Crypto people keep claiming that Bitcoin and S&P 500 move in the same way at the same time. When USD emission to the markets is high, we see green markets. So, it is believed that Bitcoin (crypto, in general) is correlated with S&P 500.

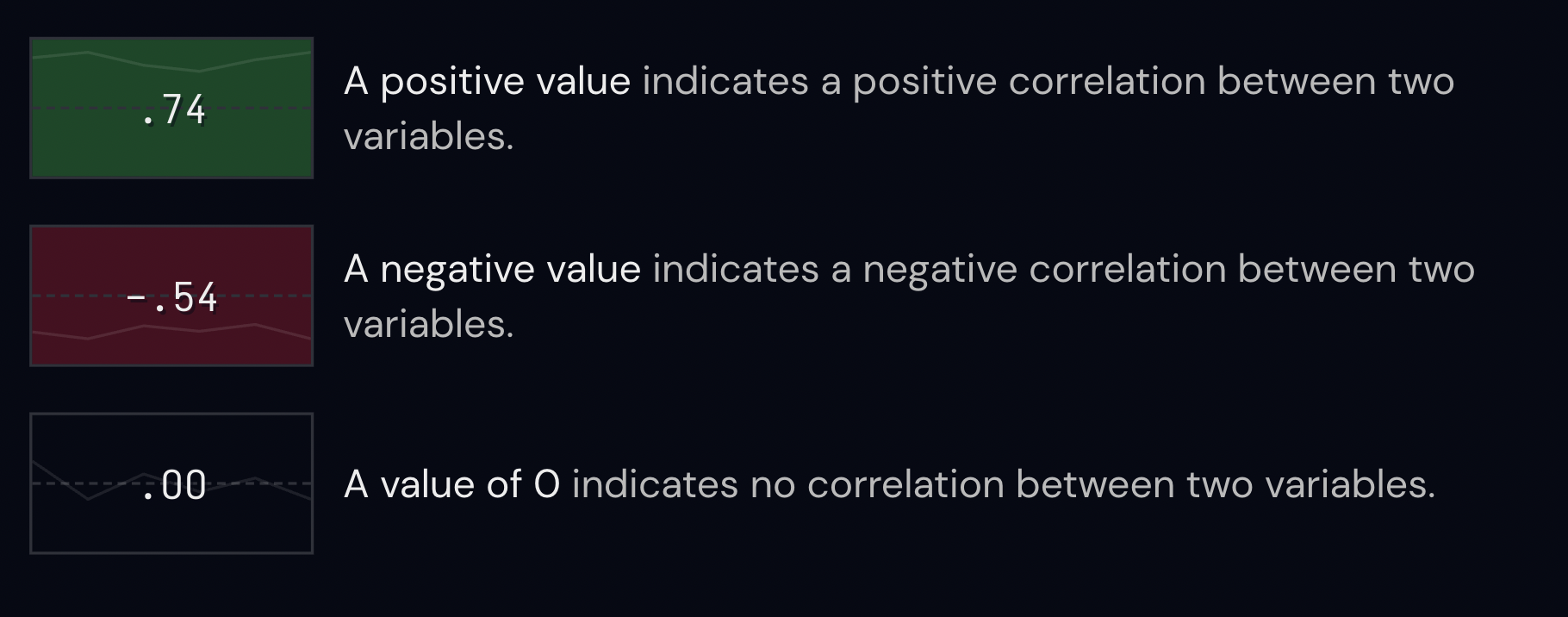

Correlation is needed to be well-explained. According to CryptoWatch:

Correlation: Positively correlated variables tend to move together, negatively correlated variables move inversely to each other, and uncorrelated variables move independently of each other.

As it is highlighted by CryptoWatch, the correlation rates swing between +1 to -1. When the value gets closer to positive or negative 1, that indicates a perfect correlation.

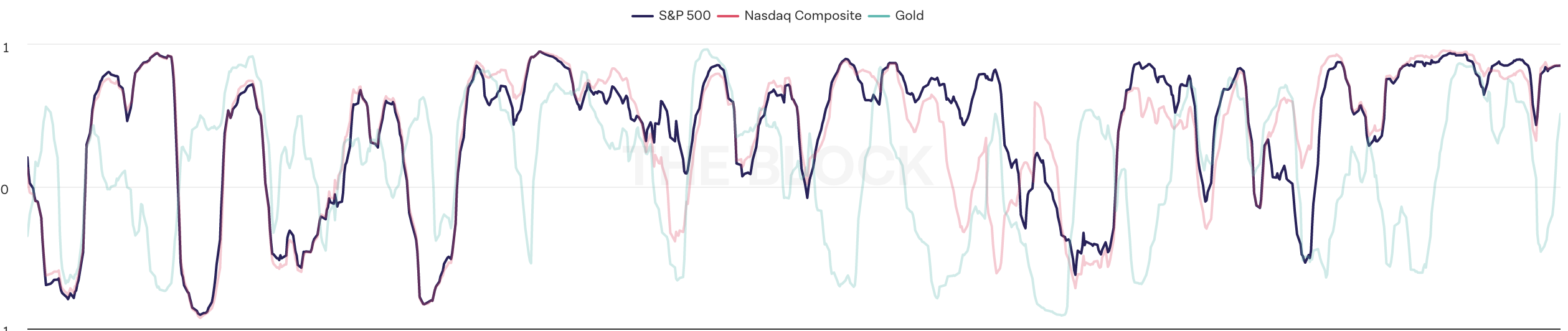

Here we go, BTC - S&P 500 (30 Days)

I use The Block to retrieve data and watch the market closely. As usual, these charts will be taken from The Block.

