Wrapped LEO (WLEO) is returning to the LeoFinance ecosystem on November 10th. With this reintroduction, we've made a lot of significant changes to the architecture of WLEO to create a secure, robust and highly redundant system to prevent past events and future reoccurrence.

Prior to the launch, we're going to unveil the different aspects of this new ecosystem. Today, we'll focus on the new geyser distribution program for liquidity provider (LP) incentives. This distribution mechanism was built for the original WLEO ecosystem. The intention was to launch it after the 90 day bounty period expired, but now we'll have it ready to launch at the beginning with WLEO V2.

Providing liquidity is one of the most valuable ways to contribute to an ecosystem like LeoFinance. Without liquidity, there would be no value to the rewards that are distributed on LeoFinance.io. Having deep liquidity allows big investors to step in and buy/sell large amounts of the token. Many have discussed these issues in the past with coins like HIVE that have very low liquidity.

While having low liquidity is great in some cases - namely, for massive price volatility (to the upside and downside) - it also turns off a variety of investors who have personal requirements that they can easily buy and sell an investment.

With WLEO V1, we all saw what happened to the price of LEO/WLEO at launch and in the weeks that followed. Having such a depth of liquidity ($450,000 USD at its peak) gave our community an incredible level of value and ease of access for large investors.

Some major investors like @onealfa are a prime example of how this allows people who want to deeply invest themselves into a project can only get involved when the liquidity is extremely deep. If he tried to buy any number close to the amount of tokens he now holds on Hive Engine/LeoDex, the price would've instantly mooned. The thin liquidity on this niche exchange is well known to all of us who've been involved in the project.

The price of LEO rose from $0.04 to $0.30 during the launch of both our new UI and the WLEO liquidity pool. Depth of liquidity and ease of access can simply not go understated. They are key components in buidling a successful project.

WLEO Geyser Distribution Program

We've been hinting at this fascinating new development for weeks now in the LeoFinance Discord. A number of users are extremely excited about this implementation and what it means for the long-term health and strength of the LEO economy and a number of other users have no clue what this means.

The term "Geyser" is utilized by a variety of DeFi projects on the Ethereum blockchain. For our purposes, it simply describes the overarching methodology in which LEO/WLEO rewards are paid out to liquidity providers on Uniswap (and other exchanges).

As a liquidity provider, you deposit WLEO + ETH (and in the future, WLEO + other cryptocurrencies) into a liquidity pool and then you receive a tokenized representation of your share in the pool - known as an LP token. As investors swap crypto on the exchange, they pay a small trading fee to the liquidity pool which is distributed to LPs based on their % ownership in the pool.

Many projects offer additional incentives on top of the fees collected for being an LP. This is especially important for projects that are newly launching on these exchanges since the volume and liquidity start at 0. In order to spur activity, an "early bird" incentive of sorts makes a world of difference. We've modeled the new distribution system after a number of other projects in the DeFi space but put a few spins on it to make it our own.

The WLEO geyser pool distributes LEO/WLEO tokens to liquidity providers based on the length of time their liquidity is in the pool relative to others.

The more liquidity you provide and the longer provide it, the greater your share of the daily LEO/WLEO incentives pool.

Where Do the Incentives Come From?

Here's where things get interesting. Adding a long-term program for incentivizing liquidity providers in a sustainable way became a focus for us after the launch of WLEO. It's clear that a 90 day bounty program would get a lot of LPs into the pool initially, but then the question becomes:

how do you incentivize users to become a liquidity provider for the long-haul and reward one of the most valuable activities you can do for the LEO ecosystem?

To solve this, we turned to a variety of models and utilized our new LP simulator tool (details below) to play around with them. We ultimately arrived at the following model.

LeoFinance currently operates as a proof of brain based ecosystem. Users create and curate content and earn rewards from a daily pool of LEO tokens which come from a set amount of inflation each day. Other ecosystems have different models of distribution for new tokens, but LeoFinance's remains one of the best models to incentivize content creators who add their valuable posts to our UI and curators who reward the best content.

We've talked about this several times in Discord and other posts: LeoFinance is evolving far beyond a standard PoB-based economy. We're constantly adding new ways to earn, better ways to reward each other and more dynamic sinks and faucets to our ecosystem. The impact of a deep liquidity pool and WLEO's listing on Uniswap (and soon, external exchanges) is immense. We all saw that in the meteoric rise of the LEO price and attention on our platform over the past few months.

The current inflation-based rewards pool works like this:

- 85% of rewards are distributed to content creators and curators

- 15% of rewards are distributed to mining token stakeholders (PoS)

The current rate of inflation for LEO is ~2,000,000 tokens per year. This is quite a lot of tokens and a few users have actually recommended that we lower it. Others like @taskmaster4450 have continually made the case that inflation is only a bad thing when growth doesn't match or exceed the amount of new tokens entering the ecosystem each day.

As we've seen, the LeoFinance economy is tiny. A few updates here and a few more there and we see a major spike in volume and buying activity. Drawing back on the original idea laid out in this post: lack of liquidity is a great thing when some buying pressure enters and sends the token to the moon. Lack of liquidity is not a great thing for big investors or generally anyone who wants to buy/sell with low price slippage.

