Hey team,

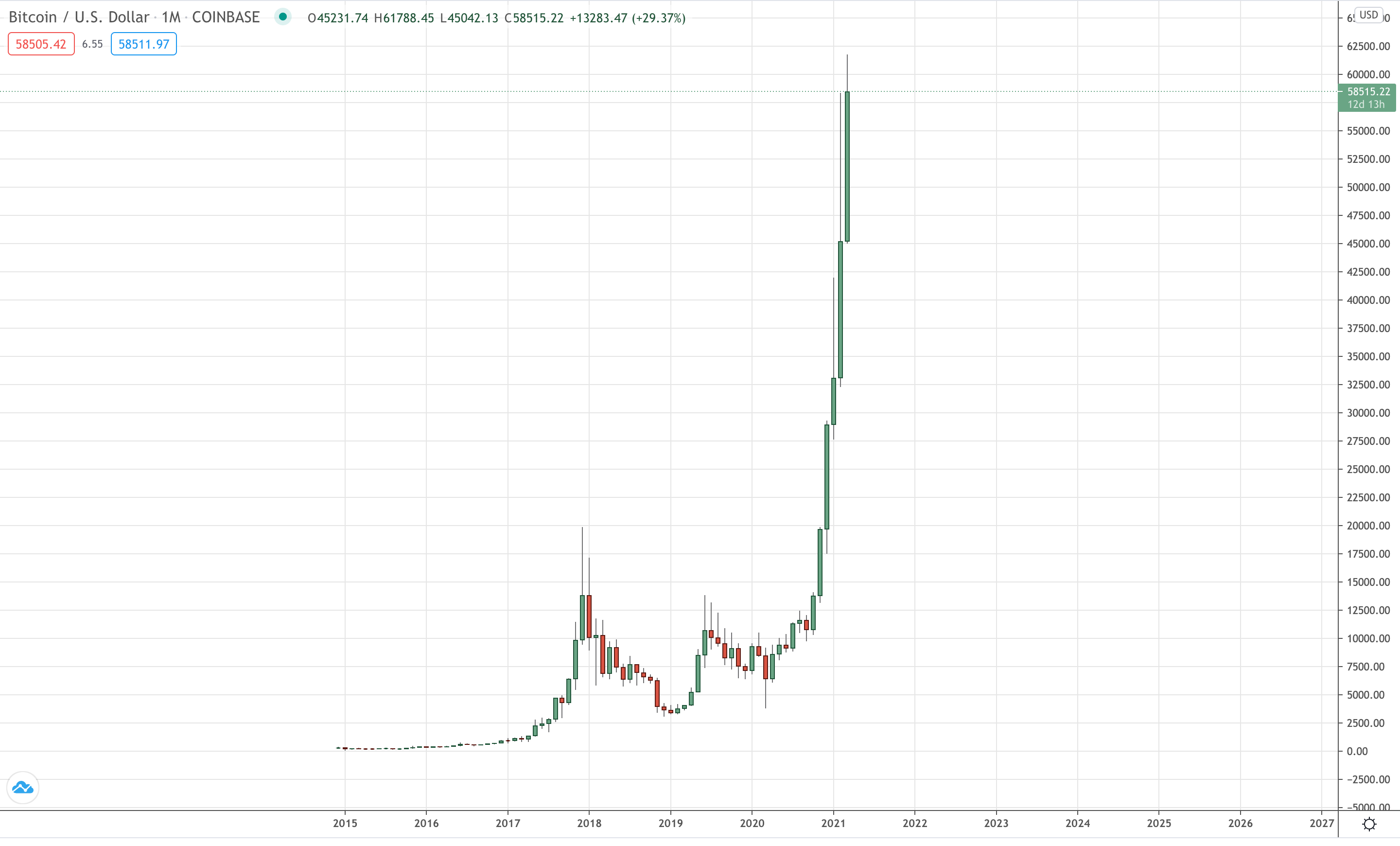

After speaking about the Bitcoin daily price action around the 60K zone earlier in the week, price has continued to hold steady around its all time highs.

But I wanted to take a step back higher again, to the Bitcoin monthly chart.

Take a deep breath and then take a look at the chart below:

BTC/USD Monthly:

Yikes!

After a few LeoFinance community members were speaking about this one earlier on Discord, the image of it has been burned into the back of my eyes and I had to share my own thoughts on the blog.

First of all it looks ridiculous, doesn't it?

It has a hint of tulip mania about it, if you'll allow me to go full blown cliche on us here.

But I honestly do believe that this time is different.

Haha, I'm sorry because yes I know how that sounds as I'm reading it back, but I really do.

When before have we seen a complete and total lack of confidence in fiat currencies by the worlds richest?

Not only are some of the biggest companies shifting their balance sheets from USD to BTC, but Banks such as Morgan Stanley are now allowing high net worth individual clients access to Bitcoin like never before.

This time is different.

What do you think when you see the Bitcoin monthly chart?

Best of probabilities to you,

Dane.

FOREX BROKR | LeoFinance Blog

Daily market analysis.

