Triple bottom line life is a concept that I conceived a week or so. Triple bottom line life is the convergence of two key ideas:

- Triple bottom line (TBL) is a framework for businesses attributed to John Elkington. The basic idea is that it is a more sustainable framework for capitalism, supported by a foundation of 3Ps - profit, people and planet. Traditionally, capitalism has been mainly about the profit but Elkington argued that if businesses also focus as much time and energy on supporting their people (and their customers) and the planet, then each foundation will support the other, thereby making them more sustainable.

- You should treat your own finances like a business. The key principles of personal finance (it’s obvious): make more money, spend less money, invest the difference in a diversified portfolio, build wealth over the long term.

I consider myself pretty savvy with money. I am very frugal and am confident to invest my money. To that end, I do tend to treat my finances like a business. mrshill and I even have finance ‘meetings’ from time-to-time (usually over breakfast or lunch). This year feels a little different though. We have been more deliberate with our consumption. We have been looking at our investments through an ‘ethical lens’. With the pandemic, looking out for other people has become more of a priority - for example, supporting local businesses. I have been picking out little pieces of my life at a time and thinking about them through the 3P framework - and now I have given it a name! The TBL life is me treating my own life and finances like a business that focuses on profit, people and the planet.

So for this post, I will flesh out one example of this. I am writing this to document my journey towards leading a TBL life.

Republic (equity crowd-funding platform)

Republic is an equity crowdfunding platform. Last time I wrote about Republic was just after I’d heard about a really exciting new feature called ‘Auto-Pilot’. That post was about digital platforms I use to automatically invest small amounts of money into different high-growth asset classes. On Republic, one can read through the pitches of the listed startups and decide whether or not to invest. Auto-Pilot was designed to automate the process for folks to build a portfolio of startup investments. When setting up Auto-Pilot, you input some parameters such as the maximum total amount you want to invest and how many companies you want to invest in for a year. With that information, Republic then adds some 'filters' to the automation process so that you automatically invest in startups that have passed some key milestones - a minimum of $150,000 USD has been invested by a minimum of 100 investors. In other words, the startup has the backing ('wisdom') of the crowd. Moreover, even for startups to list on Republic, they have already had to make it through the vetting process from Republic. But if you aren't comfortable with the idea of investing in startups that you're not interested in, you can also DIY the vetting and reject companies that pass these filters. That's what I ended up doing. So when a company that I was not interested in had passed the 'wisdom' filters I would simply reject them.

After my first few investments (a couple of biotechs, a cannabis 'picks and shovels' business and an AI/drones business) I found a company that really resonated with me - Asarasi. In summary, they make flavoured carbonated drinks using water produced as a by-product from the process of extracting maple syrup from maple trees, which I thought was a really cool solution to the global water shortage problem. This became my fifth investment. When I set up Auto-Pilot I only signed up for five investments at $100 USD a pop. A little later I came across another really cool startup - PittMoss. They are creating a more sustainable alternative to Peat Moss for garden soil. Since my Auto-Pilot had maxed out I decided to wait PittMoss to pass the 'wisdom' filters (100 investors for a total of $150,000) and then manually invest $100. Incidentally, it was on PittMoss's Republic listing page that I first learned about this thing called TBL businesses. So after investing in Asarasi and PittMoss I decided that I would seek out TBL businesses on Republic to invest in.

So how does investing in startups on Republic fit in with a TBL life?

People

Investing in startups is investing in entrepreneurship. Entrepreneurship allows people to pursue their passions (as opposed to work for someone else in a job they hate). Beyond this, successful entrepreneurs are examples to society that there is more to life than just working for someone else.

Planet

This of course depends on the startups you invest in. After discovering startups like Asarasi and Pittmoss, I decided that companies that are solving 'planet problems' are the businesses that I will seek out on Republic.

Profit

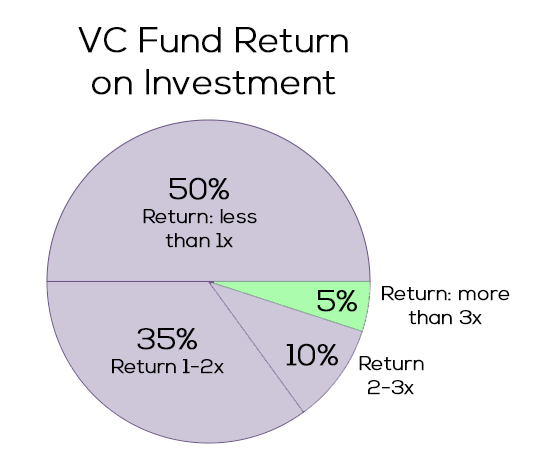

I am obviously no VC but with the selection process Republic uses, I feel like I could reasonably achieve the same success rate that VCs have (which is low!). I know that the expected returns for VCs is complicated but I think the simplified version is that: VCs expect very few of the companies they invest in to be a runaway success and a lot of them to fail, but they only need a few to be very successful for them to meet their overall fund targets. With this in mind, if I find five or more TBL startups a year to invest in (small amounts I can afford to lose) the portfolio will hopefully be diversified enough to find one (or more) winner(s), thus making it profitable for me. If I maintain the mindset that I have little or no expectation that these startups will be successful in the long term and that I may never receive any profits from these investments, at least I will be able to say that I have made a small contribution towards supporting people and the planet.

Great post @mrhill. Thanks for sharing.

Thanks for the kind words.