As a new economy (one that is only 16 months old), having this level of inflation also allows new entrants to "catch up" with the users who have been here for a while. We see this playing out with Bitcoin as the early miners were able to get hundreds of Bitcoins per day with very little work. Now it takes a massive operation to get a fraction of that.

The new LeoFinance economy under the long-term roadmap to rebuild WLEO and list it on Uniswap and major exchanges is introducing a third mechanism for distributing daily inflation: Liquidity Provider (LP) Incentives

- 70% Proof of Brain (Authors/Curators)

- 15% Proof of Stake (Mining Token Hodlers)

- 15% Proof of LP (Liquidity Providers)

This new branch of our ecosystem will allow us to incentivize people who provide liquidity to the LEO economy. Coupled with the geyser distribution model, this makes it incredibly profitable to become a liquidity provider for the long-haul.

A successful ecosystem does not have liquidity providers who continuously jump in and out of the pool. A successful ecosystem is one that finds mechanisms to reward the best behaviors that contribute to the long-term health of the project.

For LeoFinance, this means rewarding LPs who provide liquidity for months and even years on end. The longer they provide liquidity, the larger their incentive. As new pools are introduced (outside of ETH/Uniswap), we'll also be able to branch out with the geyser distribution model and share the LP incentives with those new pool providers.

After spending the last few weeks utilizing a few simulators, discussing our models with some prominent people in the DeFi space and LeoFinance users/stakeholders, I'm extremely excited to unveil the details of this new branch of LEO and also launch our project into the forefront of innovation in the crypto space.

How to Earn LP Incentives

- Provide WLEO - ETH liquidity (on Uniswap)

- Earn rewards

It's that simple. Other ecosystems require you to stake tokens - which is something we may design in the future - but we created a distribution model that doesn't use staked tokens. This saves you on a variety of gas fees for being a liquidity provider and also makes it easier to go into and out of the pool.

All you have to do is provide liquidity to the WLEO-ETH pool. We'll take care of the rest. From there, you'll either earn LEO or WLEO rewards paid out to your Hive account or ETH address each month - payouts are sent on the Hive blockchain or ETH depending on if you HiveLink your ETH address by first wrapping LEO and then providing liquidity.

