Wise author James Clear (of Atomic Habits fame) once said on twitter:

How to win - 1. Broad funnel. Research widely, explore unrelated areas for ideas, create a huge dataset of options. 2. Tight filter. Eliminate nearly everything. Focus only on the best options. Prioritize asymmetric opportunities: limited downside, unlimited upside. 3. Repeat.

The latest phenomena I am attempting to apply this framework to is the financialisation of everything. To give an idea of what this means, the pseudonymous financial writer John St Capital said this:

There’s no reason the Square Cash App shouldn’t have your Bitcoin, next to your Apple stock, next to your Michael Jordan rookie card, next to your Banksy painting, and Mid-West Farmland, all in the same place, allowing for interoperability of funds to enable holistic portfolio allocation.

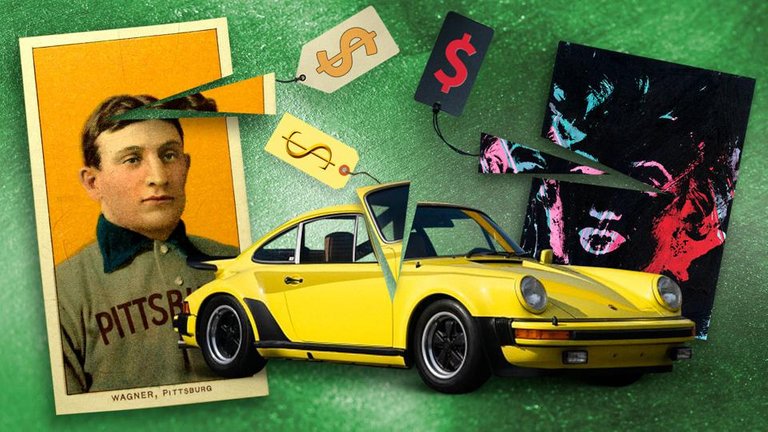

He's talking about the new trend of fractionalising scarce items such as Fine Art and sports cards and creating marketplaces for investors and traders to gain exposure to them alongside traditional asset classes such as stocks and millenial and zoomer favourites such as bitcoin. John St even calls these new platforms "alternative alternatives" presumably because, prior to the emergence of platforms such as Rally Rd, Masterworks and stockx, "alternatives" traditionally referred to asset classes such as precious metals, commodities and infrastructure.

Fractionalise this source

These alternative alternatives are coming into their own thanks to the wider macro backdrop we find ourselves in today - historically low rates, leading to the demise of the traditional 60-40 stocks-bonds portfolio, leading to the ETF bubble, leading to millenials and zoomers differentiating their investments away from just market returns and investing in what they know. They are also uncorrelated with equity markets so in theory could reduce risk in a diversified portfolio.

Curating communities

I recently listened to another Chamath podcast (from The Knowledge Base). In it he also talks about the financialisation of everything and how these new financial markets wrap a transaction layer around "taste" (ie. taste in cars, wine, art, etc), thus providing opportunities for niche experts to curate and cultivate communities around taste.

Signalling theory

You can also add costly signalling theory into the mix. Owning fractions of nice art or cars are not necessary for our survival but they do signal to possible mates that we have excess resources (as well as taste). The community leaders Chamath is talking about could end up being the new influencers whose investments are their trophies that signal to their followers how successful they are. Why not have our investments reflect our own preferences and show them off with pride?

DAOs

Unfortunately most of these platforms are currently only open to US residents. I currently enjoy dabbling with equity crowdfunding through Republic. And of course, there's crypto ... and NFTs (non-fungible tokens), which I see as a sub-sector of both crypto and fine art, not to mention gaming (hello, rare Axies!).

If these markets aren't fully accessible to everyone yet, and a lot of these scarce items are unattainable without fractionalisation, could DAOs (decentralised autonomous organisations) allow anyone to curate their own community around taste?

Example - I am interested in some of the art on the async art platform. Unfortunately the work that I've taken a liking on this platform to has sold for prices much higher than I would be willing to pay. Bummer.

What if I formed a DAO with like-minded individuals with the aim of raising funds to buy selected pieces of crypto art and other rare NFTs to be stored in the DAO’s vault? The advantage of one forming their own small DAO is that the collection would be tailored to DAO members’ tastes because the group initially formed on the basis of the type of artwork that appealed to them, eg. Async Art or rare Axies.

This works best in crypto because the DAO and the art exist on a blockchain. It would not work so well with things like cars or wine. Currently I'm doing a bit of high-level research into Aragon (a blockchain project that allows anyone to spin up their own DAO) to investigate the feasibility of my crypto art DAO idea. There are other options for one to attain fractional ownership of rare NFTs (eg Niftex). But being an active member of a small DAO that directly owns pieces is more desirable than these options, at least it is for me.

In summary - there's an a new alternative alternatives asset class. Fractionalised scarce assets allow more people to own a piece of them and signal their tastes within their community. DAOs could be an alternative to mainstream platforms that currently only operate within the US to provide fractionalised ownership of crypto art.