This is a follow-up post to the Bitcoin Dollar-Cost Averaging Strategy that I talked about in a LeoPedia article last month.

In that article, I showed the numbers and talked about the idea of using a fractional portion of your paycheck to average-in to a Bitcoin position. Many people are curious about the Bitcoin and Crypto space, but don't know where to start.

Alongside a difficult onboarding process, many of these new potential users are also afraid of price volatility. In other words, they don't want to be the person who bought Bitcoin at the top - on December 17, 2017 when Bitcoin reached an all-time high of $19,531.55 USD/BTC - and got caught holding a bag of Bitcoin as it rapidly dropped down to a low of $3,233.34 USD/BTC on December 15, 2018.

In my opinion, dollar-cost averaging with a small amount of money is the solution to both of these problems:

- By slowly investing with a small amount of capital on a regular basis, you become engaged and increasingly informed about Bitcoin with low risk and time commitments

- By investing over a long-time frame with a consistent amount of capital, you reduce your exposure to wild swings in price

The best way to illustrate this is by using BTC's price history to create models of varying situations. In my prior post, I showed two scenarios where the investor would have simply started the strategy either 2 or 5 years prior to 7/29/20 (the day this was written) and continued until the published date.

In this post, we'll examine two different scenarios that use the same start date but have two different ending dates. The purpose is to answer a few common rebuttals to this strategy of buying BTC slowly and over a long-time frame:

- "what if I pick the wrong time to start?"

- "what if Bitcoin starts dropping significantly after I start buying?"

- "what if I want to stop buying when BTC drops in value?"

- "why shouldn't I just time the market and buy-in when the price seems low?"

In both of the following examples, the investor would have chosen the worst moment in recent history to start buying Bitcoin - on the day of the All-Time High (December 17, 2017).

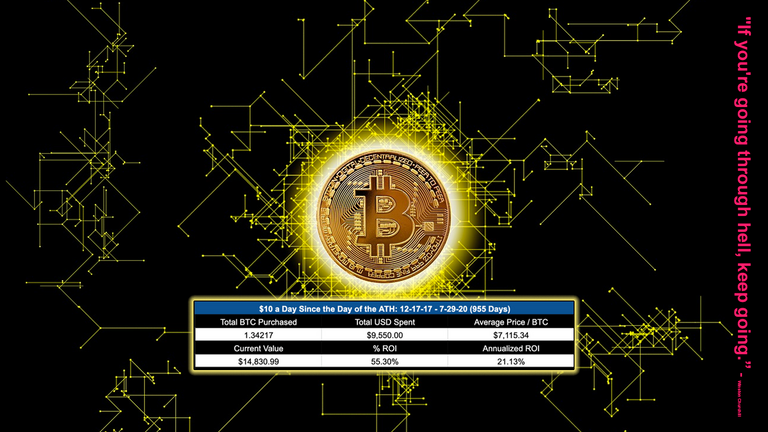

Scenario 1: Buying at the All-Time High to Present Day

Details:

- Investor starts programmatically dollar-cost averaging by purchasing $10 worth of BTC each day starting on 12/17/2017 (when Bitcoin's price was $19,531)

- Despite wild price volatility (during this period, BTC's price started at a peak of $19,531 and subsequently hit a low of $3,233 USD) the investor does not stop nor change the programmatic buying of $10 per day

- This gives us a start date of 12-17-17 and an end date of 7-29-20 (955 days or ~2.61 years)

All said and done, the investor has purchased 1.34217 BTC for a total of $9,550 USD (an average buy price of $7,115 USD/BTC).

The value of BTC on the ending date (7-29-20) was $11,050 USD. If the investor sold all of the BTC they had purchased during the previous ~2.61 years on 7-29-20, they would have a total return on investment (ROI) of 55.30% or an annualized rate of return of 21.13% per year.

The primary point of this scenario is to highlight the importance of dollar-cost averaging as opposed to "chunk buying". The issue with an asset like BTC is that it is so early in its stages of adoption. When you're dealing with an emerging market, you'll find wild levels of volatility and an even higher amount of fake market analysts.

Analysts will try to pin a price on an asset like Bitcoin. They'll try to rationalize the price of BTC today and then try to convince you of their price predictions for tomorrow.

The only thing that has been predictable about the price of BTC over the past several years is that it goes up over long timeframes. Outside of that, none of us have any idea what a Bitcoin is actually worth.

Bitcoin has many of the hard money principles that something like Gold has. One of its primary functions is as a store of wealth: an asset that will appreciate with time (and most importantly: not depreciate with time). BTC is a scarce asset - there is a fixed supply of Bitcoins that can ever exist in the world - 21,000,000.

Because of this scarcity, we can expect that BTC's price will appreciate with time as demand either remains flat or (more likely) increases and supply stays the same.