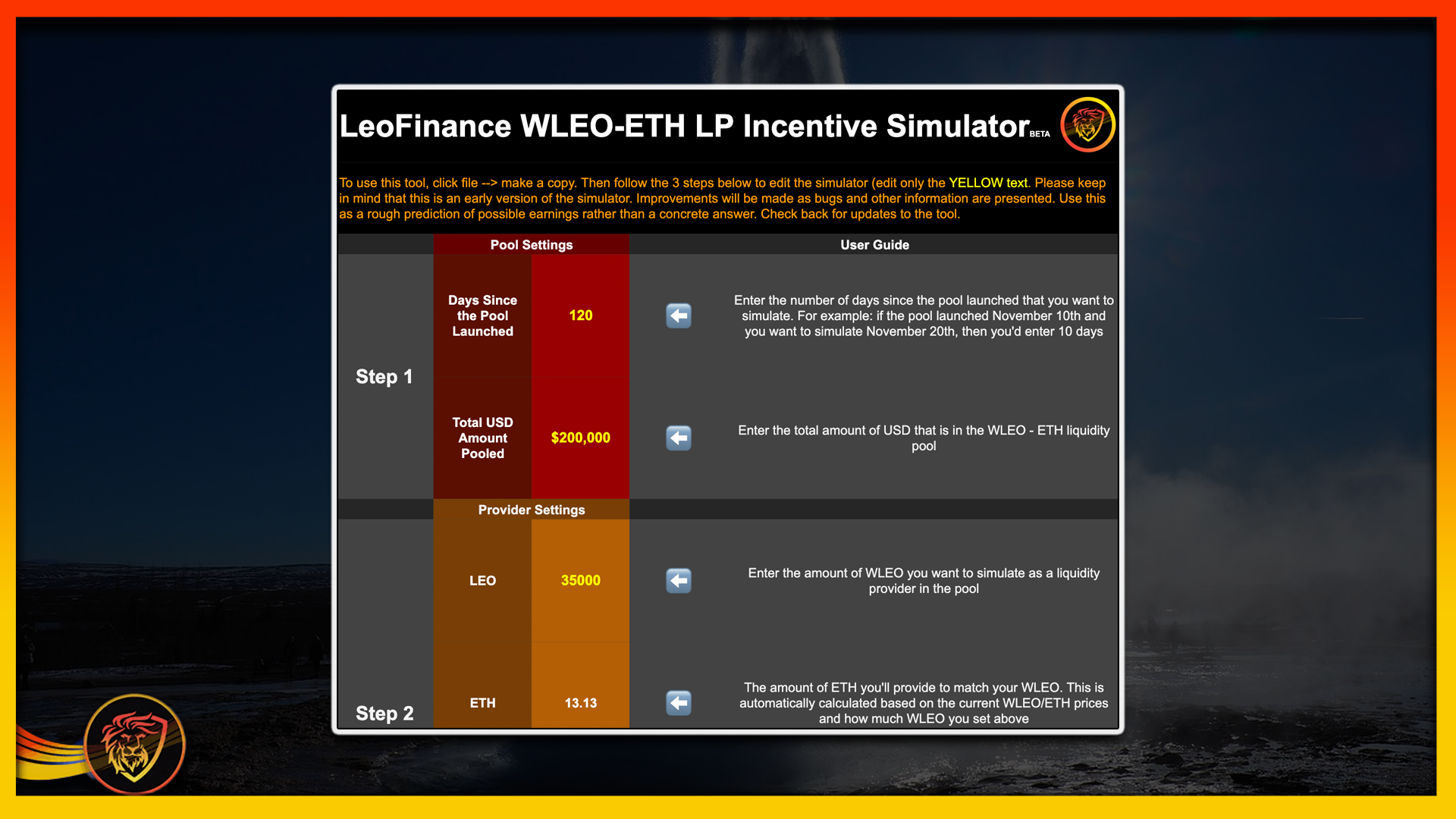

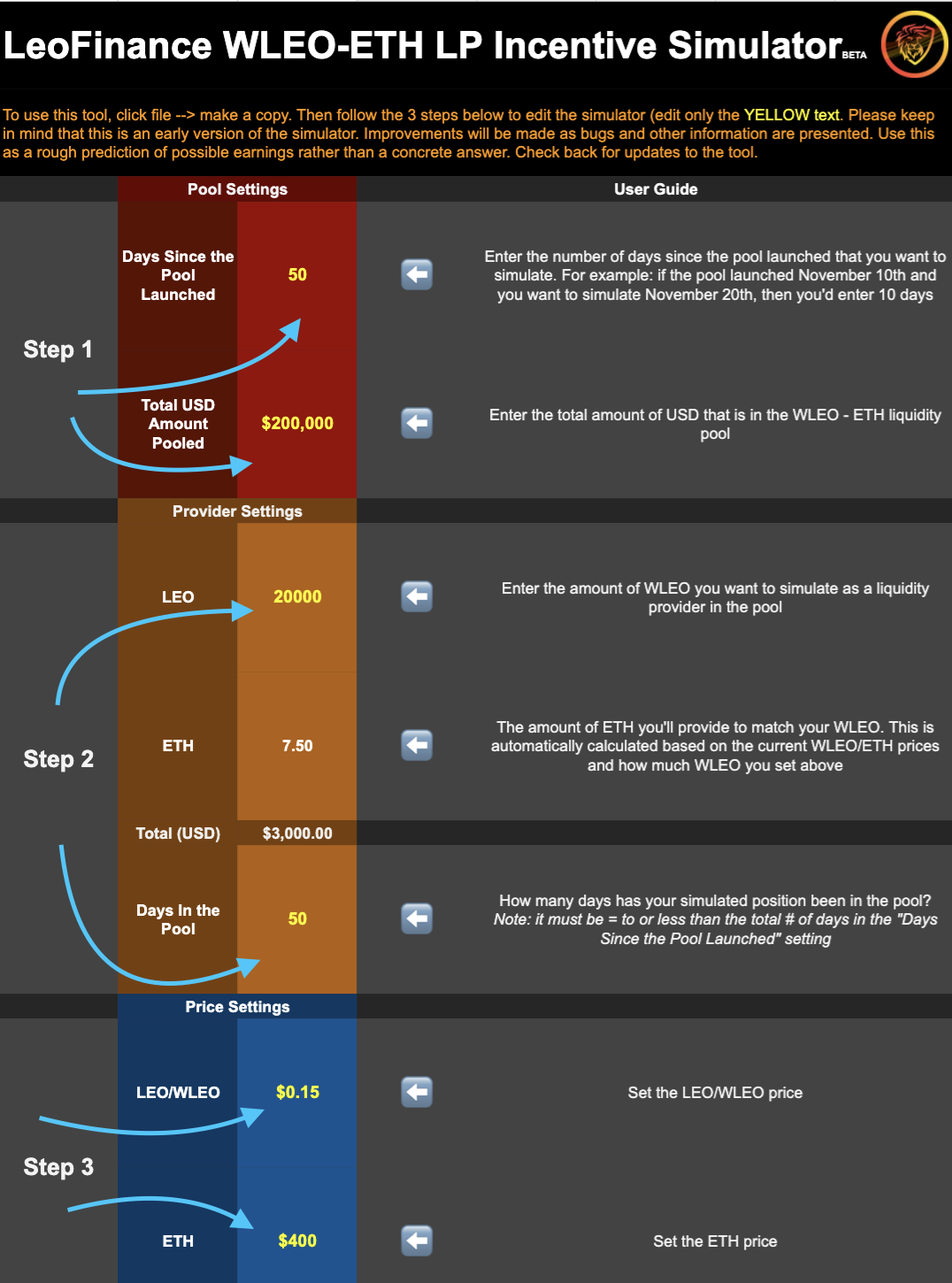

LP Incentive Simulator Beta

There are quite a few complexities with this distribution model. The formulas can be hard to grasp out of context. With this in mind, we built our own LeoFinance LP Incentive Simulator tool.

Please Note: we put Beta on this tool because it is an early version. There can be bugs and there can most certainly be changes/updates to the tool. Feel free to play around with it and use it as a rough guideline to predict future rewards as a liquidity provider.

