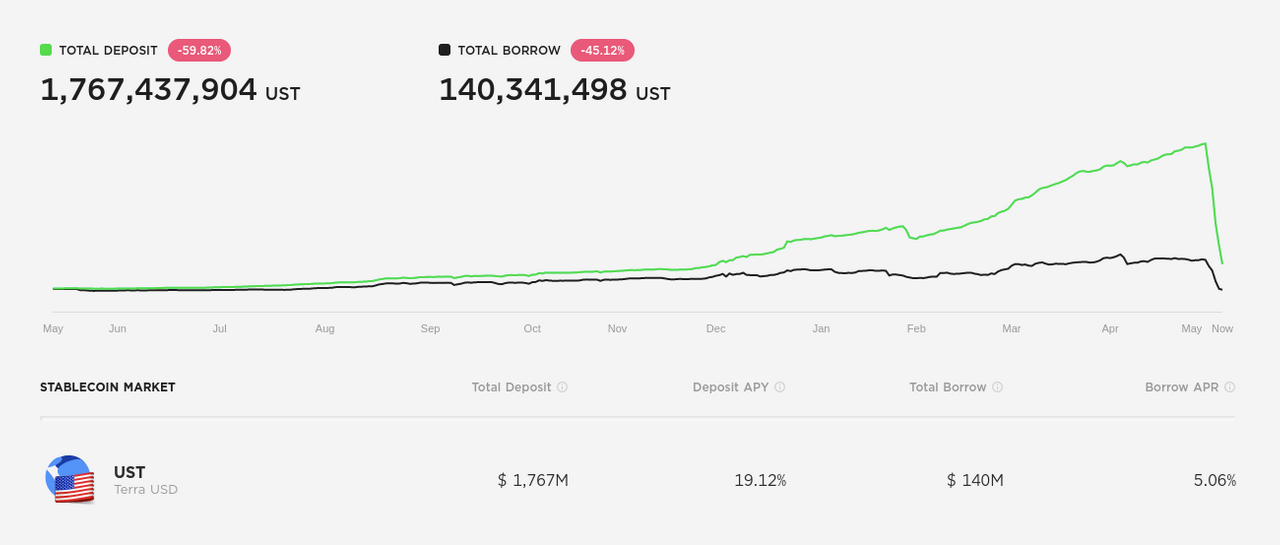

With the recent crash of UST, stable coins have gotten a lot of bad press and the returns UST provided on Anchor were comparable with HBD. But we know now how it ended with UST and it is a far larger stable algo coin compared to the amount of HBD that we have circulating.

We all know how great HBD is and the awesome 20% (22% compounded) returns, I thought it would be a good idea to look at the risks for HBD and how we could avoid a UST situation. Does that mean we should lower rates back to 12%?

One of the arguments suggested that we needed to raise the rates on HBD is to attract capital to Hive. The eco-system on Hive is Hive, and yes this can fluctuate in value, but that is only against fiat. 1 Hive is still 1 Hive. If we want to attract capital to Hive, it can also be attracted to liquid Hive or Hive Power too and earn good returns. If we attract too many speculators, would the interest become too much like on UST and cause a death spiral?

Currently, there are not too many use-cases for HBD, but the plan is to grow the use-cases for using HBD as a payment system in games and for regular transactions. A fixed amount to the $ will give people some reliability in the value when using HBD instead of say Hive. I think there is some merit to this argument, although with Hive's no transaction fees, surely it makes sense to use Hive for transactions instead?

The whole inflation of Hive and its rewards pool is what keeps things moving on Hive. Is using a stable coin, going back to the world of fiat currencies and their inherent risks?

BitcoinCash and Litecoin are two cryptos used for transactions a lot due to their low costs. But Hive is powered by RC so is free. Both of these do not have a fixed value and therefore are not at risk of causing a death spiral. Should we be promoting Hive more than HBD?

Many games running on hive also use layer 2 tokens quite successfully and therefore, why do we need to use HBD for this? This also leads on to the fact that layer 2 tokens are taking a hammering with the higher rates with HBD and don't pose any threat to the Hive ecosystem. In fact, they are an extra RISK for the holders because they are on the second layer. So earning any extra returns could be more justified than paying extra returns to HBD holders when it poses a risk to Hive.

The value of Hive layer 2 tokens to the Hive Ecosystem cannot be underestimated too. They promote Hive tribes and communities. Should they switch to HBD?

20% is a very large return and should attract more capital to Hive. As we have seen with the collapse of UST, rates of around 20% are VERY high and usually not sustainable or tied with extreme risk.

