A detailed look into the intricate mechanics of the THORChain network.

THORChain is a Tendermint-based blockchain.

As a result, the network primarily uses Tendermint BFT (Byzantine Fault Tolerance) as its consensus mechanism.

However, THORChain also employs elements of Proof of Stake (PoS) for resistance against Sybil attacks.

Breaking down how THORChain works

In order to try and explain how it works without getting too technical, let’s break down the THORChain network into subsections.

Liquidity Pools

The first thing that needs to be explained around how THORChain works, is the RUNE liquidity pools.

Each liquidity pool is made up of both RUNE and the other native asset that they’re composed of.

For example, the Bitcoin liquidity pool will be composed of RUNE and BTC, while the Ethereum liquidity pool will be comprised of RUNE and ETH.

What the RUNE token does within liquidity pools, is act as an intermediary token that allows anyone to swap between any 2 pooled assets.

You’re able to use the THORChain network of liquidity pools to swap native coins from different blockchains without ever requiring permission or to wrap.

So when it comes to liquidity pools, the RUNE token acts as an intermediary asset for use across each different pool.

All cross-blockchain trades go through these liquidity pools and are facilitated by the RUNE token.

When it comes to pricing within these pools, the free market decides.

The assumption however, is that the THORChain network is now mature enough to have discrepancies instantly arbitraged out.

Furthermore, liquidity pools require participation from both liquidity providers and users:

Liquidity Providers: These are participants that add liquidity to particular pools that is then bound with RUNE in a separate vault.

Liquidity providers earn rewards via fees generated from pools and are paid out when users withdraw.

Users: These are regular people who are using liquidity pools to transfer assets across different blockchains without permission.

For this service, users pay a fee to incentivise liquidity providers and make up for any external chain fees.

Nodes

The next aspect of THORChain that needs to be explained is the nodes that provide security to the network.

Not only do they secure the network, but nodes also act as bridges to other blockchains, ensuring that each transaction is correctly broadcast to the correct external chain.

Nodes have 3 main functions:

- Bond RUNE.

- Create vaults.

- Produce new blocks.

When users make a cross-chain transaction using a THORChain liquidity pool, nodes act on their behalf to perform the actual on-chain transactions.

Moreover, as part of this PoS component, a system of validators is able to stake RUNE tokens to run network nodes and validate transactions on the THORChain network.

The RUNE token acts as both a reward incentive and penalty mechanism, with nodes earning two-thirds of the system income from their activities.

This helps to ensure that nodes are all in sync with the network, as well as the other chains hosting assets within liquidity pools.

Nodes are anonymous, maintaining plausible deniability on all transactions.

They’re created every three days and compete to enter with bonded capital and the oldest nodes are churned out and replaced when necessary, allowing the network to stay fresh.

Want a more technical look at how THORChain (RUNE) works?

For more information on the technical side of how THORChain (RUNE) works, the official docs section is an excellent resource

Here’s a quick snippet:

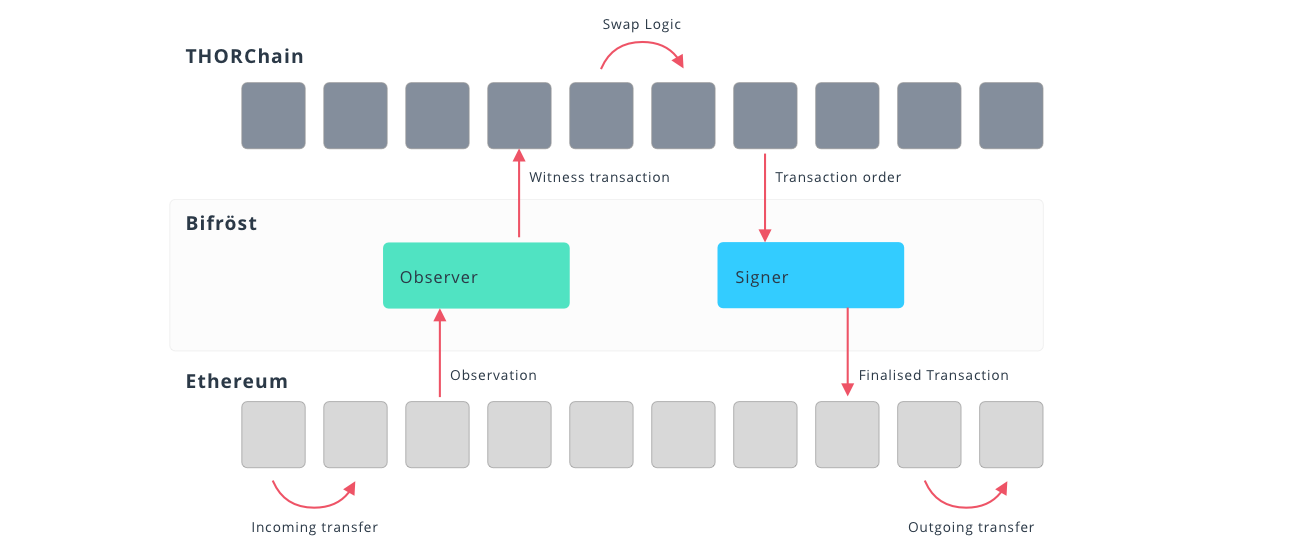

THORChain is a leaderless vault manager:

- 1-way State Pegs allow syncing state from external chains

- A State Machine to coordinate asset exchange logic and delegate redemptions

- Bifröst Chain Client to convert redemptions into chain-specific transactions

- A TSS protocol to enable distributed threshold key-signing

The THORChain docs will satisfy your tech urges, while our more digestible ThorChain (RUNE) guide will keep things at a higher level.

Let’s keep going deeper.

Best of probabilities to you.

Direct from the desk of Dane Williams.

Why not leave a comment and share your thoughts on how THORChain (RUNE) works within the comments section below? All comments that add something to the discussion will be upvoted.

This THORChain (RUNE) blog is exclusive to leofinance.io.

Posted Using LeoFinance Beta

Simple and straight to the point! Thanks 😊

Posted Using LeoFinance Beta

Cheers Trumpman.

Posted Using LeoFinance Beta

@tipu curate

Upvoted 👌 (Mana: 73/93) Liquid rewards.