Direct from the desk of Dane Williams.

Monday morning in Asia, let's do this.

You would have noticed that we've been one of the many day traders still searching for that SPX short opportunity.

But like everyone else, our SPX shorts off higher time frame support/resistance just isn't seeing any sort of sustained momentum.

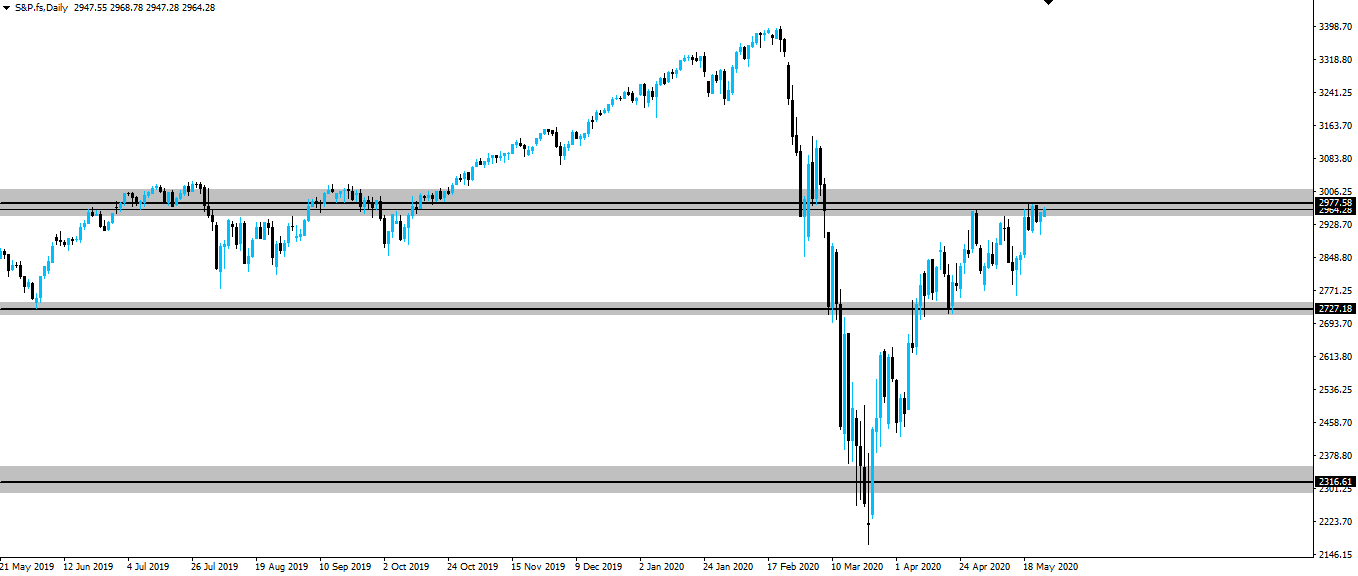

You can see that price is back to our daily zone on the updated chart below.

SPX Daily:

The thing is that this daily zone is so subjective, even as fat as I've drawn it on that chart there.

Just look to the left of that chart and how wide the price action chop through this zone has been - You could literally have drawn your zone anywhere.

This makes me think of an old saying that traders like to pull out of the bag from time to time:

"It's not about being right, it's about how much money you make."

It fits perfectly into this situation because who cares if our zone is drawn in the right place, the only thing that matters is that we can use it to manage our risk around.

We made money off the zone the last time SPX rejected resistance, now we wait to see how intraday price action reacts around it and whether we'll get another chance.

If the higher time frame zone holds, then we'll once again zoom into an intraday chart and look for areas of short term support turned resistance to enter short off.

By doing this, we make sure we're trading in the direction of the higher time frame chart and are able to get excellent risk:reward on our entries.

Best of probabilities to you,

Dane.

FOREXBROKR | Hive Blog

Higher time frame market analysis.

Posted Using LeoFinance

A bounce off that zone would be a double top perhaps leading to a larger pullback.

Time to be light on one's feet.

Posted Using LeoFinance

I think there are too many people watching it now and no doubt too many stop orders sitting just above for the smart money to ignore.

I can see one last juicy stop hunt higher before a massive goodbye move to new lows.

Posted Using LeoFinance

Great post!

I'm personally most of the time trying to trade indices to the long side, as I believe sentiment dictates SPX moves. IG, FXCM and various other brokers' provided sentiment shows regular traders being short as usual. That said, I've been shaken out of my longs multiple times recently, as I've not 100% acclinated to the larger ranges and old larger trade sizes yet.

I'm not a reader of Zerohedge, but someone shared a link recently and somehting caught my attention. Seems large traders have taken a step back and volumes have been dialed down to absolutely abysmal levels, making it look like only retail traders and a few algos are still playing the trading game on the indices. That means the playing field has changed again and possible rug pulls ahead:

Bloomberg also picked up on a chart that we showed from Goldman yesterday, demonstrating that the "fingerprints of tiny investors are all over the options market" where as we noted yesterday, trades consisting of just one contract now account for 13% of total volumeSource

Ohh nice!

I expected this to be happening, but it's good to see it written down... even if it's in ZH haha.

Thanks for sharing :)

Posted Using LeoFinance