Authored by: @hetty-rowan

Ah, how I wished

Can you still remember? February 2011, when Satoshi Nakamoto introduced blockchain technology and Bitcoin was the first cryptocurrency to be launched. The value of Bitcoin was only 1 dollar! Satoshi designed Bitcoin in response to the failing monetary system that is highly subject to inflation. In Western societies we see that this is rather steady, but if we look at the hyperinflation in countries like Venezuela, we can start to seriously question fiat money. That many people ask themselves these questions may have become clear in recent years. As you may have noticed, it is now impossible to buy a Bitcoin for 1 dollar. The value and popularity of Bitcoin has increased enormously, and Bitcoin is increasingly seen as a store of value. But why?

What is Bitcoin?

Before we can discuss Bitcoin (BTC), a digital asset in terms of store of value, it is important to know what Bitcoin actually is and what the underlying ideology of Bitcoin is.

Fiat money

We hear more often that Bitcoin is a bubble and that it has no value. These statements more often stem from ignorance and the lack of a physical currency such as the dollar or euro. To understand its value, we need to look at the initial purpose of Bitcoin's arrival. As an average citizen of the United States in the 1950s, if you had $1 million in savings, it would be worth only $100,000 today. In just a few decades, the value of money has plummeted and in recent years as much as 1/3 of all dollars in circulation have been printed. Consequence? Fiat money is decreasing in value and purchasing power is changing drastically. In return, Bitcoin was created to counter this inflation with the aim of creating a stable currency without interference from outside parties, so Bitcoin works as a peer-to-peer network. It is these government agencies that print money and thus promote (hyper) inflation.

Decentralized

The decentralized nature of Bitcoin makes it a peer-to-peer network where external parties have no influence on the value of this digital asset. Why is that so important? Without interference from financial and intentional parties, the price develops in the market between supply and demand. Many people question Bitcoin because it has no intrinsic value. They forget that a 10 euro note has no intrinsic value either, but that we as a society have given it a certain value. This is in contrast to gold, which we will come back to in a moment.

scarcity

Scarcity is a concept that is always favorable for the price. Why is the purchasing power of fiat money plummeting? By continuously printing money, we create more supply. As a result, the product, in this case bills, becomes less scarce and the value decreases as a result. Bitcoin is capped at 21 million, most of which is already in circulation. This scarcity causes FOMO, but also that the value of this asset will increase as more Bitcoin is held. This is a classic example of general economics, the relationship between supply and demand.

Payment method

We now know the world of crypto as a very diverse environment with an unprecedented number of protocols and crypto coins, each with a different purpose. This market has developed very strongly in the past decade. Satoshi's goal with Bitcoin was to generate an alternative means of payment. He wanted to turn this digital asset into a stable alternative currency with which everyone could pay collectively. The value of this currency is then determined by the network itself, namely the users. Last year we were delighted to see Satoshi's goals become more and more a reality. Institutional organizations are investing in Bitcoin and even mainstream banking systems are including Bitcoin on their agendas for the future. In addition, there are already various products worldwide that you can pay with Bitcoin. An important caveat here is that transaction speeds are still slow, which makes Bitcoin less than ideal as a contemporary means of payment.

Intrinsic value

We see that many institutional organizations are buying into Bitcoin, which gives the first crypto coin much more power. The price forecasts are therefore favorable for the coming years. However, time will tell whether the price will develop as positively as predicted. But even if Bitcoin were worth $100,000, critics are still looking for its intrinsic value. The Bitcoin as a crypto currency, in the early years never got a certain value, unlike gold and silver or stocks. The current value Bitcoin currently has is based on trust and the fluctuations of the current market system. Skeptics will therefore say that Bitcoin is a bubble, but from when does something become a bubble?

Bitcoin as a bubble?

Any form of crypto, including Bitcoin, is a bubble if one does not believe in the purpose of the project. Bitcoin aims to become a new means of payment, and it looks like this aim is becoming more and more a reality. Especially now that you can pay with Bitcoin in more and more places. And Bitcoin has even been made a national currency in El Salvador.

Although it is questionable whether we want to pay with our Bitcoin, because we are so used to euro / dollar values that we automatically calculate our Bitcoin in those euros / dollars. And we see through the fluctuations in the price of Bitcoin that one day we pay $100 for a product, but two days later it could be $200. Do we want to pay with Bitcoin? And if we don't want that, does that make Bitcoin a bubble?

