The re-accumulation is almost complete in bitcoin, once this is complete, bitcoin is going to absolutely fly

There have been a ton of indicators and patterns pointing to bitcoin going much higher over the coming months, but none of them may hold more weight than this one.

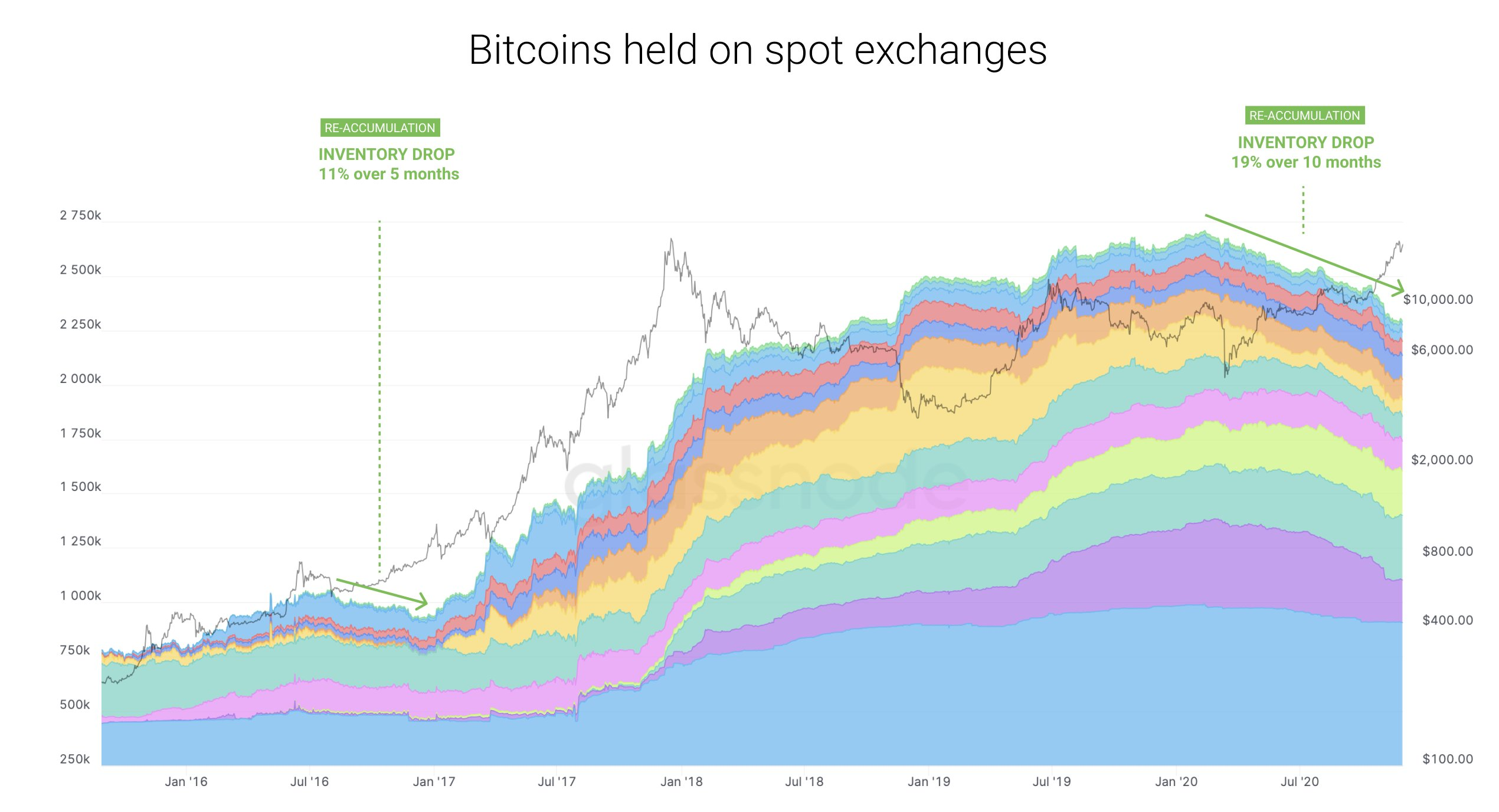

The supply on exchanges has been decimated over the last several months and that is the same thing we saw back in late 2016 and early 2017 as bitcoin was starting its bull market.

In the last 10 months there has been roughly a 20% drop (19% drop specifically) in the number of bitcoin held on exchanges.

