What was on every mind in the Cryptosphere leading up to Turkey Day? Mainly one question. How high would the BTC bulls ride before the bears clawed in for a correction?

Now we know. At least a couple days before the correction, concerns were mounting about my own position in a Balancer LP.

Providers had been exiting their positions. One large provider remained and if that provider exited, the pool would be vastly drained. When I noticed BTC begin to fall, I knew it was time to make a move.

Lessons In Impermanent vs Permanent Loss

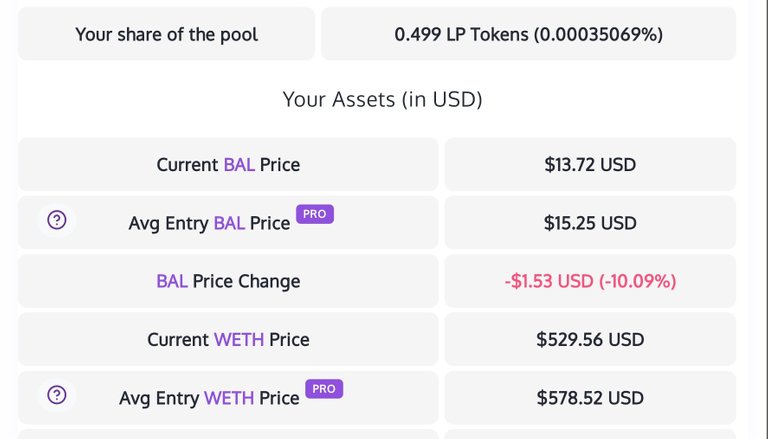

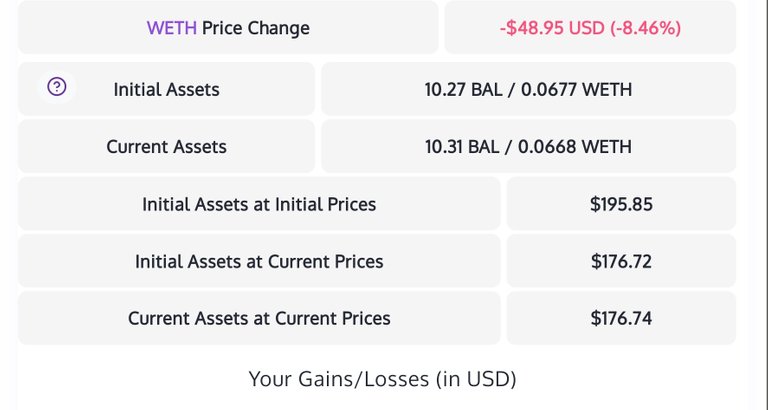

I held this Balancer liquidity position for about five weeks. Watching the ever changing relationship between the 60% BAL & 40% ETH taught a hands-on lesson in impermanent gains and losses.

Impermanent gains and losses turn permanent when you exit a pool, and mine surely did. One thing I learned, looking at losses of one token vs gains of another in an LP in terms of price may not serve your best interests.

What do I mean by this? If one token in an LP outperforms the other, the pool will adjust to give you more of the lesser valued token. What if you think that lesser valued token will be the major performer over a longer period of time?

You might therefore exit a pool and accept the permanent loss of ETH while having gained a lot more wLEO, as an example.

Exited BAL - Collected Yield - Entered New Balancer LP

I'm not sure if BAL is going to outperform ETH in the long run or not. What I did know was that it was time to make a move.

My first thought was to exit the Balancer LP and swap some BAL or ETH (or both) into DAI. That may have been a better call than what I did, but who knew the correction would dig so deep?

My very first move after exiting the Balancer LP was to find a new LP to enter. I again considered the wLEO pool, but the swap fees would have hurt too bad for the modest amount of liquidity I'm providing.

Back into Balancer it was, but I kept some of my profits from the previous pool in my MetaMask wallet. This new Balancer LP weighs the tokens at 80% BAL / 20% ETH.

I have much less a share in a much larger pool, but have a larger share of the pool tokens in return. Will this new pool pay out more or less of a BAL yield? I'll share my findings next week but my guess is it'll be about the same.

