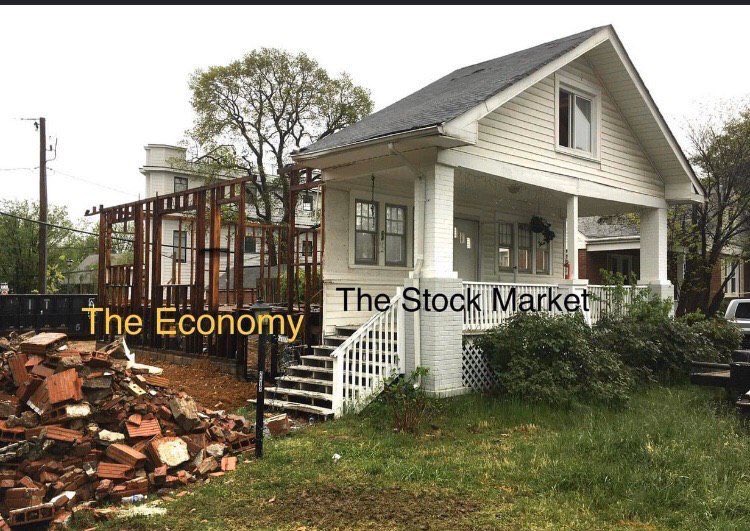

Despite the fact that Covid-19 crisis caused a heavy damage to economies globally, the stock markets remained steady and kept advancing higher. Yes, we saw brief decline in the stock market in March 2020 due to the fear of how Covid would impact the economy. Prompt response from governments to address the potential economic problems, like passing a massive stimulus package in the US - CARES act and similar responses in other countries did provide some confidence in markets and they did recover quickly. Since then markets have been doing well. Only this week we started to see some weakness. It could be either due to the uncertainty of the outcome of elections in the US, or possibility of challenges to the outcome. Or it could be many other things.

Just recently there was an article by someone from Bank of America, saying there is potential for 20% decline in stock markets. While there is some worry that we may face significant plunge in stocks, for a good portion of this year economies in the US and globally have been in trouble already.

We even have forgotten the talks of next economic crisis that were going on even before the pandemic. I remember clearly, many in 2019 were predicting next financial crisis and that the markets were in the bubble. However, nobody could exactly say where the next financial crisis would come from. Some said, it was REPO markets, some said housing, some said banking industry. I saw this narrative not only in articles, but also in conversations with friends who are in business and finance.

During a lunch conversation, a good friend and VP in one of the medium size companies at the end of 2019 was talking about expanding their business, and hiring more people. My reaction was, aren't you worried about the potential financial crisis in 2020. He said and I quote - "Oh, I am sure there is going to be a financial crisis in 2020".

That didn't make sense to me. If you are sure there will be an financial difficulty in a near future why would you plan to expand you business. Only explanation I can come up with is just like in our personal lives, businesses live beyond their means and don't take into account the rainy days. Ultimately, when crisis hits, they lay off their employees and cut their losses. In fact, the same VP who was expanding the business of the company ended up laying off one third of their employees due to the Covid.

What I am trying to say is that, Covid wasn't something anybody expected to happen while many were expecting something to happen. That is more worrisome because that something everybody has been anticipating to happen to the stock markets has not even happened yet.

Let's back up a bit. 2008 global financial crisis that started the domino effect because of the bubble in housing market. Today, housing market is in play again, although for different reasons.

Three months ago I wrote Next couple of weeks US politicians will be deciding on the future of the US Economy, discussing how the US elected officials were facing important and challenging decisions to make to response to the Covid crisis and negotiate a stimulus package to address the problems. Today, we all know that all of them failed miserably and couldn't come up with any solutions to address the problems Americans face. The consequences of these failures could start with hitting the housing markets first. If that happens, it is possible to see the repeat of 2008.

We live in an interconnected world. Not only all economies globally are interconnected and interdependent, industries within the same countries are interdependent as well. Tourism, hospitality, restaurant, sports, and service industries are in big trouble. Millions of people are unemployed. Business and people may have managed so far somehow and potentially racking up more debt or even going bankrupt. For these reasons things don't look good for 2021. Often times, there is a delay on economic impact of crisis to other industries who were not under direct impact.

This is worrisome. Yet there is always hope. Perhaps, I am over-exaggerating and things will work out and things will get much better in 2021. For the stock market though, I am staying liquid and in sidelines. While financial crisis in stocks is bad overall and many lose their assets, it also presents opportunity for those who are liquid and can take advantage of the unfortunate situations.

I don't know what will happen. But this time I will be ready, if there is about 20-30% decline in stock markets. Good thing is they usually end up recovering overtime anyway. For example Dow Jones dropped from 16k to 8k in 2008 financial crisis. They over the years it recovered and gained much more.

Posted Using LeoFinance Beta

Staying liquid sounds like a good strategy for now. I get the feeling that markets are going to decline again with the second covid wave taking place, regardless of whether or not the economy stays "open." I think the "weakness" in the markets this week that you mentioned at the begining are due to France, Germany and other parts of Europe shutting down again for covid. The morning after the announcements came the North American market went red. It will be interesting to see how things play out over the next month or so.

They just trying to buy time and kick the can down the road the more people that get sucked into thsi death spiral the more people will feel the need for government to save them! It’s all about growing your power to the point where things implode and reset, history has shown as that many times

I don't think you're exaggerating, many African countries will go into a meltdown and of course this will directly affect the lives of their citizens.

It's normal for people to downplay any potential economic crises I mean not one is surely certain if it'll come but then I feel everything happening this year will have impact even in the coming five years although economically strong countries might just be able to weather the storm.

I know I to though there will be a huge crisis the market recovered soon

Posted Using LeoFinance Beta

I to the thought that covid will effect more but in some countries is under control and market recover by the time

Posted Using LeoFinance Beta

@tipu curate

Upvoted 👌 (Mana: 0/1) Liquid rewards.