CubFinance has been the hot topic lately and many are buying CUBs to harvest more yields on this platform. Most of my friends are into this already, so I also have invaded the DENS on CubFinance because I can see the potential to this platform and for its native token itself.

Since it is an extension to one of the biggest blockchain-social finance community and crypto blogging platform LeoFinance project, more crypto enthusiasts and partners will like to invest in this platform. And to think that it is created under Binance Smart Chain, which solves the issues under the Ethereum network, will also be a huge impact on CubFinance that might as well drive the price of the CUB higher in the future.

**Why did I invest in this platform?

**

The platform may be similar to other DeFi platforms that were launched on both Ethereum and Binance Smart Chain, but the outlook of CubFinance is more like long-term. It is not similar to other DeFi platforms that are usually operated by anonymous groups or individuals because it is an extension to the LeoFinance project.

We have seen how LeoFinance grows in just a short period and that might be possible for CubFinance as well. And just a few weeks from Cubfinance launching, we already saw an increase in CUB's price.

The goal of this platform is also to provide liquidity to LEO holders and I am one of the LEO holders. And investing in any DeFi Yield Farming platforms is much more about putting our money to work and earning yield. As LeoFinance attracts more potential users, there will be more users that will invest in CubFinance as well.

CubFinance Yield Farming

So with some of my BNB in my Trustwallet, I have decided to exchange them to CUB so I can start my yield farming on CubFinance. I even thought that I was too late already because the CUB price was already $4+ compared to its $2+ two days ago. Even though I was on the second thought to swap my BNB as its price was increasing as well. But if I will just do nothing, I might be too late for this opportunity.

The BNB I used in buying CUB can be replaced once I got profit from trading. The price would be different though, but again, it was better than losing this opportunity while the APRs are still high.

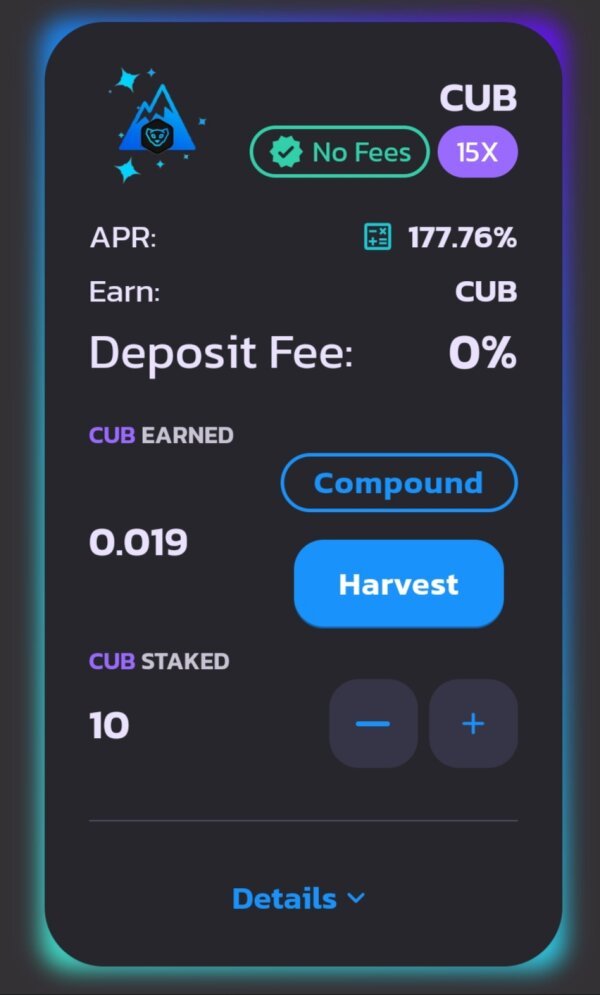

I was able to buy 22+ CUB using some of my BNB. Staking CUBs on the DENS has 177+% APR and 0% deposit fee so I staked my 10 CUBs in there. At the time of writing, it already has earned 0.019 CUB, which was a day after staking.