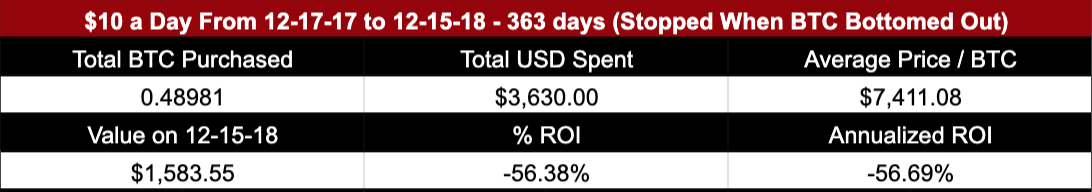

Scenario 2: Buying at the All-Time High and Stopping at the Bottom

Telling people to invest in Bitcoin can be a tough thing to do. As I mentioned earlier, most people who are either watching from afar or who are just getting started with cryptocurrencies are afraid of the volatility of BTC's price.

Volatile assets often shake the trees that investors sit in. When the tree shakes (the asset's price swings up or down by a large %) some investors inevitably get shaken out of their positions. On the upside, many investors will sell far to early - fearing that the price will drop. On the downside, many investors will "FUD" (fear, uncertainty and doubt) their way out of a position - selling for a loss out of fear that the price will continue to drop drastically.

Here is a scenario that I modeled out of an investor who - like our previous investor - got started on the day of the all-time high:

Details:

- Investor starts programmatically buying $10 worth of BTC each day starting on 12/17/2017 (when Bitcoin's price was $19,531)

- After weeks and even months of price decline, the investor grows worried and exits their Bitcoin position on 12-15-18: when BTC's price bottomed out at $3,233 USD

- This gives us a start date of 12-17-17 and an end date of 12-15-18 (363 days or ~1 year)

On December 15, 2018 we are assuming that the investor had enough of the price decline and no longer had confidence in the long-term value of Bitcoin. They cancel their programmatic selling program and offload their BTC - assuming that the price will decline further.

All said and done, the investor has purchased 0.48981 BTC for a total of $3,630 USD (an average buy price of $7,411 USD/BTC).

On 12-15-2018, the position was worth $1,583. Closing it yielded an ROI of -56.38% (a loss of $2,047).

Keep Going

"If you're going through hell, keep going." - Winston Churchill

The moral of the story is that once a programmatic strategy of buying a volatile asset like Bitcoin is started, the investor should be wary of emotional tendencies to cut & run early and/or "get out for a loss."

Whether it's a high level of conviction in the technology and economic principles that govern Bitcoin or something more simple such as a "non-interest" in the daily price fluctuations of BTC, the investor that wants to be successful with a strategy like this needs to be an investor who continues the strategy regardless of the week-to-week or even year-to-year fluctuations of Bitcoin.

Again, calling back upon the first post I wrote about this strategy, the purpose of choosing a number such as $10 a day is to choose something that is large enough to make a difference if Bitcoin is successful, but small enough to have no impact on daily lifestyle if Bitcoin is not.

With this in mind, a passive investor shouldn't worry about the price dropping to lows while the strategy is in progress. In fact, the more the price drops, the better your cost basis becomes and an argument could even be made to scale the strategy into weakness and scale back into strength - a topic that I will most likely follow-up with after this post.

LeoFinance is an online community for crypto & finance. We run several projects that are powered by Hive and the LEO token economy:

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

Archived on LeoPedia

Posted Using LeoFinance

How to get rich, save more than you spend, put it into something that either is a deflationary hedge or provides a passive income, then have patience to stick with it for as long as possible. As a greedy sat stacker, what I do is DCA in each month and then split some into DE-FI to go to work for me and add additional sats over and above what I buy

When all is said and done will consolidate into my ledger and look for great deals to leverage my BTC in the future, never sell only leverage, selling is losing

These are great rules. They passthe "refrigerator test". I have a very similar approach with my BTC/sat stacking activities. There are some great leverage points in crypto like CDPs and other use cases

Posted Using LeoFinance

Wow, even a small investment of 10$ repeated over a period of 2.6 years, would yield such high returns.

Using consistency and compounding, we can have big results with small continuous actions👍

Consistency is everything. The only people that I know personally who have lost money in crypto are the ones who bought in during a moment of FOMO/Hype and gave up when it all started dying down

Posted Using LeoFinance

Plain language and readable even by non experts. I should share this post to my friends who frown on crypto investment :) This article helps in re-solidifying my recent decision to learn more about crypto and potentially invest.

Posted Using LeoFinance

Please do share it. My goal with this is absolutely as you described - to speak with the potential crypto investors out there who are curious about the space but haven't yet taken the plunge

Posted Using LeoFinance

Yeah for sure. Managed to bulldozed my brother to invest on BTC every paycheque. Let's see if he will make the 40% ROI in the next five years.

Ra

21% return sounds solid

Posted Using LeoFinance

It's quite a good return in terms of the entire financial arena and the opportunities that are out there. Then if you factor in the timing (getting started on the worst possible day in BTC history -- $19k+ per BTC), then the returns look phenomenal. I've used other timeframes and find the APR to be around 30-50% depending on the start date

Posted Using LeoFinance

Love the concept...as I'm deploying the strategy with my Dcity rewards :)

Posted Using LeoFinance

Haha love it. You're taking it a step further by utilizing an asset's income to build another asset position. Stacking SATs at its finest.

Posted Using LeoFinance