With the current bear market, returns on other stable coins are greatly reduced. USDT and USDC (the top market cap stable coins) rates are up to 12%, should HBD rates be lower to mirror the dynamic market rates available? 8% seems a big gap?

Risk to the Hive eco-system

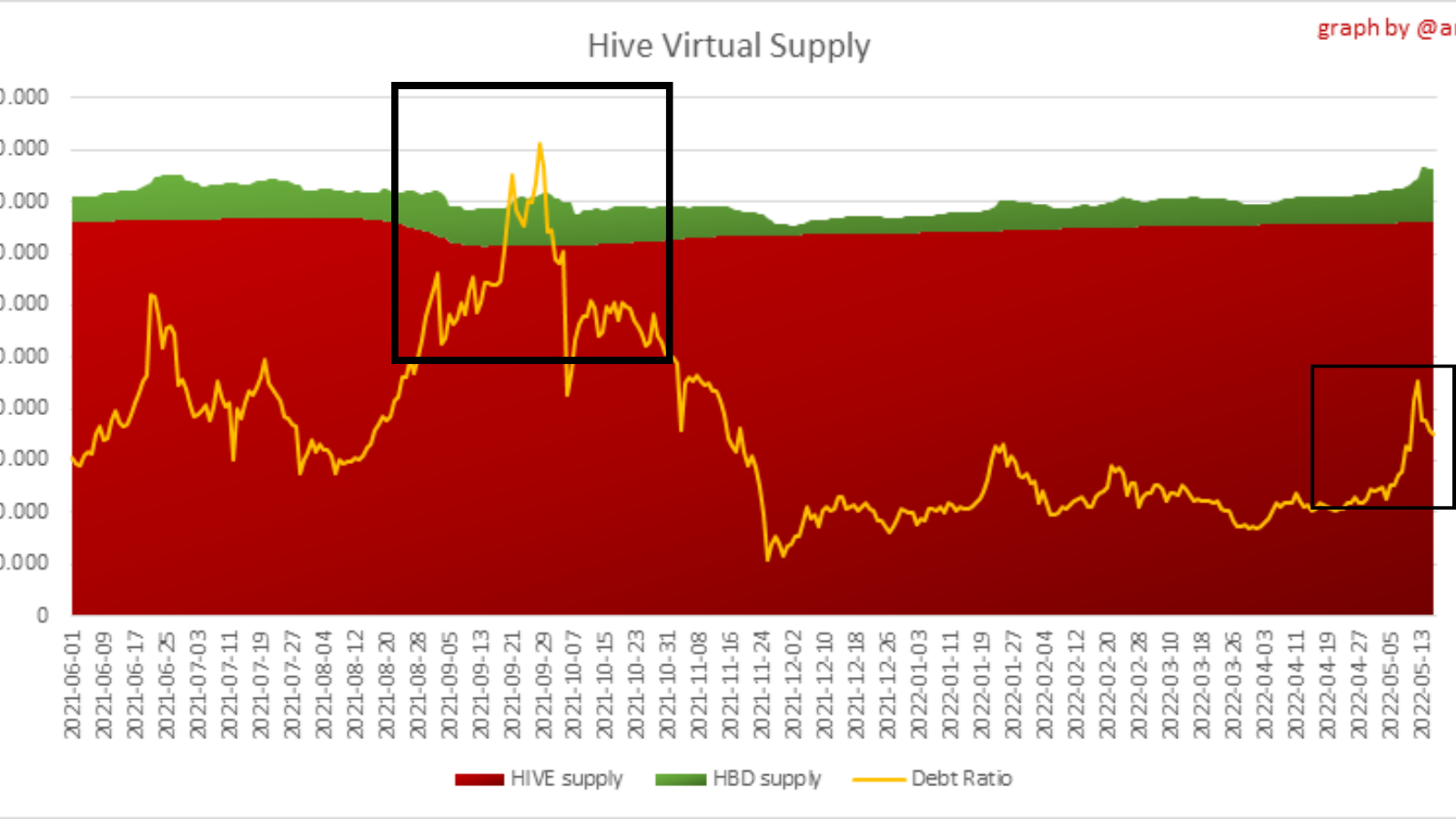

It was only back in October that the debt limit was breached as you can see in the graphic below by @arcange. That is only around 7 months ago and we didn't have 20% rates back then.

With the recent move down in price to around $0,50, there was a sharp move up in the debt limit %. This was basically a 200% move up during a week. If the bear market continues, we could reach the debt limit before it is even raised to 30% in the next fork.

The DHF is not included in the current 10% debt limit. Therefore, the real debt limit is much higher than the one calculated here. So the real strain on the ecosystem could be much greater. Are there enough users and use-cases on Hive to support a 20% interest rate?