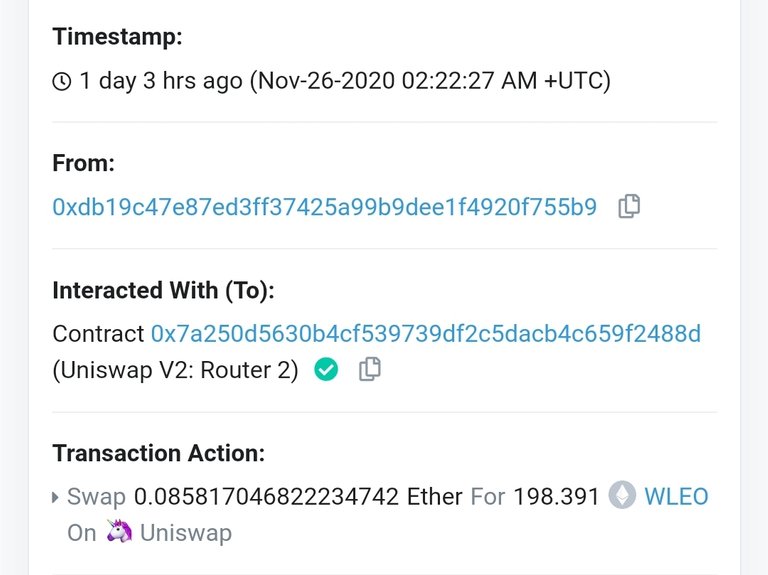

Uniswap Turned My Remaining wETH Into wLEO

Instead of swapping my profits into DAI, I opted for wLEO. The swap went through without a hitch and the fees weren't bad for about $2.50 worth of ETH.

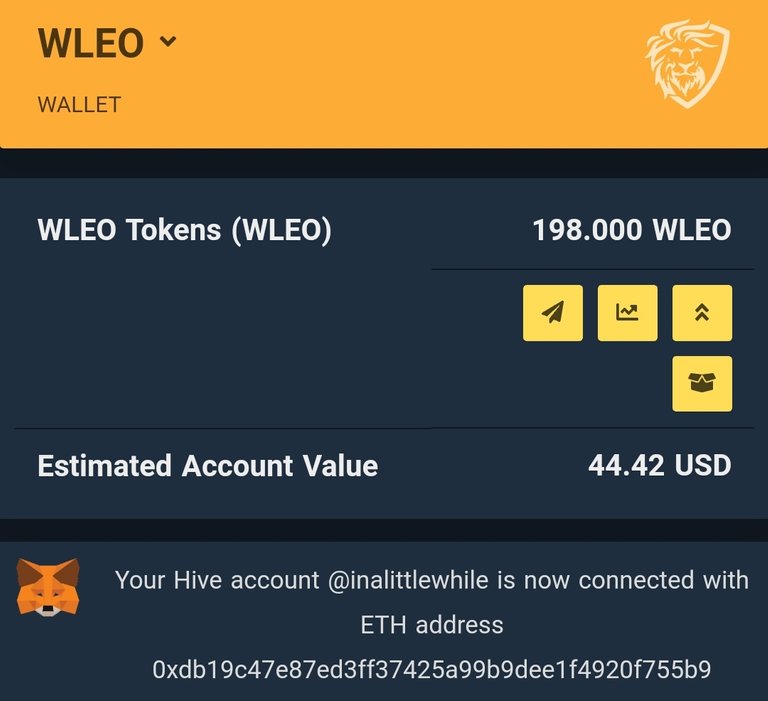

After the swap, I'm up exactly 198 wLEO. Since I don't plan on entering the wLEO LP at this time, I thought I'd unwrap and stake it. But when I try to unwrap my newly acquired wLEO, I get a required signer fail message.

The good news is that wLEO is still going to the moon, whether I can stake it or not. In the mean time, I have a request in on the LeoFinance Discord tech support channel. Hopefully, they'll be able to sort it all out.

BTC fell, but not before I made something happen out of the profits from the bull run. I hope you were able to do the same.

Thanks for your time and as always...

Images Captured As Screenshots

Bottom Image Courtesy Of Hive.io Brand Assets

LeoFinance Illustrations Courtesy Of @mariosfame

Want To Join The HIVE Community? Use My Referral Link To HiveOnboard.com

Posted Using LeoFinance Beta