Back in late 2016 there was an 11% drop in the number of bitcoin held on exchanges over roughly a 5 month stretch.

That means the current re-accumulation stage is almost 2x deeper and almost 2x longer than the one that sent prices soaring back in late 2016 and early 2017.

Check it out:

(Source: ~~~ embed:1333826694109569025/photo/1) twitter metadata:d29vbm9taWN8fGh0dHBzOi8vdHdpdHRlci5jb20vd29vbm9taWMvc3RhdHVzLzEzMzM4MjY2OTQxMDk1NjkwMjUvcGhvdG8vMSl8 ~~~

So, what happens from here?

The last re-accumulation phase sent prices more then 10x from where they were when it completed.

A similar type move right now would send prices to at least $180k or so.

However, as I mentioned above, this re-accumulation phase is deeper and longer which may mean the resulting explosion is even greater than the previous one.

Doubling the resulting move would point to prices peaking around $360k or so.

I'm not calling for either of those numbers but the fact that we saw this same setup at the start of the last bull market and we are seeing it again right now, leads me to believe we are going to explode higher out of this one as well.

The law of large numbers starts to come into play at some point as it will take a lot of money coming in to move prices to these very large numbers.

Which may or may not be a problem, depending...

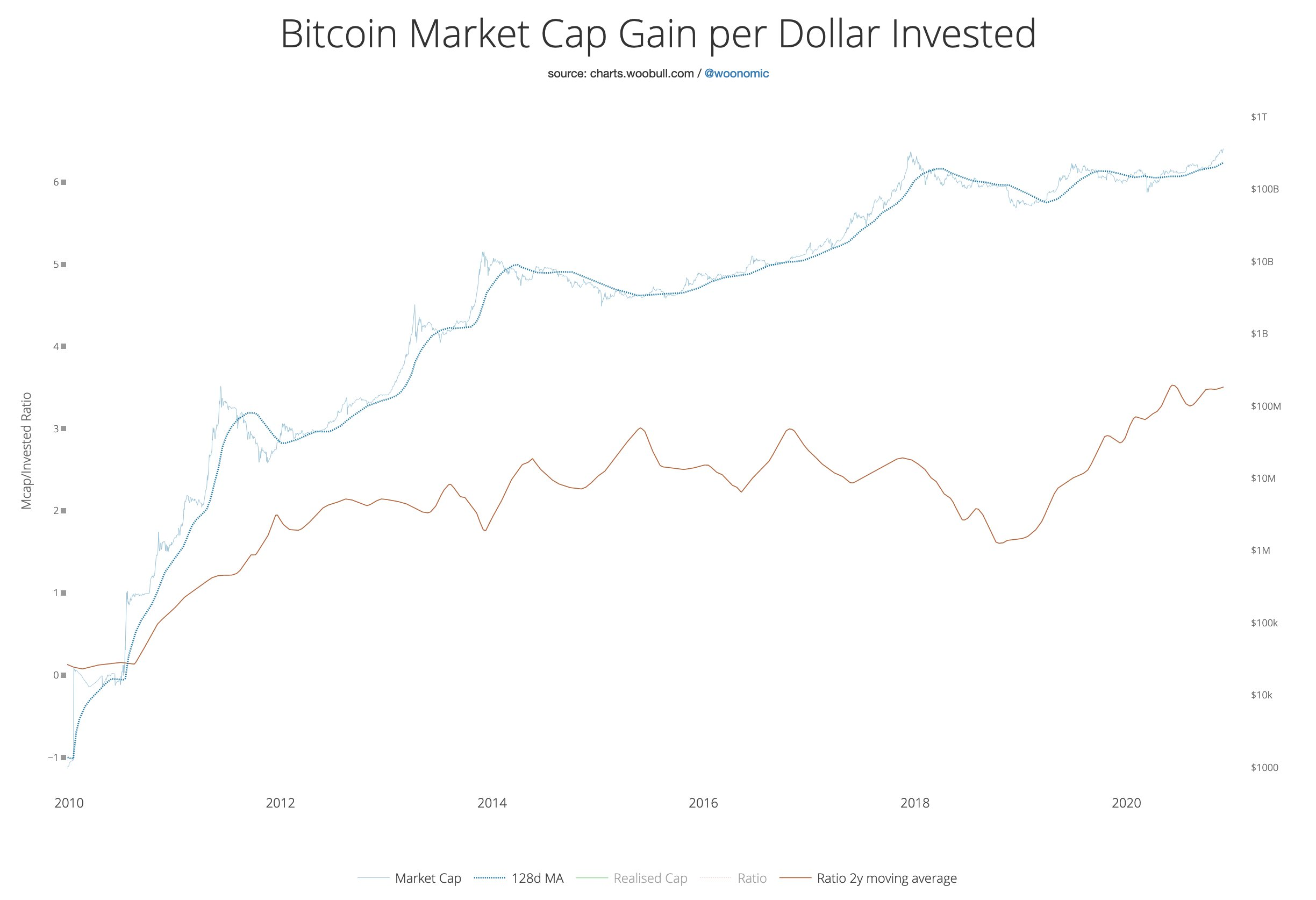

This is where reflexivity comes in!

The amount of money needed to push prices to these very high levels might be a problem, unless...

The reflexivity in bitcoin keeps increasing.

Which is exactly what you want to see as a bull.

The amount of money coming into the market is moving the market cap more than it has during both of the previous bull markets.

Check it out:

(Source: ~~~ embed:1333826700174475264/photo/1) twitter metadata:d29vbm9taWN8fGh0dHBzOi8vdHdpdHRlci5jb20vd29vbm9taWMvc3RhdHVzLzEzMzM4MjY3MDAxNzQ0NzUyNjQvcGhvdG8vMSl8 ~~~

Back in 2013, every dollar invested added about $2.00 in market cap during the bull run, and every dollar added about $2.50 in 2017, and now in 2021 every dollar is adding about $3.50 or more in market cap.

Long story short, it takes less money to move the market cap higher.

Reflexivity in bitcoin markets is increasing, which is exactly we want to see.

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

Isn’t the price of bitcoin proportional somewhat to the cost of mining them? Wouldn’t a 10x in price mean a 10x in electricity usage? We are already around 0.5% of global electricity consumption. Already such a waste, don’t that there can be justification to also x10 that.

Posted Using LeoFinance Beta

