At this point in time, there are a variety of options for your RUNE holdings. I'll take a quick look at each, and share some of my results in this post.

Add to a Liquidity Pool.

The first option is really putting RUNE to its intended use. The BepSwap platform is the first implementation of the Thorchain network. Thorchain is now its own Blockchain, with the first chain it is linked to being Binance chain. The RUNE token currently still lives on Binance chain, but will migrate to being a native asset on Thorchain when Mainnet occurs. In the meantime, Bitcoin is the next chain the team are working on linking. Once that happens, adding liquidity to a RUNE/BTC pool will become a reality, and cross chain swaps between BTC (real, native BTC, not a wrapped version) and Binance chain tokens will be available.

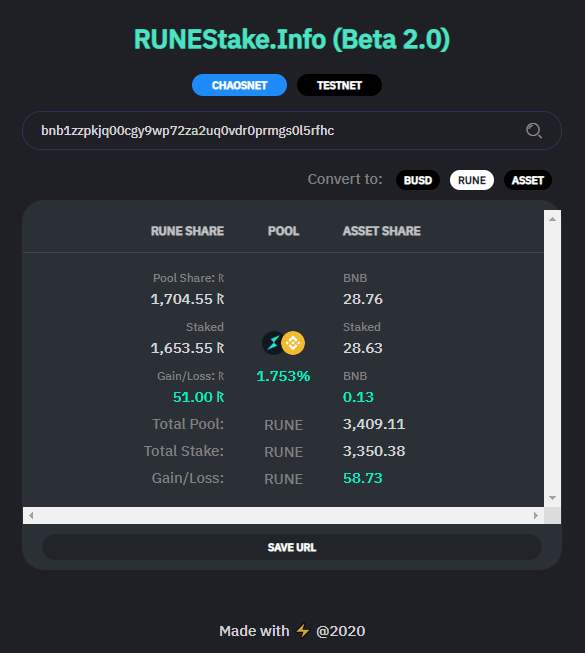

Currently, the pools on BepSwap include a BNB pool, BUSD, ETHBep2 BTCB and others. I have been in the RUNE/BNB pool, to varying degrees over the past month or so. My record keeping is not so crash hot, but fortunately a handy community made tool exists to monitor pool performance. This shows how my stake in the RUNE/BNB pool has performed so far.

The stakes added to the pool were done over 3 transactions.

- 16.67 BNB and 1000 RUNE - 22 Sep

- 10.54 BNB and 514.05 RUNE - 27 Sep

- 1.42 BNB and 139.5 RUNE - 30 Sep.

So, a 1.753% Gain in assets (measured in RUNE) over the last 2 weeks is not bad, roughly 45% annualized, as a very rough number.

Stake on RuneVault

Runevault has been a distribution tool the project has used to steadily spread the RUNE token out into the community over time, based on the amount of RUNE staked. Slowly, it is being wound down and will eventually shut, when the caps on Liquidity Pools are lifted and the chain is on mainnet. In the meantime, this is a safer option, with no exposure to Impermanent Loss, and a weekly payout currently running around 0.5% per week (around 26% annualized).

This option is the lower risk, lower return approach, but it is temporary in nature and will no longer be available at some point. If you are short term bullish on the RUNE price, or plan on actively trading, this is still attractive. Trade during the week, stake on Saturday, unstake after the weekly snapshot and distribution (usually at a random time each Sunday) and then start trading again. Alternatively, stake there keep an eye on progress, and unstake once the Liquidity Provision becomes a more appealing (or eventually the only_ option for passive ROI.

Trading.

@khaleelkazi mentioned that he has been playing the market for RUNE, buying below 50c and selling above it. If you are a trader, the RUNE price volatility makes it attractive in this regard.

One method I was using for a little while (but it became too time consuming for me) was to have the Bepswap page open while I was doing other things. Occasionally refreshing the screen, watching for a big swap to go through from someone swapping BNB for RUNE. If I saw that, I'd make a swap the other way, usually using 1000 RUNE (meaning minimal slippage on my trade - I'm just a small fry in these pools). Once other swappers make similar trades, the pool would stabilize and I could swap back to have more RUNE than I started with. This worked for me on 3 trades, and I gained around 50 - 80 RUNE each time. Crude but effective, I'm sure If I knew how to build a trading bot I could improve that performance - but I have no skills in that area.

HODL.

The least appealing option in my eyes, but If you like the concept, or just speculating on future price action, doing nothing is a valid option. Keeps funds liquid, ready to go if there is a significant market move. No Impermanent Loss from being in the pool if the price or RUNE rises relative to the other pool asset. No income from this approach however.

So there you have it, RUNE has a number of different paths you can take to get involved in the growing eco-system, and set up your little niche in this unique and interesting platform.

As for me, I just plan to keep my RUNE/BNB stake in, and build up to be ready for the RUNE/BTC pool when it comes. That is one I definitely want to be a part of, and I'll probably withdraw from RUNE/BNB and swap into BTC at that point.

After that, the goal is to get a RUNE/WLEO pool happening once the Ethereum chain is linked.

Thanks for reading, hope you found this info useful.

Cheers,

JK.

Please note that none of this is financial advice. Do Your Own Research

Post dividers and banner courtesy of Barge.

Posted Using LeoFinance Beta

Thanks for all these details! 5-8% return in trading looks better than 0.5% per week on staking ...only if one is as smart & active as you to find the opportunities for it. I'm quite content with staking rewards until I've bigger funds to play other games. Will like to follow your steps then :)

Staking is the easiest way to make bank. Keep an eye out, I think once cross chain comes to life, a RUNE/BTC pool will be a great alternative, and definitely one I will look to get into for the long term.

Posted Using LeoFinance Beta

Hey @jk6276.

Will there be a community liquidity pool for the DEC also?

Posted Using LeoFinance Beta

It is not something I'm planning on doing at the moment - I have my hands pretty full right now. I do hope someone does set it up, but it probably won't be me, sorry.

Posted Using LeoFinance Beta

Too bad! It would have been marvelous.

Posted Using LeoFinance Beta

Bought some more today just because you shill it all the time

Posted Using LeoFinance Beta

It does look good for the long term, I think, but don't hunt me down if it does not work out. Hopefully I'm far enough in Aus here to be safe. ;-)

Posted Using LeoFinance Beta