The Inevitable Will Happen

A new monetary system is coming. Historically this has happened every 40 years. This new system has always ripped the people off and enriched the governments. Luckily for us, we are no longer ignorant to what is going on. If the governments are the ones that benefit, lets look at what they are doing. There is clear accumulation of wealth in the form of gold by a large number of countries. Those countries are: Russia, China, Japan, Germany, Austria, Venezuala, Ecuador, Netherlands, Turkey, Iran, Iraq and many more. This is really alarming evidence evidence. Here are some of the potential outcomes:

.jpg)

Multiple Reserve Currencies:

Yet where is the anchor to this system? The anchor will keep exchange rates stable and thus more stable international trade. Previously, the anchor was the Dollar which was anchored to Gold. Yet, as we are aware, the US’s anchor to gold was removed by President Nixon in 1973.

Special Drawing Rights (SDRs):

Essentially, these are an IOU for money. This is no different that the system that we have today. Currency is created from a swapping of IOUs from the Treasury and the Federal Reserve through the banks. SDRs are in essence the same yet have a different name. More of the same.

Gold:

Gold has a brilliant track record. It has been stable money for 5000 years. Gold is a sound money due to its properties. Technology enables us to overcome issues of portability and more.

Chaos:

Perhaps chaos is a catastrophic word yet there may well be ruin with a complete economic meltdown. Rioting and looting on the streets, every man for himself. This however does let the free market figure it out for itself. The resulting chaos could facilitate a return to gold and silver. Perhaps even a return to bartering too. Most significantly, we will see a total loss of faith in paper currencies, perhaps in sovereign issuers too.

Crypto:

Crypto does offer a solution to the problem, a brilliant one at that. The elephant in the room here is that Governments and central banks are unable to control and manipulate these currencies. What fun for them is that? Where will they get the money to fund all of the wars and rob people of their purchasing power through inflation?

How high can gold go?

To account for all of these trillions of dollars that are being printed, gold could reach at least $8,000. These aren't just fancy numbers picked out of the air, so let's do some math.

Historically, a suitable ratio of gold in central banks backing their currency has been 40%. This is a conservative one at best, arguably the backing should be at 100% but that is unlikely given the huge amounts of currency in ciculation. Taking the US as the first example, the US have roughly 8,134 Tonnes of gold.[1] Given today's gold price of roughly $1870 per ounce, and that there are 35,274 Oz in a tonnes, this would result in a gold price of $65,962,380 per tonne. Given that the US owns 8,134 tonnes of gold this results in a total price of their gold reserves to be $536,537,998,920 ($536.5 Billion). However, the currency supply of the US Dollar is around $5.5 Trillion [2]. This is only considering M0 and M1. Therefore, what we see today is that the gold backing the US currency supply is at a less than 10% ratio. If we were to see this increase to a healthier 40% we would see the price of gold increase 4x. This could see gold close to $8,000 per ounce.

Let's take the UK as an example too. The UK has an estimated 310 Tonnes of gold owned by the Bank of England. (This is not to be confused with amount of gold they have in their vaults. The Bank of England hold other countries' gold on their behalf but do not own that gold.) The price of Gold is around 1,390 Sterling per Oz. As there are 35,274 Oz in a Tonne, this would equate to a 49,030,860 Sterling per Tonne Gold. This would put the UK's gold reserve at 15,199,566,600 (15.2 Billion). The currency supply of the UK (M4) is 2.11 Trillion.[3] This leaves the UK Gold/Currency ratio at 0.7%. To reach a 40% backing, the price of gold in the UK would be 571x higher per ounce! This would cause a 794,285 Sterling Per Ounce of Gold. This sounds rediculous but the maths is sound.