You could think of this tool as a "draft" of the future tool that we're building. This one is a simulator to show you how the model works utilizing data from the prior WLEO liquidity pool.

The "Real" or more finalized version of this tool will actually be a real-time product where all you have to do is plug in your ETH address and then see your past rewards as a liquidity provider and also predict your future rewards based on real-time data pulled from Uniswap. The future version is modeled after the Thorchain Skittles project that you may or may not be familiar with.

The intention of this Beta Simulator is just to give a rough idea of how the distributions work and the APY of returns. I feel like we can't stress this enough.

How to Use the Simulator:

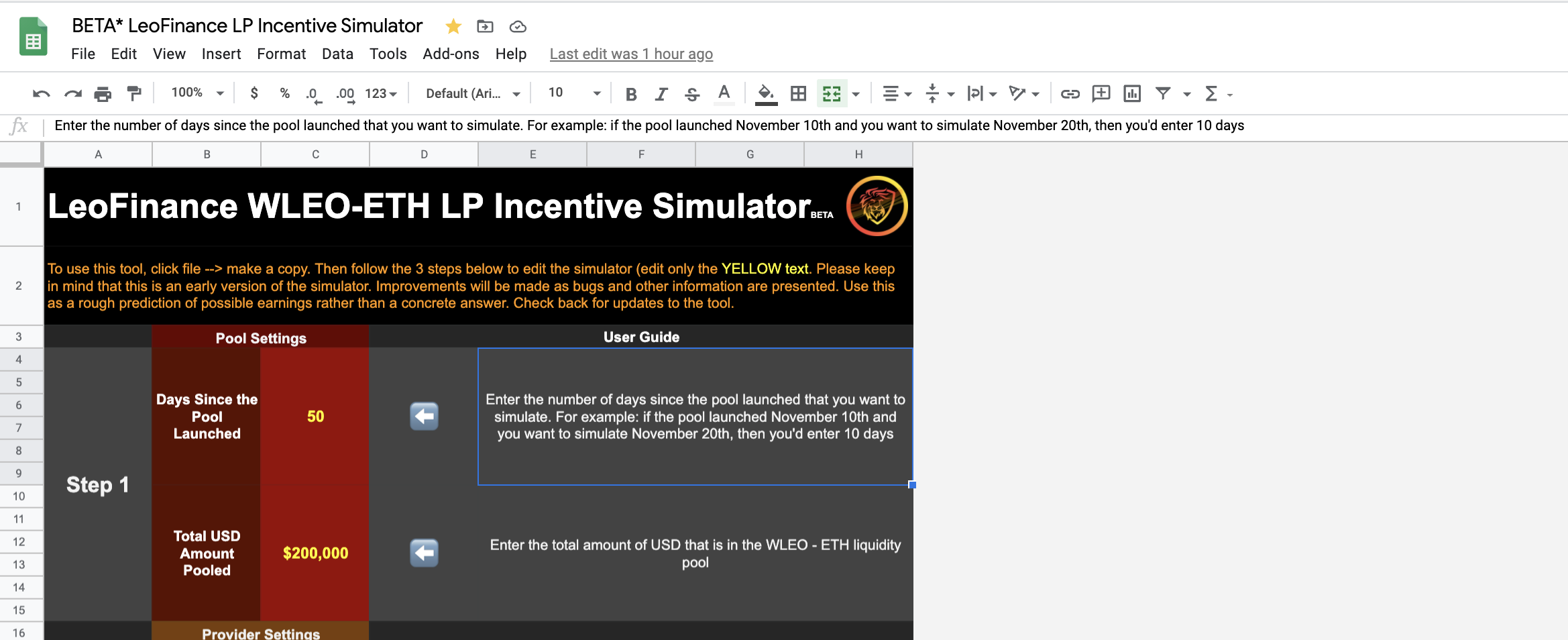

There are instructions directly in the google sheets doc, but I'll relay some simple instructions here:

