Direct from the desk of Dane Williams.

The chart that really caught my eye this morning, was no doubt Silver.

When daily resistance on Silver was broken and retested, we spoke about longing the precious metal.

Well just take a look at the daily chart today.

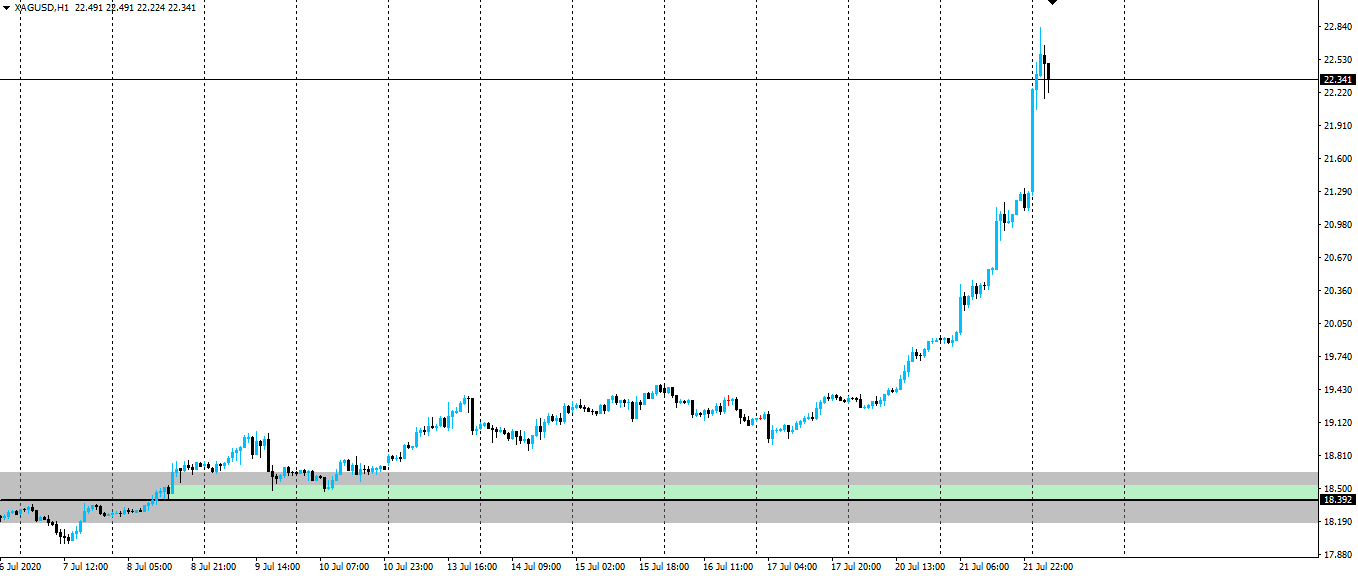

XAG/USD Hourly:

Wow.

You can see the daily resistance zone in silver that price broke out of, causing us to only be looking to long.

Price then pulled back to the first area of short term resistance turned support, giving us an entry with clearly defined risk parameters.

From there, you can see that price really never looked back and if you maintained your original long, you could have profited +24 units of risk.

Think that sounds wrong? Use the MT4 Fibonacci hack on your own charts and see for yourself.

These are the sorts of trades that can make your entire year if you put yourself in a position to take advantage of them when they present.

Best of probabilities to you,

Dane.

FOREX BROKR | Hive Blog

Higher time frame market analysis.

Posted Using LeoFinance

Absolute monster move. JPM covering their paper silver shorts now that they have basically cornered the silver market? I haven’t checked the data lately but I know they were buying a shit ton lol

Posted Using LeoFinance

I just read your Silver blog with the link to the JP Morgan stuff.

I actually wasn't aware of this, so thanks for the share!

Posted Using LeoFinance

They have been adding to silver for multiple years (while shorting the SLV etf. And guess what. They are no longer short the paper silver...lol Moon. Haha

Copper demand is low hence less sivler mined. Demand for silver is high and parties are covering paper contracts. US mint warns for unprecented situation….

I didn't realise the fundamentals were being driven by the covering of paper shorts.

Cheers for the heads up to dive down this rabbit hole a little deeper.

Posted Using LeoFinance