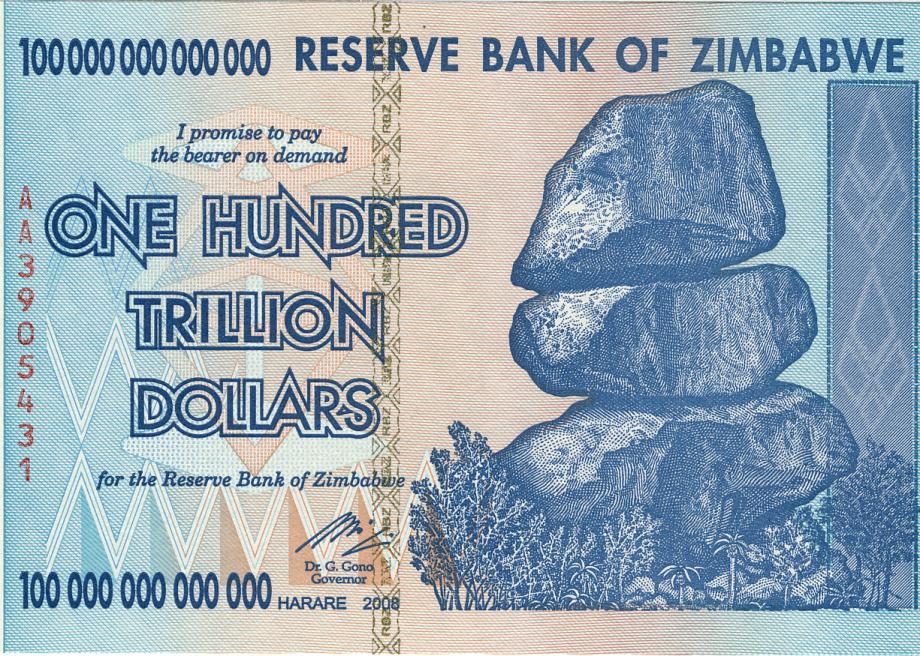

There may reach a point where people aren’t concerned with the dollar price of gold. This is because of the loss in faith of the US dollar as noone sees it as valuable. Just think of the Zimbabwe Dollar for some context. Hyperinflation is nothing new!

There is an opportunity for the greatest wealth transfer in history and this will not happen again in our lifetime. There were more millionaires created in the great depression then any other time in US history. This COVID pandemic, financially, has been the worst financial seasons in history. This is kept very quiet in the news, however. Educate yourself and be diligent.

What's important to note isn’t necessarily the numbers on the screen when you look at your bank account or the dollars in your pocket. What is important is the value of the assets that you have. When I think of something like bitcoin, I think of how valuable it is: transparent, immutable, borderless, open, programmable sound money. The positives go on and on.

If you were on the Titanic ship and you knew it was going to sink, would you get into the lifeboat nice and early? Maybe close to the side by the water and close to the food supply? Maybe even grab a blanket while you’re at it! Or are you going to wait until the ship has hit the iceberg, is already going down and you have to jump off the side of the boat and hope and pray that you can swim over to a lifeboat that may or may not have enough room in it! The choice is yours.

Financial education is really important, especially right now. COVID is happening and there are significant health and social reciprocations. Yet it is important to understand the financial implications too and what is going on behind the scenes. Please continue to read my blogs about financial education and crypto as they come out. This is aimed to educate people who know nothing about these topics with the aim of having some protection when an inevitable financial collapse happens.

Currently, if you are new to this, you are not too late. The talk in crpyto is that if you aren't already in you are too late. This is not true. This is not true for gold or silver either. There is still an opportunity to educate yourself and make appropriate decisions for yourself!

Please upvote, reblog, and comment! I look forward to your thoughts on these topics too as I want to get this discussion going! Thank you.

Posted Using LeoFinance Beta

May as well add a few more to the fiat collection.

They are pretty and colorful but don't even make good kindling or butt wipe.

Posted Using LeoFinance Beta

10,000 Venezuelan Bolivars? Use it to buy crypto or previous metals! Just wait until those notes reach the millions!

Posted Using LeoFinance Beta

The 1945 Hungarian Note is 10 Million Pengo, there are much bigger denominations than this one.

Another text book case of Hyperinflation as the Hungarian government struggles to rebuild following WW2.

Posted Using LeoFinance Beta

Very true! Central bankers seem to overreact to deflations and thus the following hyperinflations occur. War is a really obvious reason for deflation, to fund the wars and the despair that follows. COVID is also one of these sparks. Those in charge will overreact with stimulus and when people feel confident with the amount of currency they have we will see an increase in inflation and leading to hyperinflation. How long this will take I don't know, perhaps 5 years plus!

Posted Using LeoFinance Beta

You aptly use the Titanic example in your blog.

There is always an opportunity to learn and share. Thanks for sharing it.

Posted Using LeoFinance Beta

It's a great metaphor! You're welcome, please help me out by sharing and upvoting!

Posted Using LeoFinance Beta

Gold is always going to be used to hoard... If they collapse the fiat system, they would already also own most of the gold by then. ;)

Posted Using LeoFinance Beta

Hoarding the gold should help the price increase! With gold though you still get issues which crypto and BTC overcome: transparency (Announced that China lied about $2 Bn worth of gold in their vaults) and Censorship (if your gold is in someone else's vault they can seize it)!

Great comment, thanks!

Posted Using LeoFinance Beta

This says it all:

Although I don't think FIAT is going to disappear overnight - the dollar may well collapse completely, and I really feel for the 99% of Americans who aren't protected against that, but I imagine another currency will just take over, or maybe more than one - as the global reserve currencies.

