Because Cryptocurrencies are such a volatile assets, many investors prefer to trade it. Trading crypto can provide vastly larger profits than long term investments if you can manage the market correctly.

5 Crypto Trading Strategie that you can follow to earn a handsome profits

1. Technical Analysis

Crypto traders can examine the bitcoin market using a variety of instruments. A technique known as technical analysis is one of them. Traders can use this strategy to gain a better knowledge of market sentiment and pinpoint major market patterns. This information can be utilised to create better predictions and trades.

At support and resistance levels, traders make crucial judgments. If they believe the cryptocurrency will recover at a certain price point, they will "enter" at that level of support and acquire that coin. They will "exit" or sell that cryptocurrency when the price reaches what they believe is the resistance level.

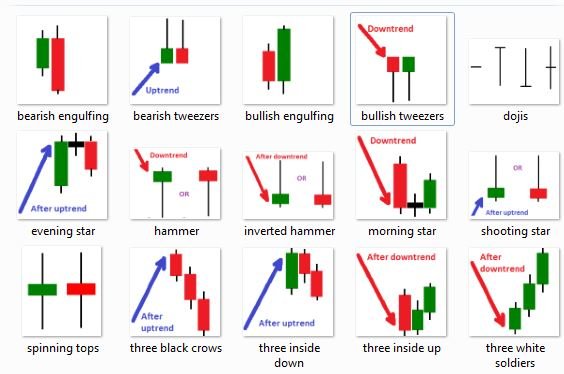

Different types of candles are like -

Image credits

Traders with a high risk appetite may choose for leverage trading, which is a type of price betting that allows them to increase their profits (or losses). Some exchanges allow traders to open leveraged "long" and "short" bets, which means you may wager on the price of a cryptocurrency going up or down with borrowed funds. Longing is bullish, meaning a trader expects the price to rise and is willing to put their money on the line to back it up. Shorting is the polar opposite of longing.

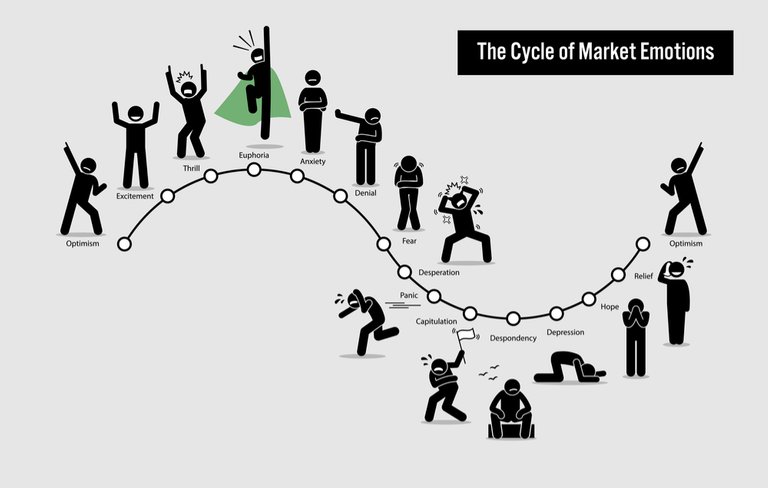

2. News and Sentiment Analysis

What are your opionion on crypto market right now? Are you frightened, eager, or somewhere in the middle? You've probably observed that your investment decisions are influenced by your emotions. Even if you grasp the necessity of technical and fundamental analysis, when the rubber meets the road, your emotions are often the driving force behind the wheel. This is especially true in the bitcoin market, where the price moves often, causing intense emotions. This causes a lot of market volatility, which can be stressful but can also be profitable if you understand and regulate your own emotions.

Unsurprisingly, much of the information created by users on social media at the time had a political bent. This type of data is incredibly useful to a candidate or political party seeking to appeal to the general public during an election campaign. The only difficulty is that reading every single post from every single user to determine what's hot and what's not with potential votes is impossible. As a result, politicians began employing sentiment analysis on publicly available social media posts to determine which way the wind was blowing on specific topics in order to fix this dilemma.

3. Range Trading

When a market trades regularly between two prices or levels over a set length of time, it is called a trading range. Range trading, like trend following, may be used on any time frame. It can be seen in all time frames, from five-minute charts to daily and monthly charts.

Unlike trend following, range trading includes traders going long and short (at different times) depending on where the price is in the range. In most circumstances, trend following traders will buy dips in a rising trend and sell rallies in a falling one, following the trend's broad direction.

Correct risk management is critical in all sorts of trading. Range trading is based on the idea that prices will strike a zone of support and resistance. As a result, prices will rarely adhere to these boundaries; trading ranges tend to attract a large number of traders, increasing volatility.Because prices can vary around these important areas, sensible traders will utilise broader stops around these critical points, as well as a reduction in position size, to keep inside the key 2% limit and avoid 'whipsaw' fluctuations that force traders out of positions that could have been profitable.

4. Scalping

Scalping is a trading strategy in which the trader profits on tiny price swings, usually after a trade is completed and profitable. Scalping traders keep their deals between a few seconds and a few hours, according to a more wide definition.

These small earnings from multiple market fluctuations in a single day add up to a larger profit at the conclusion of the day. However, because a small fluctuation can make a large impact, this method needs the trader to be hyper-active during the trading session.

Scalpers are traders that apply this method on a regular basis. Technical analysis is more beneficial in such trading tactics since intraday trading demands more attention to price movement than day trading. If a trader is adopting a scalping technique to trade cryptocurrencies, technical indicators such as Fibonacci retracements, support and resistance levels, or even candlestick chart patterns could be quite useful.

5.Bot Trading

For a variety of reasons, businesses and individual traders may want to build a crypto trading bot. It may be to allow them to buy and trade cryptocurrencies like bitcoin without having to do it in person. Another common reason for creating a bitcoin trading bot is to resell it for a profit.

What ever case, developing crypto trading bots is a lucrative profession if done correctly. In this essay, I'll look at how businesses might create their own trading bots rather than paying to employ current ones.

I'll start by defining what a cryptocurrency trading bot is before going through how they work. To do so, I'll go through the many sorts of trading methods that these bots employ before explaining how to create a trading bot.

Thank you for Reading 😃

Follow me for more amazing content😃

@funnyman

Source of plagiarism 1

Source of plagiarism 2

Source of plagiarism 3

There is reasonable evidence that this article has been spun, rewritten, or reworded. Posting such content is considered plagiarism and/or fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

Guide: Why and How People Abuse and Plagiarise

If you believe this comment is in error, please contact us in #appeals in Discord.