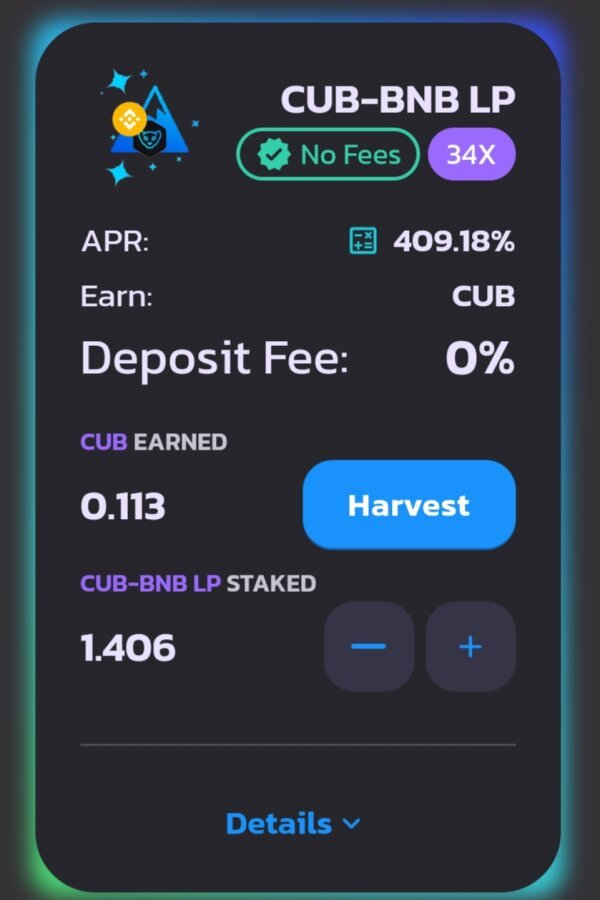

The rest which was 12+ was then added on the Liquidity Pool to get LP tokens that will be used for farming more CUB and the CUB-BNB LP has 400+% APR at the time of staking.

After more than 24 hours of staking, it already earned 0.113 CUB from 1.406 LP tokens I have staked.

It might be small compared to the earnings of others who staked on CubFinance, but Yield Farming is better if you will hold it on the smart contract for a longer time. Just be aware of the risks though, since it is normal in investing on any platform.

What's the possible risk?

It was the day before yesterday when I staked my CUB on CubFinance and added some assets to its Liquidity Pool. The price of BNB was $320+ and the price of CUB was $4+. If you have read my article, My First Time Yield Farming On Pancakeswap and Things You Should Know About Yield Farming, I have mentioned there the risks of yield farming which includes smart contract risk, liquidity risk, and impermanent loss.

Just one thing I am worried about is the possible "Impermanent Loss" since the prices of both BNB and CUB were high at the time of staking. For those who are not aware, in adding assets to the liquidity pool, you should take into consideration the possible risks. Once the price of either of the assets you have supplied to the pool drops, you will suffer from impermanent loss.

Now, I want to ask for some suggestions from you guys since I am a NOOB in Yield Farming. Should I unstake my BNB while its price is still high, then stake it back once its price goes down to avoid Impermanent Loss? And when is the right time to supply assets to the Liquidity Pool and stake them on the smart contract?

Yield Farming, staking, adding liquidity, and more. These actions are always associated with risks and possible losses. But as the west of Decentralized Finance continues to go wild, there will be more and more smart contracts that will pop out at any time in the crypto space. Taking risk management is the best way to take control of our investment and possible losses.

Will I gain more profits from Yield Farming? Let's see after a month.

Posted Using LeoFinance Beta

Cub is a promising project

I have started with 17 cubs and now I have doubled my staking

I intend to make it a long term investment

Posted Using LeoFinance Beta