A project is a bubble when investors don't believe in the underlying ideology/technology, and are only interested in their own profit. A pump and dump is a good example of how this market can be influenced. Suppose you don't believe in Bitcoin, but you see that the price is rising nicely, so you buy in, with the intention to sell again within a certain time. When this happens on a large scale, a crypto is a bubble that loses value. In the case of Bitcoin, and Ethereum, we see that crypto is gaining more and more support and that more and more investors are determined to hold on to their coins. They step in, but no longer with selling as the first goal. They step in because they see it as a store of value, the new gold.

New gold?

To say right away that Bitcoin is the new gold is a dangerous statement. This is because they are two different things that are difficult to compare. Yet it is often said that Bitcoin is the new gold, especially when we look at the price. Earlier this year, the value of Bitcoin was higher than the value of gold, which is an important milestone for Bitcoin's development. And yes, I'm talking about development, because even though Bitcoin is a daily fare on our plate, many other people have still not gotten beyond just knowing the name Bitcoin because they listen to the news on TV. For many people, crypto, Bitcoin, is still a very new and even 'scary' technique that they don't want to know anything about and certainly don't understand anything about.

Physical product vs. computer code

Gold has broad support, because it is a physical product and has served in the past as a valuable product that retains its value. Bitcoin, on the other hand, is a virtual currency that you purchase and hold in a wallet. This coin will never physically see you and therefore raises more questions because it is an intangible thing. “How can a currency that doesn't exist have value?”.

Capacity

The fact that something is intangible makes it more difficult for many people to appreciate something. If we look at the history of money, for example, we see that the first bills were based on a representation of gold. From this philosophy, the concept of 'money' has continued to develop, which has ensured that decades later, money is purely based on trust. The confidence that the money we have is a true representation of the value of gold. Now I don't have to explain to you anymore, that this has not been the case for years. However, the trust that has been built up over many years for the fiat money, that trust is not yet there to the same extent for Bitcoin. Although trust in Bitcoin is growing! Where trust in fiat money is declining.

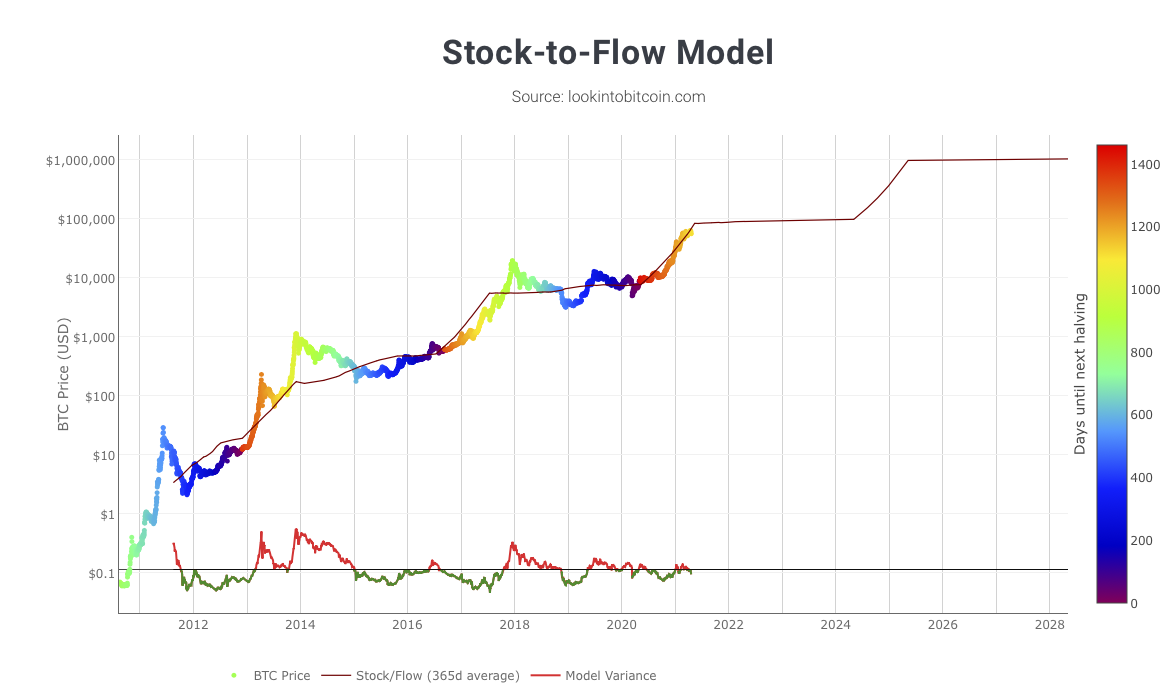

Stock to flow model

What is S2F model? The Stock to Flow (S2F) is a way to determine the price of a product based on the supply. It is calculated by dividing the amount in reserve by the amount produced annually. This is also known as the storage of value goods, as they can keep the same or even higher value for a longer period of time. A well-known example of this is gold.