Posted Using LeoFinance Beta

Regardless of what people say about BTC the value proposition of a borderless currency, let alone the other attributes, is really significant.

Of course not, I see COVID happening in the background for another year at least and then we will start to see a rise in spending velocity. This is when the hyperinflation will start. I think this process will take a couple of years at least. Being honest, crypto still needs 3 years plus to get to where it wants to be. I feel sorry for people who are ignorant when it comes to financial and crypto education. That's why I started this series. Please help in spreading the word! Thanks again for the upvote and the comment!

Posted Using LeoFinance Beta

We are still early adopters of course, hardly any of my IRL friends are into crypto - although I've got a few new friends who are showing an interested following a recent move to Portugal - mind you these new friends are hardly 'normal' - I mean people who emigrate are generally more risk tolerant, not that crypto is a risk IMO!

Posted Using LeoFinance Beta

VERY early adopters! Neither, only 1 of my close friends. Hey, I wouldn't mind going to Portugal, the weather in England is gross!

Posted Using LeoFinance Beta

I'll take the weather here in November/ December - it does rain, it can get cold at nights, but it's not sodden in the same way England is - and it can get warm.

I was sunning myself outside today in 15 degrees.

And you get the late harvests - satsumas still on the trees!

Posted Using LeoFinance Beta

Awesome! Are you based in Portugal then too? Yeah it can get pretty miserable from October to March here! Thanks for all the engagement on my posts!

Posted Using LeoFinance Beta

It has been cold some nights, but then again - yesterday it was 16 degrees - I was out running in just one layer and the sun was great!

It's currently raining (gently) but I've got the door open and it's not midday yet.

You want miserable - try Britain in December. No wonder people go so nuts for Christmas, given the weather!

And you get an hour extra light here in Winter a day which is welcome.

Posted Using LeoFinance Beta

financial reset, new world order and a single world currency?

Posted Using LeoFinance Beta

Reset yes. Alternatively they could tie many currencies together and that they can orchestrate printing their currencies at the same time to prevent value imbalance. However, the problem still remains that this robs you of your purchasing power!

Thanks for commenting please continue to do so!

Posted Using LeoFinance Beta

Excellent article. I am posting my introduction on Leofinanace in a few minutes. Please read it, some additional issues that my b2b customers and suppliers are dealing with, actually this is why I'm trying to use LeoFinance with them. Great job ! Aloha, Richard

Posted Using LeoFinance Beta

Thank you for the kind words. Link your post in a reply to this comment and I will give it a read! Thanks for dropping by and reading my article. Please continue to read my posts! What's your business?

Posted Using LeoFinance Beta

We believers in gold need to stick together and spread the word. I wish more people understood we should have gold and cryptos, not one or the other!

Posted Using LeoFinance Beta

The fundamentals of what made gold valuable are very important. There is a lot of overlap into what makes crypto valuable too. Gold bugs and crypto people have a lot of agreements, there is an element of maximalism. I am aiming of a portfolio of 15% Gold/Silver and 85% Crypto. I am a millennial so it makes sense!

Posted Using LeoFinance Beta

85 percent Crypto scares me but I'm an older person so I like my wealth to be off the blockchain, I still don't trust the powers that be to let these non government currencies to exist.

Posted Using LeoFinance Beta

That's fair enough. Put simply, the difference between older and newer generations is physical vs intangible assets. Traditional people prefer to see and touch their investments whereas millenials aren't concerned with that!

Posted Using LeoFinance Beta

Great article! Would love if you could check and let me know what you think of my first post as I'm new in this community!https://leofinance.io/@theatdhe/what-is-nexo

Posted Using LeoFinance Beta

Thanks! I'll head over now. Please continue to read my articles! There's a lot of value for you!

Posted Using LeoFinance Beta

Will do, there is some real value there!

Posted Using LeoFinance Beta

I'll be very interested to see how far governments go towards holding DECENTRALISED cryptocurrencies (not those fake central bank abominations they are making) instead of gold. Private institutions are headed that way already, and the word on the street is that the gold traders are struggling to understand gold price movements - probably due to the influence of BTC.

Whatever happens, as long as fiat falls, I'll be happy.

It's probably close to 100% that they won't. They can't control it and dictate the money. There's still an element of control they can have with gold, seizing it in vaults and lying about quantities. How do you see Precious metals vs Crypto playing out?

Thanks for the comment!

Posted Using LeoFinance Beta

Bullish on Gold eh?

Somehow I get the feeling that those who are bullish on Water are going to win this one if the chaos gets bad enough.