Posted Using LeoFinance Beta

Comparto contigo la opinion, no creo que el fenomeno del bitcoin sea como la fiebre de los tulipanes. Lo que si es seguro es que en algun momento vamos a tener un retroceso importante, aunque sano para el mercado.

Supongamos que hagamos un analisis simple de Ondas de Elliot, sabemos que la onda 4 no deberia ir por debajo del maximo de la onda 1, por lo que el precio no deberia ir mas abajo de la zona de los 25000$, la cual coincidiria con la zona de 61.8% del retroceso de Fibonacci, si tomamos como valido este retroceso, y usamos una extension de Fibonacci, podriamos proyectar valores, de minimo, 84000$, lo que no vamos a saber con certeza es cuanto tiempo puede durar este ciclo.

Posted Using LeoFinance Beta

I've never used EW theory in my own trading.

What makes this the top to draw III?

Posted Using LeoFinance Beta

El tope de la onda III aun no sabemos cual va a ser. Ese escenario que mostre seria si ocurriera una hipotetica correccion a los niveles que estamos ahorita. Si mañana el precio sigue subiendo ese grafico que te mostre no tendria valor porque aun no seria el fin de la onda III. Hasta que el grafico no nos indique que se formo un maximo, no podremos determinar el tamaño de la onda III.

Posted Using LeoFinance Beta

Wow :)

Posted Using LeoFinance Beta

I went with Yikes! ;)

Posted Using LeoFinance Beta

In answer to your question, at first glance it looks totally crazy. No corrections of any kind practically since this bullish start. Truth be told it looks like just a bubble inflating hahaha.

But as you mentioned, this time it's different. There is distrust in fiat money due to the pandemic, and a growth in confidence in BTC and maybe Gold. And not only that, but the large number of millionaires and investment funds that are betting on bitcoin.

The truth is that perhaps the value of bitcoin at the moment is much higher than its real fair value. But it is also true that the value of something also increases because of its demand and use. As the network gets bigger and more people use it, more value it acquires.

Anyway, I personally think this is just the beginning of a bullish cycle in BTC and I think it will exceed $100K this year.

Best regards colleague! 📈💪

Posted Using LeoFinance Beta

My projections are similar to yours.

I have my core investment holding and will continue to day trade around key support/resistance zones in order to manage my risk.

Posted Using LeoFinance Beta

BTC is the one who has had great benefits thanks to the pandemic, this virus made large investors begin to opt for the cryptocurrency option because the safeguard currencies would fall due to Covid 19. This created the great rise of BTC, for Now this coin has no ceiling, let's wait to see how far it can go

Posted Using LeoFinance Beta

How has your currency held up throughout the pandemic?

Do you and your family use Bitcoin because the risk of holding your nation's currency is higher than the volatility risk of Bitcoin?

Posted Using LeoFinance Beta

My country is Venezuela, before the pandemic our currency has devalued too much since 2000%. After the worst pandemic,

So far the cryptocurrency that I use is Leo, Hive and CTP, others from the Hive Layer. If I want to invest in bitcoin, I am still in that process.

Posted Using LeoFinance Beta

Thank you for sharing your story :)

Posted Using LeoFinance Beta

In the end, everyone prefers BTC, they just don't shout it out loud.

Posted Using LeoFinance Beta

Roger Ver may disagree with you here haha.

Posted Using LeoFinance Beta

Hahaha 😅

Posted Using LeoFinance Beta

The history of Dutch tulips is a good learning experience in such cases.

That will rise and should appreciate more is very likely. Now, when it comes to very exorbitant values, I don't know. Because the risk to the world economy would affect many cases and something would happen. I like the idea of going up little by little.

Posted Using LeoFinance Beta

I like the idea of it going up little by little too, but we're long past that.

If that was the case, we're due for a massive correction...

Yikes.

Posted Using LeoFinance Beta

This chart is crazy and I feel you when you say “this time I feel it is different 😆”

Posted Using LeoFinance Beta

It's got a bit more left in it this bull run, that's for sure.

Posted Using LeoFinance Beta

I hope you are right my dear ! I truly do ! 😉

I honestly laughed when bitcoin hit 20k again and someone said institutional investing was going to take it to new highs. I heard that same story back in 2017!

While yes some things have changed theirs still that big one that lingers from 2017 and that is stagnate growth because of record high fees. These fees pretty much eliminate your small time investors and every day people which is unfortunately and only allows for the big timers to make large trades and buys.

If these platforms are seriously going to replace Fiat as so many claim two things need to happen.

This is why I lean towards a different block chain at some point beating out bitcoin simply because it's so dated. It does however have a few things going for it and that's store of value. It's battle tasted and works true for what it's designed to do. If another crypto block chain can some how tap into bitcoin and build fast transactions that's my biggest bet for a crypto I'll invest in next. I think we are getting close to it.

Posted Using LeoFinance Beta

I'm a big believer in success coming from interoperability between blockchains.

I love the way we've seen wBTC come Ethereum as a prime example of how the entire crypto ecosystem can successfully come together.

In my eyes, I see the future not being Bitcoin or any other single blockchain/coin, but a healthy mix of different chains, coins and use cases all working together.

Posted Using LeoFinance Beta