Today has basically been a learning and exploration day. If you have been following along with my last couple of posts, I want to address a couple of points that have come up. You can find these posts here if you haven't seen them yet:

What did I do today?

Added some funds to the third pool - the WHIVE-DAI pair. This had a couple of false starts as I got an error on my WHIVE purchase, and then took a bit to swap ETH to DAI and WHIVE. But I got there in the end and got my little share of this pool.

Now I have a share of all three currently available pools.

Is anyone using this yet?

Volume of trades using these pools has been slow so far. They are new and need more funds added to them by Liquidity Providers to gain some traction and usage.

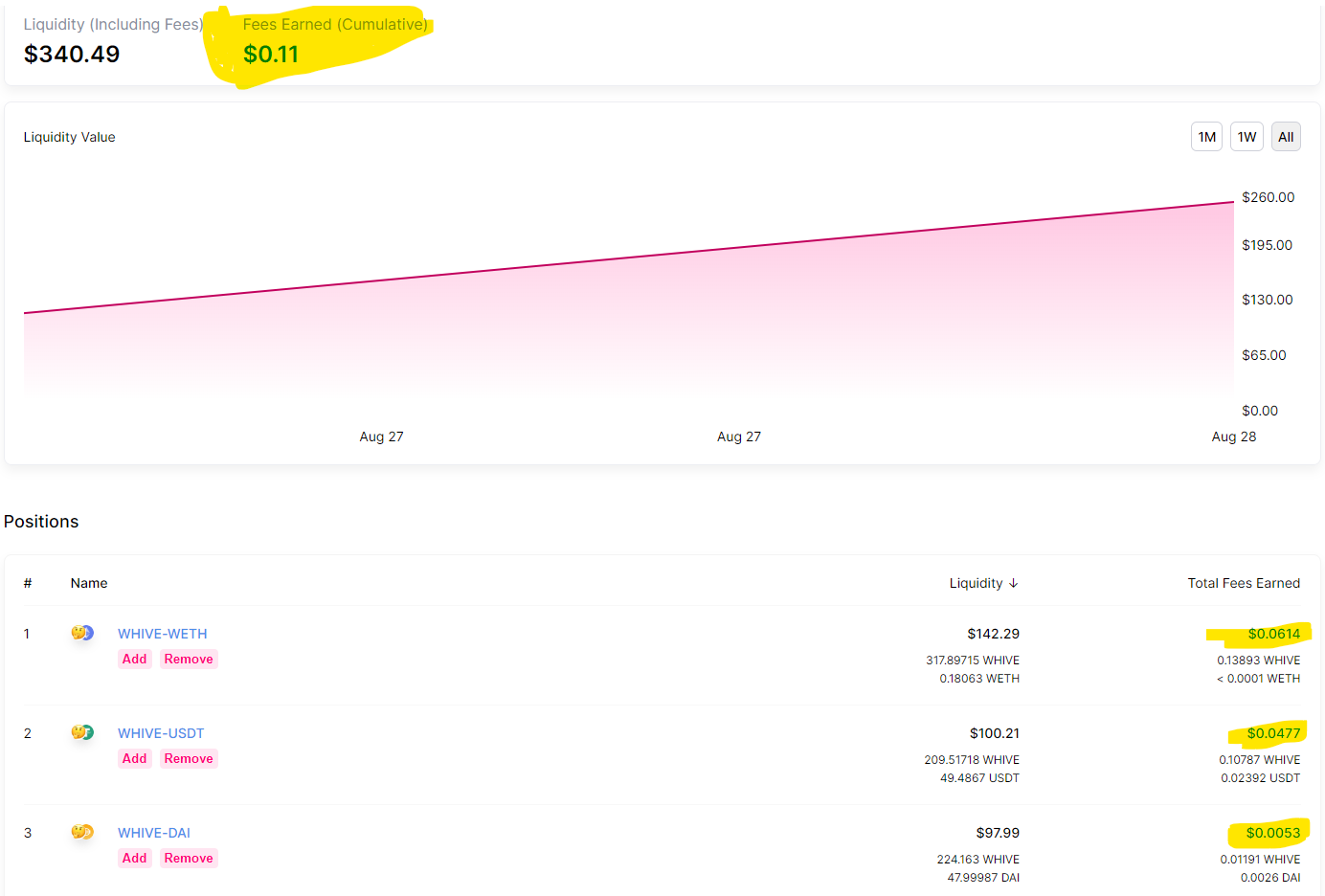

Having said that, there is some activity and fees are starting to be generated. So far my total stake in just over 48 hours has earned a grand total of $0.11 in fees. - Lambo is still a little way off.