It is estimated that about 200,000 tons of gold have been mined. This amount is what they call the stock in the S2F model. Meanwhile, up to 3,000 tons of gold are still extracted from the ground every year. We call this additional quantity the flow.

This ratio indicates a quantity, the amount of a certain asset that comes on the market every year compared to the total supply. The higher this Stock to Flow ratio, the less of this is marketed relative to the total supply. The higher the ratio, the more stable an asset is.

Scarcity in itself does not determine the price. Based on the above example of gold, we can say that gold is not very exclusive. The Stock to Flow ratio does show how valuable gold is, because the annual production is relatively scarce compared to the total supply and happens at a constant base.

Bitcoin S2F ratio

If we look at Bitcoin's Stock to Flow model, we immediately see a whole lot of interesting information that tells us more about the value that this virtual currency brings.

The red line is the Stock-Flow ratio determined on the ratio between the amount of reserve and the total amount available. At Bitcoin we now know that there are only 21 million Bitcoins and that 18 million of these are already in circulation. The scarcity that Bitcoin entails naturally affects the model below. The use of the different colors gives an indication when the next halving will take place.

Valuation

The Stock to Flow model is just as important as it gives an indication of valuation. In this way we can check whether the value of a product is overestimated. Suppose Bitcoin is currently at $200,000, Bitcoin's valuation is currently inaccurate and overestimated. The result is that the current value will also fall and a correction will take place. What is interesting to see, however, is that this model gives an indication for the coming years, until 2028. When this price does not match the Stock-Flow ratio, as in 2014, we see that the price of Bitcoin recovers to the effective value it represents according to the S2F model. If we look to the future and these predictions were to come true, it looks like the future of Bitcoin is very bright and everyone who currently has Bitcoin in their wallet will benefit from it. We see that the value is currently in sync with the current value of Bitcoin. Are you a real hodler? Then it may just be that in January 2026 your Bitcoin will be worth no less than 1 million dollars. Whether this will actually happen remains to be seen, but the S2F model is a very interesting approach.

Still, the S2F model is not foolproof and this approach is also criticized. For example, it would not be useful in the longer term to predict future prices. However, it allows us to compare the scarcity of gold and Bitcoin in the same way.

Conclusion

We all want an answer to the question of whether Bitcoin is the new gold, the new store of value that will give us financial security in the future. It is too early to answer that, time will tell how Bitcoin will develop further and will depend on how many people are stubbornly holding onto their Bitcoin. If every hodler is determined to hold onto their Bitcoin for the next 10 years, then it is realistic that having Bitcoin will become a new store of value, just like gold or silver.

However, we must not forget that the world of crypto is a volatile market and that price fluctuations here occur faster and more extreme compared to the price of gold. It will further depend on how much attention Bitcoin still gets and how much support it manages to gain in the future. The interest of institutional organizations is already a step in the right direction.

We cannot ignore the fact that the cryptocurrency of coins has done extremely well when you consider that in February 2011 a Bitcoin could be bought for 1 dollar. With a probability bordering on certainty, I can say that you can never buy 1 Bitcoin for 1 dollar again. What fiat money has ever delivered a feat of such magnitude?

Bitcoin's growth is not expected to stop just yet. It is also expected that fiat money will continue to fall in value.

Which choice do you make, do you keep your fiat money, or do you invest in Bitcoin to keep it for years to come?

Posted Using LeoFinance Beta

I have been slowly adding more and more crypto to my portfolio for the years to come. Not sure yet how exposed I want to be to crypto, but for now I'll keep adding.

Posted Using LeoFinance Beta

Well I don't have that much BTC but I do know that I will probably HODL a decent portion. If the price every reaches high enough, I might sell a tiny portion to get back my initial capital.

Posted Using LeoFinance Beta

To the current devaluation in my country currency, opting for Bitcoin and cryptocurrency has been a great way to store value. Over time the plan is to hold more BTC

Read how this all have started with Toruk

Posted Using LeoFinance Beta