The current debt limit is low at 10%, therefore this should offer some protection to Hive. But if the limit can be breached so easily, does it make sense to offer high rates to possibly breach it quicker and increase volatility?

The proposed increase to a 30% debt limit would put even more strain on the Hive Eco-system. The Hive Power holders are basically guaranteeing a 20% return to HBD holders. This could cause much higher inflation for liquid hive holders and those powered up and drastically reduce their returns. This could cause a death spiral until the debt ceiling is reached. Therefore I predict we would likely hit the ceiling faster than we expect with the huge downward pressure on Hive.

HBD > Hive Power

Not only could we see lower Hive prices to support a more valuable HBD, but if someone is holding Hive Power, they get just 2,88%, but if they curate or delegate their Hive Power, this can increase. But not to 22%, perhaps 11-12%, yet having Hive Power or holding Hive benefits the Hive eco-system because it promotes engagement, activity, gaming, curating and many other hive use-cases. It is a win/win for all.

Currently, HBD doesn't do any of that but the HBD returns are supported by those who are active on Hive. These imbalanced returns could cause instability within the blockchain. Will we see another build-up and collapse as we saw on Anchor?

source

Holding HBD on exchanges and the polygon network would cause large amounts of HBD to be short sold that would need to be compensated by Hive holders. Could these speculation risks also cause a death spiral risk? Even more, so that they are held "outside" of the hive ecosystem.

Hive Protection Mechanisms

Hive has more protection mechanisms than Luna and if there are any perceived threats, these would start to kick in. We have the hair cut if the debt limit goes above a certain level.

We also have a rewards system where it can payout in HBD and Hive. If the debt limit is breached, this would force rewards to be paid out only in Hive until it is back at a sustainable level.

If HBD becomes too popular, the Witnesses can also reduce interest rates to make HBD less popular. Although with HBD on exchanges, this could cause it to be dumped very quickly unlike in your Hive wallet.

What are your thoughts?

Does HBD have good protection mechanisms to avoid another Luna collapse? Are they even comparable?

Thanks for reading.

Resources:

Title picture was made by myself using Canva.

Other graphics are credited as above.

Posted Using LeoFinance Beta

You've already set the precedent by making it 20% so even 10%-12% which is stupid high and not sustainable either, seems like less of a deal in the minds of normies

Decreasing the interest rate and increasing the debt levels which I heard was moved form 10 to 20% doesn't make it more secure, this is just psychological, to give investors a sense of safety but as for actually making it more secure it isn't.

As you attract more people in you add more risk, not less and if there is just 2 - 3 big holders that dumped you can see a run not only on HBD that the stabliser cannot hold, but it will depress HIVE too. There isn't more liquidity or need for this token, so it's not helping.

Anyone who says different is ignoring the most important fact that the volume of buying and selling HBD is like a shoestring

Posted Using LeoFinance Beta

I agree with your comments. This is obviously going to break the peg in the near future. We can do so much with Hive, I'm not sure why the obsession with a $ peg?!

In the recent past, it has been 10% and 12%. So this has been generally less than the returns you can get by powering up or investing in layer 2 tokens. So it has been less attractive until now.

Well this was next-level HIVE for me, but based on what I read the balance is a bit off between HBD and delegating HP and as I really benefited from the delegation I got...I would say that those 2 need to be more balanced.

The rest of the story and especially the great comments I am still digesting !CTP

Posted Using LeoFinance Beta

Contagion looks to be spreading to Tether now!

Im probably too early with this article. lol

It´s a very popular topic, but I liked the HIVE part because I am still very much absorbing the whole HIVE ecosystem

The real concern seems to be if HBD gets out "into the wild" and can be freely bought and sold on exchanges (probably without even the three-day cooldown it currently has).

Is there a way to put Hive on the exchanges but not HBD, or even (and I appreciate this would be a big change) have a limit on HBD holdings related to HP, so that you can only have as much HBD as you've got HP staked ?

I'm sure there are ramifications to this that I haven't thought through, but it seems to me that the goal should be to encourage people to hold HIVE and be active in the ecosystem, not just buy and hold HBD.

I agree, that our main goal should be to encourage people to hold HIVE and be active in our ecosystem as that brings healthy growth. (Plus free transaction costs make it a nobrainer).

