“Cryptocurrency arbitrage trading is a billion-dollar opportunity”, this is without a doubt. Exploiting the periodic variation in the price of an asset across different trading platforms is a brilliant way to generate tangible profits. While this strategy has worked very well for a few, the majority of cryptocurrency investors have since given up on the idea of arbitrage trading. The few who still uphold this idea come against the numerous limitations of arbitrage trading.

Fun fact; arbitrage trading is relatively the least risky trading strategy, yet only a few traders manage to give it a try. And if you ever wondered if there is a solution to this phenomenon, the answer is Yes, and the answer is MOSDEX

Introducing MOSDEX: Cryptocurrency’s first Aggregated Arbitrage Trading Solution

MOSDEX is an arbitrage trading platform that combines tactical arbitrage trading strategies with gilt-edge technologies to develop a resilient arbitrage trading system that screens multiple cryptocurrency exchanges for asset price variations and performs trades across these exchanges seamlessly.

MOSDEX is developed and managed by a team of core traders with key experiences in cryptocurrency trading, exchange management, and decentralized finance. MOSDEX’s innovative arbitrage trading protocol takes the load of arbitrage exploitation off the shoulders of cryptocurrency traders and performs recurrent trades on their behalf.

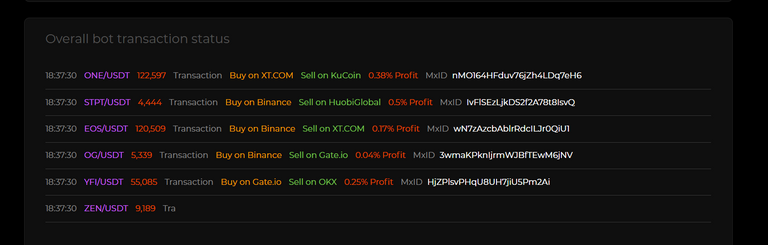

Leveraging this tool is as easy as committing your capital to the protocol and watching the trading profits accrue in real-time. MOSDEX’s trading records are transparent as users are given an avenue to follow the trading event and assess the protocol’s activities.

MOSDEX’s arbitrage protocol integrates multiple exchanges with varying liquidity and trading activity. The protocol proceeds to sort the prices of an asset on each of the integrated exchanges to detect and evaluate the gap between the buy and sale prices at the time. This gap, despite being slim most times, is exploited by the protocol using a low-risk trading system and profit management strategy.

The arbitrage Dilemma and How MOSDEX is fixing arbitrage trading

Most Losses in arbitrage trading result when an arbitrage trader is unable to close an arbitrage trade before the values normalize on the target exchange. Arbitrages are short-lived, you probably learned this the moment you made your first attempt at arbitrage trading. Succeeding in an arbitrage trade is dependent on your ability to beat the time and move your assets to the exchange with a higher trading price and complete your sale.

Not just the volatility, the liquidity, and the spread between the prices are easily miscalculated, this contributes to the short-lived nature of arbitrages. An arbitrage trader is faced with the challenge of evaluating the volatility and spread and as well endeavors to make almost ‘zero’ mistakes in any of these. Failure to do this leads ultimately to a failed trade

In addition, arbitrage traders will need extra capital to offset the fees incurred in recurrent withdrawals and trades as most exchanges charge tangible fees for each of these. Depending on the exchange and asset in question, withdrawal fees might be as high as double-digit dollars. Even if an arbitrage trade goes through successfully, the net profit is reduced and, in some cases, exhausted by extra fees paid by the trader.

Due to regulatory provisions across geographical locations, cryptocurrency exchanges are requiring extra levels of user verification to be able to use their trading platforms. Arbitrage traders will need to create multiple trading accounts, each on a different exchange, and verified to enable withdrawals and deposits. Even when this is done, managing accounts on different exchanges hardly comes off as an easy task.

In light of these hinges, arbitrage traders resolve to trade the variations in a selected exchange and move across exchanges in rare cases where the trading gap is wide enough to outlast the transfer lags and where the projected profit is high enough to offset extra charges.

How MOSDEX is fixing arbitrage trading.

MOSDEX was built with all these issues keenly considered. MOSDEX, in one piece, solves these problems and leaves investors with only little role, but maximum profits. MOSDEX’s arbitrage trading protocol is equipped with an efficient and wear-proofed oracle technology that supplies price data to the protocol. This ensures that the protocol uses the correct prices for any asset and updates as frequently as the price changes.

The arbitrage protocol is being developed using machine learning tools and Artificial Intelligence (AI) algorithms that enable it to detect price shifts and compare these shifts with any other available parameter.

The Artificial Intelligence algorithms study trading patterns and price development data to develop the best route for trade requests and the best strategy that returns maximum profit at the least possible risk level. The trading protocol is designed to submit multiple trade requests in a second and repeat these requests as many times as possible until the arbitrage is consumed and the trade’s profitability hits the lowest.

To save the stress of moving funds through exchanges, paying fees for each withdrawal, and even extra charges, MOSDEX’s arbitrage protocol integrates multiple exchanges and performs trades between them simultaneously. This is achieved by leveraging the exchanges’ API to gain access to their orderbook and trade collectively on them from a single standpoint.

Investors using this protocol are also saved from the stress of creating multiple accounts and giving away personal data to multiple administrators in the process of performing KYC.

The Arbitrage trading wave

The crypto space experiences fluctuating periods of varying profitability. The crypto winter is accompanied by some of the harshest price development events. The bull season might be generally profitable, but even during this time, the rapid changes in price could still result in losses for many traders. Regardless of the season, the profitability of normal cryptocurrency trading strategies is in question.

Cryptocurrency investors would appreciate a more steady trading strategy, one that comes with lesser risks. Arbitrage trading is the closest trading strategy to this desire.

With most other trading cultures falling apart, arbitrage trading is gradually gaining ground alongside existing trading cultures like Perpetual contract trading.

The wave is building, a wave of arbitrage trading awareness. Being under the radar for almost all of its existence, arbitrage trading where it concerns cryptocurrencies is looking to burst into relevance. This wave will be spearheaded by some brilliant arbitrage trading tools, MOSDEX’s arbitrage protocol is one of these, possibly the most advanced.

Here’s how MOSDEX as a project is gearing up for this challenge

How Arbitrage is positioning itself to lead the arbitrage trading wave

At its inception, MOSDEX was built to serve trading institutions mainly. With the goal of delivering handy arbitrage trading services to trading institutions, MOSDEX’s protocol was optimized for collective trades managed by one entity. This worked, and institutions using this tool attest to the efficiency and reliability of MOSDEX’s trading solution.

However, this usage instance streamlines the application of the Arbitrage protocol. To fix this, MOSDEX is expanding beyond institutions and extending its services to the population that needs it most – individual traders. MOSDEX is opening up to individual and retail traders, who for the whole of their investment careers have been unable to harness the power of arbitrage trading.

In addition, it is scaling its trading solution to meet up with the expected demand as the adoption continues. The arbitrage protocol is undergoing continuous strength tests as developers continue to furnish it to suit the common trader.

MOSDEX also introduces a basket of passive income opportunities for users. We will discuss this in detail in subsequent publications about MOSDEX, watch this space.

How you can take part.

The wave is coming, and as a cryptocurrency investor, the importance of being an Early bird cannot be overemphasized. Create a MOSDEX account and experience the power of the Arbitrage protocol while getting set for even more to come!

Posted Using LeoFinance Beta