In a previous post about removing my DEC from CubFinance, I wasn't sure what to do with my DEC. However, I saw this post and I thought it was a good time to add my DEC to the DEC/SWAP.HIVE diesel pool. If people are deciding to move out now, then I can get a better return for my DEC and it works out better than letting it sit in my inventory. The returns are fairly high so I decided to put most of my DEC (including what I got from my CUB farm) into this pool. This is also better than doing more work to find cards to buy and renting them out to people.

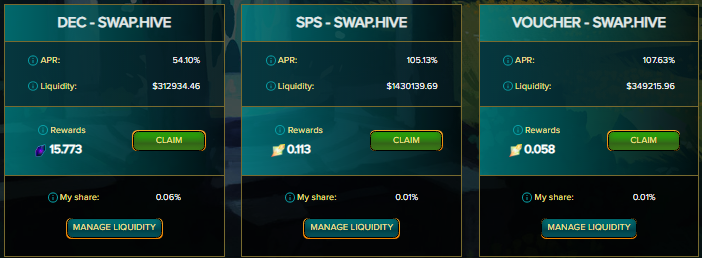

Liquidity Pool APRs

Above is the SPS management page and my current positions. As you can see, the APR for the VOUCHERs and SPS pools are over 100%. I added to these pools in a previous post. The DEC/SWAP.HIVE pool is currently at 54.1% APR and it even pays in DEC. As I swapped half of my DEC into SWAP.HIVE, I won't lose much because the DEC I generate from being in the pool will pay off for it.

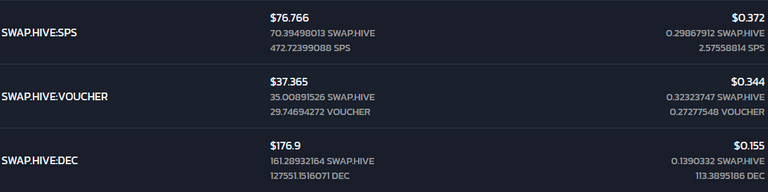

Fees generated

Above is the fees generated from the diesel pools and they can be found on the tribaldex diesel pool positions page. The DEC pool was put in last night and it hasn't even been a day yet. However, it has generated almost 0.1% of my total liquidity in fees. There is still the risk of impermanent loss but over 50% in APR is amazing.

Looking back at the SPS and VOUCHERs pools that I invested in, the VOUCHERs pool has generated around 1% in fees and the SPS pool has generated 0.5% in fees in almost a month. Compared to these pools, the DEC pool has generated almost 0.1% in a single day. It looks like the pre-sales on Riftwatchers boosted the VOUCHERs and SPS volume but I am not sure how much it affected the returns. However, the IL is fairly large as I had over 36 VOUCHERs in my pool before, and now it is around 30 left.

It's a bit unfortunate but the APR for being in the diesel pool isn't much so most of the rewards will come from the APR for Splinterlands liquidity and fees generated.

Conclusion

The result of the Riftwatchers pre-sale caused quite a few people to either leave the pool or for the price of SPS/VOUCHER to go up. With this, I thought that the DEC/SWAP.HIVE pool was the best place to put my DEC and I haven't had as much time to deal with my rentals. Rather than dealing with all the work, I just prefer to claim the rewards for providing liquidity. Besides this, it looks like the trading volume on these diesel pools isn't that bad and it is definitely way better compared to the other pools that I am currently in.

Are you in any of the Splinterlands liquidity pools?

Feel free to leave a comment if you read my post. If you have any questions, feel free to ask and I will do my best to answer.

Posted Using LeoFinance Beta

That is a nice move there and I must say I will be considering one of this pool this days

Posted Using LeoFinance Beta

If I had to choose between buying cards and the pool, I think the pool is the better choice right now based on the returns. However, there is still IL and you do miss out on card appreciation.

Posted Using LeoFinance Beta

Hi, I've started using the HIVE:DEC and HIVE:Voucher pools recently. I dont really have much in either yet - but the APRs are pretty nice. The Hive:Voucher pool pays out in SPS and I stake that back on Splinterlands, to generate more Voucher. At the moment I have been investing the DEC earned from the HIVE:DEC pool into rental cards, but with the drop in the rental market of late, maybe I'm better ploughing it back into the pool.

Posted Using LeoFinance Beta

Yea I think the DEC/HIVE pool is better than the rental market right now. From a return standpoint, its better but you do lose on the appreciation of card value but that is hard to predict.

Posted Using LeoFinance Beta

Good point about card value appreciation - I never thought of that

Posted Using LeoFinance Beta

It looks like you made a smart move there, for the DEC-HIVE pool. The APR is really tempting!

Posted Using LeoFinance Beta

Yea it is definitely more tempting compared to the rental market. Fees generated, diesel pool APR and Splinterlands rewards so it's 3 rewards for one action.

Posted Using LeoFinance Beta

Thanks for sharing! - @alokkumar121

Posted Using LeoFinance Beta