The CEO of MicroStrategy seems to be unaffected by the potentially game changing regulations on the way in the US

If you are like me, you enjoyed your day off yesterday and were ready to enjoy waking up to a nice day with family, though not too much family otherwise your risk getting reported to the police by your neighbors for violating Pandemic restrictions.

Anyways, instead of waking up to pleasantries, you woke up to this smacking you in the face...

Bitcoin dropping by some $3k and not much end in sight to the declines:

(Source: https://bittrex.com/Market/Index?MarketName=USD-BTC)

Talk about the opposite of a nice wake up call, am I right?

On the flip side, me locking in roughly 30% of GBTC holdings the other day is looking better and better at this point, so there is that for some solace.

However, the negatives far outweigh the positives of a little profit locked.

The reason for the decline had to do with a string of tweets from Coinbase's CEO, Brian Armstrong saying that major regulation spearheaded by Trump and Mnuchin is on the way for bitcoin.

Specifically how they want to KYC all self hosted wallets.

More on that can be seen here btw:

If this ends up being true it could have far reaching and potentially very negative consequences for bitcoin and crypto as a whole.

Big investors seem unfazed...

That being said, it doesn't appear some of the largest bitcoin investors have been shaken by this news, or should I say potential news as it hasn't even officially been announced yet.

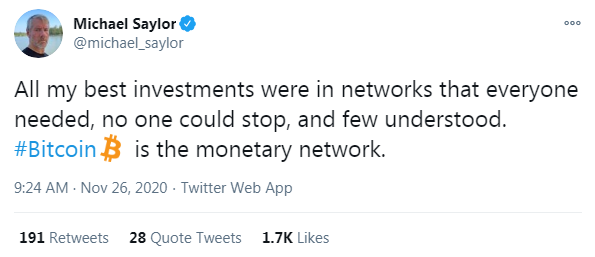

One of the largest investors in bitcoin, the CEO of MicroStrategy, Michael Saylor put this out this morning:

(Source: ~~~ embed:1331997183084810240) twitter metadata:bWljaGFlbF9zYXlsb3J8fGh0dHBzOi8vdHdpdHRlci5jb20vbWljaGFlbF9zYXlsb3Ivc3RhdHVzLzEzMzE5OTcxODMwODQ4MTAyNDApfA== ~~~

It's hard to read too much into this other than the fact that he mentions no one can stop bitcoin which sounds like it is likely in direct response the tweets from Armstrong last night.

If someone willing to invest almost $500 million in bitcoin and risk his job as well as his company in bitcoin doesn't think this is crippling news for bitcoin and crypto, perhaps we shouldn't so either.

It will be interesting to see how this all shakes out, but as of right now it looks like there could be major changes on the way for bitcoin and crypto in the United States.

Though it still remains to be seen whether these changes would need congressional approval and there will likely be significant legal battles as well depending on what officially comes down the pipeline.

Stay informed my friends.

Image Source:

https://bitcoinmagazine.com/articles/microstrategy-buys-0-1-percent-of-total-bitcoin-supply

-Doc

Posted Using LeoFinance Beta

It's been on it's way for awhile though... I'm watching

Posted using Dapplr

What has, the regulations or the dip?

The regulations. They're trying to. So I think they're going to try and bottleneck the flow of crypto to cash... Going to force real world implementation of cryptos.

Congratulations @jrcornel! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPOh my goodness.

Looking at the rate which BTC drops, one would simply conclude that the regulations are on the way with no restriction.

I'm not even a large btc holder and I'm not bothered, btc holders need to toughen up and take a cue from Michael Saylor

Posted Using LeoFinance Beta

The first brick in the wall of worry. 😉

Sounds about right. This is their way of "shaking the tree" to see what sticks and what falls.

Posted Using LeoFinance Beta

You gonna buy back in 100% if we hit $14k?

Seems like a no brainer to me.

One thing to note (I note at least here in Australia) is the finance reporters are completely NOT discussing BTC. Whereas last run it was always the end-of-show feel-good-story.

That makes me think that either they don't want users to know about alternative money options. Because they just want the regular options to be appealing, given that the global reset is in effect.

Or they're all already aware that regulators are going to kill the BTC option so it's not a wise thing to even talk about BTC. Like a drug addict family member "we don't talk about brother Tom."

I certainly wouldn't be making decisions based on tweets. The other thing that people should have expected too is that when big money players got in, then bigger money regulators would follow.

Also to kill BTC one need not even mess with the code or network. Just punish merchants in the real world from using BTC as payment. Technically a brick of cocaine could be used as payment but who the hell would accept it knowing the repercussions?

I have posted a few posts that take this thought into account. Large players only move once the majority of the risk has been removed. They know something the average Joe doesn't. Swim with the whales...

Posted Using LeoFinance Beta