I've been an investor/user of the Ethereum network for a while now (about 4 years). The transaction fees are far from stable. In times of low network congestion, I can get a transfer through for just a few cents but when the network is being called upon for anything from CryptoKitties to the latest COMP DeFi craze, I'm forced to pay anything from $0.50 to $15 just to send a simple transaction op.

As somebody who uses Hive more than Ethereum, it's hard to switch back and forth between a chain with no fees and instant transactions (Hive) to a chain with high fees and transactions that often take ~15-30 minutes (Ethereum).

Granted, each has its own pros and cons. Ethereum is a staple for development and DeFi while Hive is a staple for social transactions and engagement. I can't just choose one or the other.

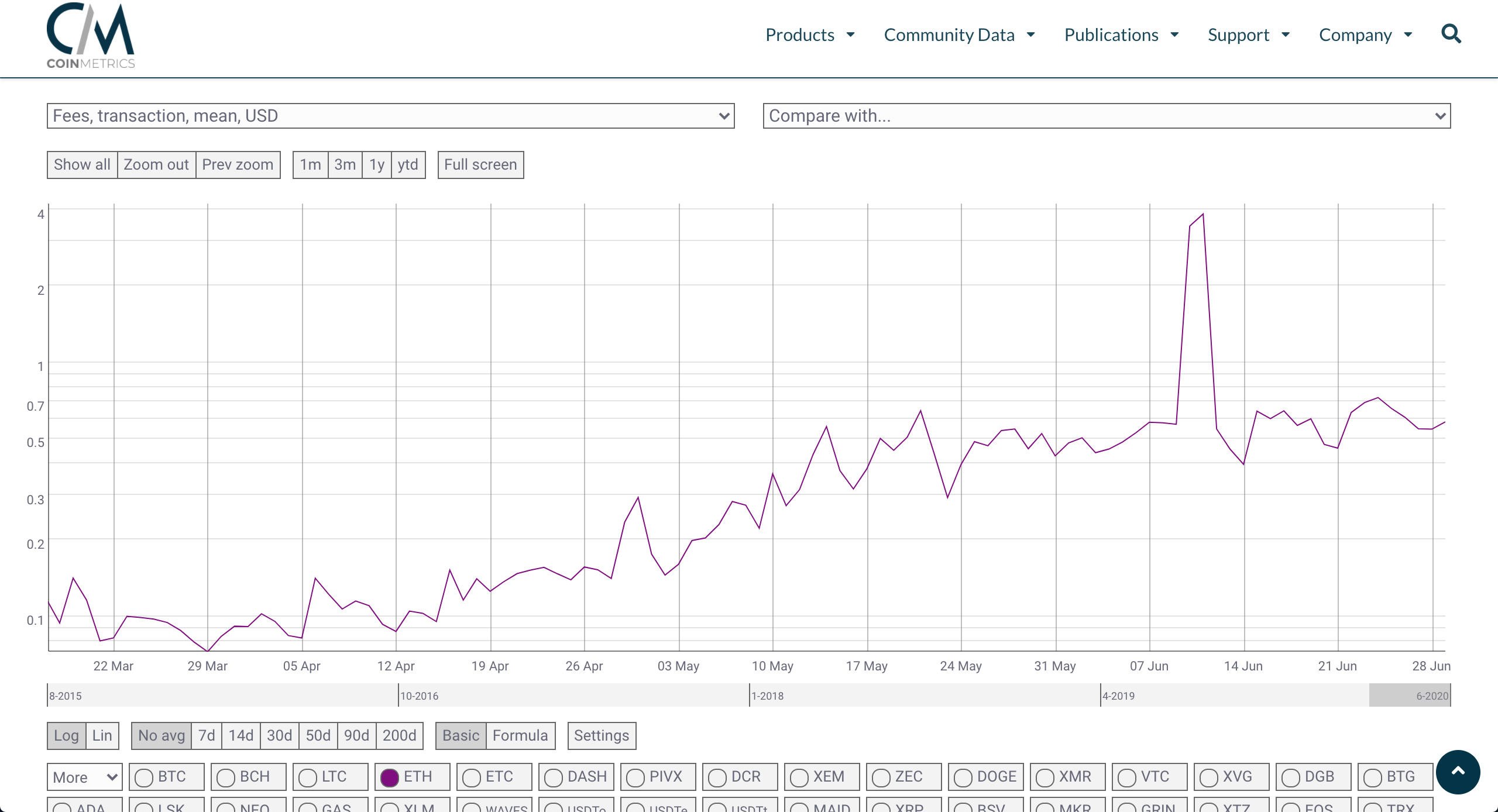

In the first chart at the top of this post, you can see the ETH Gas fees (Gas fees = transaction fees on Ethereum) climbing as of late. This is largely due to the increased level of activity in the DeFi space.

People from across the globe are starting to transact with DeFi contracts and protocols on the Ethereum network. We would all think that this is a great thing because it means that more real-world use of crypto-based applications are coming to the forefront... instead, we 're sitting here paying $15 to send a proxy transaction or manage a wallet.

Scalability Has Been an Issue for Years... Where's Our Solution?

Scalability on Ethereum has been an issue for years. There have been a countless number of debates and rationalizations had over this issue of how to scale Ethereum and make transactions cheaper, faster and more user-friendly.

ETH 2.0 is the star of the show in this regard. We're all waiting for the PoS (Proof of Stake) to swoop in and save the day, but we still could be several months or years away from a full-scale implementation of ETH2.

So in the meantime, the developer community on the Ethereum network has been considering interim solutions to try and combat this scaling and user-experience problem.

EIP 1559

Economic Improvement Proposal 1559 is a proposed solution to solve the gas fee issues of the ETH 1.0 network. Co-authored by Vitalik Buterin himself, this solution opts to create a sort of "algorithmic price discovery" for transactions on Ethereum.

A simple analogy that's being tossed around is a regulated highway. You could think of this change being akin to creating a highway that can dynamically open and close lanes depending on current market conditions. On the side of the road, you also have a fast-pass lane where people can pay extra to have their transactions scooted to the front of the line.