I don't know of any way that things can be limited but it will be interesting to monitor the price of these synthetic HBDs when we near the debt ceiling as the returns will theoretically drop to 0. (at least for a short time).

https://www.coingecko.com/en/coins/polygon-hbd

In my opinion, one of the crucial mistakes with UST was that it was highly connected with the protocol token (LUNA) itself... And when de-peg happened, everything collapsed and the damage was immense... I have to agree with @chekohler and his comment, as playing with HBD APR can make some benefits to HIVE, but it can't harm so much too... As the correlation thing on HIVE-HBD is very similar to LUNA-UST...

HIVE is so much more important that HBD and I bet that nobody wants to see the UST scenario played out on HBD...

Posted Using LeoFinance Beta

I agree and that's why I find it strange that HBD is promoted above Hive, which is the lifeblood of the system. Once the HBD stack mounts up, the interest payments will have a large effect on depressing the price and the value of Hive.

If Hive rewards are lower, activity on hive goes lower as people are less motivated.

HBD is being promoted because this is what the market narrative demands at the moment, algo stable coins are the story they sell you as a group and hbd is just hoping on the train

Just like they did with play to earn abs NFTs and where did that go? Not very far

I am pretty sure the next grift is going to be staking pools

Makes sense. I guess the yield farming promotion is already underway?!?

Yep stablecoins are going to get regulated for sure and it will be choked off so they need to move to something else and that's doubling down on keeping capital in a circular ponzi

No algo stablecoins just don’t work period, Luna had avax and BTC to back their token but you can’t back it with a correlated asset if the market goes down

If you are going to back it you not non correlated assets like puts or a short position but that looks bad because it’s an obvious point of hey you looking to profit from collapse and that it’s not Decentralized which it never was but you know narrative

Algo stable coins you’re just running a central back with less tools than they do

The only reason DAI has been able to survive so long is that it’s over collateralised meaning you have to put more in than you can get out making it less attractive for yields and pointless for farming

In addition a lot of DAI is collateralised by issued stablecoins which can be blacklist and you can pull the plug easy on that market

Algo stable coins are a joke

The UST situation is causing Hive to panic a little more than we should about HBD. They are not that similar but you do raise interesting questions that need to be debated by the Hive community.

UST market cap was 68% of Luna's market cap and was only growing faster each day with no safety rails to stop the print. As you mentioned Hive has safety rails.

That being said I do agree that 20% is not sustainable in the long run FOR SURE! We should keep a close eye on that because the compounding effect sneaks up on you.

Increasing the debt limit to 30% concerns me a lot and I think it might be too high.

I would prefer to see Hive take it slow and steady like we've been doing than end up like Luna. There are TONS of potential here, let's not waste on a quick money grab. Keep building results will follow

Posted Using LeoFinance Beta

I agree, there are no real concerns at the moment. But we could be building bigger problems down the road with this.

I think you have it right also, slow and steady wins the race.

Hive will have its day in the sun, but there is still lots to build first.

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @mypathtofire! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 5000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Does delegation increase the apr?

Okay. Honestly speaking there are many things I don't understand about crypto and its mechanisms. I am only trying to understand them. That's why I could make sense of this post only partially. However about HBD apr too high is something that I didn't really like. Those who have bigger investment acquire the most of the HBD this way. I read a post a month ago that 90% of pool of HBD was collected by 10 or 15 accounts. The rest of the people on blockchain had the 10% share. Now the point is if half of those accounts decide to leave Hive and xonvert their HBD to hive then fiat, would this coin will remain stable any more?

If you delegate your Hive Power to others, you can maybe get a higher %APY if the curation is better than if you curate yourself.

Yes, this 20% HBD benefits mostly those with a larger stack of HBD and seems to go to a top few accounts. Also by making HBD's high-interest rate available on polygon through pHBD, it allows some whales to more easily take advantage of the high-interest rate without having to be on the hive blockchain at all - perfect for gamblers and speculators.

If the top accounts decide to leave hive, then it could reduce the price of hive. This risk stays the same FOR NOW. What changes is that the compounding effect of 20% interest (22% compounded) is creating a massive debt bubble in the future and at 22% will grow rapidly. This will in future put huge downward pressure on the price of hive and rewards HBD holders at the expense of hive power holders (passive investors rewarded at the expense of active users of hive).

This takes hive basically from hive power holders to pay HBD holders - and HBD holders do not participate in the hive ecosystem at all. At least if a whale holds hive power, they are incentivised to participate in the rewards pool and support the hive ecosystem. This is my main argument against HBD's high-interest rate. It is bad for Hive and the community and makes no sense.

Logically, we should promote Hive as a payment and have HBD rewards lower than you can get by holding hive power. This means if Hive community does well, you share in the rewards and the community benefits if there are large whales. If a whale holds HBD, the community suffers (with 20% interest).

I hope that is clearer. :)