Above is a screen shot of my current position, and the fees earned are highlighted.

Is it worth the gas?

One question I have been asked in my previous posts is around the ETH GAS fees on transactions. I haven't had any crazy $30 - $50 GAS fees. If that did happen, I simply wouldn't do the transaction. None of what I'm doing here is high urgency. The highest fee I have paid in this whole process is $4.69. Having said that, yes fees do cut, and I am probably down around $25 to $30 total in fees, spread across around 18 unique transactions and swaps since I got started. Going to take a while to recoup that (if I ever do) but there is more to it than that.

So why do it?

Making money isn't the short term goal for me here. I have gotten involved in this for other reasons. Mainly to learn and explore a bit around Uniswap, and ETH in general which I haven't really done much with up till now. Mostly, over time I want to build a little diversification into my portfolio, and building it through adding to the WHIVE-WETH pool in particular has a couple of benefits:

- I add it to the pool as a savings plan, maybe earn some pool fees and slowly grow my stake.

- It's readily accessible if I really need it.

- Getting involved with this is my little contribution to helping HIVE branch out and bridge to ETH.

- I have an exposure to the upside potential of both ETH and HIVE, in a place that adds value to the HIVE eco-system.

- The beauty of HIVE and LeoFinance is that I can blog about my experiences here and the post payouts can potentially recover the GAS Fees.

Recommended posts and links:

I would like to highly recommend this post by @partitura. In it, they go through step by step using some BTC to borrow HIVE. This is a fascinating move, and another way to hold a position in BTC, and use it to increase your exposure to HIVE. There are ways to do this without using WHIVE, but @partitura's post shows what is possible.

@khaleelkazi posted his video explainer about the process, from what is WHIVE throught to swaps and adding Liquidity to the pools, and removing it. Very helpful guide I wish I had before I started out. . There will also be a full, long form post coming which will be added to the Leopedia in time.

You can easily follow along and see everything happening on Uniswap with WHIVE at the WHIVE token information page

Thanks everyone for following along, not sure if I'll have anything new tomorrow, but we'll see.

Cheers,

JK.

Posted Using LeoFinance

Great points here :) I would also add, that adding liquidity greatly helps the HIVE ecosystem - basically we need a lot of liquidity so big bois can come and make big trades to get profit (for example from price arbitrage). @tipu curate 3 :)

Upvoted 👌 (Mana: 0/12)

Hey thanks @cardboard. I really hope this does take off and grow. It's been fun to learn how all this works and your posts have been a huge help.

I saw your comments under @khaleelkazi's post about Balancer. Is there plans to set up there yet? How hard would it be once someone sets it up to get involved with that? I have no experience with Balancer, but would be keen to participate.

No idea but it probably works very similar to Uniswap. Just remember that because of the fees users prefer bigger trades and those require a lot of liquidity (so the price does not move too much with single trade). So in general we need more WHIVE :)

I agree re the gas fees trade-off for learning and experimenting on ethereum. I have tried to be a bit too cute a few times recently and lost out on gas fees but it’s been worth it for the learning curve, especially if you remember the mantra - only ’invest’ in crypto what you can afford to lose.

It most definitely has been interesting branching out. ETH is a very different beast and so far my crypto experience has been mainly HIVE/STEEM. Hopefully, the ETH ecosystem can push through some of its reforms to reduce GAS fees, and make it less expensive to learn and play around with.

"Only what you can afford to lose" is still the most important advice anyone in crypto should heed.

Posted Using LeoFinance

I'm following your journey and starting mine today.

Thanks :)

Posted Using LeoFinance

That's great to here, thanks for following. Remember to do your own research, I'm just sharing my journey but none of it is advice of any kind. Best of luck.

Posted Using LeoFinance