Direct from the desk of Dane Williams.

Still following the Bitcoin price action, I've sat down at my desk this morning to read some Bitcoin drops/Bitcoin on sale headlines.

We know the financial media loves a good headline, but let's take a look at the price action to see what's really going on, shall we?

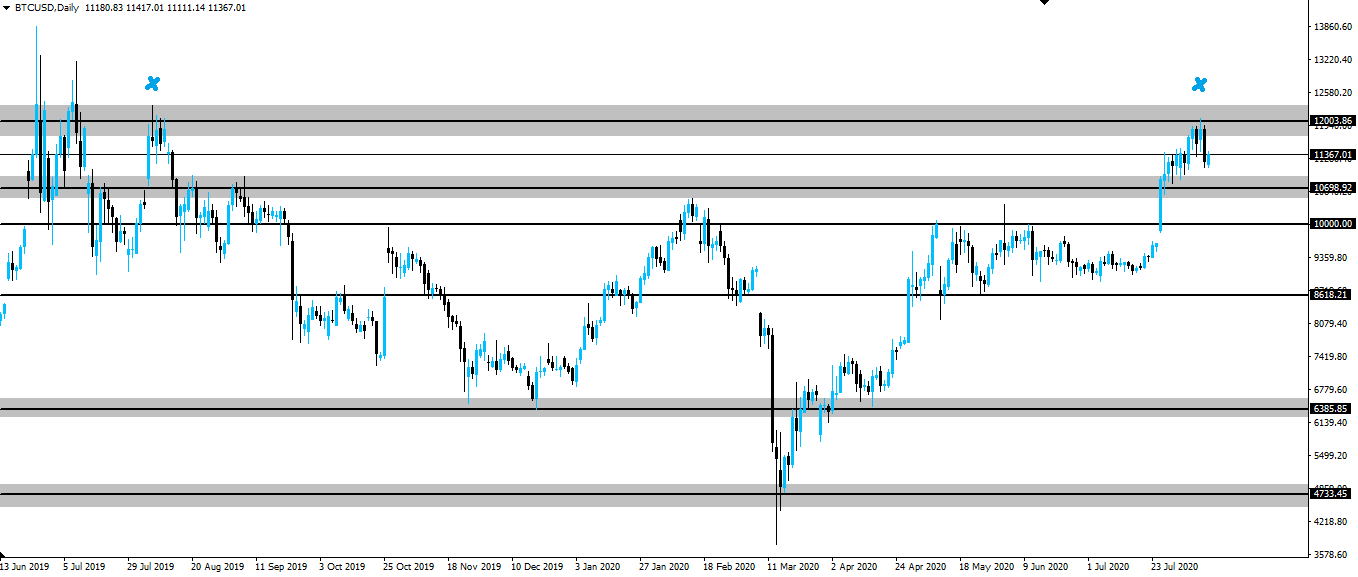

Start by bringing up a Bitcoin daily chart such as the one from my MT4 trading platform below.

BTC/USD Daily:

To find the most significant higher time frame resistance zone, all we need to do here is sinply scroll to the left and see what level that price last rejected from.

You can see on the Bitcoin daily chart above that the last time price was at the 12k level was back in 2019 when it rejected hard and wasn't tested again... until yesterday.

On this first retest, price rejected the level, confirming our analysis that the zone is significant and in play.

The fact that price didn't pull back all the way to the 10.6k zone where we were buying, shows that this move in what's essentially no man's land between zones, doesn't mean a whole lot.

Let price do what it wants between zones and we'll do our business more effeciently when price trades around them.

Best of probabilities to you,

Dane.

FOREX BROKR | Hive Blog

Higher time frame market analysis.

Posted Using LeoFinance

With Gold and Silver getting savaged in recent days Bitcoin will be doing well to hold that zone.

To hold here would be a sign of underlying strength.

In saying that, I think that what I said about Bitcoin applies to this gold move too.

There doesn't look to be any clear support/resistance zones between the last zone at 1748 and the 2000 psych level.

Gold has pulled back and there's no clear place for it to stop until it gets back to the 1748 zone.

So in dollar values, it looks like a massive move, whereas maybe it's not really?

Posted Using LeoFinance

Good point, though (unlike bitcoin) gold is not normally a volatile asset so a 5% daily move is kind of a big deal. The sharp reversal almost looks a bit blow-off-top-ish from a purely TA perspective but I'm still a bull. I'll definitely be buying again if it gets down to $1750