This proposal would accomplish this by creating 2 new rules for transaction fees:

- A BASEFEE for all transactions on the network

- An optional "tip" for miners (allowing you to tap into that fast-pass lane)

There are some interesting dynamics at play here, but I'm currently taking a backseat on most of my Ethereum transacting. I'm still using certain DeFi contracts, but only when it's a critical transfer and I'm transacting in larger amounts as well.

My main concern is that these issues of scalability, high fees and an overall poor user experience is reaching the masses. I want to see a world where anyone can transact instantly, globally and freely on blockchain tech. With Hive, we already have that - albeit on a smaller scale than a network like Ethereum - but I'm waiting for these larger chains to catch up in terms of UX.

Join The LEO Community and Transact for Free!

LeoFinance is an online community for crypto & finance. We run several projects that are powered by Hive and the LEO token economy:

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

Posted Using LeoFinance

I have a presence on Minds where I own some on chain tokens I use to boost posts. Some days the cost of buying boosts is really high. I usually wait for ETH gas prices to go down. It’s discretionary.

I don’t quite get what effect this has on stablecoins, if any. Hopefully the upcoming changes bring the cost under control.

Posted Using LeoFinance

Stablecoins are contributing to the high tx fees (because of congestion from massive amounts of transfers).

I agree with your approach, picking your timing definitely matters. I am always waiting for low gas fees before initiating any transfers.

Posted Using LeoFinance

is there a LEO plan to build a DEFI platform?

Posted Using LeoFinance

Congratulations @khaleelkazi! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!

Contained in every problem is an opportunity.

If DeFi is a big reason for the congestion while Hive has feeless transactions, perhaps we could help with that situation some.

Hmm something to consider.

Posted Using LeoFinance

It's redonk I was doing some trades using Uniswap and back to my atomic wallet and it's crazy how expensive ETH transfers are getting they used to on beverage like 10 and 20 cents. I don't think POW is meant for scale and that's why they want to move to staking.

I do like what's going on with the lightening and liquid network since you still get the support of POW once you go back on chain but off-chain you can do transfers supercheap

Im currently hoarding eth to get the 32 unit stake