1). Access the Simulation Tool

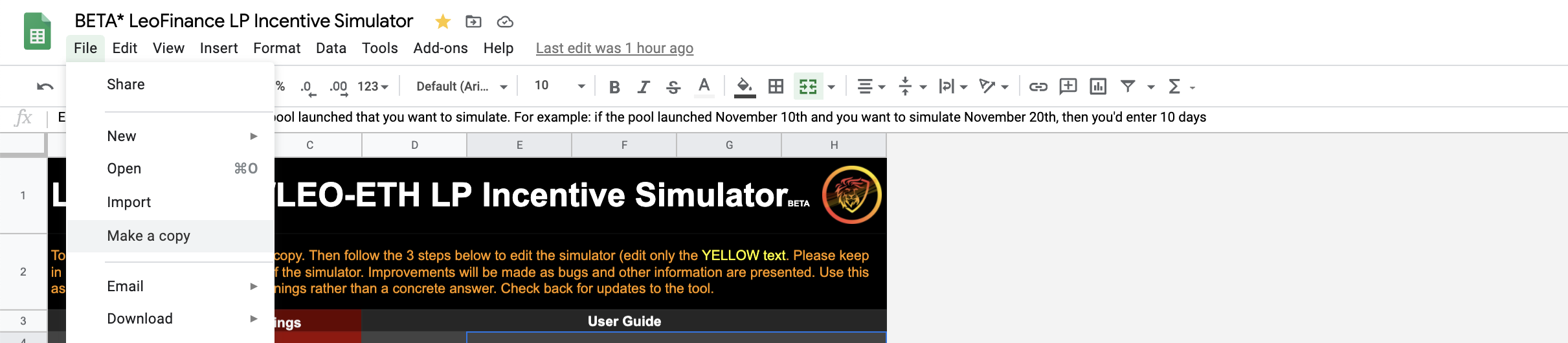

2). Click File --> Make a Copy

3). Edit ONLY the yellow highlighted text in the "Instructions" sheet

Follow the instructions on the right side for additional details. One aspect which may be a bit confusing is the "Days in the Pool" feature. Note that the "Provider Settings" are to simulate you as a provider in the pool. If you set the global pool settings to say "50" days since the pool launched, then you as a provider must select 50 days or less as being an LP (since you can't simulate being a liquidity provider longer than the pool is operational).

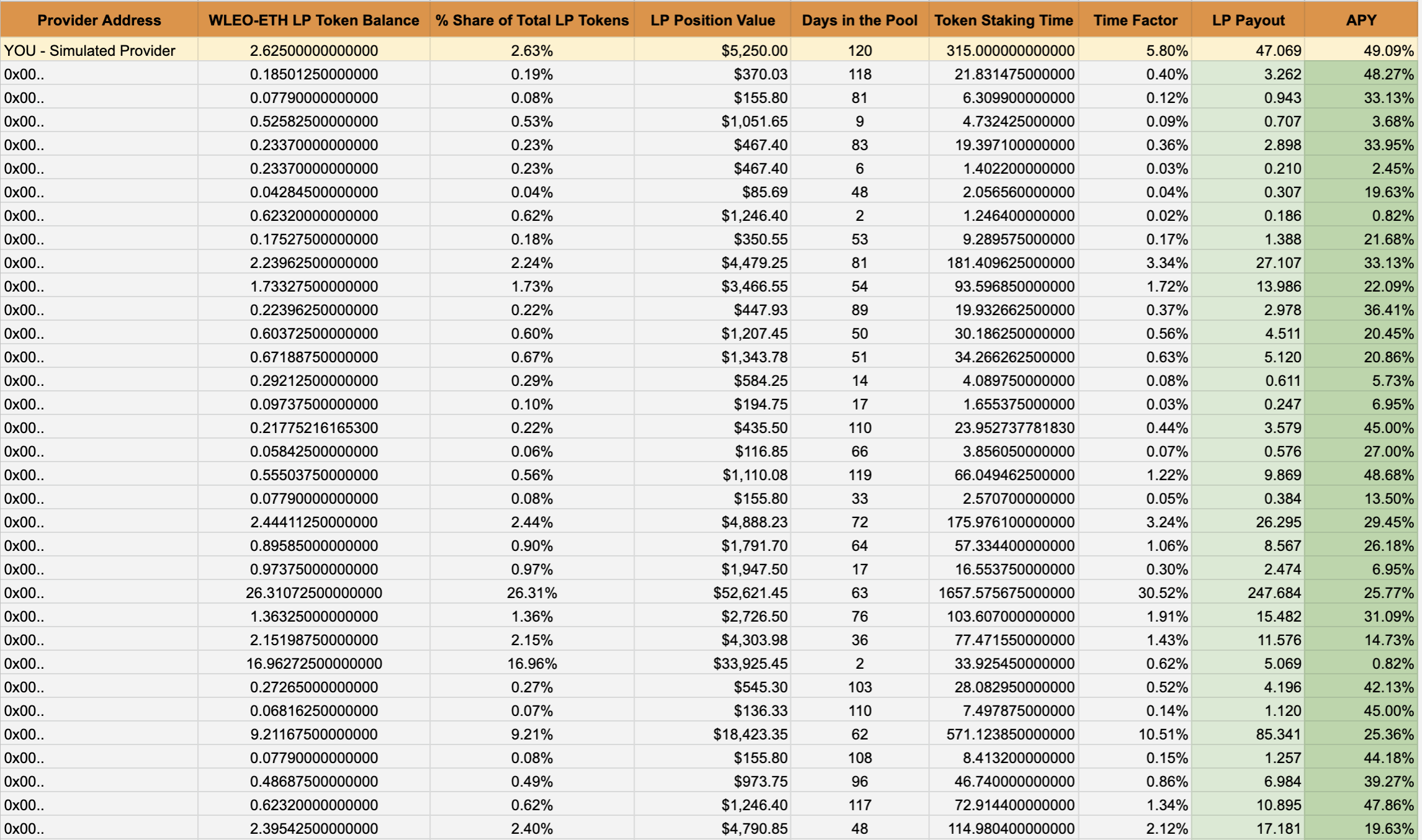

4). View the Table

Overall I think the tool is relatively straightforward but takes some time to dig through. It has some twists and turns and may not seem intuitive at first but plugging in some numbers and seeing the populated data on the table will likely give you exactly what we were aiming to provide: a rough idea of what you can expect to earn as a liquidity provider under the new WLEO Geyser Distribution model. @khaleelkazi will also post a video soon showing off the tool and explaining some key aspects and scenarios.