Posted Using LeoFinance Beta

Get them filters while you can, that's always the last thing people think of, I laugh (feel sorry for) at all the folks buying all the bottled water before a hurricane.

Posted Using LeoFinance Beta

If we really descend into chaos, looking at people's reaction following a catastrophe like a hurricane would be really helpful information to have to help us to prepare! I like the way you think!

Thanks for the comment!

Posted Using LeoFinance Beta

Thanks, @localgrower, I'm a prepper and my hurricane survival kit gets bigger every year. I like to grow things also but in Florida, it's easier to buy local for the ROI with my limited time at the moment.

Posted Using LeoFinance Beta

What are you prepping for? What's in your survival kit? What's taking up your time?

Posted Using LeoFinance Beta

Well, I work full time and I am saving up to get some land in the mountains. (I'm very close) I then plan on a nice homestead where I will be mostly self-sufficient.

I'm prepping for most reasons and I think this pandemic is just covering up the financial collapse that took off in 2008.

Food, water filtration, gold, and silver. I also have the means to protect it!

Posted Using LeoFinance Beta

Wow! Really planning ahead! Or maybe this is all going to happen sooner than we think!

Posted Using LeoFinance Beta

I'm bullish on Sound Money. Gold has been that historically for 5,000 years. Crypto holds some of those fundamental properties too, so I am bullish on that too. Water won't be a problem if you are financially prepared!

Thanks for the comment!

Posted Using LeoFinance Beta

Financial education should be our top priority, otherwise, all the effort invested in distributed networks will be pointless. Covid has shown the weaknesses of the current system, enabling us to see through that shit.

Keep it real, our time is comin'.

Posted Using LeoFinance Beta

That is something I am trying to push as the moment! I've come flying out the gates with quite a few Financial Education posts already! Yes, COVID has just exposed cracks in the foundation! Thank you for the encouragement!

Posted Using LeoFinance Beta

You're at top of trending! Congratulations!

Posted Using LeoFinance Beta

That's awesome! Right where I want to be! I burned a few LEO to promote the post. I wanted more exposure to my posts and I'm so lucky I got it!

Posted Using LeoFinance Beta

I've never tried the option. I really love the HODL. But your results are tempting! I was holding back because I wasn't too sure of results :)

Posted Using LeoFinance Beta

It's coming whether we like it or not, which way we go remains to be seen, could we be gold backed, do we go to a bretton woods again, do we move to basket currencies, do we go CBDC its all up in the air right now but at least we have private money now with Bitcoin.

I think it's on its last legs but we'll be surprised how long governments can continue to print because we're all still so tied to the system and the brief that fiat money has value

Posted Using LeoFinance Beta

It's likely that the IMF will bail central banks out and make countries use their native currency. Just more of the same scamming. Crypto offers a way out of that. Out of the removal of freedoms that using a currency from governments! You offer some probably alternatives too!

I think it'll last a couple of years still. Germany didn't enter hyperinflation untill 2 years AFTER WW1. The 'damage' so to speak was done yet the hyperinflation happened a year after. WW1 went on for 4 years. Arguably hyperinflation took 5-6 years from the inception of the problem. Drawing parallels to COVID, we may not see the real economic impacts untill 2025!

Posted Using LeoFinance Beta

Of course, although many such assets may be degradable, or not?

Who values these assets? Market, demand and supply, I think. If there is no one to buy, what will be their value, what will be your wealth? Just a question from a newcomer.

Posted Using LeoFinance Beta

You've hit the nail on the head. Simply, value is determined by how many people want something because of how useful it is. This often translates to price because of supply and demand economics. When it comes to crypto, some people have recognised the value that it has whilst others are getting there. Eventually this will be reflected in the price! Thanks for the comment!

Posted Using LeoFinance Beta

Gold is a sound money due to its properties. bitcoin very good

Posted Using LeoFinance Beta

Absolutely gold is sound money! Bitcoin arguably has the exact same properties if not better! Hence 'Gold 2.0'!

Posted Using LeoFinance Beta

Thanks!

Posted Using LeoFinance Beta

Congratulations @localgrower! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Thanks

Posted Using LeoFinance Beta

You're welcome @localgrower

Support us back and vote for our witness.

You will get one more badge and bigger upvotes from us when we notify you.

How do I do that? How big will my upvotes be?

Posted Using LeoFinance Beta

Remember to use ounces Troy when dealing with precious metals and not ounces Avoirdupois. There are about 32154 ounces of gold in a metric tonne.

Posted Using LeoFinance Beta

Remember to use ounces Troy when dealing with precious metals and not ounces Avoirdupois. There are about 32154 ounces of gold in a metric tonne.