We Are Told That Spending Money Will Make Us Happy

One truism about American life is that we are frequently told how we can be happier and more successful by spending money on things. Through the internet, television, signs, magazines and newspapers, we are bombarded with advertising messages that encourage us to spend money.

The truth is, people who overspend on material things tend to feel anxious and miserable, while people who live below their means tend to feel secure and happy. Of course they are. They figured out how to get rich slowly.

How To Trim Down Your TOP 3 Living Expenses

Trimming relatively small expenses such as lattes, magazines and gym memberships is a common approach to reducing expenses. But to get rich, you need to learn how to live below your means. To do this, you need to examine your essential living expenses and #TrimDown the TOP 3 biggest expenses in order to #maximize your investment capital.

YES you need a car, but you DON’T need a $1K per month car payment.

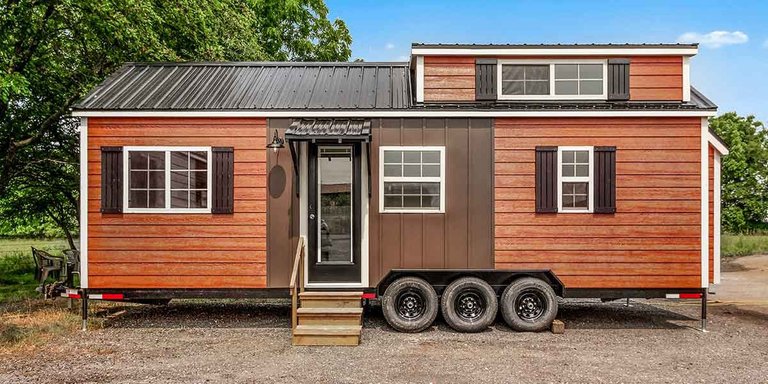

YES you need a place to live, but you DON’T need a place that costs 3/4 of your income.

YES you need to eat, but you DON’T need to spend $500 per week eating out.

Housing Expense Trimmed Down

Total housing expenses

Depending on whom you ask, experts recommend that total housing costs should require only 20% to 25% of your take-home pay or 28% to 33% of your gross pay. Total housing costs includes not only your mortgage or rent, but also utilities and homeowner’s or renter’s insurance. If you own your home, total housing expenses also include real estate taxes and an allowance for maintenance and repairs.

The homeowner’s maintenance and repair allowance needs to cover unexpected expenses, such as plumbing repairs for a broken pipe in winter, as well as expected costs to maintain your home. Big ticket maintenance items include a new roof, on average about every 25 years, and repainting the house every 5-10 years. Other smaller expenses are replacing appliances as needed, plus any other house (and yard) maintenance costs. A maintenance budget of at least 1% of the value of your home, set aside annually, is a reasonable estimate.

If you are thinking about buying your first home, pay close attention to these numbers. I would rather see you buy a small multifamily as your first house or consider house hacking and renting out the bedrooms or additional living spaces like attics, basement and garages.

Transportation Costs Trimmed Down

Average car ownership in the U.S. costs around $9,500 per year, according to a 2020 report from the American Automobile Association. You can lower the cost of vehicle ownership by buying an economy model, buying a used car that is at least two years old and keeping the car for at least six years (and preferably longer, eight years or more). It is usually less expensive to maintain an old car than it is to buy a newer car. My used (and paid for) vehicle costs me about $2,800 a year to operate. I don’t plan to trade it in any time soon. It runs great and I keep up on maintenance.

Some families reduce transportation costs by only owning one car. When they need a second or larger vehicle for a special need, they simply rent one. There are also less expensive transportation vehicles to consider, such as a motorized scooter.

Some cities have good public transportation that is much more economical than owning a car for routine trips such as getting to work. Still other cities and towns have walkable neighborhoods with good stores and services that reduce the need for routine car trips.

Your ability to get by with fewer or no cars or to use alternative or public transportation is often dictated by where you work and live. If you are considering a change to your housing situation, be sure to examine transportation options as well.

Cost Of Food Trimmed Down

The more convenience products (packaged or prepared foods) you buy, the more you will spend on food. As much as possible, buy seasonal produce, seconds, foods in bulk or generic and store brands. But be mindful of what you buy in bulk. Buy only what you can use. Five pounds of cheese or a gallon of marinara sauce that goes bad before you use it does not save you money. (Here are more tips for saving money on food.)

For packaged products you do buy (from applesauce to tomato sauce), clip coupons if you have a lot of time to devote to the practice. Better yet, learn to cook from scratch. You really only need a few basic recipes for soup, stews and stir-fries. Then just vary the ingredients seasonally or according to what you can buy cheaply in any given week.

But what about chips, sodas, snacks and desserts? These nonessential items should not come out of your food budget; they should come out of your budget for extras.

The Bottom Line

Live modestly and build wealth until you create so much wealth, you don’t need to play that game anymore 😎

Learn more from each of the millionaires I interview on the Alchemist Nation Podcast episodes I post here on LeoFinance!

Posted Using LeoFinance Beta

Congratulations @gualteramarelo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 10000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

I think these are a great three things to pick. I will share it with two people I am mentoring, and I will look at my personal situation to see how it can be improved.

Thanks for this concise presentation.

Posted Using LeoFinance Beta