Somewhat, though the the correlation isn't as direct as you make it sound here. Regarding the total usage, those numbers don't concern me much for several reasons. One being that renewable sources are starting to account for more and more of this total usage. Not to mention that some of the byproducts, IE heat generated are being used for other purposes as well. Finally, the traditional banking system uses exponentially more electricity than the bitcoin network when you factor in all their brick and mortar stores as well as ATMs etc...

This constant higher price is making it feel like I need to start buying up a bunch of alt coins soon, to get some liquidity for if following the Bitcoin explosion, alt coins take a big rise like the previous one.

Luckily dCity gives me some, so I should start looking at some of that so I do have my favourite alts on the ready!

Cheers for the update.

Posted Using LeoFinance Beta

That is the hope yes. I have no doubt that if bitcoin makes significantly higher highs, eventually some altcoins are going to explode. The only question in my mind is whether that explosion in altcoins will include just about all of them again or if it will be much more selective this time around. Either way, we better hope it includes HIVE...

This is one of those posts when I do not hesitate to give a 100% UP

Posted Using LeoFinance Beta

Thank you, I appreciate that. That part at the end about reflexivity in the markets going up is what gets me really excited. It's going to take less money to push the market up than I originally though. For example, in order to push the market cap of bitcoin up by a trillion dollars, it's only going to take about $200 billion or so coming in to do so, which is a lot better than needing $1 trillion coming in to push the market cap up by a trillion. :)

Great charts - I haven't seen anything like these two! If you're at least partly right, we're up to have some real fun ride!

Posted Using LeoFinance Beta

I mean with supply leaving exchanges and demand continuing to come in and buy what is left on exchanges, the only direction for price is up.

It does sound reasonable!

Posted Using LeoFinance Beta

Interesting article ! Thanks

Interesting article .... thanks for sharing

Bitcoin is growing like a monster.

Posted Using LeoFinance Beta

Taking all this fundamental information and coupling it with the bitcoin chart makes things more bullish. The two biggest moves in crypto were still roughly twice the % move that we have had since the move started at the beginning of October.

December could be a very big green candle taking as well past 20K, and this is just the short term move that is possible.

Posted Using LeoFinance Beta

Yep, as I have mentioned, markets correct in terms of price or in terms of time. The longer bitcoin hangs out up here near the highs means these aren't the highs and we are getting ready for the next leg up.

Nice TA and can not wait for BTC to moon. Crypto rules!

Posted Using LeoFinance Beta