If you decide you want to provide liquidity to the wLEO pool on Uniswap there is something you need to consider...

After a full day now of providing liquidity to wLEO on Uniswap there is one thing that I hadn't really considered initially, but may end up being a big deal...

That is the fact that as wLEO goes up, you will hold less and less of it.

Let me explain...

Yesterday I pooled close to 17k wLEO total and a corresponding amount in Ether (in USD terms).

Today, I have a little over $16k wLEO and more Ether than I had yesterday (but the USD value is equal).

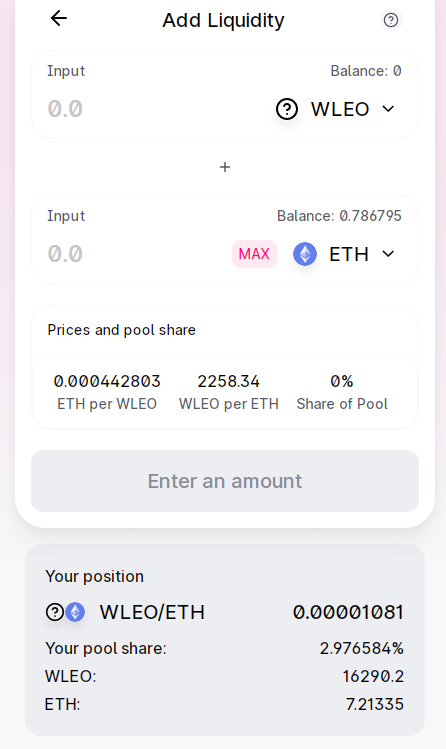

Check it out:

(Source: https://app.uniswap.org/#/add/0x352c0f76cfd34ab3a2724ef67f46cf4d3f61192b/ETH)

If you look down at the bottom there, you can see that my current wLEO holdings are a little over 16k currently.

Why does this matter?

Well, this could become an issue down the road if say wLEO keeps rising more than Ether...

It appears when you create liquidity, the USD value that you contribute in relation to Ether is what stays constant.

For example, if you contributed $2k worth of wLEO and $2k worth of Ether, if the price of wLEO climbs, you will have less wLEO and more Ether.

If wLEO were to go up significantly, you could end up with a lot less wLEO and a lot more Ether.

This may or may not be a bad thing depending on how you look at things...

If you are like me and you think wLEO is going to go significantly higher, providing liquidity may end up being the wrong move in terms of maximizing your returns.

The amount you receive from the 300k LEO bounty for providing liquidity will help offset this loss in wLEO, but if prices keep moving north it could still greatly eat into your returns.

For that reason my current line of thinking is that I will continue to pool some and hold some in other places just in case the price of wLEO continues to climb.

I want to make sure I am not cleaned out of wLEO when it is eventually sitting at $2. :)

Stay informed my friends.

Image Source:

https://uniswap.info/pair/0x85c4f11c4b3887425762e9d7e63774f087411dcf

-Doc

Posted Using LeoFinance

Thanks for the explaination yes it make sense since your LP needs to stay balanced in some way but I guess it’s the price of doing business! While it may or may not be profitable you can still offset it by taking profits and buying miners or arbitraging between HE and Uni so still ways to scalp additional ROI from your LP

Yep good point. Also the bounty gets paid out every 2 weeks from the 300k LEO LP bounty, so there is that as well.

Indeed, I am looking foward to to seeing the first ROI posts as the liquidity keeps adding to the pool, it sure does look like its growing

Yep, though as the pool grows the ROI will drop from the LEO bounty. Though it may increase from trading fees. Several dynamics at work here. :)

thats what they call unconfirmed loss if I am not mistaken

I think it's called impermanent loss.

thats it, I got a bit confused there, thanks for clearing that up

Yep, thanks for the help!

Also I think that the fees can get rid of the impermanent loss in a long run.

Possibly. It is an interesting dynamic. If the price is moving up it also means there is activity going on, and if there is activity going on, you get more in fee rewards. Several moving parts to take into account.

Actually I think it is more a function of more people buying wLEO using ETH than the other way around which could be another way of saying what you are.

If people start to swap ETH for wLEO, the amount of wLEO entering the pool will outpace the amount of ETH, reversing the trend you just mentioned.

Uniswap is based upon USD for the pool, maintaining parity through that as opposed to the tokens themselves.

It will balance out if trading gets heavier and more people move in and out of wLEO as opposed to accumulating it like right now.

Posted Using LeoFinance Beta

Correct, though if more people are accumulating and the price is going significantly higher you could easily end up with a situation where you have a lot more ether than wLEO compared with where you started.

Interesting perspective that I have never considered before @jrcornel!

I just went to check: I have more wLEO and less Ether than what I initially pooled. Still trying to figure out how all this works...

Posted Using LeoFinance

Yep, it can work in reverse as well. If Ether goes up you could end up with a situation where you have more LEO than you started with and less ether.