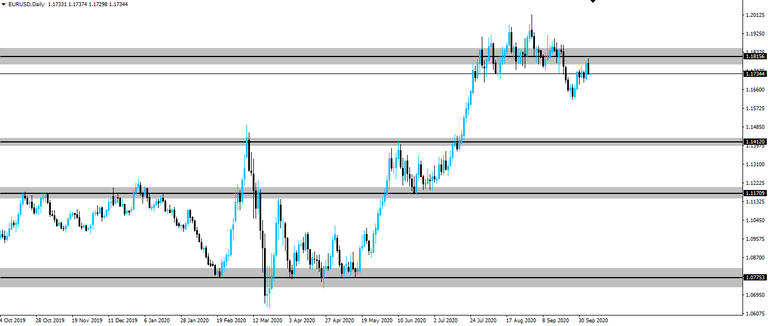

Starting off with a EUR/USD daily view, let's take a look at where price was at when we last spoke about the pair in the blog that I've linked to above.

But does the euro daily chart below show that we're due for a pullback?

EUR/USD Daily:

Answering the quoted question from that previous blog, the answer is now yes.

Take a look at the current daily price action below.

EUR/USD Daily:

You can see that with the bears having pushed price well below the daily zone and then having it cleanly retested once again, we'd be looking to trade only from the short side.

EUR/USD Intraday View

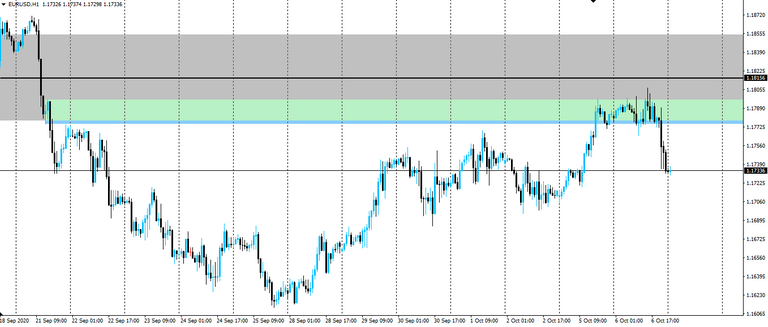

Now zooming into a EUR/USD hourly view, it's time to look for areas to manage our risk around and enter off if we were to take a short.

Take a look at the hourly price action below.

EUR/USD Hourly:

You can see that as we were looking for shorts, we find the first area of short term support that when retested as resistance, could be used to enter off.

I've marked that zone in green, from the candle you can see above.

With price now retesting the zone, you can see that the bears held firm and rejected once again with minimal drawdown.

Once again you can see that by trading something similar to my forex support and resistance strategy, you can find numerous low risk/high reward setups on a daily basis.

Whether you trade them aggressively with your stop above/below the intraday zone, or conservatively with your stop above/below the daily zone, is entirely up to you.

Best of probabilities to you,

Dane.

FOREX BROKR | Hive Blog

Higher time frame market analysis.

Posted Using LeoFinance Beta

Solid analysis!

Also, your post has just prompted me to take a look (finally) at Leofinance Beta - and it looks quite clean! Might have to switch to the dark side, now 😈

Posted using Dapplr

Cheers!

There are still a few things missing such as post templates and an easy voting mana slider, but they'll come in later versions. But if you're focusing on the LEO side of things rather than the generic HIVE, then the new interface is perfect.

I'm going to try and get a bit more involved in Hive Hustlers via my @danewilliams alt account. You're the next community that's going to explode, right? ;)

Posted Using LeoFinance Beta