No It's Not In Real Estate...

I know I'm the real estate guy and I should stay in my lane, but I can't help myself! I was doing some research and playing with the APY's on PolyCub when the thought hit me, "where is all the BIG crypto money held"?

I didn't get to where I am in life by being creative or thinking outside the box. I am successful in real estate, business, stocks and now crypto because I follow the advice of people much smarter than I am. I study what they do and it has worked out. Anyway, I decided to go to check the market caps of the top 10 tokens. We've all seen the screens on all the major indexes and coingecko, but it didn't give me the answer to the REAL question.

I wanted to know HOW MUCH of each individual asset was being held!

Since owning 10% in an exploding coin gives a different result from holding 100% in that coin I wanted to see how the BIG MONEY was splitting up their growth and protection strategy.

I ended up pulling the numbers over into an excel spreadsheet and adding a simple formula to add up the full market cap of the top 10 tokens and then used that figure to identify the percentage of each.

The Result Shocked Me! 55% Is Being Held In Stable Coins!

From the image above you pulled less than an hour ago, you can see that the biggest holdings are the 2 most famous coins followed by a coin that everyone ignores (being honest, I've also always ignored the stables when reviewing the market).

What Does This Mean For Us

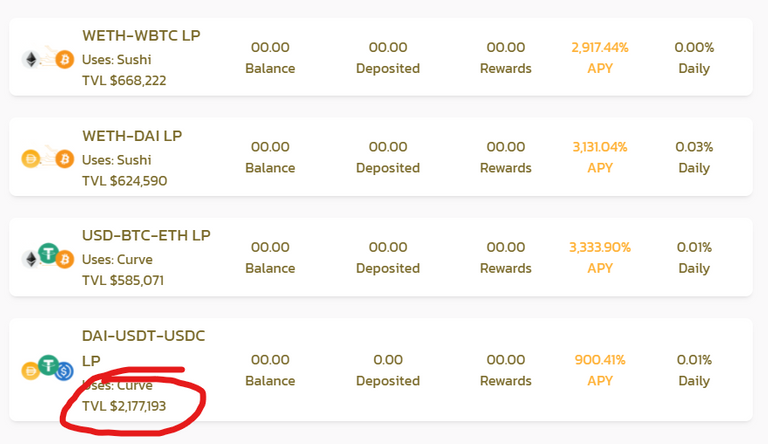

I realize now how detrimental this has been for my investing strategy, but looking back it is exactly what @scaredycatguide and many of the LEO whales are doing! Nearly 40% of the assets held in the Kindoms on #PolyCub are in the stable pools also!

The long and short of it is that Crypto is still a growing investment class and we are also experiencing a loss of faith in the markets. I know cash and stable coins are not the sexiest positions and I admittedly hold very little in cash most of my investment career, but I am taking a good hard look at things these days and finally actually have cash to protect and to sit on the sidelines to future investments.

I'm Not Suggesting To Hold Cash If You Are Broke

This advice is only for people who have made big gains and would be sad if they disappeared or missed out on a great opportunity. Speaking of great opportunities. We have one with both CUBdefi and PolyCub earn high yields. It's just something to think about, but as we continue to invest and grow our businesses it is important to remember that CASH is also a position. When the market is booming or a coin is mooning it is easy to get caught up in the game of it all, but being sure to stake your earnings against a stable coin is a very good way to make sure you get to keep them.

If you aren't already on https://polycub.com/farms you are going to very seriously want to consider jumping into the PolyCub/USDC pool and letting your money work for you.

A Word Of Caution

If you are staking on PolyCub and are getting itchy fingers seeing all that polycub locked up... Just remember that there is a 50% fee for taking out your rewards early. PolyCub is designed to be a deflationary token unlike it's older brother CUB which is used for the airdrops, which some of us are using our PolyCub airdrops for the next 58 days to stake in the xPolycub pool and will be earning on those 50% fees from the paper handed cats. The richest lions on the platform are the ones with #DiamondPaws

Posted Using LeoFinance Beta

I love the part you said, don't hold cash if you are broke.

If you are yet to be wealthy then you should do more of investing rather than saving.

On the other hand, holding stable coins or storing gains in stablecoins is the best way to preserve profits and also take advantage of market crashes

Posted Using LeoFinance Beta

@tomlee you've got it my friend! Holding cash is a great strategy for being able to deploy capital when a great opportunity arises, but if you don't have cash, it's time to get out there and earn it, which usually involves 1000% more effort and risk, lol

Posted Using LeoFinance Beta

Nice advice.

Most times, people feel that they need money to make money. However, it is just an opportunity that a person needs to make money. Opportunities are everywhere and only those that see them, take advantage. Hive blog is one of such opportunities.

Posted Using LeoFinance Beta

This is amazing, I've learnt a lot from this post of yours my boss. Speaking of the CubDeFi and PolyCUB, I know that the PolyCUB airdrop surpass Cub in no time but the system programs it that they grow in parity.

It's been awhile since I saw your post, I think you've been pretty busy lately. I've good news for you, I've been making little headway on my post this day's and I owe this progress to your advise and what I learnt from your blog on a daily basis. You can check my post for the past four days to see the level of progress I've attained at your leisure time.

Thanks for the encouragement and support.

Posted Using LeoFinance Beta

@faquan my friend! I will check out your latest posts and I did recently notice that you are getting far more upvotes! It's all about building other people up on social platforms like this!

Yes, the last few days I have been researching and getting myself onto PolyCub and helping some of my students and close friends get onto the platform as well. It's been a busy week, but everyone is earning massive returns that will come back to LEO over time!

Posted Using LeoFinance Beta

You're right, it's about building others up on social media platforms. Thanks for helping me this far. I appreciate.

Posted Using LeoFinance Beta

Hopefully this risk-off environment will be done once the war ends. But right now, I don't think new ATHs are anywhere near.

Posted Using LeoFinance Beta

Great post.

I was thinking a few months ago that if a bear market like the one from 2018 would come this year I'd rather switch to some stables and stake them. I haven't tried that out with HBD yet because I don't "feel safe in stables" yet, having the feeling we kind of bottomed, but it looks like HBD is becoming pretty stable. Not yet pegged to $1, but close to that, and 12% APY is not something worth throwing away.

Posted Using LeoFinance Beta

@acesontop I agree with you that 12% is still a good return and it's Even better if it protects your from a potential drop in the markets!

Posted Using LeoFinance Beta