The 2020 Stock Market as explained by Wikipedia...

The stock market has behaved rather strangely in 2020. With a global pandemic ravaging the country and a global economy that is hanging by a thread, stocks continue to march towards new highs.

Something that doesn't really make much sense all things considered.

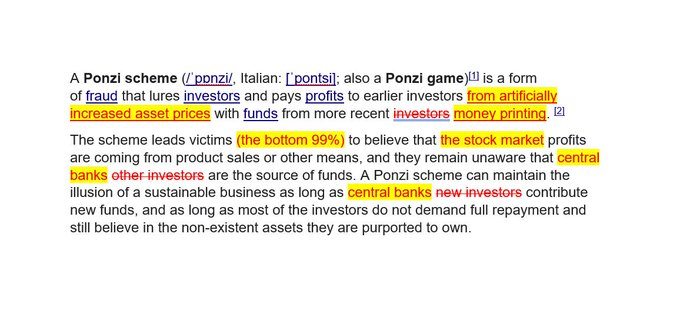

However, when you take into account the definition of the US Stock Market as defined by Wikipedia these days, it starts to make a lot more sense...

Check it out:

(Source: ~~~ embed:1278699753006653440) twitter metadata:Y2FwcmlvbGVpb3x8aHR0cHM6Ly90d2l0dGVyLmNvbS9jYXByaW9sZWlvL3N0YXR1cy8xMjc4Njk5NzUzMDA2NjUzNDQwKXw= ~~~

And the game goes on and on as long as central banks are willing to keep assets afloat.

Does this new definition of the stock market sound familiar?

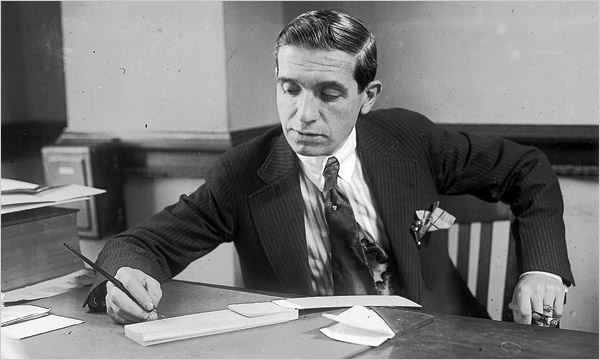

It should, this guy created the playbook way back when, and he didn't even realize that eventually central banks would be using it...

(Source: ~~~ embed:1278701950545133574/photo/1) twitter metadata:Y2FwcmlvbGVpb3x8aHR0cHM6Ly90d2l0dGVyLmNvbS9jYXByaW9sZWlvL3N0YXR1cy8xMjc4NzAxOTUwNTQ1MTMzNTc0L3Bob3RvLzEpfA== ~~~

The stock market is essentially sick and frail and the government is using steroids to prop it up.

In the short term it seems stronger than ever, but in the long run there will be significant consequences.

They won't fully be felt until the steroids (QE) is pulled away.

On the flip side, we have bitcoin mean-reverting to something it has done before major price rallies previously...

Check it out:

(Source: ~~~ embed:1280122398684184579/photo/1) twitter metadata:Y2FwcmlvbGVpb3x8aHR0cHM6Ly90d2l0dGVyLmNvbS9jYXByaW9sZWlvL3N0YXR1cy8xMjgwMTIyMzk4Njg0MTg0NTc5L3Bob3RvLzEpfA== ~~~

From that standpoint, volatility is now at the lowest levels it has been since the major parabolic rally in 2017.

The same type of setup we have seen previously before major moves up.

Would you rather own a zombie stock market at all time highs or something with the same setup it had before it rallied 20x more than 50% off its all time highs?

I know which one I would rather own...

Stay informed my friends.

-Doc

Posted Using LeoFinance

Central banks are either directly buying stocks, or in the case of the Federal Reserve they are giving newly diluted dollars to hedge funds and other groups to buy up stocks. Definitely a ponzi scheme, but I wonder to what end... My gut tells me we're going into a long preparation for large scale war, because none of the world players involved want to budge, nor can they. There's going to be a stale mate for who knows how long until either a new "we win" weapon is developed to strong arm the rest of the world into a new trade system, or someone gets desperate. By all rights the stock markets around the globe should be in the sewers, but they're part of the front being put up to see who can keep their ponzi scheme going the longest - winner takes all.

They are buying corporate debt, which as we have seen since 2009 eventually gets used to buy back stocks and juice the stock price. It doesn't get lent out into the broader economy or used to build new business, well the majority of it anyways.

Before a bubble bust it blows up right? I had the same discussion some days ago :D

Feed dat bubble.

And if it bust we will see years of rescission

Charles would be proud :D

Yes, usually there is a blow-off-top when a bubble bursts. They don't die quietly in the night, they die with a bang. We are still inflating said bubble currently.

Im ready for it :D

Nice one Doc, keep the stats coming, along with the attractive graphs that I love so much. Indeed bitcoin will be headed for its next ATH now, while the stock market is propped up like a ponzi for sure. Alhtough the Fed did say that there is no limit to th currency printing they will allow themselves, we hope that reality will correct all this ponzi activity among the elite.

Good analysis.