Modern Monetary Theory types like Paul Krugman want you to believe that government debt can be created without limit and it has no impact on your life. This is only half true. Government debt rising has no impact on the life of the wealthy.

Austerity Always Follows, Unless You Want Hyperinflation

Keep in mind, when I say austerity here in the US, what I mean is the increase in government spending slows. It doesn’t really go down except in short stints and then bounces right back again. If you have the power to tax and spend with Federal Agents and the IRS behind you, what’s your incentive to stop spending all that stolen money?

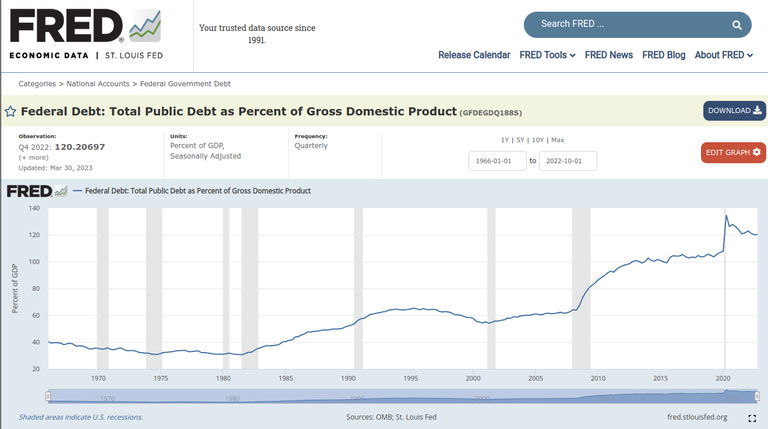

Once the ratio of debt to gdp gets high enough (typically over 100%), governments are forced into austerity measures (cutting back on discretionary spending). Why is that? For a multitude of reasons:

- Government spending outpaced domestic growth and must slow down so tax receipts can catch up

- Interest rates rise as a result of inflation from money printing and servicing costs on the debt begin to balloon (which erodes discretionary spending)

- Increased taxes could fill the gap for 1 or 2 but as soon as that comes into the conversation, a spending slow down is in order

What Does Austerity Look Like?

In the United States it has typically looked at trimming spending and benefits on certain social safety net programs or socialized programs like medicaid and medicare. There are also cuts to pet projects and dark pools of spending that we often have no idea what they are. All in all, that means less benefits for the middle class and working poor. They keep the benefits for the poorest Americans because austerity also means more folks fall into poverty. That is because austerity also coincides with recessions. And without that spending, the elites fear the pitchforks and torches will come after them.

Taxes also typically rise. If you don’t see an increase in the tax rates themselves, you see reductions in deductions and tax credits. Usually making only a marginal difference to the wealthy and a very meaningful impact to the middle class and working poor.

The Debt Ceiling Deal

Whether it includes reductions in spending or not is just theater. At the end of the day it will be raised and also at the end of the day Economics will win out and the US will be forced to slow spending and increase taxes.

This will create the first leg of the crash in the casino (Wall Street). The markets are currently riled up because of the stand-off. Even if it persists beyond the June 1 date Treasury Secretary Yellen gave, and eventual deal (combined with a firm Federal Reserve pause on interest rates) will see a bounce back rally. That rally will more than likely be the exit point for the big money managers. It’s once everyone think’s the all-clear has been called that the markets pull the rug out. Economic numbers throughout the economy are falling apart. The last show to drop is unemployment and that always lags all the damage to the economy that the Federal Reserve and US Government has done. Do not be enticed by the moved in the stock market. It’s time to start raising cash and putting together your shopping list for investments you really want to buy on the cheap!

How to Get Involved

Follow me to get the Anarchist Investor on HIVE or sub on substack to get it in your email.

anarchistinvestor.substack.com

Share this with friends and family that could make use of this info.

***Keep in mind that investment and investment results are very much based on you as an individual. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you.