We now have a lower put to call ratio in equities than in February of this year prior to massive drop in March. Now we are position for what maybe something similar as the irrational exuberance is shown by lack of option protection of puts.

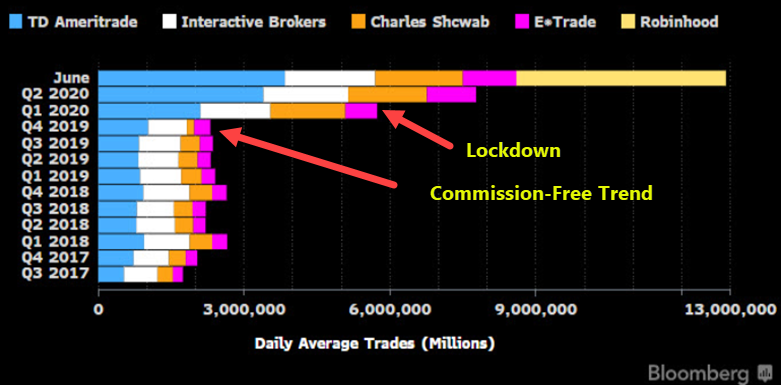

Hype of retail traders in the market is proven with chart above. This is insane to see as Robinhood has not existed for more than a few years compare to other platforms. Yet there is now more trades in Robinhood than any of those major brokers. The main theme here is to realize there are a ton of retail traders in the market. Likely something big will have to happen as on average 90% of retail traders lose money.

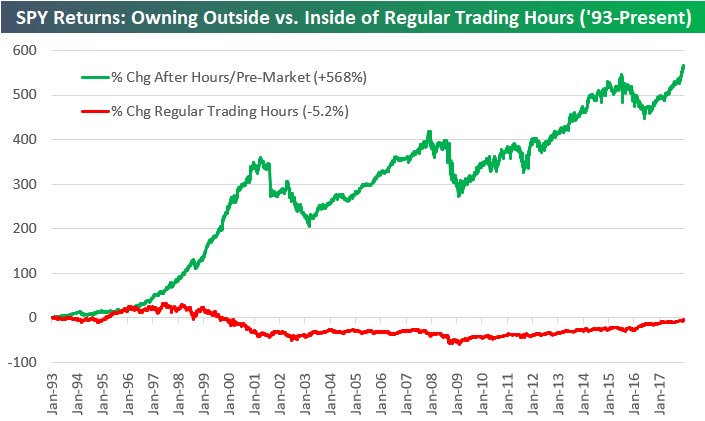

After seeing the chart above I tend to avoid swing trades holding over night unless I have conviction in the trade or I do not want to close a losing position. The later has always brought me greater pain, but also want to avoid gap ups and downs as they could happen randomly and I would have no control over if I was on the wrong side. However it is obvious from the chart buy and hold would fair much better since the after hours tend to ramp up more than regular trading sessions.

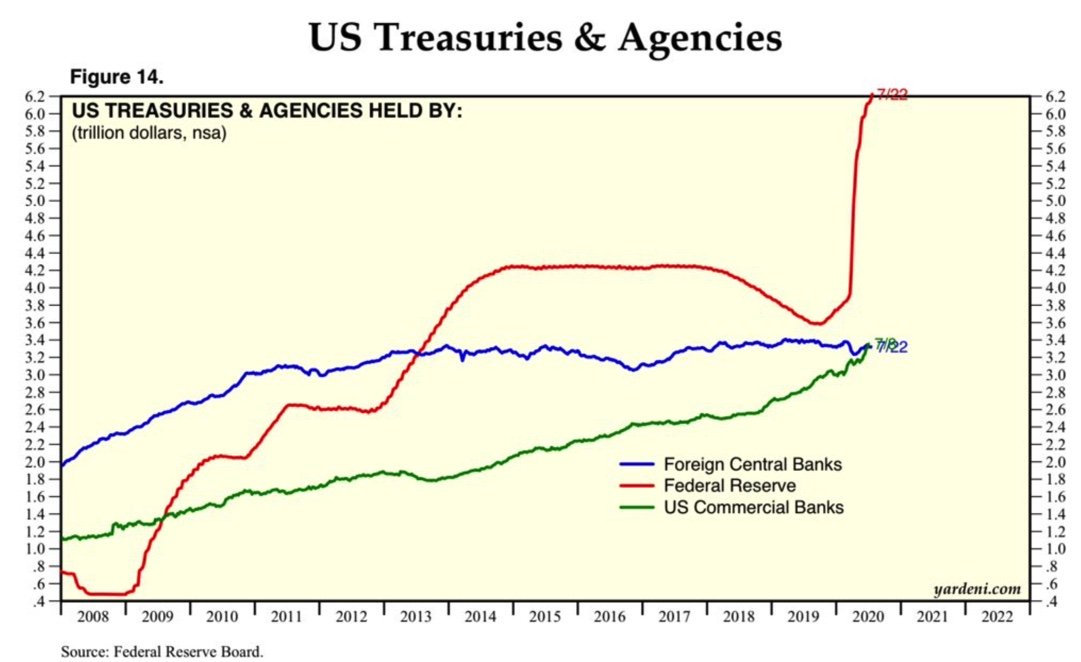

With the recent pullback in the markets have no fear the FED is here. As of July there is ample amount of cash in the Treasury to do what is necessary and I would be doubtful they will not put some of this cash into the markets. The already have purchased commercial bonds above par on many US companies. With trillions to spend I do believe at the very least a crash will not happen before the elections. Again the chart shows around $2 Trillion in money for the US government to do what it pleases to do.

Posted Using LeoFinance