Frequently Asked Questions

I Don't Want to Mess Around With Simulators/Details. How Do I Maximize My Return?

There are definitely some users out there who fit this category. Nothing wrong with it at all. This stuff can be time consuming and many people just want to provide liquidity and follow the set it and forget it model.

Providing liquidity as early as possible and leaving that liquidity in the pool for as long as possible will yield the highest returns. It's that simple. If you want to mess around with calculations and understand the mechanisms that govern the size and payouts of those rewards, then you're free to do so and I hope we've provided ample tools for anyone who wants to geek out on it.

In future releases, we're aiming to work these APYs and figures directly onto the LeoFinance UI. Our end goal is that you'll go to your wallet page on LeoFinance.io and have a button to provide liquidity and then see your daily returns and projected yearly returns all on-site. No tools required.

What is HiveLink?

HiveLink is a system for linking Hive accounts and ETH addresses for liquidity providers. We developed it for WLEO V1 and the initial 90 day incentive program and have migrated it over to this new WLEO geyser model.

The benefit to linking your Hive account is that your payouts will happen as LEO on Hive as opposed to WLEO on ETH. This will save you some gas fees on distributions and for many users, will allow you to quickly stake the LEO rewards you earn. Others may not have a Hive account or may prefer receiving WLEO on Ethereum as opposed to LEO. For them, they can simply provide liquidity and not worry about HiveLink at all.

To HiveLink your account, you simply need to wrap any amount of LEO into WLEO prior to providing liquidity.

How Often Do I Receive Rewards?

In the prior incentive program, rewards were staggered for ETH and Hive users. This led to quite a bit of confusion so we built the WLEO geyser model with distributions happening 1x per month. Every month, all liquidity providers will earn their respective geyser rewards.

How Are Geyser Rewards Accumulated?

A snapshot of the WLEO-ETH pool is taken every 24 hours. This snapshot records the respective share of LP incentives for each liquidity provider.

What About Content Rewards?

We've discussed these changes to the overall distribution model for LEO/WLEO tokens in prior posts, Discord chats and amongst various LEO stakeholders. It seems unanimously in favor of this change as the recent history of WLEO has proven the value that this brings to the LEO token - and thus, any creator/curator who earns the token.

Some users may still have concerns over the changes to the pool. We want to hear all opinions and openly discuss changes like this. Feel free to continually discuss these changes as we have been doing in the comments/posts/Discord.

The main question is: does having deep liquidity bring more value than 15% of the yearly inflation? To everyone we've heard from thus far, it's a resounding yes. Liquidity providers can and should be rewarded for being a long-term user and value-add to the entire LeoFinance economy.

What's the Minimum for Participation in WLEO Geyser Incentives?

There isn't necessarily a minimum for the geyser incentive program. It is definitely not recommended to provide a low amount of liquidity due to gas fees and other costs associated with being an LP.

For example, if you're an LP with less than $100 in the pool, it's unlikely that your rewards will be significant enough to cover the costs of your gas fees in the first place. Staking LEO/creating content would provide the best return for this type of user.

Do I Have to Stake My LP Tokens in the Geyser?

As mentioned above, most ecosystems with Geysers implemented require you to stake your LP tokens for various reasons. The current implementation of our Geyser program doesn't require LP token staking. You simply provide liquidity and start earning LP incentive rewards. In the future, we may explore a more complex version of Geyser distributions which would require various forms of token locks/staking.

What Happens if I Remove or Add Liquidity to an Established Position?

We purposefully put this in the FAQ section as opposed to the main post body as it can be relatively confusing. As it works now, removing liquidity will not impact any of the remaining liquidity that you have left in the pool. The snapshots are taken daily, so the system will automatically reduce your share of the incentives pool based on the reduced amount of liquidity you hold. However, this doesn't impact the "Days in the Pool" figure for your remaining LP position.

If you add liquidity, things get a bit more complex. We've built in a calculation that averages your new liquidity against your old liquidity and factors in the time that your old liquidity has been in the pool. This impacts your "days in the pool" figure. The current version of the LP incentive simulator does not have an option in the Settings to play around with these effects yet. We're working on the next version of the tool which will have that. We'll post an update when the tool is ready and you can play around with those nuanced mechanisms.

Month-to-Month Roadmap Progress

Follow along as we deliver on our short-term roadmap. The next major update will unveil the details behind WLEO V2 which will be an even lengthier post than this one as we dive into the details behind a more secure version of Wrapped LEO ahead of the November 10th launch date.

LeoFinance is a blockchain-based social media community for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Hive Witness | |

|---|---|---|

| LeoDex | @financeleo | Vote |

|  |  |

Posted Using LeoFinance Beta

My head is spinning .... ! Ohhhh 😃

Posted Using LeoFinance Beta

well it is exciting to see what future updates hold

Why are you figuring out how much your LEO will be worth in about 12 months? LOL

Clue, it will be a big number.

Posted Using LeoFinance Beta

Emoji needs

Posted Using LeoFinance Beta

finally 5 more days to goo I like leofinance new vote vp% option on the top corner

We’re getting closer!

