I have started staking DFI tokens at Cake Defi for almost half a year now.

I cannot deny that Cake Defi caught my attention when I saw one of the online articles sharing about the high APY.

Staking DFI tokens at Cake Defi can earn an attractive reward of 37% currently.

The price of DFI tokens has gone up many times since I started. When I first invested, it was only around $0.25 but it has broken a new milestone of above $3 due to the bull run that is happening even at the point of this post.

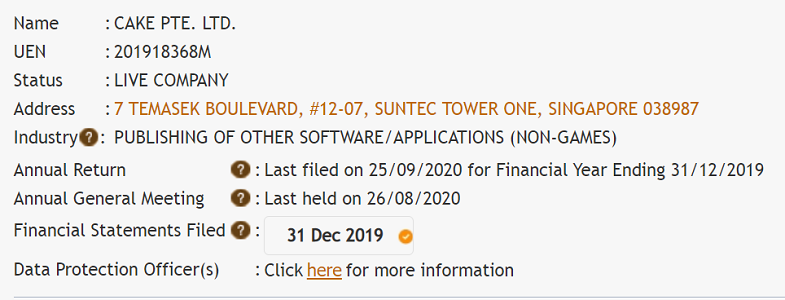

With a little digging into Cake Defi, I got to know that it is a registered company in Singapore so this does boost my trust in Cake Defi.

As we know that yield farms can disappear and cause one to lose everything so staking in a registered company is a lot safer.

Both its founders have good reputations with solid portfolio.

After the release of the new Dex of DeFiChain, I was able to see how the price of DFI tokens grew steadily for most days.

I have invested in its liquidity mining but I would like to warn that there is impermanent loss for such yield farming even with high APY.

The fact that the pair of cryptos that we provide into the liquidity pool would have changes in prices so it would need to be balance for the crypto pair.

As a result, arbitrary would enter to buy the cheaper tokens that result in a balance of the pairs.

At this current moment, I am only losing in the possible profit that I can earn if I had held my DFI tokens since the price of DFI tokens have pumped up so much.

The total value of my liquidity pairs did not go down much but it has increased slightly.

I started out staking DFI tokens at Cake Defi and it is definitely a safe way without impermanent loss.

I have already earned and taken out my initial investment actually and my current stake is only my profit that is still generating income passively.

With the current rate that it is still growing during this bull run, I would personally think that staking DFI tokens with a 37% APY is really profitable.

For new users, there is a free $20 worth of DFI tokens after the 1st deposit of at least $50 at Cake Defi.

Those who sign up through a referral link can still get the additional $10 worth of DFI tokens.

Referral link: https://pool.cakedefi.com/#?ref=610483

A total of free $30 worth of DFI tokens.

These free DFI tokens would be locked up for 180 days with staking rewards as a bait to ensure new members would have experienced Cake Defi for six months as well as to prevent abusers from selling their free reward.

Staking and unstaking of DFI tokens has no lock-up period actually. I have always stake and unstake within minutes but removing our liquidity mining may take a few hours.

I agree that the need to complete KYC can be really a hassle but as a Singapore registered company, this is one of the ways to prevent illegal money laundering so that Cake Defi can protect against itself from legal issues.

You can find out more or join Cake Defi using my referral link below.

https://pool.cakedefi.com/#?ref=610483

Disclaimer: This is my personal reflection and I am not in any position to instruct anyone what they should do. I am not responsible for any action taken as a result of this post. My post can only be a reference for your further research and growth. By reading this post, you acknowledge and accept that.

Posted Using LeoFinance Beta

Will check this out.

Posted Using LeoFinance Beta

Thank you