Direct from the desk of Dane Williams.

I trust the weekend was kind to you, but with forex markets open again in Asia, get back to that desk and let's crush it once more.

I have a Monday morning follow up to last week's blog for you, where we had GBP/USD at daily resistance. Click the link and bring up the hourly chart from that blog, because I'm going to refer to it in the comparison below.

Take a look at the cable charts below.

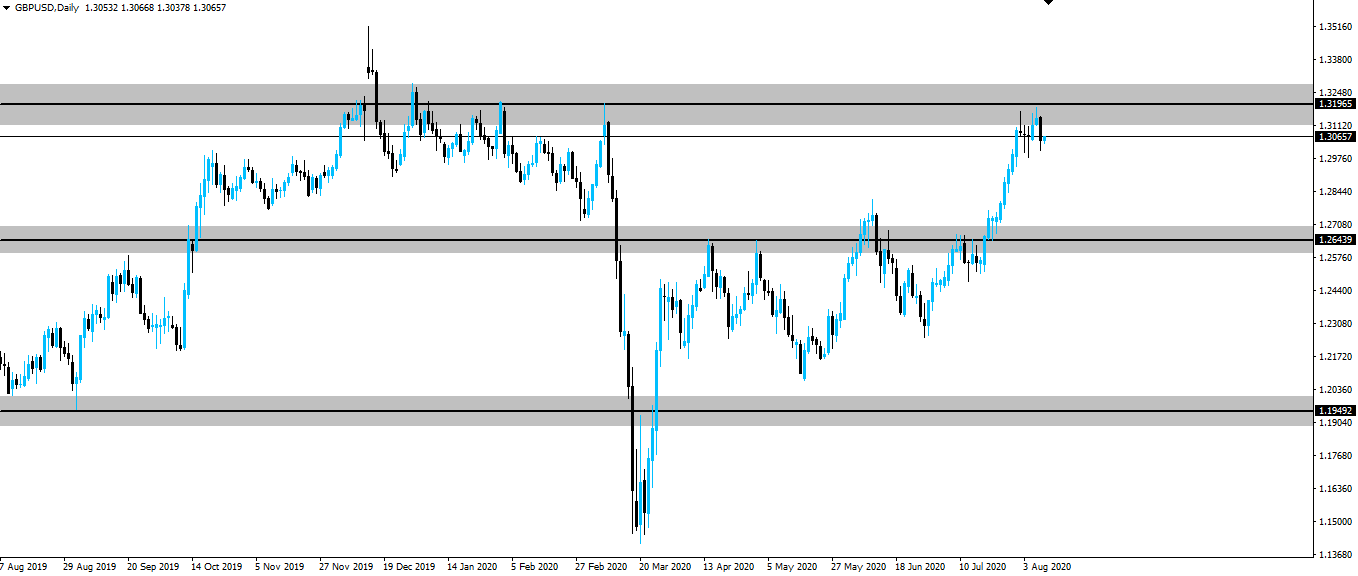

GBP/USD Daily:

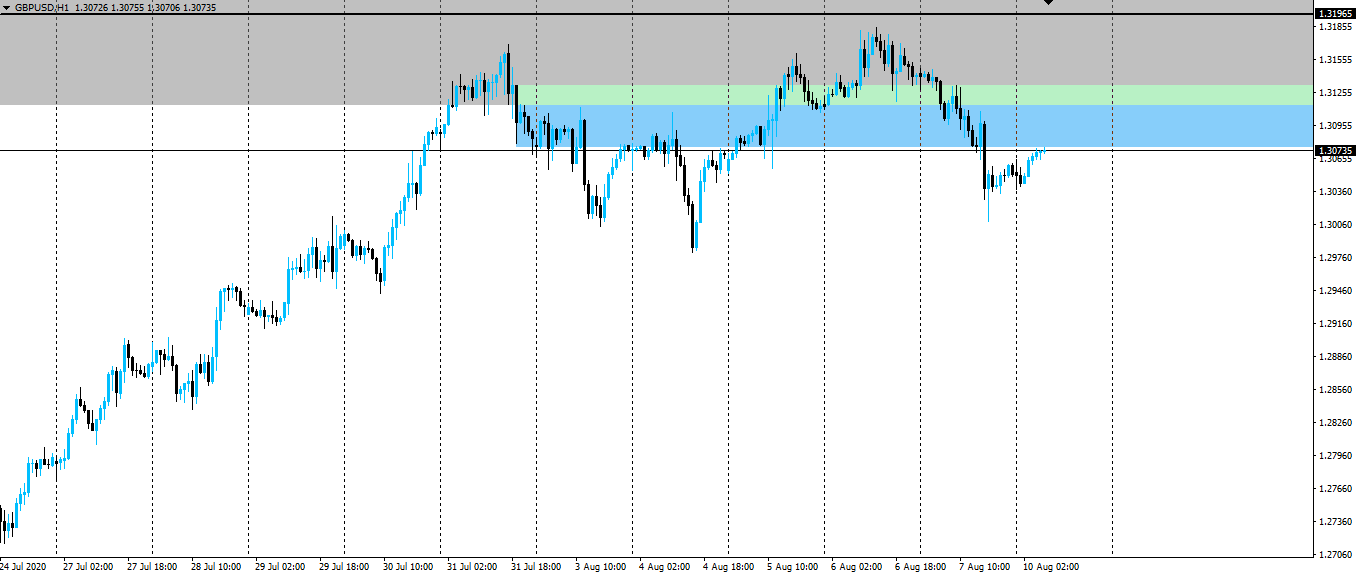

GBP/USD Hourly:

Conservative vs Aggressive Trading Styles

This is a good example showing how there are two ways to attack my trading strategy - conservatively or aggressively.

If you lean toward the conservative side as a trader, then you'd have had no problems here. You would have kept your stop loss above the higher time frame zone and your short would still be alive and nicely in the black.

On the other hand, if you are an aggressive trader then you'd potentially have been stopped out when price made a new high on Thursday. By pushing above the intraday zone we had marked and you can see in the hourly chart above, your short position may not have lasted.

Can you now see that two people can trade the same strategy, but have vastly different results? If you needed proof that there's no such thing as a holy grail trading strategy, then this is it.

What makes a trading strategy profitable is how you trade it and nothing else.

It's all on you.

Best of probabilities to you,

Dane.

FOREX BROKR | Hive Blog

Higher time frame market analysis.

Posted Using LeoFinance