BTC - S&P 500 correlation ratio swings above .75 levels that indicates a positive correlation. So, we can say that those who believe S&P 500 and Bitcoin move in the same way are not totally wrong about it.

Especially when FED does not have an impact on the strength of the USD, the markets tend to go up.

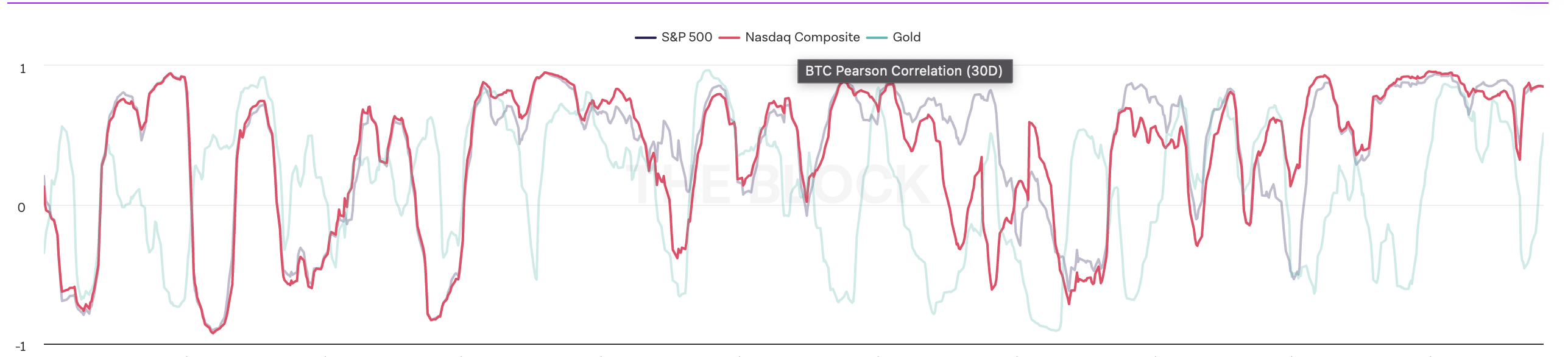

BTC - Nasdaq Pearson Correlation

Similar to S&P 500, BTC and Nasdaq may move upside down at the same time. I believe the most effective factor in this ratio is the DXY.

Overall, markets vs the fear of recession + inflation (stagflation?) are the story.

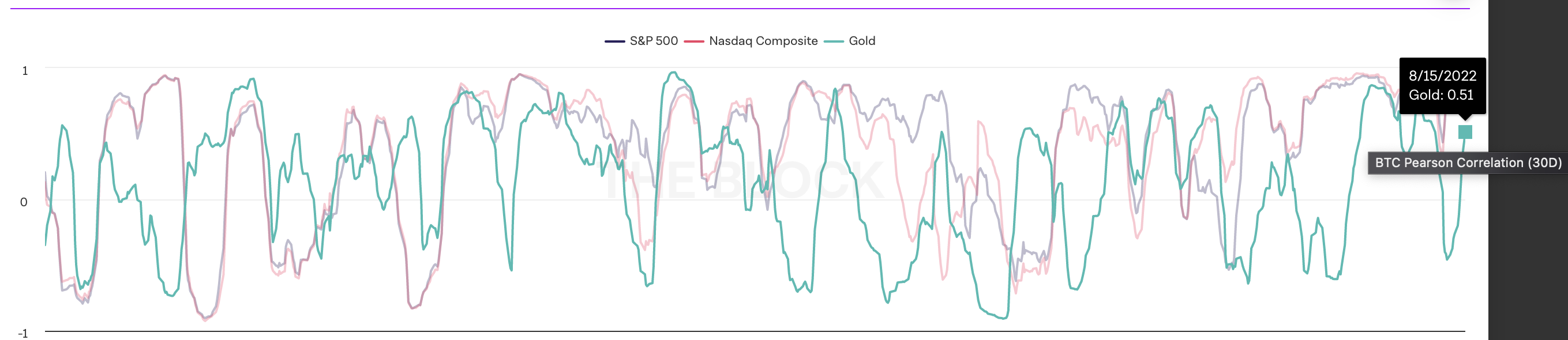

BTC - Gold | Yellow Boyz

Gold is different once again.

What has been feeding the price of Gold?

Most probably the global problems that we face.

0.51 correlation indicates that Gold outperformed the rest and gained value while the rest was suffering 😅 Jokes aside, I think Gold has not reached its fair value in the midst of inflation and global cases.

BTC - Hive - Avalanche - ETH

You must visit CryptoWatch and use the tools available for free.

As you can see below, we have the correlation matrix for our beloved projects over a whole year.

When we focus on Hive, We see that Hive has a better correlation rate to Ethereum than Bitcoin. Most probably, it is because ETH is the leading altcoin that pushes the altcoins to go up with it. BTC, on the other hand, is the single boy of our ecosystem. Nonetheless, ETH & BTC has .85 correlation!

I think we need one more comparison in the bull-run. Today's correlation matrix is shaped by the depressed crypto market and the upcoming Ethereum merge. What would be the case in the bull run?

I expect a higher correlation with Ethereum once again 😎

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @idiosyncratic1 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

When I checked the last time, Hive was highly correlated with metaverse coins and play2earn games. It is because of Splinterlands I suppose.

Posted Using LeoFinance Beta

The buy pressure coming from Splinterlands account creation IMHO 😌

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more