I’m a huge fan as well. I played with a few designs and I personally think this is the best VP display ever built on Hive :)

There’s a few other changes in the mix along with some updates that will roll out every day for the next 7 days or so as we officially launch V2 Phase 2 of the LeoFinance UI 🚀

Posted Using LeoFinance Beta

I miss the ticker on the top. It looked really cool.

Posted Using LeoFinance Beta

When is Phase 3? 😂

Posted Using LeoFinance Beta

I am very much new with the wleo project. I think I need to learn a lot and read more. it is clear that something good is happening with leo.

Posted Using LeoFinance Beta

Sorry. But I am not fucking selling

Have you seen the price? Its 1.65!

I want to add and was waiting for a pullback, but that may be wishful thinking at this point....

Posted Using LeoFinance Beta

I am buying some every day with my BRO hive dividends actually at market price. Why wait for a pull back when it's certain it will moon soon? At least compared to hive.

Your are helping me improve my typing skills, as I have to type faster everyday to keep up with the changes on this project. Which is an excellent problem to have. :)

The Leoborg Chronicles: the tales of the Leofinance Collective...

Its a metaphor related to Star Trek's infamous villains the Borg.

As you can see I feature a cyborg Lion......

This is my new story series on my Leofinance blog

Link

Posted Using LeoFinance Beta

This is a really huge project... I was just thinking what WLEO and Gaysers meant but now I understion that it's all for the purpose of paying liquidity providers. And this news of WLEO listing on uniswap makes this sound even bigger... I'm anticipating the project already, best of luck.

Posted Using LeoFinance Beta

Pool early and pool often. Got it

Posted Using LeoFinance Beta

Damn I wish I came up with that tagline.

Posted Using LeoFinance Beta

too late now haha

Haha, great tagline! We need to say that on the wLEO livestream cus you know we need to do it again.

Posted Using LeoFinance Beta

Wow already excited about leo and planning to buy 1000 Leo. Keep it up.

Ideas don't just run dry with leofinance, this would actually be brilliant, would be looking forward to the video version From Khal

I am in young sir! All the things I am learning about monetary topics is invaluable. I will invest, what I can.

To be involved, in my little way, maintaining LEO Finance's ranking as the premier blogging site on the HIVE Blockchain Network is an honor (wouldn't mind making a few bucks in the process as well)! 😎

Posted Using LeoFinance Beta

Can't wait to see what the future holds for LEO.

So 15% less rewards from now on for authors and curators. Interesting. Alas, LPs earn via inflation from now on. What about the fees from trading? I guess that stays as it is.(?)

Posted Using LeoFinance Beta

Certainly having the 15% inflation going to liquidity provides an enormous lift to the entire ecosystem. We have to realize that, even with the 2M inflation, there will still be less than 8M LEO after the next year. That is a drop in the bucket.

wLEO V1 showed what liquidity can do. When big players want in (or out) then need to be able to do that. It just isnt going to happen on leodex.

As much as we all love the mooning of our tokens, the reality is that this approach is much better. Token distribution is vital and, with all that is planned for leofinance over the next 6 months, there will be plenty of avenues to pull in more people.

Ultimately, we want to have the means where if someone wants to buy 100L LEO, he or she can. Right now, we all know that would be near impossible on H-E.

Posted Using LeoFinance Beta

If this early version of the tool provides an accurate representation of the actual APY, then it will be profitable for liquidity providers; very exciting stuff here.

Posted Using LeoFinance Beta

Nice to see that you guys stick to the main purpose of our growing community with the allocation of PoB. However, I question that could the percentage of Proof of LP be higher than %15 or is it the optimum rate 😅

Posted Using LeoFinance Beta

One of the best things ive seen today

Posted Using LeoFinance Beta

Way to go, this sounds great for LPs IMO! I'm not going to join in this time as I've not got the numbers and have also spent the refunded ETH.

As one of the stay-at-homes this time, I have no issue at all with the 15% LP incentive being taken from the content creator/curator pool. For one, as you state, the overall effect will be to bring more traffic and interest and this will more than compensate. For seconds (as I understand it), the amount of overall staked LEO will be less due to LP exodus, thus making votes and returns more valuable.

Posted Using LeoFinance Beta

Very good! Happy to accompany this growth, and LeoFinance's tireless development! Congratulations for the work! Leo to the sky!

Posted Using LeoFinance Beta

What is the exact meaning of LP Payout? It's the total quantity of LEO rewarded at the end of the period or a quantity/month/day?

Posted Using LeoFinance Beta

Congratulations @leofinance! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Excellent update, I am very excited and looking forward to these last days before the launch.

However, I have a simple question @khaleelkazi, the tool will show us at the end how many LEO I will receive daily right, you take the snapshot every 24 hours, after the simulation I perform, I only have to calculate what I earn daily x 30 days and that will be the monthly payment for being a liquidity provider?

Financial Markets Analyst

@lenonmc21

Posted Using LeoFinance Beta

Beside being a great article and containing all the information as a Whitepaper for wLEO launch, what I like the most is that you've included also the FAQ within it. The answer I was looking for and that also probably do was right there.

Painting a clear picture of the mechanics, use case and benefits of wLEO on Uniswap and the easiness to participate in it is bringing the right information for every user.

