Gold is typically thought about as a hedge against inflation and a safe haven asset when the economy gets crushed. Well it is an it isn’t. Here’s why you may want to wait to start Dollar Cost Averaging into Gold.

Gold Front-runs Inflation

The inflation hedge story line for gold isn’t as straight forward as you might think. Gold typically rallies in anticipation of inflation. Once the inflation hits, Gold is most of the way through its’ move higher. And when the inevitable happens (ie - recession), gold doesn’t perform as well and sometimes it’s outright awful as a store of value.

We’ve certainly had an ongoing bout of inflation that The Federal Reserve (money printer go brrrr!) is trying to get under control. The sledge hammer they’re using on the economy (federal funds rate) will eventually take its’ tole and the price will be considerable. So for now inflation isn’t in the short-term outlook.

There will be a buying opportunity if and when The Federal Reserve fires up the money press again. And it’s coming in a couple years.

Gold Isn’t the Only Safe Haven Asset

Even among precious metals bugs Gold isn’t the only game in town. Silver, Platinum, and Palladium are all possible precious metals plays when the economy hits the skids. Interestingly, a number of those have industrial uses and they typically fall early on in an economic downturn.

Outside of metals, the main safe haven assets (much to my disappointment) remain as United States Treasuries and United States IOU’s (aka Dollars). Economic turmoil sends investors from all over the globe scrambling for Treasuries and Dollar Bills. And while I can’t stand them, even an Anarchist Investor needs to have some of their portfolio in Fiat currency of some form. That can be Yen or Swiss Francs if you prefer to stay away from the Greenbacked Monopoly Money.

Finally, there’s a new kid on the block and this is the first major economic crisis it will be tested in. Bitcoin has been touted as an inflation hedge and port of safety during economic storms. We’re about to see if that holds true. My first guess is it won’t be without further pain but that will be another article in the very near future.

The Charts Don’t Look Great

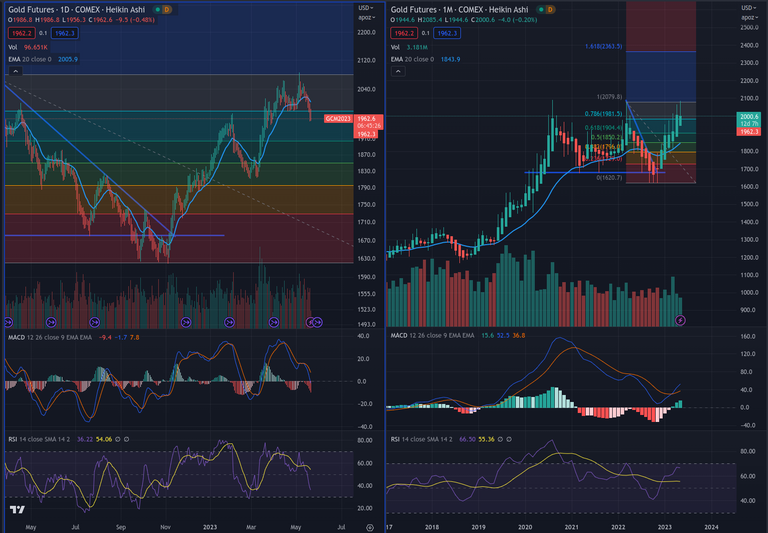

On the Daily chart, gold is trending lower. This is coinciding with rising recession risks in the world markets. And it’s not if but when we get hit with this recession. Then the next question is How Bad Will It Be? Especially after kicking the can down the road for 3 recessions now.

The Monthly chart looks better for longer-term investors but keep in mind Gold has challenged its’ all-time high at around $2080 per oz with a much lower Relative Strength reading. Gold will break $2100 one day but it’s unlikely to happen in the next couple months (at least without a pullback).

What If You Don’t Currently Own Gold?

Well you need a lottery ticket to have a chance at the prize. This means it’s never the wrong time to make your first gold purchase. Just keep in mind that you should be keeping powder dry (meaning keeping cash available to buy) when gold continues to pull back.

What If You’re Currently Dollar Cost Averaging In?

Two options:

- Keep up the same level of dollar cost averaging as before (never a bad idea)

- Turn down the periodic purchases you’re making now in anticipation of making future purchases a higher amount once the price declines

What If You’re Currently Sitting on Gold?

No one ever lost money by taking a profit. If you’re at your peak level of investment, you’ve had a nice run the last couple months. Don’t get greedy. Take some off the table and reallocate somewhere else like into fiat cash and get a monkey market yielding 2-4%, bitcoin, or pay down any debt you may owe.

How to Get Involved

The main newsletter will be free to all. Follow on HIVE or subscribe on Substack to get the daily article in your email. In the coming months, I will begin building a paid offering that will provide a ‘model portfolio’.

anarchistinvestor.substack.com

Share this with friends and family that could make use of this info.

***Keep in mind that investment and investment results are very much based on you as an individual. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you.

Congratulations @matt-archy! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 150 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!