While I intended to put 1,000 LEO into the Liquidity Pool and after reading everything in this thread, I think the best option for me is to power up and continue my way as a content creator.

Posted Using LeoFinance Beta

So good.

Posted Using LeoFinance Beta

According to the simulator my return goes down the longer I leave my money in??!?

Posted Using LeoFinance Beta

There is an interesting relationship about staking for curation and providing liquidity.

For example, the curators earn roughly 35% of inflation (i.e. other 35% goes to the authors) and 15% goes to the LP. Then curators or long-term LPs have to decide whether to stake or be LPs.

The more staked LEO leaves for LP, the more rewards curators earns proportionally for their staked LEO. For example, there is currently 4.66M LEO is staked for curation.

If we assume 4M LEO are staked and 1M LEO goes for LP, then 4M earns 35% of the inflation and 1M LEO earns 15%. As an example, if daily reward is 5000 LEO, then a whale with 500K LEO will earn 218.75 LEO (500K/4M50000.35) for curation. On the other hand, if the same LEO whale can own 50% of the LPs, then he will earn 375 LEO (0.550000.15), on top of fees of trading.

This is a very simplistic example that shows the dynamism between curation and LPs. If LPs profit looks handsome, then more LEO will be unstaked and go for LP which will increase curator's reward. When LPs become crowded then LEO can left from LP to be staked for better curation reward.

However, big investors such as @onealfa can change the whole dynamics in very substantive way such as buying up 500K LEO from LP and staking up.

The bottom line is that there will be incentive for both curation and LP. Reward for LPs will not diminish curation reward. It will be forth and back, cats and dogs between LPs and curation.

Posted Using LeoFinance Beta

Wow, this is phenomenal and a lot to take in, but now I have a much clearer understanding of LPs and staking. I can't wait to be a part of this, more updates as the geyser comes nearer to going live. thank you!!!!

Posted Using LeoFinance Beta

Glad to see the upgrade and directions of LeoFinance's WLEO and LEO!

The same thing will be added to the same thing.

Many Money come where there is money.

To be get richer, Investment is very important or the best.

If we use or waste income in a day what we get from earning at a day, we will never rich. If we can save or invest income what we got, we can/will richer.

Please, give me Uniswap link to register.

Or,

Can I direct invest from Leo Wallet?

Posted Using LeoFinance Beta

Oaw grate opurtunity But I'm poor, I probably have 10$, but I'll invest in something

Excited about the relaunch of WLEO and it is truly amazing the work done to make the system safer for investors.

I also really appreciate the commitment to returning stolen funds to users and this shows how serious the team and the project are.

Chapeau 👏

Posted Using LeoFinance Beta

It's just wonderful to see LEO going forward! I'm also seeing other changes like instant sharing to FB, TW, Reddit and so on. And the LEO symbol next to the payout. Beautiful!

Posted Using LeoFinance Beta

:P

Posted Using LeoFinance Beta

I had a look at the tool and was looking at ways I might be able to provide LP as I'm a "set and forget" kinda guy but when I read the line:

Then I'll stick to my two favourite past times! I don't even have $100 worth of LP built up yet but as time goes on and I acquire more stake, I'll look to be a very long term LP and probably link it to HIVE as I imagine gas fees will be through the roof if I were to wrap my head around the... wrappy thing! Haha!

Thanks for the great update and cool tool, I've saved a copy of it so I can play around and see when a good point to provide liquidity might be in the future!

I do like the VP in the top right of the screen, I do follow the leo.voter curation trail on HIVE though so I'm surprised it's been sitting at 100% all this time - am I missing something? I've just been slapping upvotes like a madman on comments on my posts and other blogs I come across though to put it to use!

Posted Using LeoFinance Beta

Another well explained and detailed insights in to the what, how and foremost the why! I'm very short with LeoFinance, and didn't sign-in to Leo Discord channel yet, therefore I do like this post very much.

Wrt using a portion of the inflation of Leo for incentives to liquidity providers, I think is a very good idea. Though I'm a small Leo owner, I like to provide some liquidity since I think (like you) it is super important the markets have liquidity. You mentioned that with eg less than 100$, providing liquidity may not be profitable. What is the minimum you think is required to be breakeven in lets say 180 and 365 days of providing liquidity? I have 1000 Leo ready for providing liquidity; Would that be something you would discourage, or encourage, ie is this a too low amount or is it sufficient in your view for providing longer term liquidity?

Wrt liquidity and the complexity when adding liquidity a 2nd and 3rd time on top of the previous provided liquidity. Why are formulas adjusted to reflect the total liquidity, and aren't the formulas applied per liquidity transaction? This would avoid to adjust the formulas, ie distribution and incentives are given based on a liquidity order instead of based on a user account.

Posted Using LeoFinance Beta

Improvements keep happening here in the community and this is incredible to see!

Go, LEO team and the whole community!

Posted Using LeoFinance Beta

I'm just starting, on this platform. every day I learn new things. As Leofinance each has new projects for us users. This will be a success for Leofinance

Posted Using LeoFinance Beta

Thanks for this.. ill get my head spinning soon! and then ill invest!

Posted Using LeoFinance Beta